“To succeed at any activity involving the pursuit of gain, we have to be able to withstand the possibility of loss.” – Howard Marks

It’s now been about two years since the S&P 500 has seen a correction of at least 10%. In that time we’ve had roughly 9 million pundits (give or take) predict that we’re overdue for one.

A smaller subset serial forecasters have also been extremely bearish on the market’s prospects for the entire bull market run that began in early 2009. The opportunity cost of being out of the market has only continued to grow with every move higher.

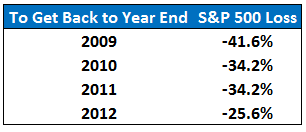

I thought it would be a useful exercise to see how far stocks would have to drop from current levels to get back to the year end closing prices for the S&P 500 for those that have been calling for a crash every single year:

Remember the magnitude of these losses when the inevitable correction does happen and the perma-bear pundits take an undeserved victory lap. Saying stocks will go down is easy (they will). Timing those losses with any precision is another matter entirely, especially if you’ve been bearish for a number of years and confirmation bias takes over.

Is it possible we could see a drawdown that take us back to these prior levels? Sure, anything is possible in the markets. Is it probable? Not exactly. Losses in excess of 40% have occurred on average about once out of every 12 years and they usually coincide with an economic calamity of some sort (so you’re really making two predictions if you’re saying a crash is imminent).

Anything can happen in the markets. But think to yourself what normally happens based on the past? This doesn’t cover every scenario because each cycle is different, but it can help you gauge you tolerance for risk from a probabilistic standpoint– one of the reasons it makes sense to have a historical perspective on the markets.

Since the markets tend to correct much more often than they crash it does make sense to prepare yourself for that eventuality since it’s bound to happen at some point in the future, whether we like it or not. One of the reasons stocks have offered premium returns in the past is because they fall from time to time.

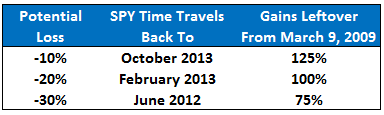

Here’s another way to think about this. If the S&P 500 were to fall 10%, 20% or 30%, how far would that set us back into the past and what gains would remain since the market bottomed?

These types of double digit losses would sting, but it’s important to put them in perspective and think about how far the market has risen in such a short period of time. Even a 20% drawdown only brings us back to mid-2013 levels on the S&P 500.

Did your favorite doom-and-gloom newsletter call for a crash at the beginning of 2012 after the rally was already three years in? They would now need the market to fall more than 30% just to get back to break-even on that crash call and the market would still have to fall off a cliff from there for that prediction to work out.

Stocks will go down sooner or later. They always do. But waiting for the next big crash to hit is a huge opportunity cost if you’ve been calling for one after the initial rally in 2009…and in 2010, 2011, 2012 and 2013.

A crash will happen at some point if you have a multi-decade time horizon. That doesn’t mean it has to happen right now just because stocks have seen extraordinary gains. Financial markets tend to frustrate the largest number of participants that they can, which seems to be happening in 2014 as markets reached new highs again this week.

Those that have been calling for a crash for the past five years have been turned back at every move higher. Try to remember the timing of their call when they try to say ‘I told you so’ once stocks do correct.

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

[…] Crash Predictions […]

[…] on the sidelines waiting for the inevitable, Ben at A Wealth of Common Sense notes that you are missing out on some tremendous gains as markets once again hit new highs in […]