“A house is certainly not an investment, for one simple reason: You have to live somewhere, and you are either going to have to pay for it or rent it. Always remember, investment is the deferral of present consumption for future consumption, and it anything qualifies as present consumption, it is a residence.” – William Bernstein

According to one study, 90% of people think home ownership is the best path to living the American dream. Also a recent Gallup poll that’s been flying around the blogosphere showed that Americans think that real estate is their best long-term investment option, with gold and stocks tied for second place.

There is a huge disconnect between the way people view housing when it comes to building wealth and the reality of real estate as an investment. You can build wealth by buying a house, but there are a number of problems with viewing your home as your best long-term investment option.

Here are a few common arguments I’ve heard over the years when it comes to real estate as an investment along with a counterargument for each.

Point: “Housing provides great returns over time. Just look at the price my parents paid for their house 30 years ago versus the value today.”

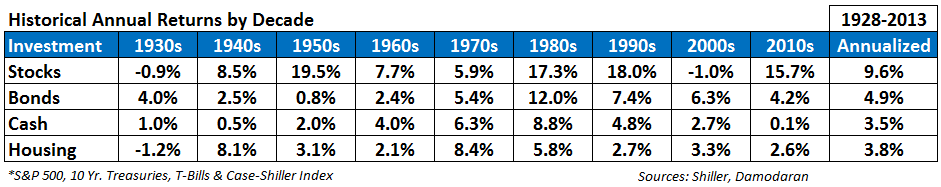

Counterpoint: Housing barely keeps up with cash over the long-term and doesn’t come close to the returns of stocks and bonds (click to enlarge):

Point: “Yeah but housing didn’t really take off until the 1990s.”

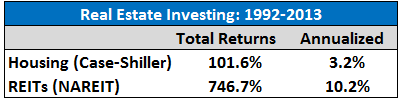

Counterpoint: If you’re going to invest in real estate you can get much more diversification (by geography and real estate type) by investing in REITs, which have destroyed housing since the early 90s:

Point: “But if I only pay 10-20% for my down payment, leverage can juice my returns.”

Counterpoint: Leverage is never a good reason for making an investment. As GMO’s James Montier says, “Leverage is a dangerous beast. It can’t ever turn a bad investment good, but it can turn a good investment bad.”

You could leverage any investment and possibly increase your performance if thing go well. But good luck if things take a turn for the worse when you buy on margin. Leverage works both ways. Remember, unless you pay cash, your house is not only an asset, but also a liability on your balance sheet. Leverage can amplify this liability by quickly wiping out your equity in a downturn.

Point: “Stocks are dangerous investments and can crash so I feel more secure in a tangible investment like real estate.”

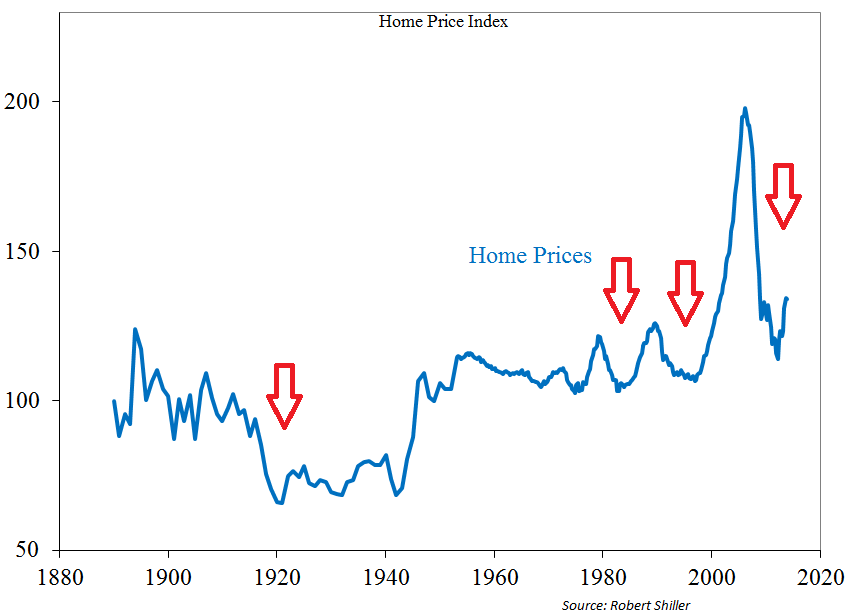

Counterpoint: Housing prices had a spectacular crash following the latest boom (as many found out the hard way) and it’s not the first time:

The lack of liquidity in housing is another problem. Although it’s probably a good thing most people can’t easily sell their home so there aren’t the irrational transactions we see in stocks at the extremes in market sentiment.

Point: “I don’t want to pay someone else’s rent.”

Counterpoint: This is one I heard from many of my friends in the first few years right out of college. I actually think most young people are probably better off renting at the start of their working years until they can make sure they have chosen the right career path and city to settle down in. It’s great to be able to build equity, but the flexibility you gain from renting can be just as valuable.

In most cases, young people should avoid buying the proverbial starter home. The switching costs (closing costs, broker fees, heavy upfront interest payments on a mortgage, moving costs, etc.) can be huge if you only live in a house for a few years and trading up doesn’t always work out.

Point: “My bigger house is going to make me happier.”

Counterpoint: The research doesn’t back this claim. Studies on money and happiness reveal that although we become more satisfied with our new homes compared to the older ones, there is no change in people’s overall level of happiness after the trade up. As with most large purchases, we adapt and the satisfaction wears off.

To be clear, I am in no way against homeownership. I own a home myself. It’s one of the best purchases I’ve made. But I would never stake my entire financial future on my house alone.

There are far too many risks involved and those risks are amplified by the fact that it’s an asset that doubles as the roof over your head located in the city where you’re employed. My house is considered part of my overall net worth, but I would never want every dollar of savings I have in my home to ensure my financial freedom.

There are a number of benefits from owning a home — the psychic income you get from choosing your neighborhood and personalizing your house, a fixed payment for long-term financial planning and the ability to eventually have your housing costs paid off to offer flexibility in retirement.

But none of these factors mean that housing is your best or only investment option for building wealth.

This is the mindset in Canada right now – probably similar to the U.S. a decade ago. It’s funny how we frame it in terms of what it cost two or three decades ago versus what it’s worth today, but if you actually calculated the annual rate of return you’ll find it’s much lower than stocks.

Right, it’s the law of large numbers. The biggest purchase people will ever make and all they think about is the change from point a to point b. There’s no CAGR calculation.

The Canadian housing market is fascinating to me. People have been calling it a bubble for a few years now but it keeps on chugging along. Do you think things have gotten out of control?

It has definitely gotten out of control in markets like Vancouver and Toronto (http://www.thestar.com/business/2014/04/28/lawrence_park_fixer_upper_gets_72_offers_goes_for_195_per_cent_of_asking.html)

Tons of people getting into condos now because they have been priced out of the housing market. Surely there will be a correction at some point, but I’m not sure what the catalyst will be. Low rates are here to stay for a while, so I guess there will come a time when prices are just too high for buyers to qualify.

Wow, crazy story…those are the kinds of things people look back on after the fact and say things were really out of hand.

Too bad for younger people. These things can go on for a long time too. Should be interesting to see how it plays out.

I think the problem is actually that not enough people treat their homes like investments. They figure that they have to have a place to live and assume buying is always cheaper than renting.

In CA (where I live) and other high cost of living areas a lot of homes are bad investments since you can rent for the same price or less. I agree that you shouldn’t rely solely on capital appreciation because the numbers don’t justify it. But when you save on the buy vs rent premium, then a home can be a great investment.

Good point. Geography definitely matters, especially in places like CA and NYC where buying can work out over the long-term. On average, the majority of places you shouldn’t expect huge price appreciation and performance should be measured after all costs (if it’s an investment).

[…] Is housing a good investment? Let alone an investment? (A Wealth of Common Sense) […]

Numbers don’t lie, but they don’t tell the whole story either.

Why is it an almost immutable matter of public policy to encourage home ownership and to employ that immortal phrase “American [Canadian] Dream’?

Because home ownership is a great investment. It invests you in community and all that accompanies it – schools, public facilities, the ‘things’ that make life livable and enjoyable.

Every now and then we see chatter about how governments may be in huge debt, but that’s because we don’t account for all the material things they own on the balance sheets, which tend to reflect tax revenues vs. borrowing. It’s much the same thing, I think [and welcome dispute, because I haven’t done the math].

Home ownership is a commitment to yourself and your family and to a way of life, and it makes for stable communities and, let’s face it, it’s easier for taxing authorities to find and to tax REAL property.

This leaves all the other folly still hanging out there – investing in housing as a landlord, etc., which should be distinguished from personal home ownership in every sense — and usually are, until a cheap money fueled boom comes along and mass greed and stupidity have their way. [So, maybe that commitment to schools should include a commitment to better EDUCATION — something that doesn’t seem to happen nearly often enough, for reasons you can choose, largely according to your politics.]

REITs and other investment vehicles are proven ways to INVEST in real estate, and I’m all for that.

I do think that this entire argument and many others concerning investing and public policy are entirely too biased towards the kinds of arguments that people with MBAs make — and that people with JDs have to tease apart when things collapse.

Yes that’s the psychic income I mentioned and that’s impossible to quantify. Not every financial decision has to be based on the numbers alone. There are intangible and emotional elements that can’t be counted and those make a big difference. I’m looking at it from. Truly investment perspecitve and because of the importance of all of the things you mentioned this is why you can’t rely exclusively on your home for wealth creation. Too many other important pieces invovled if something goes wrong.

My 3200 sq ft nicely finished home with a three car attached garage purchased when prices were depressed and mortgages were 4 percent costs me about $700 per month LESS than the 2 br townhome I was renting… and that’s before calculating the tax savings from the mortgage interest and property tax deductions.

Describe it any way you want, but I say something that puts over $700 a month in my pocket – and lets me live better while doing so – is an investment.

I actually agree with you that now and the past few years will have turned out to be an excellent time to buy with low rates and marked down prices (and high rents in most cities). But that doesn’t change the fact that you need to diversify your finances in case something goes wrong with your home or the local economy you live in.

This begs the question the, how do you feel about rental real estate for ordinary retail investors? Historical rental yields tend to add another ~5% or so to the returns of the investment, which makes the asset class a lot more competitive. However, this is typically achieved through large application of leverage (as you mentioned), from the very same types of people who wouldn’t dream of borrowing money to buy a large balanced portfolio of financial assets.

In my experience, investors who are extremely overweight rental properties fear the intangible nature of stocks and bond, and are more than happy to lever up so long as they’re pretty sure someone is writing them a check at the beginning of every month. I’m not convinced that a) such leverage is healthy, and b) this mode of exposure is necessarily better than REITS (or the large exposure to the asset class typically provided by one’s own personal residence, which is often ignored).

Great question. I think it can be done but it takes the right type of investor. I’ve heard horror stories of terrible tenants, maintenance costs and difficulty finding renters. There’s a lot that can go wrong and a lot of headaches from owning rental properties. If everything goes a planned I’m sure you can get decent returns on your investment. I just think it’s a lot of work that most people don’t have the expertise or time to put into it for it to make sense.

[…] Is investing in the current Real Estate market a wise option? There is a huge disconnect between the way people view housing when it comes to building wealth and the reality of real estate as an investment. You can build wealth by buying a house, but there are a number of problems with viewing your home as your best long-term investment option […]

[…] Further Reading: My Advice to Young Real Estate Investors Point/Counterpoint on Real Estate as an Investment Option […]