“Given the large percentage [of Americans] who never refinance, it’s really important for them to step back and determine whether there’s an opportunity for them to get this big benefit that’s potentially out there,” – Steve Deggendorf, Fannie Mae

Aaron Task had an interesting video on Yahoo! Finance this week about the state of the mortgage market and refinancing.

Some interesting stats from Fannie Mae in the video (emphasis mine):

According to Fannie Mae, between 40%-50% of Americans with a mortgage have never refinanced and have an average mortgage rate around 6%. With roughly 70 million American households holding a mortgage, according to Zillow, that means over 30 million Americans are potentially in a good position to refinance.

These numbers are fairly shocking to me. I would have assumed that just about everyone that could refinance would have done it by now. But 30 million people are basically leaving money on the table.

Fannie Mae also gave the results to their survey which asked people why they weren’t refinancing their loans. Here are the main reasons:

- Payments aren’t reduced enough.

- Closing costs are too high.

- Don’t want to extend term of loan.

- Trust issues with lender.

- Under water on mortgage or other qualification issues.

I can understand that it’s difficult to get a new loan if you are severely underwater on your mortgage or have bad credit, but the other reasons don’t hold up when you dig into them.

In an oversimplified example, assume you have a $200,000 30 year mortgage with no down payment. A 6% mortgage would lead to a payment of around $1,200/month (before taxes and other expenses).

Refinancing that rate down to the current 4.25% interest rate would drop the payment to $985/month, a savings of $215/month.

Assuming you stay in the house for the entirety of the loan and never make any early payment, the total cost of interest payments at 6% would be $231,676 vs. only $154,197 with a 4.25% rate. This is a difference of nearly $80,000 over the life of the loan.

As far as closing costs go, they can be expensive, but many banks allow you to roll those costs right into the new loan.

Bankrate.com shows that average closing costs are $3,750, which you obviously need to take into account when calculating your total savings.

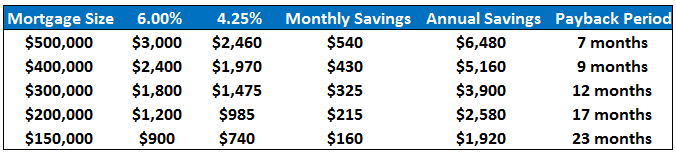

For those that say their payments aren’t reduced enough, here’s a chart with the monthly and annual savings from refinancing a 30 year fixed rate mortgage along with the payback period on the closing costs:

You can see that refinancing makes sense at every mortgage level as long as you aren’t planning on moving within the next two years.

For those in the survey that were worried about extending their loan, the simple solution is to continue to pay the same exact amount you are currently paying after the re-fi is complete. This actually allows you to reduce the term of the loan.

Here’s how this would work. Let’s say you’re 5 years into a 30 year fixed mortgage. If the original balance was $200,000 after 5 years you would have paid it down to about $189,000.

Refinancing $189,000 (assuming you pay the closing costs out of pocket) at a rate of 4.25% drops your payment from $1,200/month down to $930/month.

But after refinancing your loan is now reset back to a 30 year term even though you’ve been paying it down for 5 years.

To fix this problem, instead of saving the $270 difference in monthly payments, simply continue to make the same $1,200 payments every month. The extra money will go towards your principal balance and reduce future interest expenses.

This would drop your payoff length down to only 19 years. By making no changes other than your rate of interest and paying the exact same amount as before, you can reduce your payoff time by six years (from the current 25 that was remaining before the re-fi).

My wife and I have refinanced twice since we bought our house in late 2007. Each time we have just kept paying the same amount and refinancing to lower 30 year mortgage rates.

We could have easily used the extra monthly savings for something else, but this has essentially dropped our loan payback period from 30 to 15 years just by lowering the interest rate and continuing to pay the same amount.

Since we were already comfortable paying the original payment this didn’t change our spending habits or lifestyle in any way.

Many people make the mistake of focusing only on the small ticket items when trying manage their finances. It’s why people will drive across town to pay a few cents less for a gallon of gasoline to save a few bucks.

This approach mistakes doing something with having an actual impact on your bottom line.

Getting the big decisions right is the best way to discover the huge savings that can compound over the years and really make a difference.

Refinancing is one of these big decisions.

If you haven’t refinanced already, make sure you run the numbers to see if it makes sense to lower your interest rate and monthly payments.

It may not seem like it now, but these low interest rates won’t last forever.

Sources:

Millions of Americans are “leaving money on the table”: The case for refinancing (Yahoo! Finance)

When to refinance your mortgage (Bankrate)

[widgets_on_pages]

Follow me on Twitter: @awealthofcs

It sounds like mortgages differ between Canada and the US. In Canada in most cases if you want to break (re-finance) your mortgage mid-term you often have to pay a very, very large interest penalty called an interest rate differential.

The terms of the penalty do NOT have to be clearly disclosed at the time you first sign up for the mortgage. In fact it can be very difficult to even get a good estimate of the penalty when you are trying to re-finance.

Some examples: a $28,000 penalty on a $500k mortgage; another couple have $7,900 in penalties on 5 year term $130,000 mortgage (with 3.5 years left) plus they have to pay $6,100 back from a cash back for deposit promotion.

Ellen Roseman, a consumer advocate, has many examples on her website.

So many Canadians wait till their term is up before trying to improve their rate.

I’ve heard that things are much different in Canada. That’s crazy about the larger pre-payment penalty.

In the U.S. most people get 30 fixed rate mortgage or sometimes 15 yrar fixed rates which I think is a great deal especially for those that plan on staying in their house for a long time. Easy to prepare for since payments don’t change and you have to option to re-fi if rates fall.

If they’re locking in for 15-30 years I can see why they should re-negotiate! That’s a long term!

Exactly. Locking in these low rates if you can get them is a no brainer. As the Yahoo! Finance article said, leaving money on the table.