“The Prussian General Clausewitz has said, ‘The greatest enemy of a good plan is the dream of a perfect plan.’ And I believe that an index strategy is a good strategy.” – John Bogle

I think the best way to succeed with your investments is by minimizing your mistakes. Defense wins championships so to speak.

That’s why I do my best to point out the mistakes that investors continue make on a regular basis (mainly because I’ve made many of them myself). Behavioral biases and emotions decisions can ruin anyone’s portfolio.

As much as behavioral finance has proven how irrational we all can be, it doesn’t mean we always act irrationally. Sometimes we do learn our lesson after touching the scalding hot stove top.

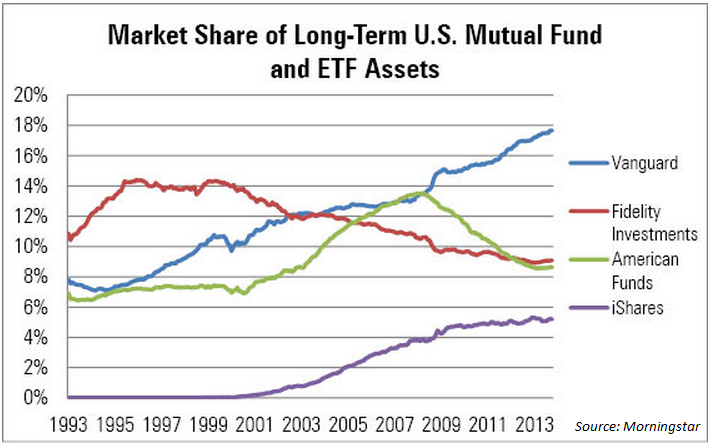

Investors are finally starting to wise up to Wall Street’s ways. Take a look at this graph from Morningstar that shows the market share of the largest mutual fund companies:

Vanguard has gone from an 8% share of fund assets to almost 20% in two decades. Low cost ETF provider iShares has also gained ground while well-known actively managed fund companies Fidelity and American Funds have been going in the opposite direction.

Investors have simply been burned too many times over the years by hyperactive financial advisors, high fee products and underperformance.

It looks like the tide started to turn after the market debacle of 2007-09. That’s when many investors decided they were fed up with complexity. Simple is actually better when it comes to building wealth.

And those investors that made the change have been rewarded with terrific performance at a tiny fraction of the cost.

According to Morningstar, Vanguard’s funds have an average expense ratio of just 0.15% while Fidelity (0.67%) and American Funds (0.74%) have costs that are over four times higher. iShares also fits the low cost model with average expenses of 0.33%.

It appears the low cost line of thinking is catching on.

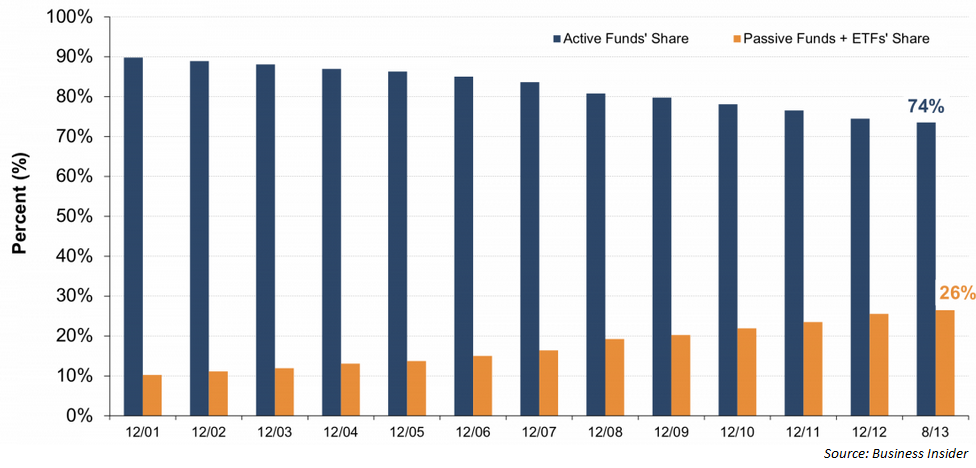

Of course it’s still a small fraction of the total mutual fund and ETF investable universe. Index funds represented 10% of funds in 2001 and that total has grown to 26% today, as seen on this active vs. passive chart:

Index investing will never completely dominate the market because there will always be people willing to try their hand at beating the market with actively managed funds.

Some investors will always shoot for the moon and continue to implement a more complex strategy because it’s in our DNA to gamble and take chances.

There are probably 5% of all investors out there that have the time, intelligence, skill set, patience and emotional control to pull off a successful long-term, actively managed investment strategy (most are value investors).

For the other 95% of investors, keeping things simple through long term thinking and a reduction in fee drag gives the highest probability for success.

The world’s least complicated investment plan goes like this:

Step 1. Invest for the long-term.

Step 2. Keep your costs low.

Step 3. Control your behavior.

Step 2 is becoming more mainstream according to the data. This is a positive development.

Steps 1 & 3 are where most investors run into trouble.

Many claim to be long-term investors right now, but it’s easy to make that claim during a bull market.

The real test of long-term thinking and behavioral control will come the next time we have a decent drop in the market.

Sources:

Vanguard dominates the fund industry again in 2013 (Morningstar)

Bob Doll’s 2014 Investment Outlook (Business Insider)

[widgets_on_pages]

Follow me on Twitter: @awealthofcs