A bear market is normally defined as a drop of 20% or more in stock prices. By this definition, according to BAML, there have been 25 bear markets since 1929. That means markets have averaged one roughly every 3.5 years or so.

Unfortunately, market averages aren’t neat and tidy. They trade in both short and long term cycles. Losses and gains tend to get clustered together.

For instance, 10 of those 25 bear markets occurred during the Great Depression and its aftermath in the 1930s.

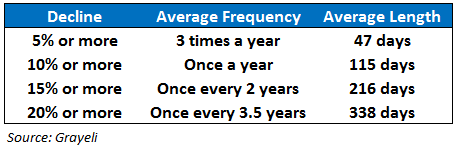

Grayeli Inc. went through and broke down all of the corrections and bear markets since 1900 on the Dow Jones Industrial Average. Here are the results along with the average occurrence of loss and the average length of the decline in prices:

You can see that while we average a bear market about once every 3.5 years, corrections occur much more frequently.

The average, run-of-the-mill correction happens at least a few times a year historically. Bear markets last much longer but don’t come about nearly as often.

When people think of a crash today, they look at the last two (2008-09 & 2000-02) as their guides. Both basically cut the market in half.

If we define a crash as anything over a 40% loss in the market, then this becomes a fairly rare event that occurs once every 12 years or so.

Garden variety corrections occur with much more frequency.

Yet because we have lived through such a volatile investing period since 2000, investors and market strategists are quick to predict that another crash is right around the corner any time markets hit new highs.

It seems as if investors think that we live in a world where the markets only trade at the extremes. One group (the bears) is always calling for the next crash while another group (the bulls) think that stocks can only go up.

We could be setting up for another crash, but it’s impossible to predict with much accuracy when it might occur and what the severity will be. You can use history as a guide, but that doesn’t mean things will play out exactly the same way going forward.

That’s always the case when you have markets that are ruled by the emotions of its participants.

Just because we’ve seen two recent crashes and subsequently experienced a sharp rise in prices since 2009 doesn’t mean that we’re in store for another crash. We could be, but more likely we will see another correction before we see a huge crash, based strictly on historical probabilities.

It’s been about two years since we’ve seen a 10% correction in the market, but markets don’t always trade right on schedule.

While there could be a catalyst (economic or political) for a crash or correction, most of the time it simply comes down the the fact that there is more selling pressure on the market than buying pressure.

You cannot predict the timing of a correction or a crash so don’t spend your time trying to time these things. Just know that even though the stock market has had both corrections and crashes on a regular basis, stocks have still been your best bet and have doubled your money roughly every 8 years since 1928.

And every single time investors have experienced large losses, the stock market has always made up for them and then some.

Trying to jump in and out of the market every time you have a hunch that there will be a crash or a correction is a good way to miss out on those long term gains.

You’ll be much better off implementing a diversified investment plan that periodically rebalances between and within the various asset classes to take advantage of the cyclical losses.

Sources:

Frequency of past market corrections (Garyeli)

History of Bear & Bull Markets since 1929 (G-E)

Further Reading:

Time to Prepare for the Coming Crash?

Stocks Will Go Down

And here’s the best stuff I’ve been reading this week:

- Why hangovers get worse as you age (WSJ)

- Stock market valuation is a relative game (Reformed Broker)

- What happens to stocks when disaster strikes (Crossing Wall Street)

- The few people that actually help from financial media (WaPo)

- How to think about active investment management (Abnormal Returns)

- Another reason to buy index funds (Rick Ferri)

- The worst mutual fund ad of the year (Canadian Couch Potato)

- 5 tools for evaluating a mutual fund (Vanguard)

- The importance of an investment policy statement (Morningstar)

- Rebalancing mistakes (Capital Speculator)

- Candy Crush parallels with your finances (Your Wealth Effect)

- Financial terms 101 (My Own Advisor)

- A bubble in bubbles (Barry Ritholtz)

[…] are becoming concerned with the continuing record-breaking market. Ben Carlson looked at the difference between a correction and a crash. Ben writes, “Just know that even though the stock market has had both corrections and crashes on […]

[…] I continue to believe we will see a garden variety correction in the market before we see another huge crash (see The difference between a correction and a crash). […]

[…] probably spent far too much time discussing the short term level of the market lately (here, here & here) so it’s nice to take a step back and look at the bigger picture from time to […]

[…] Here is another one (Difference between a crash and a correction) […]

[…] Reading: The difference between a crash and a correction The truth about stocks and the […]

[…] Reading: The difference between a correction and a crash How I think about stock […]