“Heaven: Where the Police are British, Chefs are Italian, Mechanics are German, Lovers are French and, it’s all organized by the Swiss. Hell: Where the Police are German, Chefs are British, Mechanics are French, Lovers are Swiss and it’s all organized by the Italians.” – Proverb

Investors seem to have a hard time focusing on more than one headline risk event at a time.

The government shutdown a couple weeks ago is the latest example of THE MOST IMPORTANT THING GOING ON RIGHT NOW headline of the moment.

In the last few years we’ve dealt with possible debt defaults, recessions, a flash crash, credit downgrades, elections, the possibility of war and William & Kate’s royal wedding among other things (maybe one of those doesn’t belong).

Throughout the 2010 to 2013 time frame the European debt crisis reared its ugly head from time to time as well. At some points it looked like the European Union was going to collapse under its own weight of debt and poor planning.

Since our wonderful politicians have been hogging all of the headlines lately, for the moment, investors have all but forgotten about the troubles across the pond. But they haven’t necessarily gone away.

The poster children of the European crisis are Italy, Greece and Spain. All have had their fair share of bad headlines along with political and economic troubles.

Here is the most recent economic growth and unemployment numbers from each of these three countries, according to Bloomberg:

GDP Growth (Year over Year as of 6/30)

Greece -3.8%

Spain -1.6%

Italy -2.1%

Unemployment Rate

Greece 27.1%

Spain 26.2%

Italy 12.1%

The youth unemployment rates for these countries are even worse at greater than 40% for each. Not too pretty.

Looking at these numbers and the headline risks you would assume that their stock markets would have been terrible places to invest.

And you would be wrong.

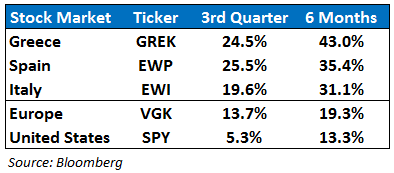

Here are the 3rd quarter and past 6 month returns (as of Monday, 10/21) for each of their stock markets along with the all of Europe and the US:

As you can see, the European stock markets are handily outpacing the US markets as of late, even with the sorry state of their economies and the constant headline risk. And Greece, Spain and Italy have been leading the charge.

So what are some lessons you can take away from these numbers?

Valuation, expectations, trends and sentiment are much stronger indicators of future stock returns than GDP growth, the unemployment rate or really any other piece of economic data.

At a certain point, even countries with really bad economics can make for great investments because valuations become attractive, expectations are low and there is no one else left to sell. All it takes are a few pieces of relatively better news and buyers will begin to bargain hunt.

This should also show you the benefits of having a globally diversified portfolio. You must be willing to look outside of your home country to find investment opportunities in an increasingly globalized world.

I’m not saying you have to invest in individual countries (even though it’s now much easier with the advent of country ETFs). You can gain access to other countries through diversified foreign ETFs or index funds that track multiple regions.

A total international equity fund is an easy way to gain broad diversification at a low cost and is good bet for most investors.

It was no fun being invested in the international markets when the US markets were killing it in the first half of the year. They were definitely a drag on performance. You are bound to hate some of your investments eventually if you are diversified.

And it didn’t feel great to rebalance to these underperforming markets on my periodic rebalancing date half way through the year. But I put my head down and followed my plan.

Mean reversion kicked in (much faster than I would have anticipated) and now my international stocks have picked up the slack from earlier in the year.

It doesn’t always work out that way, but selling some of your winners to buy some of your losers will work more times than not. Buy low, sell high, get lucky every once and a while, rinse and repeat.

Further Reading:

You Should Hate Some of Your Investments