In my last piece I said that you’re not really diversified if you don’t hate something in your portfolio at the moment. Stocks are the obvious candidate right now, as they were down anywhere from 6-10% in August depending on which market you’re looking at.

But bad months are nothing. The true test of a long-term investor comes when there are bad multi-year periods. Emerging market stocks fit the bill on this one. EM stocks are down 21% as a group since May 1 of this year. Since they peaked in late November of 2007, emerging markets have a total return of -24.3% through the end of August. That’s nearly 8 years with a return of -3.5% per year. In the same period, the S&P 500 is up 52.3% or around 5.5% per year since the last cycle peaked.

Two obvious questions come to mind when looking at this data:

- Why would an investor allocate money to emerging markets when they have these types of dry spells?

- Why would a diversified investor continue to hold emerging markets during this type of environment?

Both are valid questions and the answer depends, as always, on the individual investor’s own risk profile and time horizon. The volatile nature of the emerging markets probably aren’t suitable for everyone. But let’s take a look at the historical data to get an idea about why anyone in their right mind would hold these developing countries that are prone to the boom/bust cycle.

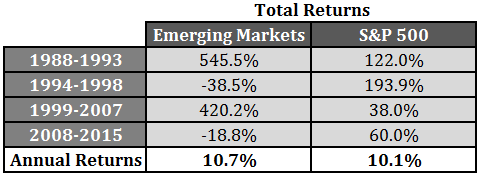

Here’s the long-term picture of the cyclical nature of the over and underperformance in the MSCI Emerging Markets Index set against the S&P 500 going back to the EM’s inception in 1988:

The annual returns for the two market segments are fairly similar but the path to get there was not. Both have taken turns leading and lagging. The differences have been quite large at times. So if both have had similar long-term performance, what’s the point of holding each in a portfolio?

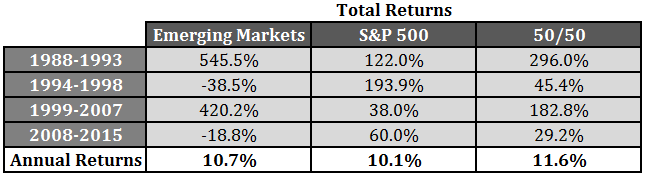

Now let’s see what would have happened if you would have utilized a simple 50/50 split between U.S. stocks and emerging market stocks with an annual rebalance back to those weights:*

This is where the real benefits of diversification really show up. The fact that the return streams for these two markets were so different and volatile actually makes the combined returns much better than the individual parts. A rebalancing bonus to the tune of one to one-and-a-half percent per year is pretty remarkable over close to a thirty year period.

There are certainly many good reasons to avoid emerging markets at the moment. China is slowing. Inflation is out of control in certain countries. Commodities are down big. The dollar is rising. Interest rates may follow at some point. The thing is that there are always going to be short-term issues and not just in developing countries but everywhere.

The biggest problem most investors have with a diversified portfolio is that it rarely “works” over the short-term. Asset allocation is a long game. There could be cycles that last a number of years before you’re able to see the benefits of holding assets that have different risk and return characteristics.

Diversification sounds simple. It is in theory, but simple isn’t the same thing as easy. Simple can be extremely hard to implement.

Further Reading:

Global Diversification: Accepting Good Enough to Avoid Terrible

*Obvious disclaimer: I’m not suggesting you use these weightings for your portfolio allocations. This example is being used to illustrate the long-term benefits of diversification.

Ben, what do you think of using the IFA Emerging Market Index for EM data between 1972 and 1987? This is what PortfolioVisualizer does: https://www.portfoliovisualizer.com/faq#dataSources

I’m honestly not too familiar with the IFA data, but I like the PV site. I’ll take a look. Thanks.

IFA’s site describes their Emerging Market index:

January 1928 – December 1969: 50% IFA US Large Value Index and 50% IFA US Small Cap Index

January 1970 – December 1987: 50% IFA Int’l Value and 50% IFA Int’l Small Cap

https://www.ifa.com/disclosures/index-data/#EM

These appear to be proxy indexes constructed with the benefit of hindsight, based mainly on the value and small cap sectors of developed markets. Whereas MSCI’s Emerging Markets index was maintained contemporaneously since 1988, and excluded developed markets.

Proxy data can be useful as a plug-in for testing and system development, but shouldn’t be taken too literally.

Interesting. So basically IFA simply used a 50/50 portfolio of the international value index and international small cap index as an approximation for emerging market performance? That seems like of lame. Or not?

Attached a screenshot from PortfolioVisualizer.com of 50/50 intl value/smallcap vs. emerging markets from 1988-2014. They don’t seem very comparable to me (EM in orange).

Great article about staying with diversification! One question that I’ve recently contemplated with Emerging Markets is this- wouldn’t an EM country that continues to prosper economically move from EM to developed? If so, wouldn’t this imply that countries that do not “move up the scale” have fundamental issues/flaws? Or is being considered “emerging” a relative term? Meaning there can only be, say 20 developed countries, so for an EM country to move up means a developed country must move down?

Sure, there’s some of this. Kind of like when small caps move to mid caps or mid caps move to large caps, but it’s a much slower process. There’s no science behind it. Here’s a short methodology on the index if you’re curious (doesn’t give much):

https://www.msci.com/resources/factsheets/index_fact_sheet/msci-emerging-markets-index-usd-net.pdf

Nice Summary, I like the example of rebalancing benefits! I think EM stocks are on sale, as Mr Buffett might put it, but it could be so for years to come. For the 5% of my portfolio I play with, I do have some in EM. On your larger point about the portfolio results, wow, I never even considered a portfolio construction with such a large EM component! My point is that it reminds me how easily we get locked into expert’s recommendations and therefore fail to consider the full range of possibilities. Just the idea that I had this unconscious mental constraint is both unsurprising yet exasperating at the same time. Thank you (he says with a wry grin) for something new to obsess over! (It also makes me think of Cullen Roche and his issue with 60/40, but that’s a whole new discussion.)

EM currently makes up less than 10% of the Vanguard World Stock Market ETF so by no means am I suggesting that large of an overweight to EM. And I agree that EM could be a huge buy at some point…it’s just tough to know when because those countries are so prone to blow-ups. It’s an interesting space for sure.

Sorry Ben, I really did not mean to imply you were giving advice of any kind regarding EM portfolio weighting… I just found it interesting I’d never thought of the possibility of such a skew, and the wording in my comment was inelegantly structured. I was struck by the reality that despite trying to weed out unsupported assumptions from my thought process, there are still many assumptions/limitations I’ve accepted without examination.

No worries I was just clarifying. It would be a fairly heavy risk tilt for sure.

It’s interesting to see how wealthfront for example addresses the value of various asset classes in modern portfolio theory. For higher risk levels, they put a ton of weight in emerging markets as a result. It’s where the international “growth” comes from, in contrast to developed economies outside the US. And after seeing this article, it’s easy to see why… with daily balancing, the volatility of the class works well with an obviously heave US stock exposure.

EM would definitely be higher risk IMO. Hopefully the higher risk investors understand the boom/bust characteristics of these markets, though.

[…] Two obvious questions arise from the Emerging Markets rout (A Wealth Of Common Sense) […]

[…] The Emerging Markets Rout Continues (Wealth of Common Sense) […]

Great post, Ben, that very clearly demonstrates the virtues of diversification. As for emerging markets, this is an area where good active management can add value over the long term. EM indexes are terribly flawed and tend to capture only the largest, often state-run companies. I prefer to gain EM exposure through active mutual funds that aren’t necessarily “pure” EM funds but are strongly overweight in EM. There are several such funds with reasonable expense ratios and excellent long-term performance.

District wanderer, If you look at the SPIVA reports, I think you’ll see that the majority of actively managed emerging markets do not beat the index. Over 10 years only 10.3% of actively managed emerging market funds beat the index. It’s because of the cost. Emerging markets may be less efficient, but it’s more costly to trade there.

It is a very important point you make, and yes most actively managed EM funds under-perform the index. However, what I meant is that are are some compelling funds that offer outsize access to emerging markets where the EM exposure could add value (just as Ben’s article illustrates). For example, Dodge & Cox International typically has about 20% in emerging markets, much higher than peers. (And it is within their mandate to allocate more to EM as they see fit, which they likely will over coming years). The fund charges 65 bps, so not a bad deal in my opinion. Just something to consider if the roller coaster EM indexes make you nervous!

Ben, excellent post. I think you make a good point that while emerging markets are much more volatile, they are not over long periods riskier, and diversification works IF the investor can stand the volatility. The problem is that a lot of investors think that they can ignore the volatility, do so for a period of time, but over a prolonged period (like the last seven years in emerging markets) eventually conclude that they made a bad a choice and sell (at the wrong time). All one needs to do is look at fund flows to see that this is the case. I suspect most investors do not outlast the extreme volatility of emerging markets, and should not be placed in these markets. A slightly lower but much more consistent return is for most investors the better alternative, because it allows them to sleep at night and stick with the plan. While “Simple can be extremely hard to implement” is correct, simple can also be much easier to implement if you avoid the most volatile of asset classes.

[…] Emerging market rout continues – A Wealth of Common Sense […]

Ben,

Enjoyed the post. There is a major issue with historical EM data: it’s not long enough for us to say anything conclusively, and what we can say/observe is questionable. Since 1998 (the inception of MSCI data), EM returned +10.7% vs. +10.2% for the S&P 500 and +6.6% for EAFE. So far, so good. But the vast majority of EM’s stellar performance came before anyone was really investing there.

Vanguard and DFA only launched their EM funds in 1994 – from 1998 to 1993 the MSCI EM Index did +36.5% compared to +14.9% and +6.3% for S&P 500 and EAFE Indexes, respectively. (most EM countries experienced a severe crisis in mid-1980s and the 88-93 returns reflected their recovery from that meltdown).

Since 1994, the MSCI EM Index has only returned +4.5% compared to +9.0% and +5.4% for the S&P 500 and EAFE Indexes, respectively.

Ironically, the only thing that has been consistent with EM stocks is their risk: from 1988 to 1993, the MSCI EM Index had 57% more risk than the MSCI World Index (developed). From 1994 through 2015, that number is 55%.

So, with EM, you are getting higher risk for sure, but the higher returns are sporadic. There is the diversification benefit, as you mention, but the entire package needs to be evaluated within the context of alternative ways to take on more risk and/or increase diversification (hold more stocks vs. bonds and/or smaller and more value-oriented stocks).

Good stuff, thanks Eric. I also think the retail investor’s infatuation with EM didn’t really start until BRICs hit the lexicon in the mid-2000s so there aren’t many investors with much experience in this area either.

That’s right. You’re never going to make money investing if you buy an asset class after it has done well and then sell after it has done poorly.

The best part of the emerging markets rout is that all investors who didn’t live through the 1990s (1998 in particular) have seen the downside/bust properties of EM and will logically relegate these stocks to a small part of their portfolio and a fraction (say a quarter?) of their foreign allocation. Bundling EM inside a “world ex US” strategy is also a way to hide some of its extreme stand alone behavior.

[…] emerging markets bounce back and forth across their long-term trend line — sometimes rather violently. That makes them risky allocations for anyone with a limited risk tolerance or time horizon. As […]

[…] 5. Carlson, Ben. The Emerging Markets Rout Continues. https://awealthofcommonsense.com/the-emerging-markets-rout-continues/ 6. Malkiel, Burton. A Random Walk Down Wall Street. W. W. Norton & Company. New York, NY. 2011. […]