We’re roughly seven months into the year and people are already starting to talk about how certain investment styles don’t work anymore. In the financial world, people act like seven months is considered statistically significant because everyone assumes that short-term trends trump all.

The proliferation of a wide variety of new ETFs and mutual funds make it easier than ever for investors to allocate to just about any type of strategy or risk factor they choose. Value, growth, smart beta, dumb beta, fundamental indexing, and momentum are all vying for your attention like the little kid at the pool screaming for their parents to watch them jump off the diving board for the fifteenth time that day.

Growth and momentum stocks are on fire this year, crushing their value counterparts, so of course investors are trying to figure out what it all means. The problem with looking at just the latest performance figures is that there’s no context involved. This type of thinking is how investors make mistakes.

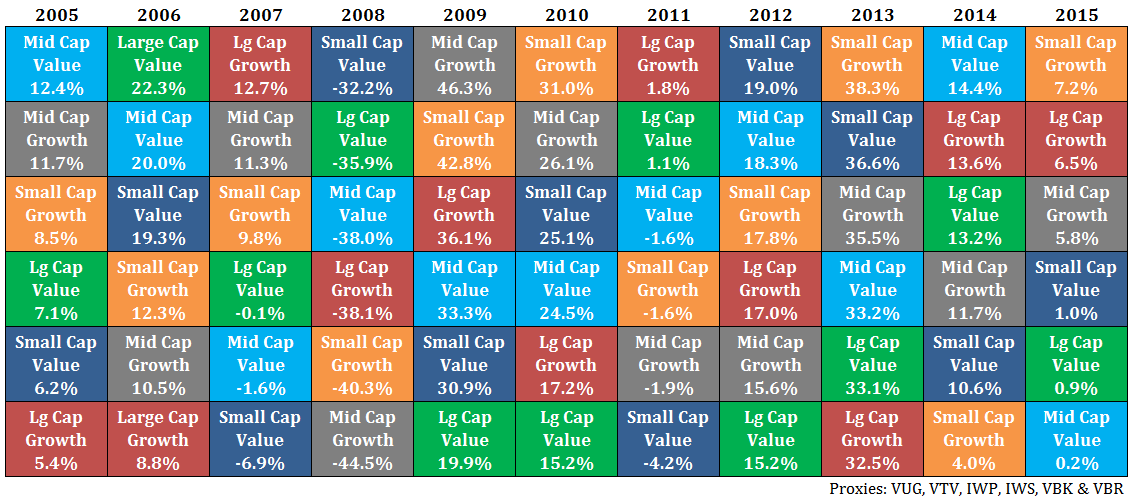

Nothing makes sense when you look at just the most recent performance in the stock market or its various components, risk factors or strategies. You always have to keep an eye on what’s happened in prior years or longer-term cycles to see how mean reversion and short-term momentum can come into play. Here are the return numbers for the various U.S. stock market styles separated out by market cap through the end of July (click to enlarge):

Like all asset allocation performance quilts, it would be difficult to come up with a formula that explains the return numbers from year to year. There were no repeat winners but there were a couple of repeat losers. Sometimes relative outperformance one year leads to relative underperformance the following year, but not always. Some years can be explained by market cap (large, mid or small) while others are driven by style (growth or value).

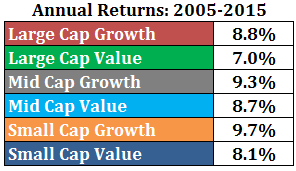

The average range between the high and low returns over this ten plus year time frame was nearly 12%, so there’s been a pretty large gap between the top and bottom performing styles in any given year. If you’re able to look past the changing nature of the winners and losers from year to year you can see that all of these different styles and markets caps have delivered pretty good results over this period:

But based on most behavior gap studies I’m guessing most investors didn’t earn these returns and probably underperformed their own fund holdings. Investors love to make snap judgments about the markets based on short-term moves or indicators. Doubt can always start to creep in when anything you invest in underperforms or even loses money. People start talking about how certain investment styles or strategies don’t work anymore.

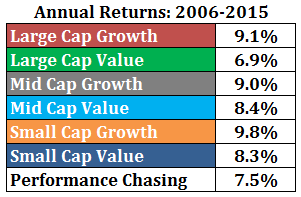

To see how this mindset can hurt investors I also looked at what would have happened if an investor moved their money each year into the previous year’s best performer. Here are those returns, using the 2005 numbers as the first signal:

You can see the performance chasing strategy would have underperformed all but one of these funds. Merely staying put would have made more sense than constantly chasing past performance, but most investors don’t like to just sit on their hands. We’re constantly tempted to make portfolio changes and invest in new and exciting products or investment fads.

When asset allocators analyze their outside money managers one of the biggest worries is always style drift. You don’t want your portfolio manager to be chasing performance or changing things up from their stated objectives. But even professionals aren’t immune to this type of behavior as short-term underperformance is uncomfortable and requires more hand-holding and explanations to their clients. It’s often easier to just go with the crowd instead.

Personally, I’m always more concerned about process drift than style drift. Process drift comes into play when you start changing when and why you’ll include something in your portfolio. If you have a good process in place, style drift shouldn’t even be an issue, because you’ll have rules in place to keep out certain types of investments. If you’re investing in different risk factors a good process would require that you’re adding to them when they’re underperforming, because that’s how you capture those premiums over time.

Jumping in and out of the different risk factors or smart beta-type strategies is a dangerous game to play. I don’t know anyone who can do it consistently. If you find an asset class or strategy you’re comfortable investing in over the long haul, you have to get used to the fact that they’re not going to work every single year.

What would returns look like if one moved 25% of each of the 3 top performing categories into the 3 bottom ones?

I’m sure you could calculate that but I quickly ran the numbers on simply picking the worst performer from the previous year and that returned 11%/year. Not bad

In that 2005-2015 quilt, looks as if investing every year in last year’s 3 worst would bring an enormous return.

But investing in the worst strategy is a strategy itself.

If you choose to pursue this method because it has worked in historical data you are quite literally falling for the performance chasing trap yourself.

Markets are hard that way.

True. The truly bad performance chasing occurs when you do it because everyone else is or you’r sick of missing out on gains. Based on most studies that kind of performance chasing works out much worse for people.

Ryan, that isn’t the worst strategy, it turns out to be one of the best.

I ain’t got no beef with performance chasing, that’s what Antonacci’s “Dual Momentum” system is, isn’t it?

This is an another example that value strategy will work in the future because it doesn’t work every year. If You don’t believe in the value strategy but believe in the mean reversion it is the time to invest in value too now.

Agreed. The only reason anything works is because sometimes it doesn’t.

[…] This year “small cap growth” is leading, next year it’ll be something else. Chasing style leads to underperformance (A Wealth Of Common Sense) […]

Nice post Ben. I “borrowed” your quilt idea to do my own post on “Apple funk” and momentum stock consistency. Take a look and let me know what you think. I’d appreciate inclusion in your weekly blog round-up if you are so inclined 🙂

http://gordianadvisors.com/apple-drag-and-other-momentum-stock-worries/

Very cool. Thanks for sharing. It’s amazing how wide the range is year in and year out in some of those stocks. It shows how tough it would be to hold some of those names over time to benefit from their performance.

[…] Ben Carlson, CFA, process drift is a bigger cause for concern than style drift. “Process drift comes into play when you start changing when and why you’ll include […]

[…] Avoiding Process Drift – A Wealth of Common Sense […]

[…] Avoiding Process Drift: AWOCS […]

[…] over time, but the results aren’t pretty when they’re prematurely abandoned. If you can’t follow your investment rules, results are going to disappoint. This is especially true when the market, or a particular strategy, experiences inevitable periods […]

[…] A good lesson about not changing investing horses mid-stream: “Avoiding Process Drift” […]