There’s so much going on in the markets that it’s hard to think in terms of a goals-based framework when investing.

Paying attention to the best-performing stocks, digging through the 52-week low list for bargains or trying to figure out when the next recession will hit are all much more exciting activities than figuring out how much you need to save and invest prudently to reach goals that could be years or decades out into the future.

Investors spend an inordinate amount of time and effort trying to outperform the markets or their peers. For most people, that time would be better spent investing in themselves to increase their income. Saving more is often your best investment decision and the best way to supercharge your savings is to earn more money.

Most personal finance experts will tell you the best way to get ahead is to cut back and live frugally. Living below your means is the only real way to save money but frugality has its limits (and it’s not much fun). Earning more money may be harder to do for most people but it can pay big dividends.

A $10,000 raise early in your career could be worth well over $1,000,000 over the course of a lifetime.

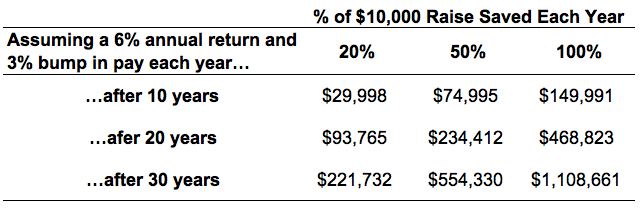

Let’s take a look at a simple example to see how. Let’s say you’re able to negotiate a raise or start a side business that brings in an extra $10,000/year to your net income. Here are three different scenarios that show what this single raise could turn into if you prioritize it in terms of saving:

Assuming you’re able to grow your income at the rate of inflation every year, call it 3%, and earn 6% on your investments, simply saving part or all of this raise each year can give you a huge boost in portfolio growth.

Now think about how much of an impact a few raises over the course of your career could have on your wealth if you approach them in this manner.

Obviously, this means you have to make a concerted effort to save any additional income a priority but the hard part for most people is actually earning more money or figuring out how to get a raise.

You could always hope and pray that your employer takes care of you and sees all of your hard work but most people need to be more proactive to make something happen. Here are a few considerations when asking for a raise:

- You have to actually add value to your organization.

- You have to be able to demonstrate that value.

- You have to be able to convince your boss they can’t function without you.

- You have to research your salary range and prove why you deserve to be closer to the top than the bottom.

- You have to actually ask for it.

I’m not a born negotiator but have learned it’s an important skill for a number of different avenues in life. If you can’t sell yourself you’ll have little chance of making more money.

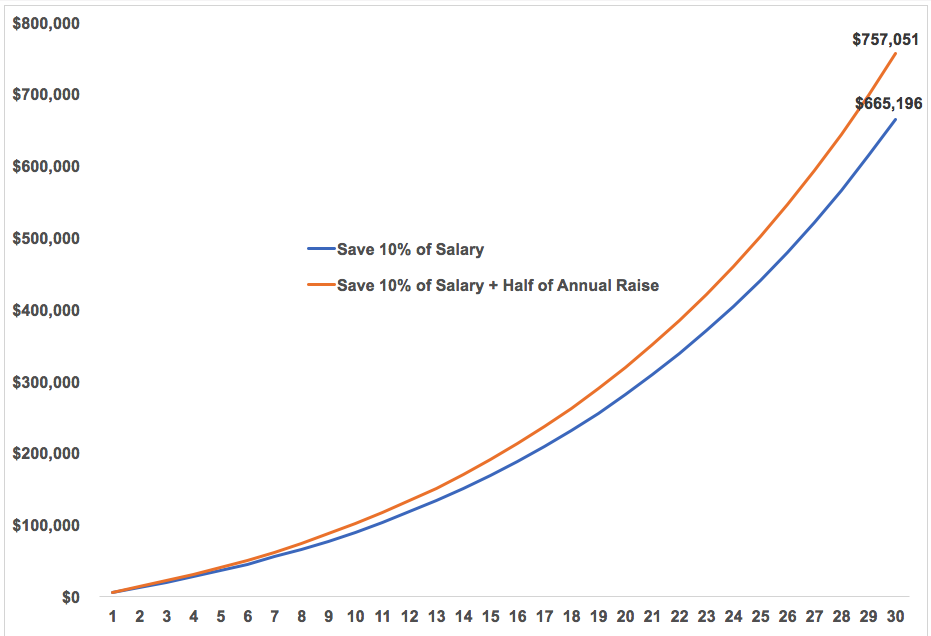

And even if you can’t negotiate a large raise, simply saving more of a cost of living increase each year can have an impact. Let’s say someone makes $60k a year, saves 10% of their salary and gets a 3% raise each year. The following chart shows the difference between simply saving 10% of the salary every year versus saving 10% plus half of the 3% raise every year (again assuming a 6% annual return on capital):

Investing just half of a 3% raise over 30 years leaves you with close to an extra $100k in this example. Life doesn’t operate as neatly in real-time as it does on a spreadsheet but this gives you a good idea about the power of compound interest and incremental change.

It’s also important to remember that your education is just beginning when you reach the working world. The best investments I’ve made in my career haven’t come in the markets but in the time and effort I’ve put into self-improvement through reading, studying, research, classes, conferences and building relationships.

If you don’t invest in yourself, you’ll be fighting an uphill battle when trying to increase your earning power.

No one is guaranteed the returns they want or need from the markets. But an increase in earnings, and thus savings, can have a significant impact on your bottom line. And unlike market returns, this is something you actually have control over.

Further Reading:

When Saving Trumps Investing

Now here’s what I’ve been reading this week:

- Tony Isola: “Most investors are basically paranoid and deranged behavioral algorithms.” (A Teachable Moment)

- A lesson learned from the 1987 crash by Jim O’Shaughnessy (What Works on Wall Street)

- The lie of averages (Newfound)

- Myths, markets and easy money (Pension Partners)

- The two sides of doing nothing (Brian Portnoy)

- Mutual fund names are confusing (Thirty North Investments)

- How college endowments learned to love risk (Bloomberg)

- How much money do NBA players actually take home? (ESPN)

- The Greg Popovich principles (Waiter’s Pad)

- The 30 best breweries in the midwest (Rave Reviews)