Financial advisor Ric Edelman gave Howard Gold at MarketWatch some pretty sobering thoughts on the bond market this past week:

“The typical investor today has never experienced a sustained rising-rate environment and they are emotionally and historically unprepared for what happens when interest rates go up 3% or 5%,” he said in a telephone interview this week.

Millions of Americans, he observed, “are engaging in a variety of risky behaviors, often without knowing what they’re doing. They’re setting themselves up to lose a lot of money over the next several years, perhaps as much as they lost in 2008 in stocks.”

“You could see 20%, 30%, 40% losses in the bond market over the next several years,” he continued, “and the people who are most exposed to it are retirees trying to live on their income. The people who are the least able to handle it financially are the ones most likely to suffer.”

Edelman runs one of the largest independent financial advisory firms in the country, so this isn’t simply a pundit spouting off.

The question is: could we see 2008-like losses in the bond market?

First of all, you have to define the types of bonds we’re even talking about here. Edelman says that many investors have piled into long-term bonds and high yield debt because they come with higher yields. High yield bonds have only been around since the 1980s, so they’ve never really experienced a sustained rising rate environment.

We can, however, look back at the performance of various treasury bonds to see how they performed in the last real bond bear market.

Before we get to that, there’s something that many investors forget when discussing the implications from rising rates on bond returns. Namely, that higher yields are eventually a good thing for your bottom line.

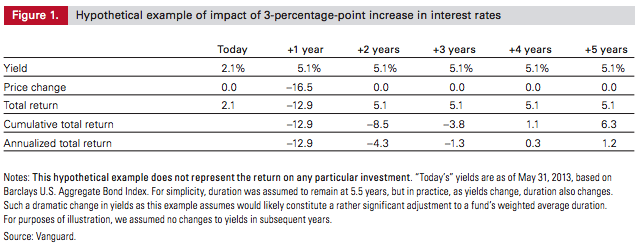

A few years ago Vanguard performed a study to see how the Barclays Aggregate Bond Index would be affected by an overnight 3% rise in interest rates (something that has never actually occurred). They calculated what would happen if rates suddenly rose from 2.1% to 5.1% and showed the impact going out 5 years:

You can see the immediate loss would be around 13% (they also noted that the worst 12 month loss ever in bonds was -13.9% in 1974). But because the yield on bonds would now be much higher, the expected return going forward would now be around 5.1% annually, meaning the breakeven would be just over 3 years. So not exactly a crash of epic proportions.

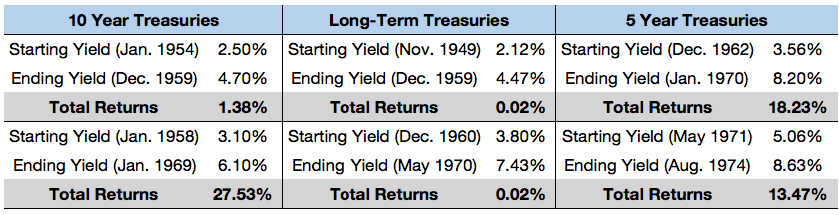

While anything is possible in the markets, it would take something crazy to have interest rates rise 3% or so this quickly. Historically, rates have risen much more methodically. I looked back at the historical interest rates for 5 year treasuries, 10 year treasuries and 20+ year treasuries to see how they have performed during past rising rate environments. Here are some examples for each maturity level:

I found instances where rates rose anywhere from 2%+ to 5%+ and calculated the total returns during those time frames. Long-term bonds saw the worst returns during these periods, which makes sense given their higher duration (thus higher volatility and magnitude of loss).

These returns weren’t anything to write home about, but they never saw huge crashes, mainly because the biggest threat during the 1950s to 1980s bond bear market was inflation, not rising interest rates. It also helped that the pain was spread out over a number of years and didn’t happen all at once.

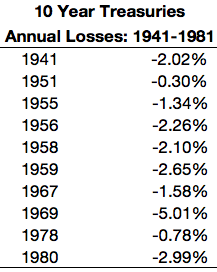

In fact, if you look at the returns on 10 year treasuries from the time yields bottomed in the early-1940s until they peaked in the early-1980s, the drawdowns were all fairly mild. In the 40 years or so, the average annual loss was just -2.10%. Here’s the entire list of losses:

A few additional thoughts:

- Rates could definitely move higher much faster today than they did in the past, simply because news and information flows much more quickly these days.

- In my opinion, higher inflation is a much bigger risk than rising interest rates when it comes to bond performance. Inflation and rates would likely move up together and for the same reasons, but unless we see a huge, short-term shift up in rates I’m guessing we won’t see any 2008-sized losses in high quality bonds.

- If rates do rise, high duration, low credit quality and long maturity bonds will get dinged the most. As always, it’s important to know why you own bonds in the first place and understand their risk/reward profile. All bonds are not created equal.

- I’m amazed at the number of people who are certain rates are going to see a sustained rise. It could happen, but you would think people would have learned their lesson about the difficulty of predicting interest rate movements over the past 5-10 years that has seen nearly everyone get it wrong.

- A bad year in the high quality, intermediate maturity bonds is typically the same as a bad day or week in the stock market.

- Some investors may choose to avoid bonds altogether and just hold cash and stocks in a barbell approach. The problem here is when do you get back into bonds? What if you’re wrong on rates?

Planning for fixed income assets is not as easy as it once was…

Sources:

Bond-market losses may hit 40%, and retirees are most vulnerable (MarketWatch)

Risk of loss: Should the prospect of rising rates push investors to high quality bonds? (Vanguard)

Further Reading:

Do Stocks Diversify Bonds?