Here’s a recent headline from Investment News:

Now here’s an alternative headline and byline:

DOL fiduciary rule could add $2.4 billion to retirees’ pockets

Implementing the standard on retirement accounts could help investors lower their costs by more than twice the current estimates, according to new research

It’s all about how you look at it. Morningstar estimates that the rule could affect around $3 trillion of client assets and $19 billion of revenue at full-service wealth management firms. Here’s more on this research from Investment News:

The DOL’s proposed conflict-of-interest rule “could drastically alter the profits and business models of investment product manufacturers like BlackRock and wealth management firms like Morgan Stanley that serve retirement accounts,” according to Stephen Ellis, director of financial service equity research at Morningstar Inc. “Current government and financial industry reports have a high-end annual cost of $1.1 billion,” but the low-end impact could be more than double that at $2.4 billion, Mr. Ellis wrote in a research note issued yesterday.

The $2.4 billion number is Morningstar’s low-end estimate of prohibited mutual fund front-end load commissions and mutual fund 12b-1 fees paid to full-service wealth management firms for commission-based IRAs. It is a revenue number, according to Morningstar. Some industry groups have interpreted the lost revenue to financial advisory firms as a cost of the proposed regulation.

Front-end loads and 12b-1 fees fall in the I-can’t-believe-these-still-exist category. Again, this is a huge positive for financial consumers. They will no longer have to pay these worthless, excessive fees.

The fiduciary standard legally obligates those offering financial advice to act for the sole benefit of the client. It’s amazing to me that this rule has to be legislated in the first place, but the finance industry has a history of putting their own profit motives ahead of their client’s best interests.

The problem is that many clients don’t know that there isn’t a fiduciary rule already in place. Studies show that 87% of people who speak with someone affiliated with their workplace retirement plan believe that person is obligated to give advice in their best interests. Also, 67% of people believe anyone who calls themselves a ‘financial advisor’ is obligated to give advice in their best interests. And 67% of people believe that insurance agents are obligated to do the same.

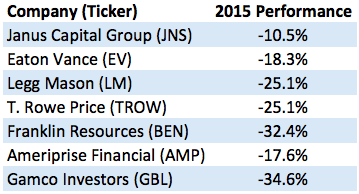

In some ways the markets could already be taking the potential affects of the fiduciary standard into account as you can see from the performance of many publicly-traded financial firms in 2015:

The initial beneficiaries to this rule change will likely be places like Vanguard, Charles Schwab, Betterment, Wealthfront and other low cost fund providers. There are always winners and losers with this type of rule change, but it’s not like the incumbents will just sit on their hands and take the losses without a fight.

They will have to adapt. I’m sure many will buy or create their own robo-advisor products. ETF product offerings will continue to grow. And some firms will find other ways to charge clients different fees to make up for the lost revenue. Wall Street is very good at adapting their business models to the changing environment, even if many of these firms get knocked down a peg or two from their current standing.

Nothing is set in stone with these regulations just yet, but it’s becoming apparent that something is going to have to happen. Implementing this rule alone isn’t going to change the financial industry forever all on it’s own, but I see no downside for financial consumers about the fact that those offering advice will be legally obligated to provide advice that acts in the client’s best interests.

Source:

DOL fiduciary rule could take $2.4 billion bite out of financial industry (IN)

Further Reading:

Do I Have a Financial Advisor?

*Thanks to one of my anonymous readers for sending along this article for the idea on this post.

Must chime in on this one. Have you read this new ruling in its entirety? Maybe you missed the part where the employee with a rollover will need to sign a contract with an advisor BEFORE accepting any advise whatsoever on what to do with their funds. (I hope I don’t have to do that before I buy my next car!) Among other huge flaws and governmental over-reach (trying to fix a problem that doesn’t exist), this ruling will take the hardest toll on small investors. Do some research on the UK and how well this is working for them since they enacted similar legislation 2 years ago. They now have what they are calling an ‘advise gap’, where small investors aren’t getting the help they need. Will this really make things better for the working middle class American? Not likely. Ben, I normally admire your unbiased and objective viewpoints. But this one dropped my jaw this morning. I have a really hard time believing that you could actually agree with the DOL proposal.

Anna, the small investor? That’s where Robo advisors come in combined with hourly rate financial planning.

Agree with Grant here. Small investors were never getting advice anyways. They were the ones being taken advantage of. Robos and hourly advisors are springing up all over the place. I don’t see how looking out for your clients is ever a bad thing.

I have several small investors as clients, who don’t own a computer or have an email address. Will robo advisors help them? They wouldn’t even know where to start. Granted they are the exception rather than the rule, but you can add in a pretty huge percentage more that who are also just not comfortable with doing everything online and need the face to face contact with a real person who they trust and who is looking out for them. Legislation like this is anti-advisor. I believe most advisors (and certainly the ones I know) are looking out for their clients best interests already and we don’t need more rules telling us what we can and can’t offer our clients. IE: Some of the Jackson IRA VA’s would not be allowed under this rule, and those are a pretty large chunk of our business. Many of our clients are receiving 5-6%, non-annuitized payments for life from Jackson, and are living very comfortable and happy and will until they die. This product would no longer be allowed with the new rules. Are you telling me this will be better for the client? And why can’t it be a win-win? Yes we make money on these products, but our time and effort is worth something too.

Anna, VA’s would be excluded for good reason. They are complicated, expensive products and complexity nearly always favours the seller not the investor. SPIAs, yes, in some circumstances, but not VAs.

Advice gap? On what planet would would an investor paying a management fee be placed into a private REIT, leveraged ETF, high fee mutual fund or any sort of insurance product? And yet, I saw this sort of nonsense all the time when reviewing portfolios of prospective clients who were coming to us from the SEC/NASDAQ world. If this is what some today call advice, I can only suggest that their assertions carry a strong odor of self interest.

As far the supposed harmful effect on middle class Americans, this is a blatant red herring. Given that 80% of wealth in America is held by approx. 7% of its citizens (and less than 30% hold 95% of all wealth), the so-called middle class that many pundits seem so worried about, hold little of much interest to most RIA’s.

The argument that many investors would be forced to sign management agreements and pay fees also seems specious as both conditions already exist. The difference (hopefully) would be that firms would be required to better disclose all of the fees they charge, as well as the embedded fees in the investment vehicles into which they are placing their clients. It also seems unlikely that a large segment of investors would become under advised as the growth in so-called robo investors can fill this gap and likely at a lower cost.

Application of the fiduciary rule is long overdue and continued resistance has little to do with client concern and a great deal more to do with firm profitability. However, I am confident that if enacted, firms will find new ways to replace revenue lost under the old rule.

Agreed. The argument that the “little guy” will get hurt from this rule is a strawman argument. They were never being helped in the first place.

Oh, no no, but I help small investors every day. 🙂 85% of our business is clients under $100,000. I would hate to have to limit their options, and make new clients sign a contract before I even discuss their situation.

The fact that broker-dealers, insurance companies, and others in the “financial services” industry are resisting a requirement that the advice they give be in the best interest of their client says it all. If they can’t survive by being fiduciaries, find another line of work.

Yup, the ones who legitimately help their client have nothing to worry about.