In a recent Q&A with Patrick O’Shaughnessy, I said the following when asked about the momentum factor:

I’m a huge fan of the momentum factor, mainly for its diversification benefits. It’s also the least understood of the well-known risk factors. I’ve done a ton of work on momentum in my day job, but haven’t been too impressed with the retail products available. Most cost too much or they’re not tax efficient because it’s a higher turnover strategy.

One of the reasons I think momentum is so widely misunderstood is because not enough advocates of the strategy have explained it well enough (although maybe that’s on purpose). It’s also counter-intuitive to almost every other strategy out there, which can make investors uncomfortable if they don’t know what they’re doing.

Even if you aren’t a practicing value investor, the value anomaly is easy to explain — buy at a discount and then wait. The momentum factor is based on buy high, sell higher or alternatively, cut your losses and let your winners run. Value investing is based on a long-term reversion to the mean. Momentum investing is based on that gap in time that exists before mean reversion occurs. Value is a long game, while momentum is usually seen in the short- to intermediate-term.

Another misunderstanding comes from the fact that investors are constantly told that it’s a huge mistake to chase performance. And it is a terrible idea to chase performance if you don’t know what you’re doing or why you’re doing it. Momentum is chasing performance, but in a systematic way, with an entry and exit strategy in place. Momentum tries to take advantage of performance chasers who are making emotional decisions. This is why the best momentum investors use a rules-based approach, to avoid those emotions.

So what exactly is momentum? In short, momentum is the fact that markets tend to continue to trend in the direction they’re going much longer than most people assume is possible. Investments that have performed well tend to continue to perform well and investments that have performed poorly tend to continue to perform poorly. None other than Eugene Fama and Ken French, the fathers of the efficient market hypothesis, had this to say on the topic:

The premier market anomaly is momentum. Stocks with low returns over the past year tend to have low returns for the next few months, and stocks with high past returns tend to have high future returns.

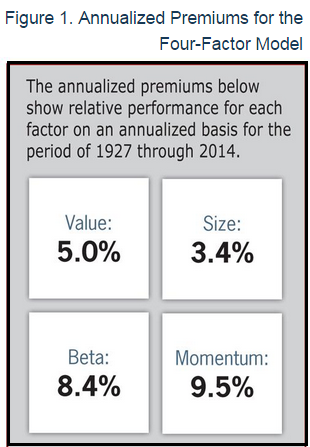

Here are the long-term risk premium numbers from the Fama-French database, courtesy of Larry Swedroe and Andrew Berkin:

As with any strategy that has been proven to work historically, there are usually two explanations given — either the strategy takes more risk and is compensated for those risks or there are behavioral factors involved that allow the premium to persist. To me, the behavioral explanation always makes more sense, because really the only way for one investor to outperform is for another investor to underperform. To do better you have to be able to take advantage of someone else’s mistakes. This is the foundation that any viable long-term investment strategy rests on.

There’s a laundry list of mistakes and behavioral biases that investors exhibit that have been covered in detail here and elsewhere. Many of these emotional responses and mistakes are the very reason that momentum works. Research shows that investors hold onto losing stocks too long in hopes they will come back to their original price while selling their winners too early. Investors also anchor to recent results, so initially markets underreact to news, events or data releases. On the flip side, once things become apparent, investors herd and overreact, causing an overshoot in either direction. Fear, greed, overconfidence and the confirmation bias can lead investors to pile into winning areas of the market after they’ve risen or pile out after they’ve fallen.

All of these behavioral issues can lend a helping hand with short- to intermediate-term momentum in markets for those who are willing and able to take advantage. Basically, momentum tries to benefit from irrational market participants. This can be easier said than done as these trends don’t last forever and can have swift reversals when they do come to an end after they overshoot.

There’s a huge body of research to back this up, but you’d be hard pressed to find many average investors who actively seek out the momentum factor. Other than the fact that it’s misunderstood by most investors and counter-intuitive, momentum can also be a high turnover, high cost strategy to implement if not done the right way. As I said to Patrick, there really aren’t that many retail products available at a low cost that make sense for investors to legitimately invest in this risk factor. Momentum typically involves high turnover in holdings over short time periods, which can lead to increased costs and tax inefficiencies if used in the wrong structure. Momentum can also lead to severe drawdowns, often larger than the overall market, at the inflection points. As usual, nothing works all the time.

In my next post, I’ll explore Gary Antonacci’s book, Dual Momentum, which explains the two different types of momentum — relative and absolute. Antonacci has also devised a system that tries to minimize the flaws that are seen in most momentum investment strategies, so I’ll explore Dual Momentum in more detail to see how it works.

Further Reading:

Why Value Investing Works

The Style Box of the Future

Fact, Fiction and Momentum Investing

Dual momentum is just a marketing campaign built around overfitted backtests.

Google “optimal momentum” and you will see the same guy pushing the same strategy under a different name.

Big surprise, optimal momentum blew up out of sample which is why we now have version 2. Five years from now we will be talking about the USA Best Book Award Winner: “Triple Momentum”…

Every strategy is something of a marketing campaign. I’ll offer a balanced review of the book and strategy in my next post.

http://blog.alphaarchitect.com/2015/05/19/tactical-asset-allocation-beware-geeks-bearing-formulas/

I’ve been following optimal/dual momentum for awhile and don’t see any overfitted backtests. Antonacci has a simple model using the same 12-month look back found in many academic papers and that has held up over many years of out-of-sample data. What evidence do you have that optimal momentum blew up out-of-sample?

I ran the numbers myself and I don’t see any data-mining or back-test issues. I think the beauty of the strategy lies in its simplicity. The biggest reason I think it could still work going forward is because it’s not an easy strategy to follow (none are). I’ll share some more thoughts on it tomorrow morning in my review.

You say that you that ‘average investors’ don’t participate in momentum (don’t know if it’s fair to consider the S&P as a momentum play)… but why the institutional asset managers don’t participate either? Specially on ‘time-series momentum’ or trend following.

Cheers, Cord

Great point. it’s something few inst’l investors explicitly target as a return stream. Some of their managers may use it whether they understand it or not, but I think for some reason there’s a stigma that momentum is performance chasing, even for professionals.

Also, I agree with you that the S&P is the simplest form of momentum investing there is. I’ll comment more on this in a later post.

I find it odd too. And specially when used in combination with stops and leverage (e.g. Trend Following), it looks like a nice add-on. But certainly, the AUM of those strategies is very small and only considered as a diversification and tail hedging product. David Harding is worried about that last consideration, saying that ‘we will be beta 1 to the common asset classes sometimes’, but I see the flip side of that: the ability to participate on good long term economic trends.

I guess that the fear of missing out is too big, specially in times where paying for ‘insurance’ is paying twice for the same thing that the government already gives. But who knows.

(also I find odd that risk parity is a much more welcomed strategy)

Most professionals hate the idea of momentum. Selling stocks at lows and buying stocks at highs makes investors extremely uncomfortable.

There is also some subtlety with regards to implementing momentum, especially if you want to take the short side. Cross sectional momentum has capacity/turnover constraints.

Asset allocation using momentum is too easy to datamine which makes sophisticated investors more skeptical.

A more complex argument against asset allocation using momentum is that you get only a small number of signals per year. According to the information ratio/kelly criterion, the fewer decisions you make, the more confident you must be.

Agreed that it’s an uncomfortable position to be in. An even harder one to explain to their investors. The career risk from going all-in or all-out can be huge. But I think it works as a good return stream diversifier too.

You don’t need to datamine. The same 12 month look back criteria has worked very well both both cross-sectional and time-series momentum. It was first used in 1937 by Cowles and Jones and has held up out-of-sample going forward and backwards. Yes, there are few signals per year, but over 200 years of signals now so plenty of signals overall.

I tested dual momentum back to 1970 and found there were 58 total signals, so around 1.3/year. Not too bad at all.

True, and I’m sure one of the reasons Harding is worried about it is because their fund has gotten so large. Maybe the premium gets compressed but I don’t see it nearly as mainstream as value is right now. I think it’s still fairly underfollowed and under-utilized.

Maybe one of the reasons the pros don’t participate so much in momentum is career risk. There will be times when they will be out of the main stream waiting for their chosen look back period signal to make the trade.

Makes sense to me. It’s not an easy position to be in at times, especially when implementing trend following rules.

[…] Why momentum investing works. (awealthofcommonsense) […]

Which new momentum ETFs do you think are worthy of scrutiny for one’s portfolio?

I’m not a huge fan of any at the moment. I know ishares has one and AQR has a mutual fund. I’ll profile any that come along that pique my interests.

What is your opinion of Cambria Global Momentum ETF?

I’m a huge fan of Meb Faber’s work but I honestly haven’t looked too deeply into that ETF.

As Ben wrote nothing works all the time. So if You want to follow any strategy You sholud ask Yourself how You can endure the periods when Your strategy doesn’t work. It is especially damned hard for a momentum investor to stick to this strategy when it underperforms and maybe You have expensive stocks. In contrast to this a value investor can be more confident with cheap stocks in the periods of underperformance.

Exactly. This is why I prefer a diversified approach by both asset class and strategy. You are never too hot ot too cold and you can take advantage of the underwhelming periods by rebalancing and hopefully lowering the amount of risk you take on an overall portfolio level.

True, and not only that, most investors will sell exactly at the wrong time, like after a correction. These things are extremely volatile and require holding through an entire correction for them to work. If you sell at the bottom, it will hurt the returns of a well diversified portfolio as well.

Correct. It’s the same as any strategy — you have to be willing to follow your process no matter what happens and try to avoid making decisions and changes based on short-term outcomes.

Momentum is speculation not investing. You are not thinking as a business owner buying into something that has gone up to short term trade it and sell it soon after.

The risk-factor persists due to behavioural factors, herding etc. And it works until it doesn’t. Case and Point – look at the Chinese stock market right now. 100% gains in 12 months, if you were a momentum trader, at either 60%, 70%, 80%, or 90% your rule would have been to buy…fundamentally flawed reasoning, leads to the blood bath we are now seeing, even with government support/intervention.

This is true. That’s why I don’t recommend that investors try to utilize this factor unless they truly have a plan and understand how and why it works. I’m planning on covering a post in the future on how investors can utilize momentum in other forms in the future that are much simpler.

Every strategy is speculation even the CASH too. Who knows the future?

Exactly. You try to make good decisions based on a legitimate process and not pay attention to the short-term outcomes.

All momentum strategies need a safety net combined with a prudent exit strategy. Take a look at http://us.timing.net/performance-itp/

I saw you four factors risk premia and wondered if I was reading this correctly. Value has a risk premium of 5% and Beta has one of 8.4%. does this mean that over this time period you had higher returns following an pure beta strategy versus a pure value strategy?

Good question. Those premiums are calcualted as follows:

Size = small – large

Beta = stocks – cash

Value = cheap – expensive

Momentum = high mom – low mom

So they’re excess return calculations.

So Value=8,4%+5%=13,4%.

[…] ← Previous […]

Nice article. Momentum is a viable. Notice how CANSLIM-type screeners that rebalance <= 4 weeks (AAII or P123) always perform well. I dare say better than the actual CANSLIM system that awaits "breakouts". In my experience, you are best served having a timing or trend following mechanism to get you into cash during a bear. Momentum investing w/ the markets below the 200 day MA is not for the faint of heart. If you have an IRA (no cap gains) momentum investing may be for you. I think there are better options for your cash accounts that generate short cap gains. Clenow just published a new book on momentum equity investing, but I haven't gotten to it yet.

Agreed on the not for the faint of heart. No strategy is right for everyone. You really have to buy in to run this type of strategy.

Hi Ben, have you ever looked at the Morningstar CPMS momentum models? I think they’ve launched at couple of ETFs (at least here in Canada)

http://corporate.morningstar.com/US/documents/Indexes/Construction-Rules-US-Momentum-Target-50-Index.pdf?122407

Interesting. I had not seen that. I’ll take a look . Thanks for sharing.

[…] Why Momentum Investing Works by Ben Carlson via Wealth Of Common Sense […]

[…] Why Momentum Investing Works by Ben Carlson via Wealth Of Common Sense […]

[…] Why Momentum Investing Works by Ben Carlson via Wealth Of Common Sense […]

[…] Why Momentum Investing Works by Ben Carlson via Wealth Of Common Sense […]

[…] Why Momentum Investing Works by Ben Carlson via Wealth Of Common Sense […]

[…] Make Sense? (WSJ) The Hugely Profitable, Wholly Legal Way to Game the Stock Market (Bloomberg) Why Momentum Investing Works (A Wealth of Common Sense) podcast: Campbell Harvey Interview with Michael Covel (Michael Covel) video: Some Neuroeconomics […]

“Value” is investing, “Momentum” is trading. Rules based can works, if you follow your rules.

Agreed. It’s up to the investor to stick with the strategy. Most can’t.

I took the current stock holdings in the QVAL ETF — 40 stocks — and ran it through my momentum algorithm, from 1-Jan-2003 till 30-Jun-2015. The test was to see the result of holding only the 10 high momentum stocks (as opposed to holding all 40 as in the ETF) and updating the portfolio only once every month. Anyway, the portfolio shows an compounded average annual return of 33.42% compared to the S&P500 index return of 9.15%. The Russell 1000 Value Index gained 9.20% and the Russell 2000 Value Index gained 10.46% during the same period. There was obviously some hindsight bias because the database of stocks was static (40 stocks) for the entire 12-1/2 years and taken from the present QVAL holdings.

Interesting. You should bring this up to the team at Alpha Architect. They might even run a longer backtest for you with the results.

Hi Ben. I was just testing the combination of value and momentum in one coherent model to check its validity. Looks like it works quite well. Not sure if the team at Alpha Architect will be interested in my approach. I will send you some of my research results via e-mail. Thanks for this wonderful blog.

Nice, thanks. And yes, all of my research tells me that value and momentum are the two best factors historically across asset classes, sectors and markets.

Actually my research shows that growth stocks combined with momentum and a prudent exit strategy works better than value plus momentum. Take a look at http://us.timing.net/performance-itp/

[…] Op de beurs lijkt iets soortgelijks te gebeuren. Als een koers eenmaal begint op te lopen, blijft hij niet zelden door denderen. Zo’n aandeel heeft momentum, ofwel vaart. Het proberen zo goed mogelijk op en af rijdende treinen te springen heet ook wel momentum-beleggen. […]

[…] Op de beurs lijkt iets soortgelijks te gebeuren. Als een koers eenmaal begint op te lopen, blijft hij niet zelden door denderen. Zo’n aandeel heeft momentum, ofwel vaart. Het proberen zo goed mogelijk op en af rijdende treinen te springen heet ook wel momentum-beleggen. […]

[…] momentum is a big part of what Paul Tudor Jones does. Ben Carlson gives an excellent summary of the momentum approach to trading here which reads in […]

[…] every different type of investment strategy imaginable. My conclusion? Value investing works. Momentum investing works. Trend following rules work. Index investing works. Diversified global asset allocation works. And […]

[…] momentum is a big part of what Paul Tudor Jones does. Ben Carlson gives an excellent summary of the momentum approach to trading here which reads in […]

[…] fruitful investing style is momentum investing. This entails purchasing stocks that have done well in recent history. While this strategy can be […]

[…] Further Reading: What Happens When The Umbrella Shop Gets Too Crowded? Why Value Investing Works Why Momentum Investing Works […]

[…] ook het artikel Why Momentum Investing Works door Ben […]