I was dubious of online conferences once this pandemic hit and everyone began hosting Zoom and Skype events but I’m coming around to the idea.

Sure, you don’t get the social and networking opportunities that you get at a normal conference but there are plenty of positives:

- More people can attend

- You don’t have to travel anywhere (this is a big one for me since I hate leaving my kids)

- There are no awkward conversations with salespeople

- You don’t have to wait 10 minutes for everyone to find their seats and quiet down before starting the next speaker

- It’s much easier to perform a Q&A online

- People have the opportunity to be more selective about the presentations/talks they listen to

I did a presentation for Ally Bank this week. The entire thing happened on Skype. All I had to do was share my screen and walk through my presentation from the comfort of my desk.

After my talk, they did a rapid-fire Q&A from the audience (which sounds like it was just over one thousand people) where I probably answered 7-8 questions.

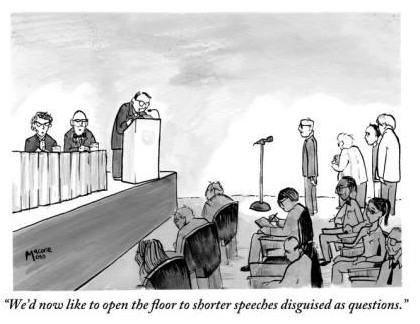

There was no waiting for someone to walk up to the mic (which doesn’t work half the time) and no diatribes from someone who wants to prove to the room how much smarter they are than the speaker.

All in all, I was pleasantly surprised by how much I enjoyed this format.

I still enjoy the regular conference experience because of the social interactions they bring about. It’s much harder to develop meaningful relationships via Zoom.

But now that everyone is more comfortable hosting and attending video chats I think this format will work until the world gets back to normal.

It could be a while until regular conferences are back so this is what people will be dealing with for the foreseeable future. I think it can work for the right speakers and a willing audience.

Here’s the presentation I did on diversification:

Diversification Presentation by Ben Carlson on Scribd

UPDATE: I found the full presentation on video which you can watch here:

Here’s this week’s Animal Spirits video where we touch on the possibility of inflation, why investors would probably freak out from an inflationary spike, a potential spending boom, the post-WWII scenario for the economy, why poverty improved during a depression, why people will demand more fiscal stimulus in future recessions and more:

Now here’s what I’ve been reading lately:

- Movie weddings, ranked (The Ringer)

- The new weapon in the Covid-19 war (Bloomberg)

- Traditional vs. Roth 401ks (Dollars and Data)

- Never the same (Collaborative Fund)

- The new 60/40 portfolio (Irrelevant Investor)

- Inside the world of high roller poker games (Vanity Fair)