The New York Magazine profiled popular blogger Mr. Money Mustache, who is very well known for his frugal ways and the fact that his extremely high savings rate allowed him to retire at the tender age of 30.

The piece went through his history and talked about others he has inspired to live a similar lifestyle that cuts down on over-spending and pushes for 70-80% savings rates to be able to retire young and do whatever you want after that. The extreme saving lifestyle isn’t for everyone, but I find it to be a fascinating case study in setting priorities in life. Then for some strange reason at the end of this write-up there was this unnecessary caveat:

But Keynes’s famous paradox of thrift still holds: Six years after the crash, the American economy could use more consumer spending, especially among those who can afford it. Growth has picked up this year in part because Americans have started to open their wallets, and retailers anticipate a frenzied holiday season. Were we to suddenly start living like Mr. Money Mustache suggests, the implications for the economy would be dire; were we to start spending like we did in the 1990s, things would feel great. Mustachism may save us from our worst excesses, but saving, ultimately, isn’t the only point. A better economy requires more income growth, not just more personal thrift.

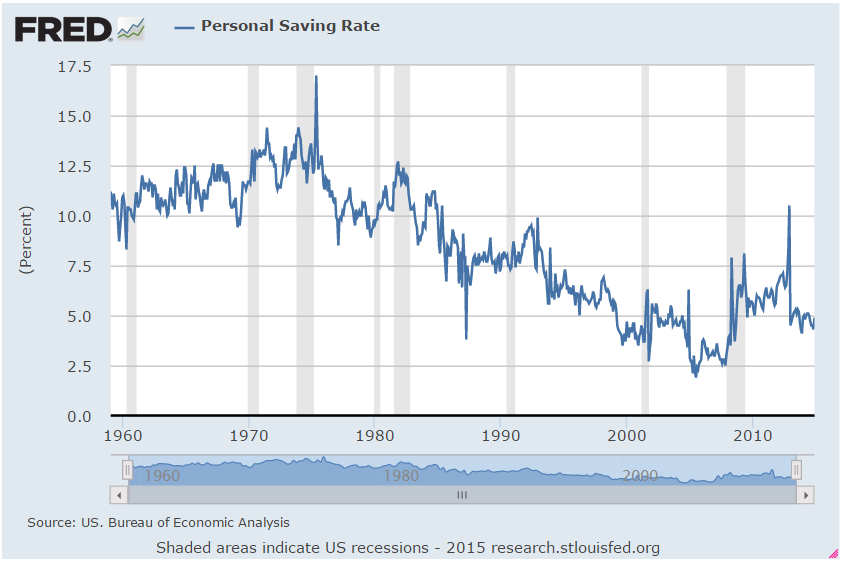

While I agree with the fact that most people should be looking for ways to increase their income to improve their finances, I think it’s rather ridiculous to make personal finance decisions based on how they could potentially affect the overall economy. The U.S. economy is a roughly $17 trillion behemoth. What are the odds that every single person in the U.S. is all of the sudden going to decide that they should substantially increase the amount they save? Take a look at the personal savings rate over time:

Thinking this way just gives people an excuse to put off saving money. Well if everyone saves more money all at once the economy will crash. We live in a consumption-based society. There’s no way this would ever happen. One person’s decisions aren’t going to crater or jump-start the economy. It’s a drop in the ocean. And remember that cutting back on current consumption is simply delaying your inevitable spending for later.

A similar argument is often made about index investing. What happens to price discovery and the efficiency of the markets when every investor turns passive and indexes? Again, this is something that’s never going to happen even as index funds continue to gain ground in market share. There is far too much institutional capital that invests actively and the gambling instincts inherent in most people are never going away because it’s human nature.

Living in a relative world when it comes to your finances rarely turns out well. A Bankrate study found that most people don’t necessarily equate a higher income level with increased levels of happiness. People’s level of happiness is determined by how much they have financially compared to those around them. So people are more concerned with their wealth on a relative basis rather than an absolute basis based strictly on their own situation. This is the keeping up with the Joneses syndrome.

When making financial decisions it’s best to focus on your own personal circumstances. Don’t worry about how your savings rate could derail the economy, how your investing style could affect market dynamics or how your neighbors are spending their money. Thinking in relative terms is a destructive line of thinking when it comes to your finances.

Further Reading:

Putting Passive Inflows Into Context

When Saving Trumps Investing

Absolutely! Great post! Thank you for share it!

That’s a common academic objection to personal responsibility and self-improvement in general. It doesn’t matter if someone improves themselves. Not everyone has that amount of willpower, so the government should level the playing field instead. So goes that argument.

Yeah, unfortunately some people need to be saved from themselves. I’ve actually written about this before as far as retirement savings go:

https://awealthofcommonsense.com/should-we-be-forced-to-save-for-retirement/

And going back to the main point of your post, it’s interesting that some people (the type that often becomes academics and journalists) think that a necessary corollary to what is the fact that many people can’t do it for themselves, is that those who do in fact do it for themselves are just outliers and there is nothing to learn from them. Which you can see in the article on MMM. It has that condescending academic/journalistic air – oh, look how cute that this guy has “deprived” himself, but that doesn’t mean anything for anyone except him.

Right, personal tastes and circumstances have to come into play. It makes no sense to base your actions on what others are doing. That’s not a fun way to go through life.

The paradox of thrift is real. My spending is your income. Savings does not lead to more ‘lendable funds’. If I consume less, more money stays in my bank account, and less money goes to the bank accounts of places where I buy goods and services. The net amount of money in the banking system is unchanged.

If income equals spending, you only get ex-post income growth when people spend more than there incomes. This is the role of the debt markets. Effective demand is equal to income + the change in debt. In a monetary economy, there is no income growth without debt.

When the private sector has a particularily hight savings demand, eg, after recessions, the government should fill the gap by deficit spending. Otherwise, you get a debt-deflation spiral. Everybody tries to repair their balance sheets simultaneously, but incomes and prices fall so fast as purchasing power is destroyed by the massive debt pay down that problem just gets worse.

As far as personal finances, yes, macro economic realities should not be taken into account. But the mechanisms which enable aggregate private financial savings are important. The private sector cannot save in aggregate without the public sector going into debt.

Yes this is true, but I don’t know how much value this information provides to every day people that just need to save more for retirement. And again, everyone deciding to become a saver is not something that’s going to happen overnight (or probably ever unless we have another Great Depression).

It is useless from a retirement planning perspective. Except for policy makers. If the government runs a surplus, then the private sector cannot save on net. (Private debtors can allow some private savers, but private debt minus private savings is zero). Politicians would be well advised to remember this when they decry the dangers of the Federal debt/deficits

I think that’s an important part of the puzzle. Journalists write with the view that they are writing for policy makers, not ordinary people. Maybe it’s true. Obviously not by number of readers, but maybe by purpose. I guess that’s why “journalistic” publications like the New Yorker are losing out to publications that actually write for ordinary people, like Buzzfeed and Business Insider. And niche blogs too, of course.

From a Mr. Money Mustache article titled ‘First retire then get rich’:

“Over time, this $20,000 [annual income] stream accumulates and compounds at 5% after inflation.”

At current stock and bond valuations (both around the 95th percentile of expensiveness), it is quite unlikely that the markets are going to deliver 5% after inflation over the next 10 or 20 years.

This may come as an unwelcome surprise to some readers of the blog.

It’s not an easy world out there from a retiree’s perspective, that’s for sure. There really are no easy answers. Diversify globally and be prepared to go back to work if your nest egg can’t support your lifestyle.

But it’s not unlikely that if you continue dollar-cost-averaging into the market, there will be corrections which will allow your average dollar to get a return similar to the past return of the average dollar.

This is true. Low returns are actually a good thing if you’re going to be a net saver over the next decade.

[…] Why you should live your lifestyle not some one else’s. (awealthofcommonsense) […]

Perhaps the type of spending should be considered… I like when consumer spending grows, but think it’s best to avoid the crowd. Consumer spending growth makes the economy run well, jobs more plentiful, and provides an opportunity to pay down debt and build wealth. Rather than go out and buy a car, my wife and I bought into a business. Honestly, it fell into our laps as a byproduct of her work, but practically, that was the trade-off. I have yet to do the full ROI analysis, but I can safely say it beats a new Highlander, or even a used one. Our 17yo Toyotas will have to last a few years more :>) Btw, fantastic website, I think you have a lot of value to add in the personal finance/investment/retirement space.

I agree. It really comes down to priorities. You don’t have to cut back your spending on everything, but you do have to cut back on a few big things if you ever want yo get ahead. I’m with you on the car angle. Never been a huge deal to me.

You have to do things differently from the average if you want above-average results. That’s one thing that most people (almost definitionally) don’t and won’t get, whether it relates to personal finance, behavior or investing more generally.

Well said. I agree.

That’s why they call it personal finance…because its…well PERSONAL.

MMM is an extreme case of frugalness that only appeals to a small percentage of the population.

But it is sad how little people do save in this country.

Right, you don’t have to go to that extreme to be successful in your own situation. It’s all about your own circumstances and finding what works for you. But you still have to delay gratification on certain things to get ahead for your future self.

[…] possible for some to live on that level of income, but I’m not sure that’s what many consider when they think about the lap of luxury in […]

[…] people focus exclusively on cutting back to save as much money as possible. Others are more interested in advancing their career to earn more money so they can both spend and […]

What’s missing from the discussion is the impact that low wages and lack of job security are having on the economy. It’s all well and good that CEO’s are earning such high wages, but their company profits depend upon consumer spending (approximately 17% of GDP) and as long as there is little to no money to spend, economic growth will be anemic at best. We’ve seen this is the recently revised economic numbers.

True, it’s been a sluggish recovery. We’re coming off one of the largest debt bubbles in history so the deleveraging process is taking some time (much longer than most assumed). I’m operating under the assumption that the millennial generation is going to be our savior when they start to settle down, buy a house and buy a couple of cars. It’s coming. In the meantime, here’s some good news for you:

http://csen.tumblr.com/post/115570318269/racing-towards-full-employment

Very interesting thoughts. As Robert Reich wrote a few weeks back, the new economy consists of multi-billion dollar companies run by less than a hundred employees. It is not like industry of old, with thousands of employees making a decent wage and benefits.

Toffler in the Third Wave nailed it with the information age. This is an age of specialization by a few talented employees, not a huge number of workers.

I guess what I’m getting at is the next wave will like never get to the full employment of the past, and significant numbers of workers will never achieve middle class status.

And finally consider that significant numbers of millenials want to live in the large urban areas, have no need for, nor are interested in driving a car, and are content to own or rent an apartment in the city, never a house in the suburbs.

I see events as perhaps being kicked off by the greed and lawlessness of the bankers of the mid-2ooo’s, but the outcome is our heading into a new age, not unlike the major upheavals that accompanied the industrial revolution.

Thanks for the great comments

Unfortunately I think you’re right that a large group is going to get left behind in this transformation. Those that can’t or won’t adapt are going to have a hard time keeping up. Tyler Cowen’s Average is Over did a good job of considering the fallout from this. It could push an even wider gap between the haves and the have-nots.

No question, and the results of the disparity is going to get ugly.

[…] Further Reading: I Have a High Tolerance for Repitition Why Should You Care What anyone Else Does With Their Finances? […]