Robo-advisors make up a tiny fraction of the financial advisory business. Registered investment advisors oversee roughly $5 trillion in AUM, while robo-advisors currently have less than $15 billion in total. But because of their rapid growth in AUM over the past few years, robo-advisors are increasingly coming under scrutiny from traditional advisors.

Some think they are a product of a bull market. Others are worried clients will have a difficult time during the next market swoon without an actual person to guide them through the carnage. Still others have criticized the way robo-advisors build portfolio allocations and risk tolerance questionnaires. These are legitimate claims, but to me this is splitting hairs. There needs to be some context in this debate.

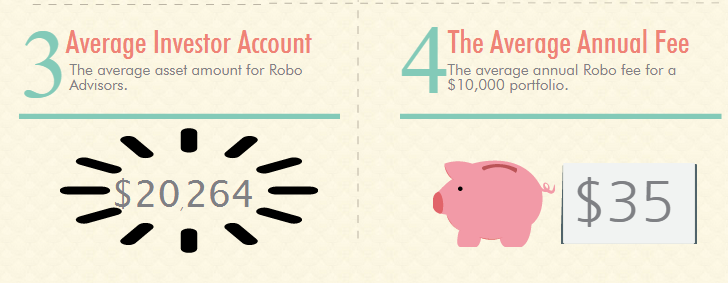

This is the average account and fee size for the robo-advisors:

So the average client with a robo-advisor is paying roughly $70 a year for a low-cost, automated asset management service to create a diversified portfolio along with a tax harvesting service. In the past that annual account fee would have been eaten up with a single trading commission on a terrible stock recommendation from a broker. Investors with this amount of money in a portfolio would have been preyed upon by retail brokers looking to churn their portfolio and sell them unnecessary products. This is one of the reasons for the robo-advisor’s success — they tapped into an underserved market.

How many financial advisors would be willing to take on accounts of this size at these fee levels? Not many.

To all of those people and firms criticizing the robo-advisors, my challenge to you would be to take on clients of this size. If you think you can do it better, prove it, by taking on smaller, overlooked clients that don’t have enough assets to reach the account minimums set by many financial advisors. And charge them a similar fee as well. I don’t think I would get many takers on this challenge. Most advisors simply cannot afford to to scale their business the way that robo-advisors can through the use of technology.

I understand why financial advisors are going on the defensive about robo-advisors. This is their livelihood and many think it’s coming under attack by a bunch of venture capital-funded Silicon Valley firms looking to take over the industry. But I think these fears are misplaced. Last month Bob Veres shared 3 reasons why robo-advisors are actually a good thing for the financial advisory profession:

1. Robo-advisory firms are expanding the market for investment advice. Most of the money invested in robo-advisors is coming from new money that wasn’t previously paying for financial advice before.

2. Robo-advisory firms are creating institutional platforms that will improve the economics and expand the client mix of advisory firms. All of the well-known robo-advisor firms have rolled out institutional versions of their services to try to help advisors instead of competing with them directly. There’s no reason to fight the technology these firms have developed.

3. The robo-competition will drive down custodial costs and raise service levels for advisory firms. The banks will have to compete with the technological offerings from these firms as well. This should create lower fees and better service offerings for advisors as the competition for assets heats up.

Veres concluded, “This robo-invasion is the best thing that’s happened to the planning/advisory market in decades. Let’s stop wringing our hands, and celebrate the robos among us.”

Robo-advisors will gain Baby Boomer clients, but the Millennials are the ones currently signing up in droves. Younger generations have always been ignored by the financial services industry because no one wanted anything to do with small portfolio balances. As the younger generation works with the robo-advisors and grows their portfolios over time they will develop good money management habits. This is a great thing for financial advisors that can differentiate themselves from robo-advisors because they can be there to pick off the best clients when the time comes for more personalized advice with a larger portfolio and more complicated issues.

Financial advisors need to start embracing robo-advisors instead of constantly criticizing them. First of all they’re not going away. Second of all, the technology side of the business is important and that importance will only continue to grow in the future. And finally, the robo-advisors could end up being the farm team for the major leagues for developing talented future clients.

Eventually this will be a win-win-win for everyone involved.

Sources:

What is an online financial advisor (robo)? (Paladin)

Three reasons why robo-advisors are a huge benefit to the advisory profession (Advisor Perspectives)

Further Reading:

How financial advisors can fend off the robots

Things just keep getting better and better for investors

Portfolio management & decision fatigue

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

I will continue to be critical of the robo advisors as long as they market to consumers as if their solution is the only solution needed for a successful financial future.

“Why pay for expensive financial advisors?” one exclaims, as if their service is an equivalent substitute for financial advice.

Access to low-cost, broadly diversified portfolios that are appropriate for one’s risk tolerance is an excellent thing, but it alone does not guarantee positive outcomes for consumers’ financial future.

That’s valid. They can’t market themselves as a be-all, end-all financial advisor. I guess that could be confusing for many clients. I know it’s a young industry, but I think they need to be marketed as different tiers of service. You get one thing with robo-advisors, but another with traditional financial advisors (at least the legitimate ones).

The key to an almost guaranteed financial future IS simple:

1) Save a large percentage of your income, at least 10% and ideally 25%, from the day you start work or soon after.

2) Invest in a balanced portfolio of very low cost index funds over some reasonable allocation of asset classes.

3) Don’t cash out or make radical changes to allocation target until your reach retirement.

Now I know people run off the tracks following this advice because saving isn’t as much fun as spending and they let fear get the better of them in massive declines, but I fail to see honestly how live people will do a substantially better job than an automated robot.

It really depends on the person. Some people to need the behavioral/emotional coaching because they just can’t get out of their own way. Others with more willpower should be able to get a lot out of the robo model. Knowledge is not always the problem for most people; changing bad behavior is.

As an adviser, I agree completely with Veres. Sure, there are some unanswered questions about robo advisers. How will consumers respond when a large market sell-off occurs? Are their risk tolerance questionnaires effective or not (IMHO these questionnaires are very flawed). However, after being in the industry for 20 years I have concluded that advisers grossly overprice and oversell the value of investment management services – and not just for small balance clients. I believe investment management will become a commodity and price pressure should bring its costs down to 10 to 15 bps or even flat fees, which could be a much, much better alternative for consumers. But that will take a long time. In my view, the value of an adviser is guidance and planning and not investment management. But as long as many consumers with wealth are still willing to pay 1% + for these services, advisers will thrive.

Thanks Mark. Glad to hear your perspective. I think the best part about all of this is that the people out there with no real value-add will be exposed. I also agree with you that the pricing model will continue to evolve — maybe hourly or on an annual retainer basis? There’s going to be plenty of changes in the years ahead and I think it’s going to be very interesting.

Robo-advisors are just a blip on the screen right now but they represent a paradigm shift for investors. As an advisor to ultra high net worth clients, I can relay that it isn’t strictly the $20k clients that are interested in low fees and algorithm-driven investment models. Studies show that the Millennial generation trusts computer models more than human decision making. As this generation ages and acquires/inherits wealth, algorithm based trading will likely become more popular. We have yet to see a truly innovative robo-advisor, though, but there will be one eventually (flat fee?, single integration of all financial aspects?, unique user interface?, etc…). Financial advisors should plan ahead to prepare for fee compression as existing advisors try to compete. The advisors who do nothing will struggle to stay relevant in a changing market. The advisors who focus on client experience and process automation through technology should benefit the most by staying ahead of the industry shift. If I’m wrong and this scenario doesn’t happen, those who have prepared will have more lean organizations.

Great points. And I agree. Those advisors that stand still and try to fight this will lose out eventually. I think this opens up the doors for younger advisors that are more comfortable with technology as well. Here’s an interesting one about unbundling of financial services that could be a possibility:

http://www.dentonrc.com/business-tech/denton-business-headlines/20150117-scott-burns-unbundling-opens-avenues-to-savings.ece

It’s also interesting how technology has already made most organizations so lean. It doesn’t take that many people to run a practice if everyone knows what they’re doing.

Plus all of your current UHNW clients are going to pass that money along some day to the younger generation so you have to be ready for that from a tech perspective. The next decade is going to be exciting in this industry.

As one of those people that put a seven figure portfolio into wealthfront last year, and who is absolutely over the moon happy with the level of communication and automation of tax loss harvesting and buying/selling of individual stocks…

… and as someone who in my early life before business school was both Series 7 and registered financial advisor and have seen at least a perspective on that side of the business…

I’ve got to say that “those jobs are going boys and they’re never coming back.”

It takes a tremendous amount of competence for me to turn over management of my portfolio to someone else, and the robot does it better, with less emotion and far more efficiency, than either I could (and there was no one that cared more about my portfolio than I did) or any other live advisor.

The only really compelling argument I think for live financial advisors for people with less than $10 mil in assets is to try to talk them out of timing the market. And I will agree that the right advisor can do a better job than most.

But roboadvisors make it at least reasonable hard to time as well. Surely one heck of a lot easier than when it was in my brokerage account and I could sell ETFs with the touch of a button. I’m not saying a 50% market decline wouldn’t cause a lot of roboadvisor clients to exit the market, but I think it would be far less than the average investor. My 2 cents.

Anyway, my perspective.

Keep up the outstanding blog.

Thanks, nice to hear from an actual investor on this. I think the fact that so many people have been burned in the past by traditional advisors makes it easier for them to trust robo advisors too. I think there is something to be said for handing your money over to Wealthfront as a buffer to keep you from making poor decisions. It’s just one extra step you’d have to make. Glad to hear you’re happy with how it’s working out and it’s interesting to hear from the perspective of a larger investor in a robo.

[…] Why financial advisors are defensive when it comes to the rise of robo-advisors. (awealthofcommonsense.com) […]

[…] 1. The Robo-Advisor Challenge […]

[…] Source: A Wealth of Common Sense […]

[…] Reading: Advice for a Young Robo-Investor on Asset Allocation The Robo-Advisor Challenge Financial Advice For My Fellow […]

[…] Further Reading: Is Technology Speeding Up Market Cycles? The Robo Challenge […]