On today’s show we discuss peaking inflation, confused banks, whys stocks are the best inflation hedge, and much more.

On today’s show we discuss peaking inflation, confused banks, whys stocks are the best inflation hedge, and much more.

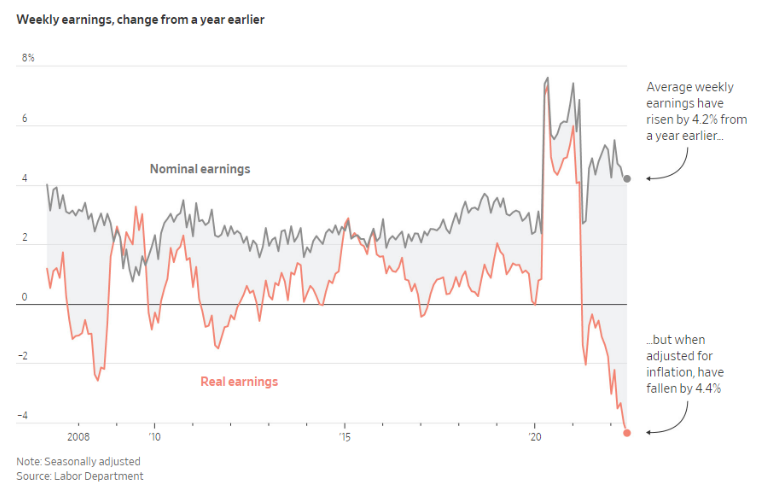

My latest Fortune piece looks at how to think about bear markets depending on where you are in your investing lifecycle.

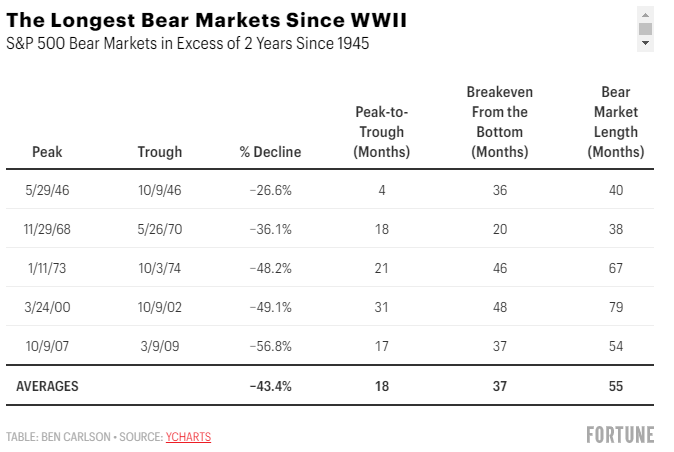

Similarities and differences between now and the inflationary 1970s and early–1980s.

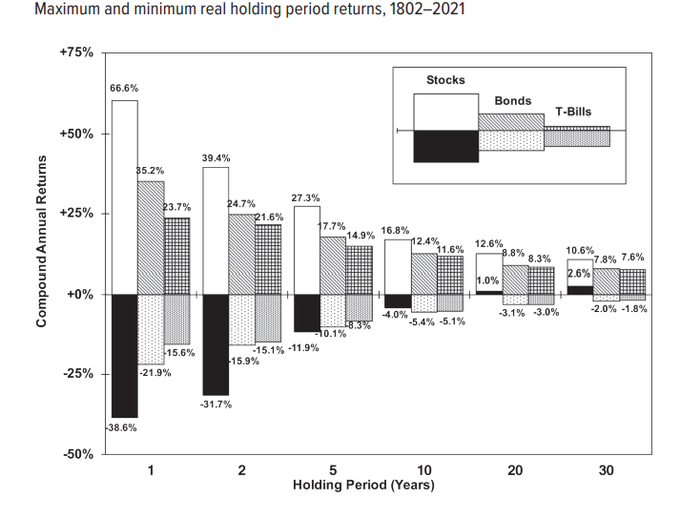

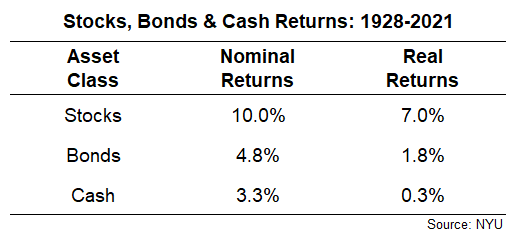

Stocks, bonds and cash over the long run and the short run.

What are the real returns investors should expect in stocks and bonds going forward?

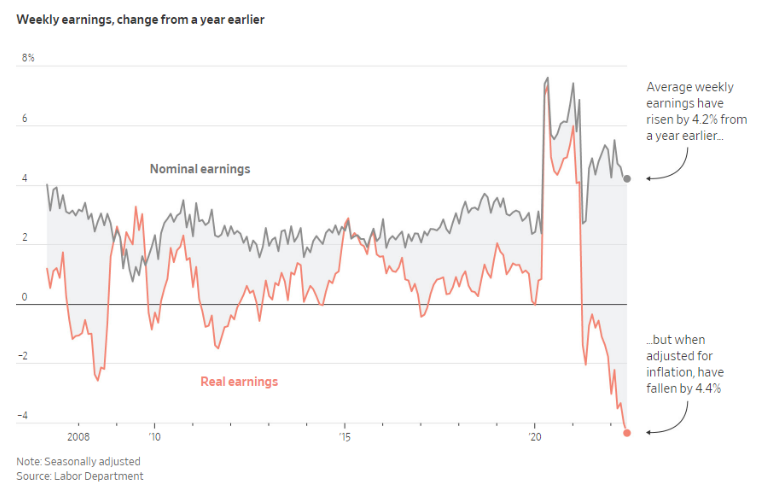

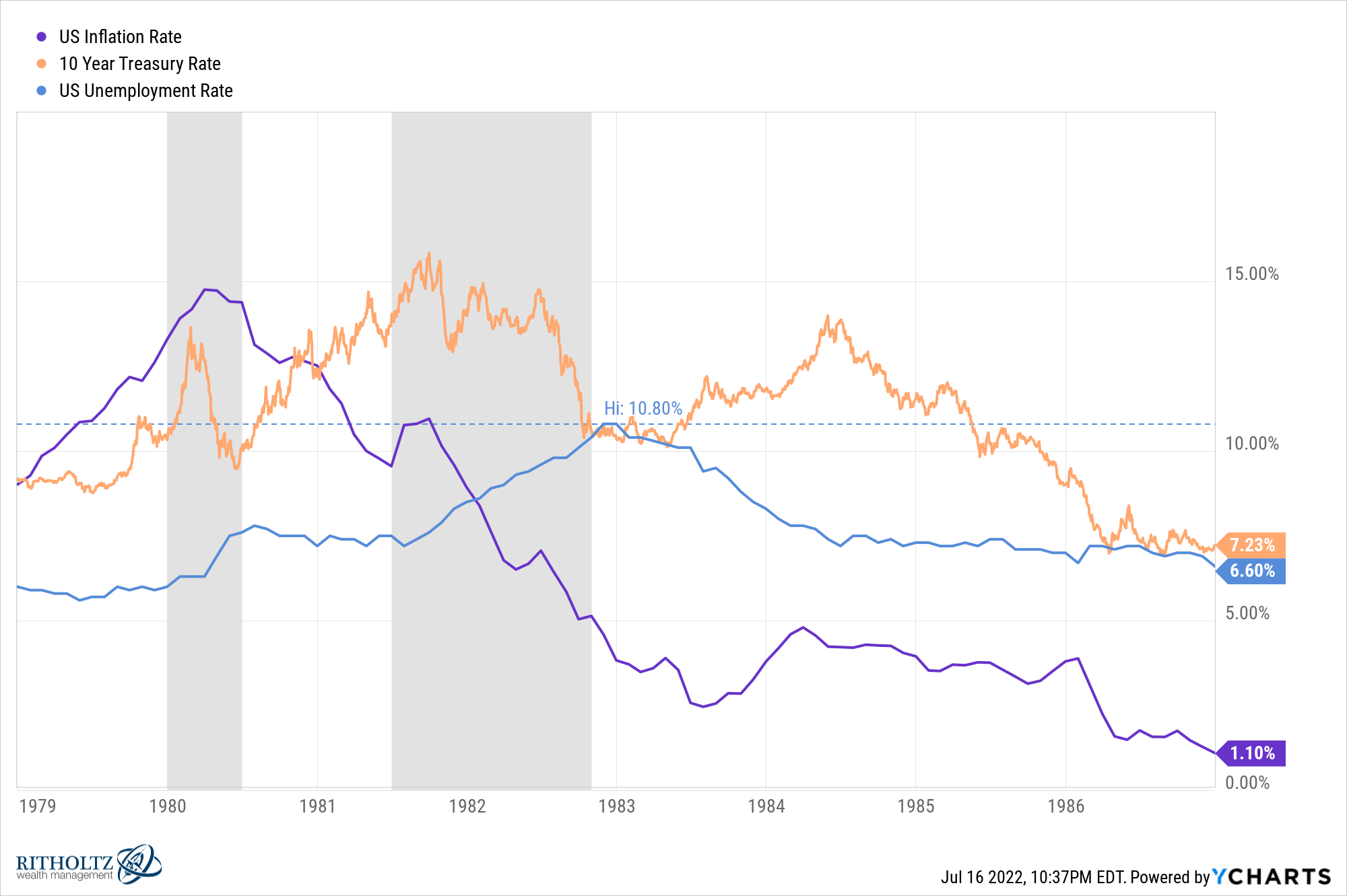

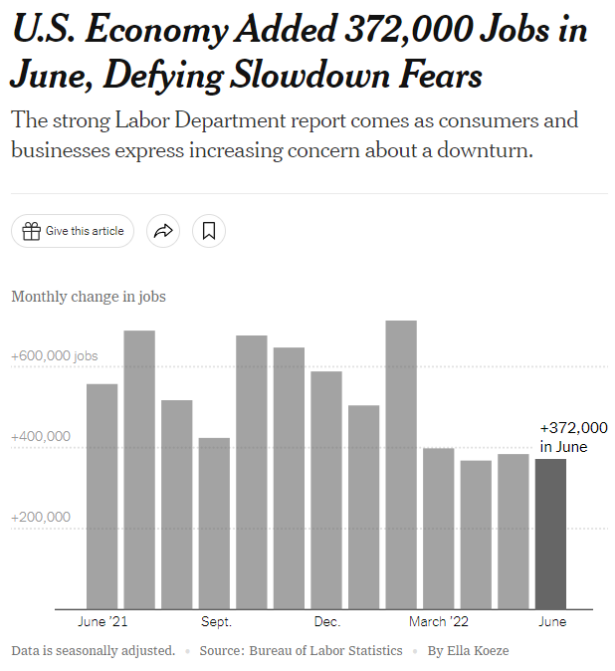

On today’s show, we discuss stocks for the long run, Elon’s Twitter debacle, the labor market vs. inflation, the number of cycles we’ve experienced since the pandemic, peak inflation, and much more.

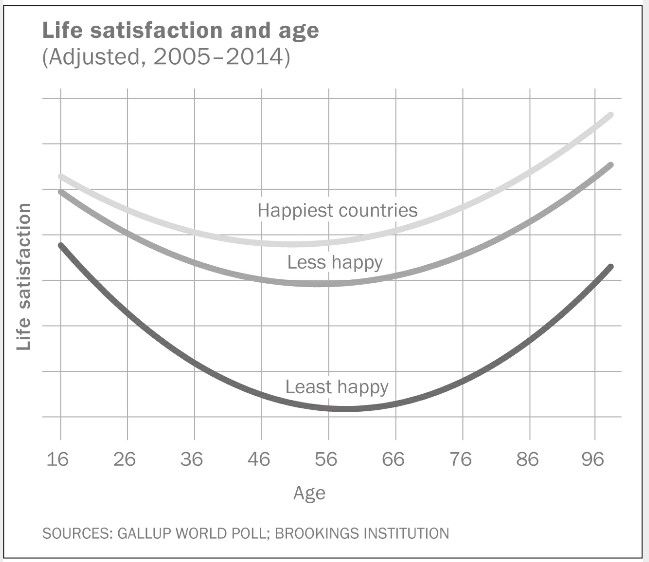

Why doesn’t more money make you happier?

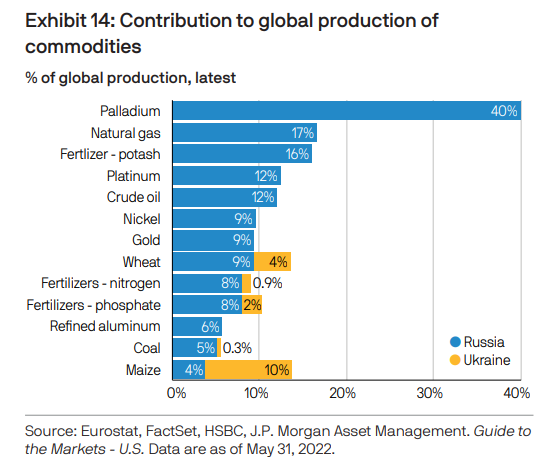

On today’s show, we’re joined by Sal Gilbertie of Teucrium ETFs to give us an update on global commodities markets, Russia’s weaponization of wheat, and much more.

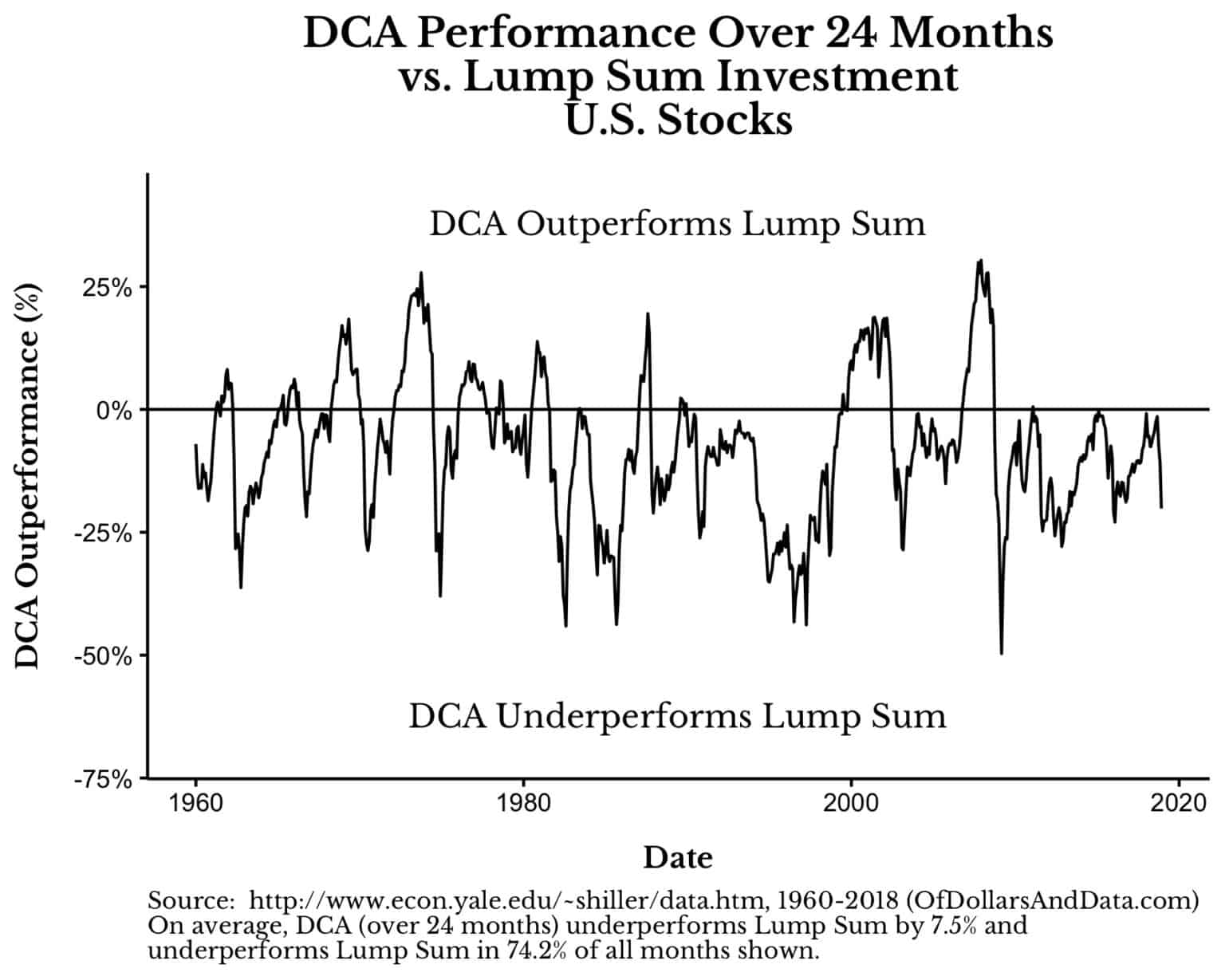

Lump sum vs. dollar cost averaging in a bear market.

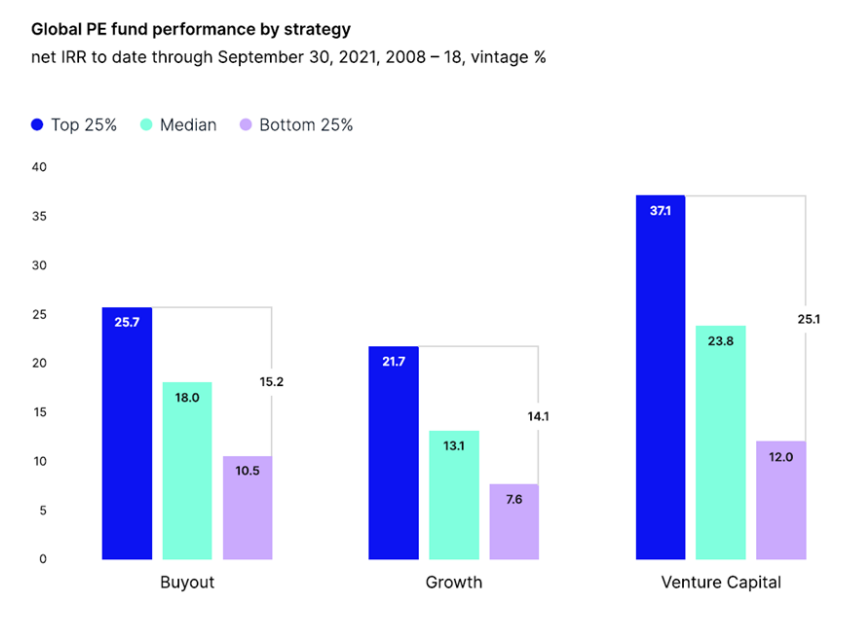

On today’s show, we discuss similarities between the late 90s and today, how tough it is to get VC exposure, current market dynamics within the private markets, and much more.