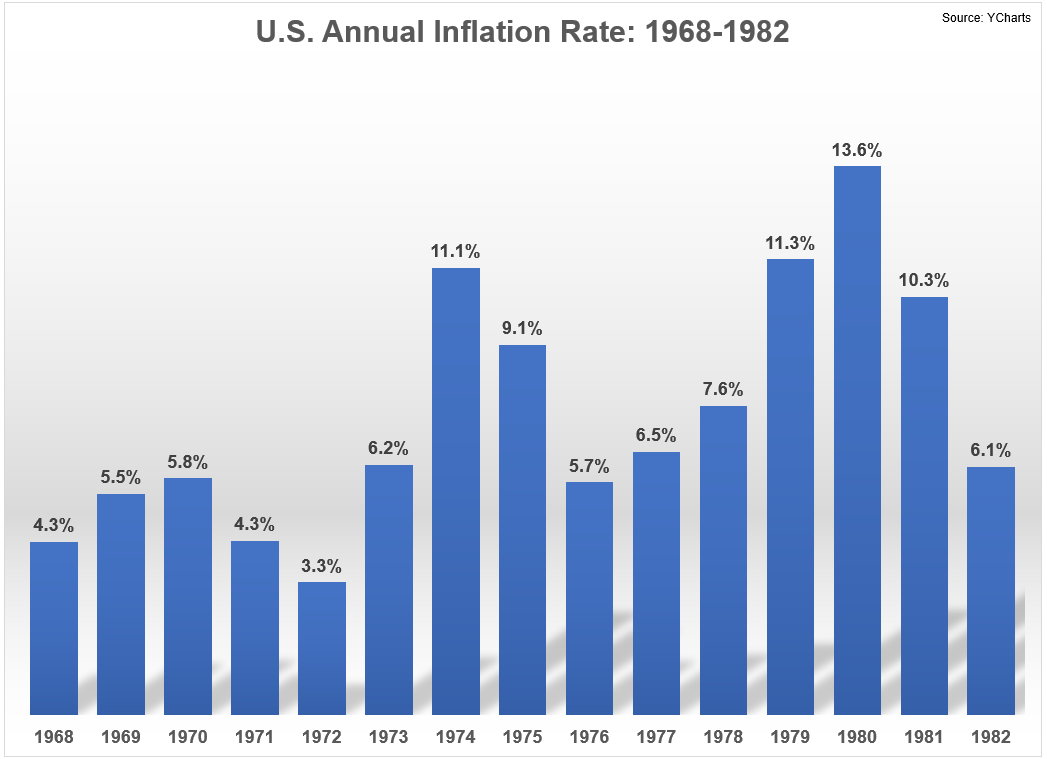

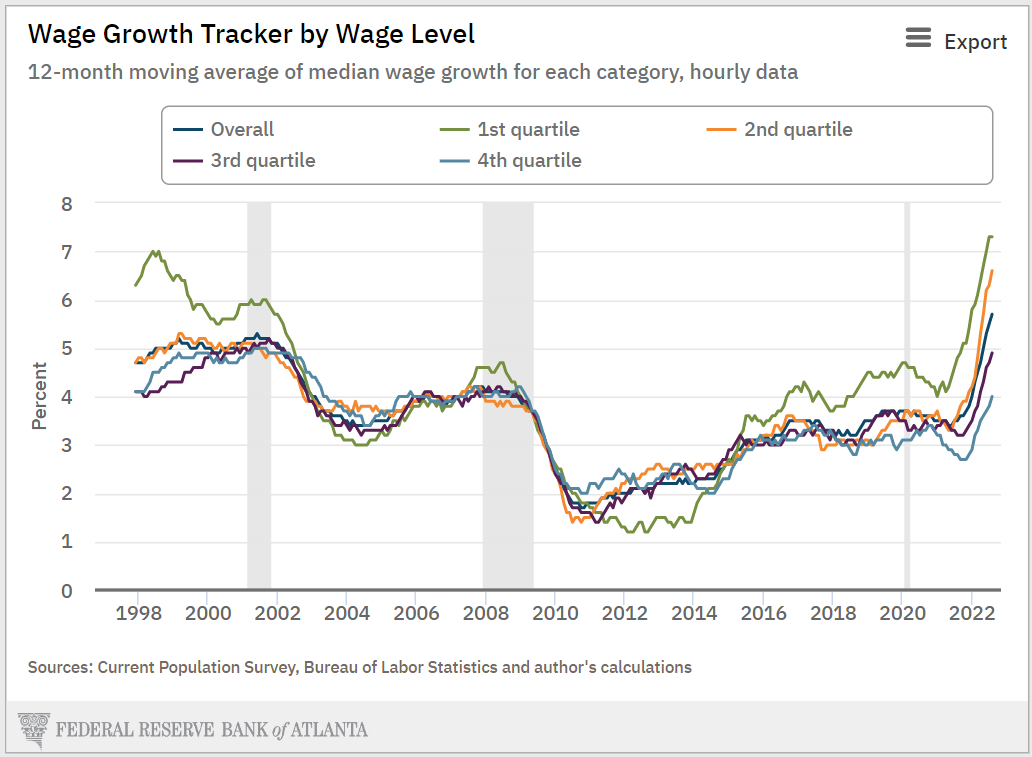

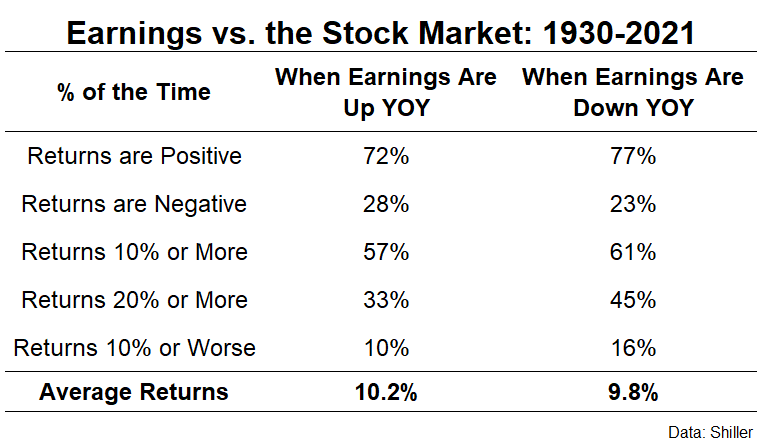

On today’s show, we discuss the trouble with nailing the bottom in a bear market, why money continues flowing into ARK, why the VIX isn’t higher, sticky inflation, why the bottom 50% has seen their net worth double since the start of the pandemic, Netflix with ads and much more.