On today’s show, we discuss:

– How we prioritize our spending

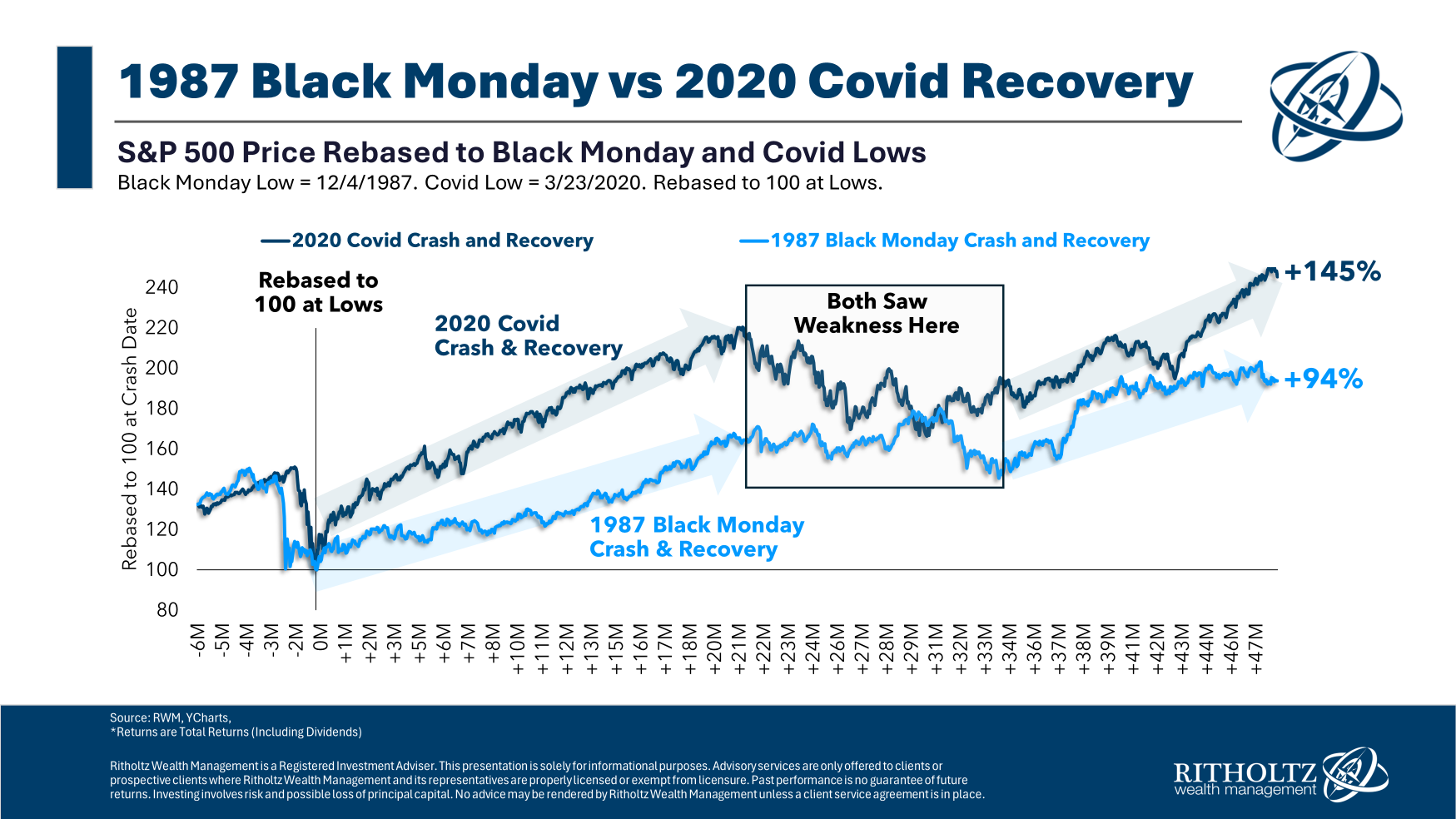

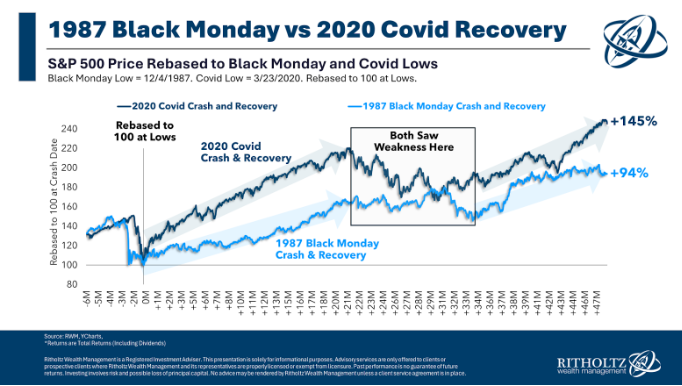

– 1987 vs. the Covid crash

– Crazy index fund flows

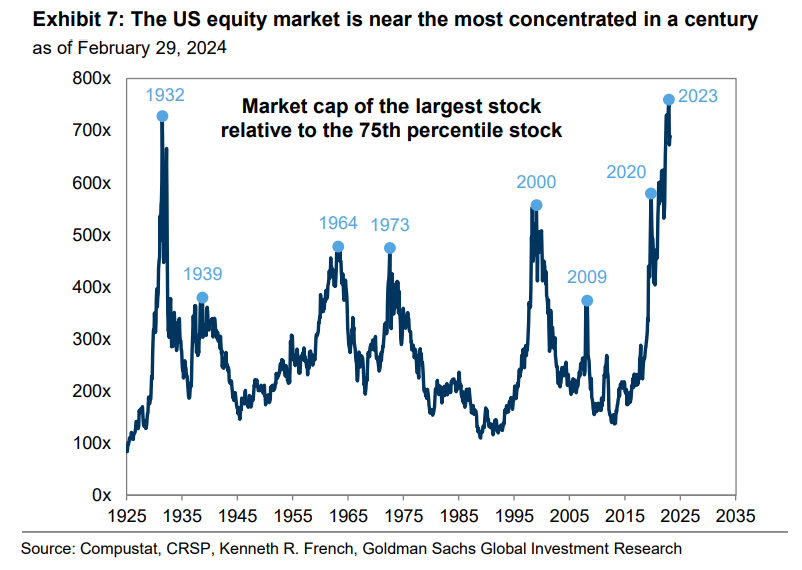

– Stock market concentration

– Panic about government debt

– The tech recession in California

– Will Millennials move to Florida in retirement

– The most streamed shows, and much more!