Why diversification is a survival strategy but also an agressive one.

Why diversification is a survival strategy but also an agressive one.

On today’s show, we spoke with Matt Kaufman, SVP and Head of ETFs at Calamos Investments to discuss:

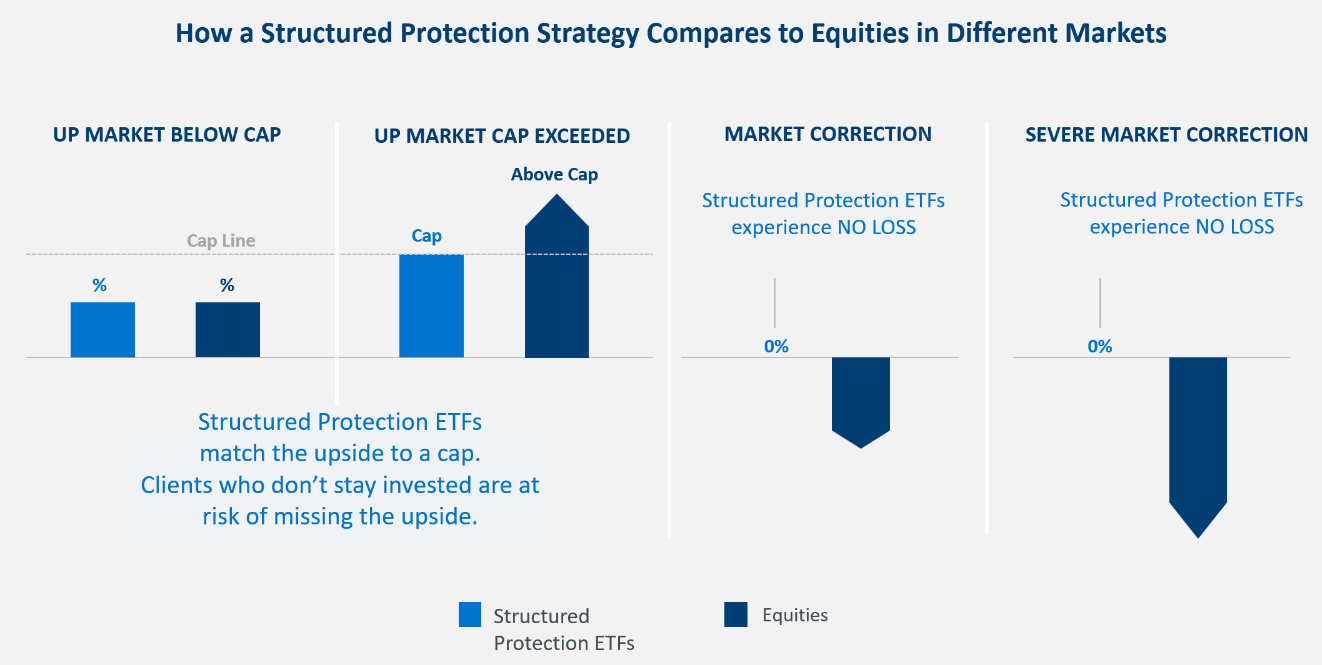

– Why embedding options within ETF wrappers has gotten so popular

– How Calamos structures protection ETFs

– Why timing can matter with structured protection ETFs

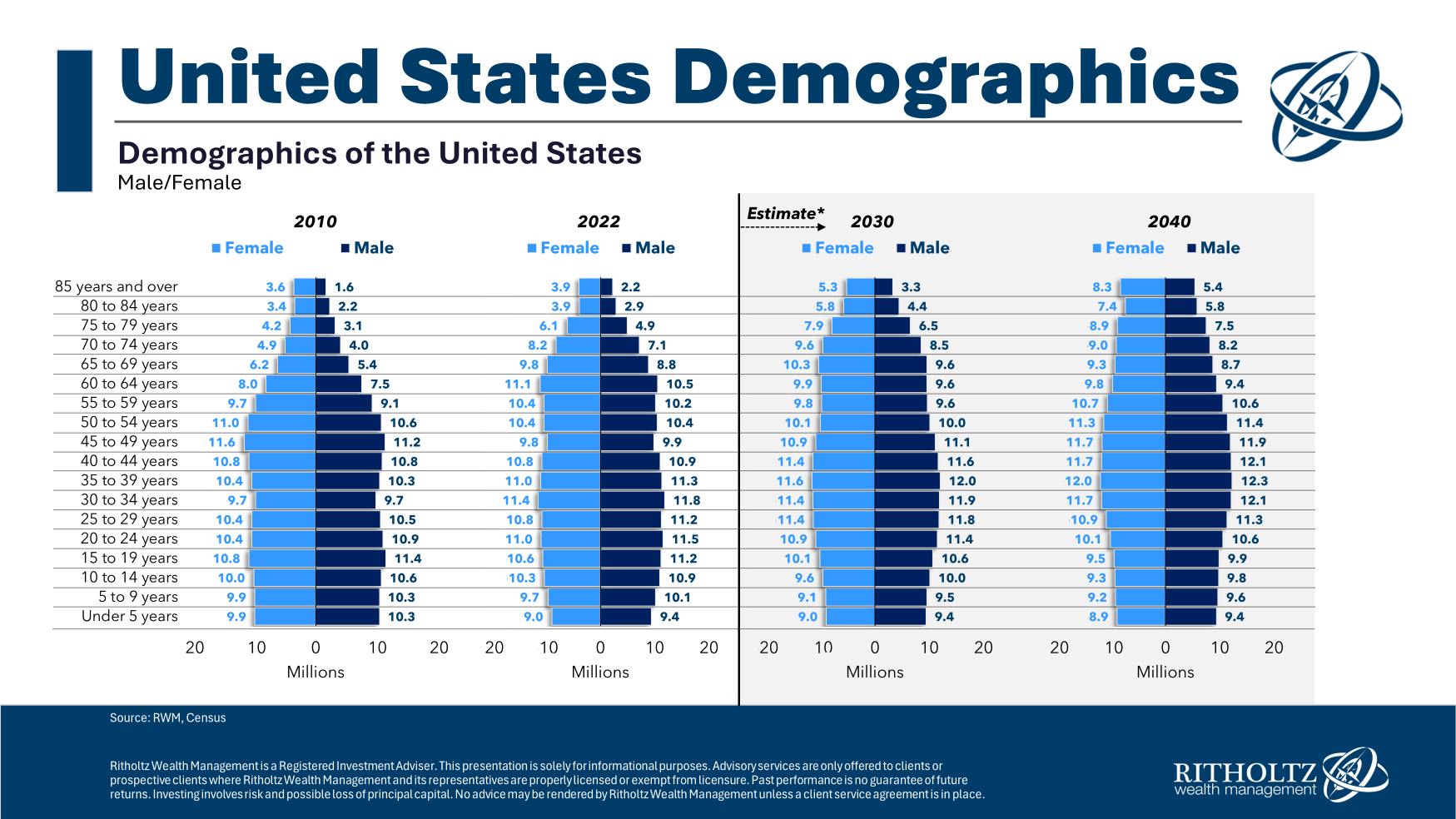

– Demographic tailwinds for structured protection products, and much more!

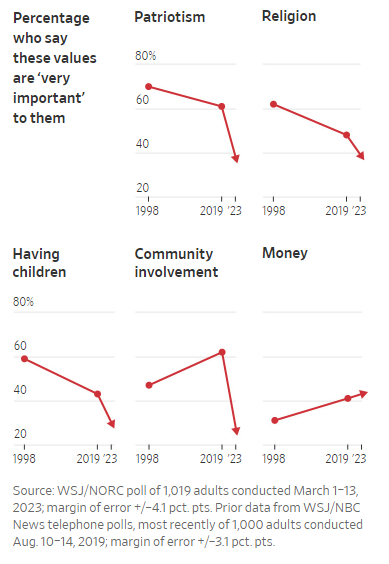

Some questions I have based on current demographic trends.

Translating some of Wall Street’s favorite words and phrases.

What does insolvancy mean for Social Security?

On today’s show, we discuss:

– The suffocating bull market

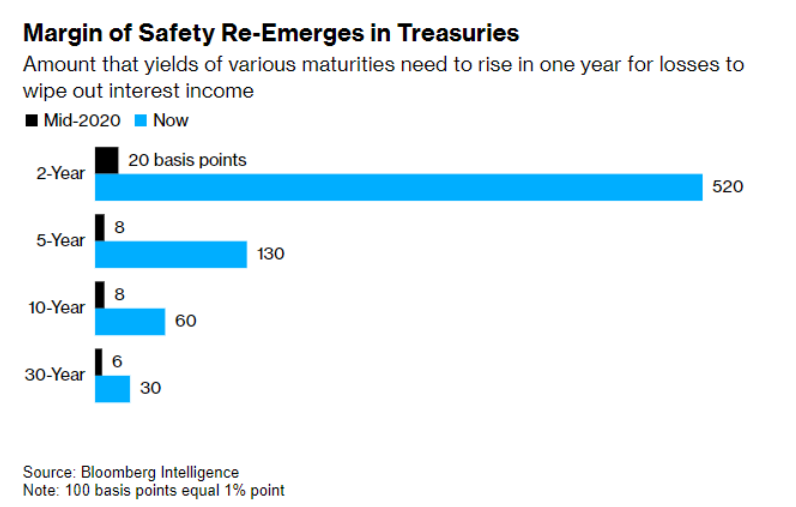

– The other side of government debt

– Jerry Seinfeld on when money changed everything

– Consumers are finally fighting back against inflation

– Wall Street translations

– Who is buying Bitcoin ETFs

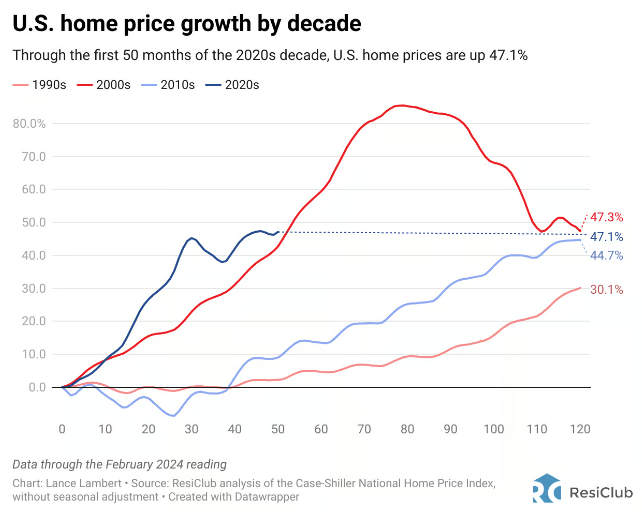

– The bear case against housing, and much more!

If your work is unfullfilling, the money will be too.

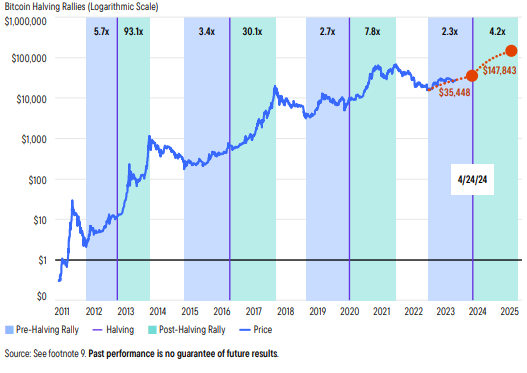

On today’s show, we are joined by Christopher Jensen, Director of Digital Assets Research for Franklin’s Digital Asset Investment Strategies Group to discuss:

– The resiliency of Bitcoin

– The global casino vs global computer use-case theories

– Understanding the Bitcoin halving, and much more!

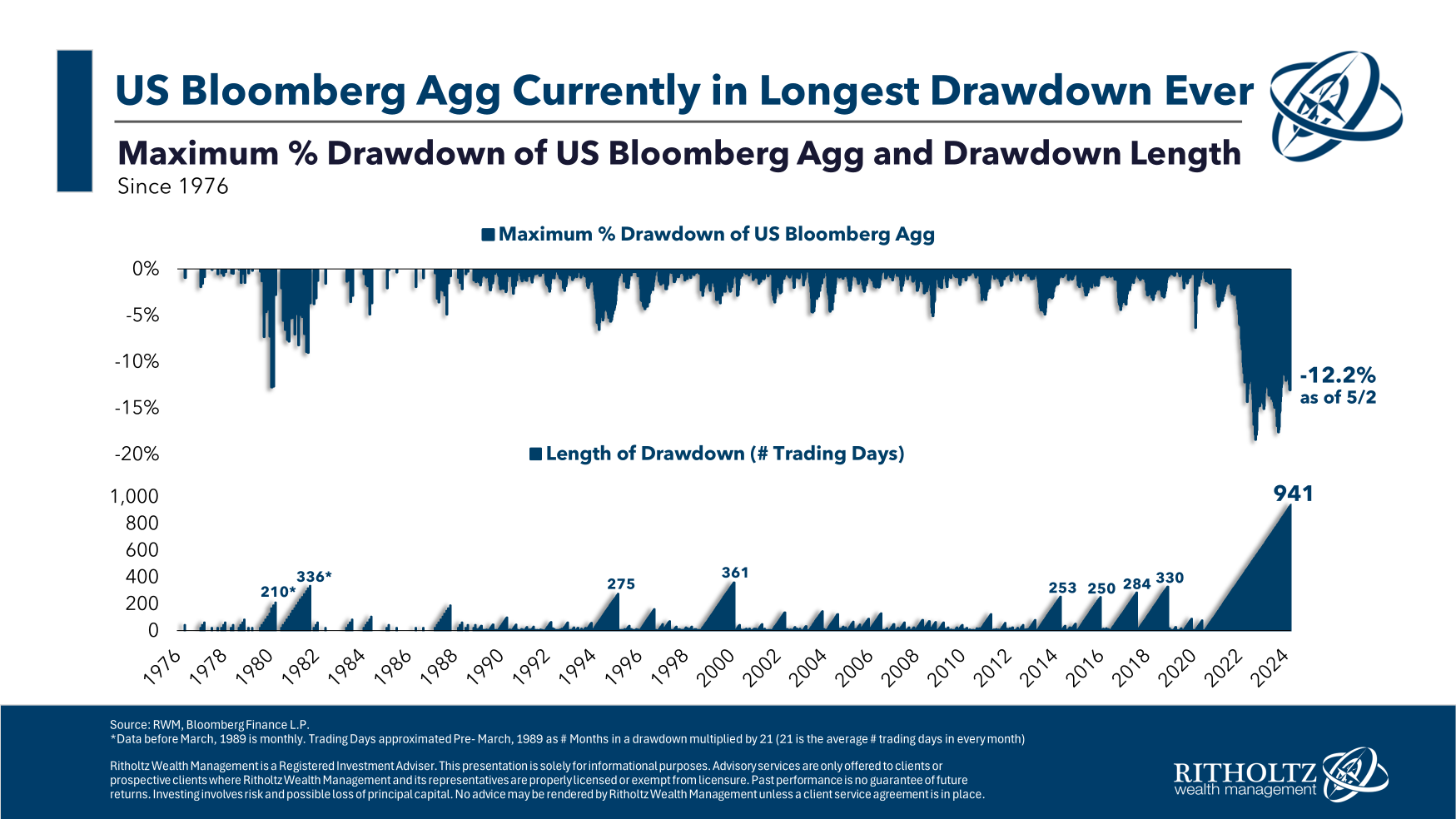

Why aren’t investors freaking out about bond market losses?

Why higher housing prices are here to stay.