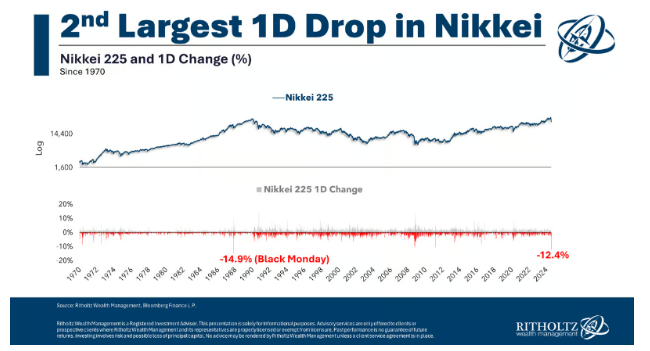

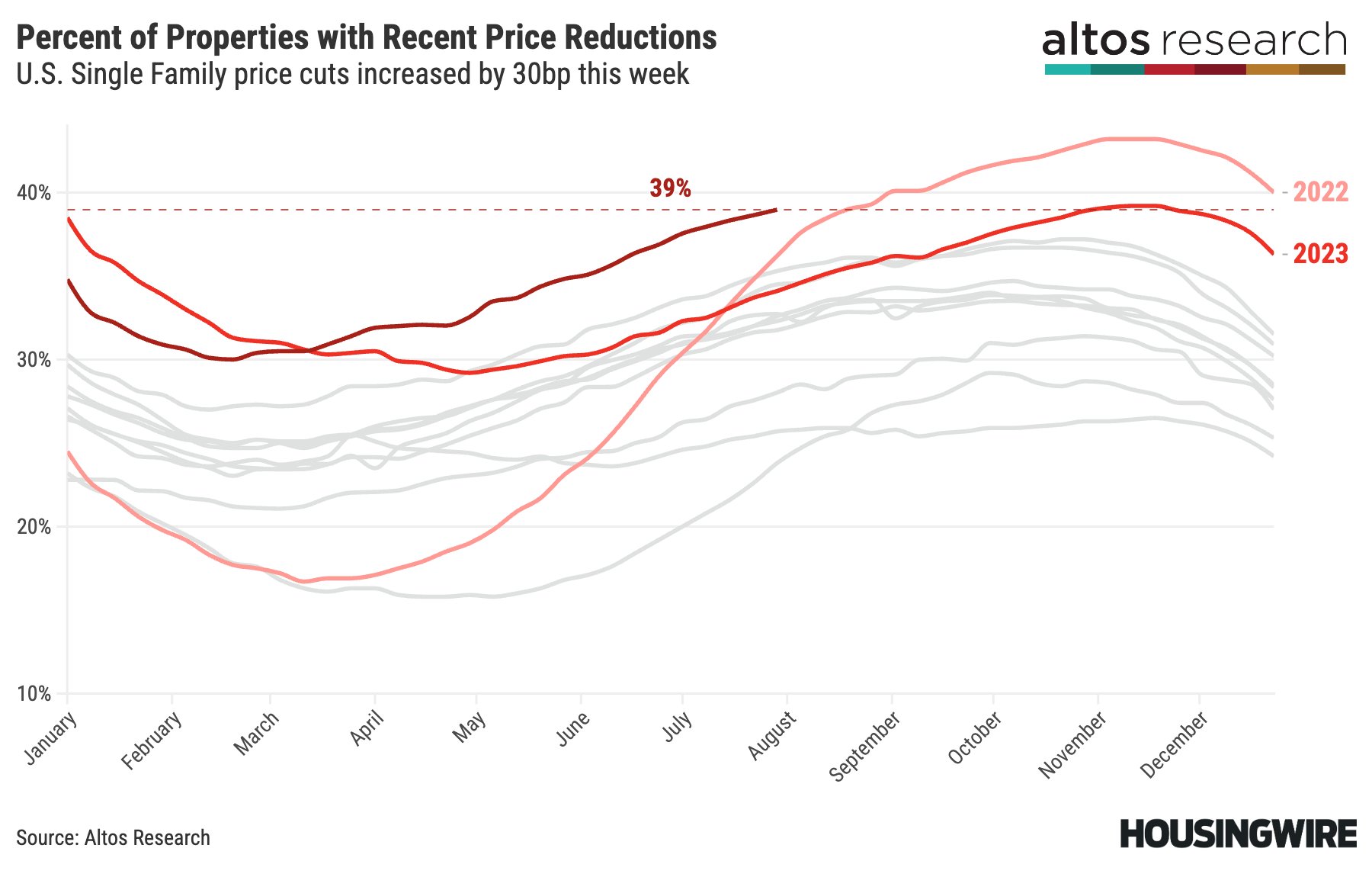

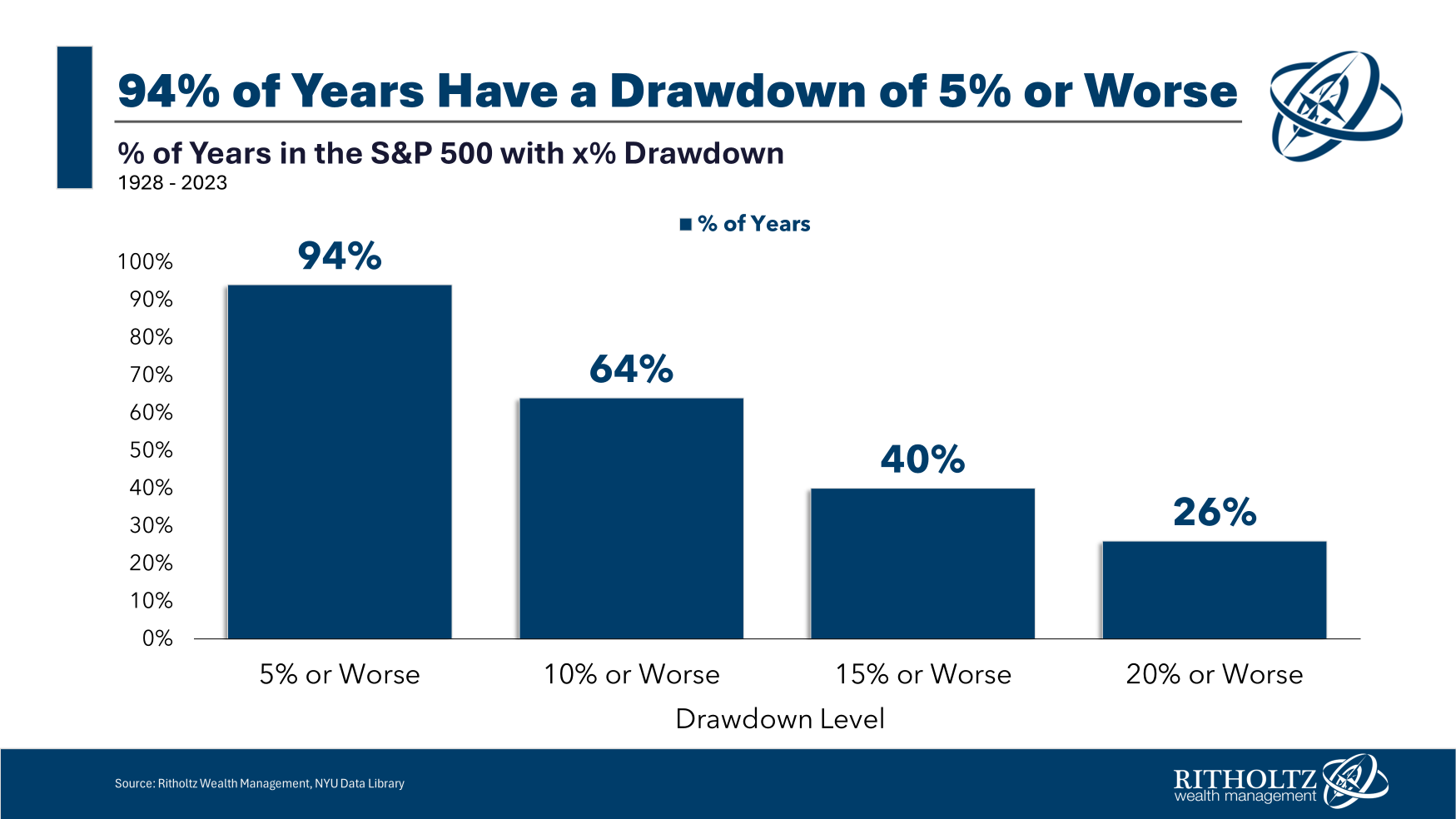

On today’s show we discuss a history of stock market flash crashes, the end of the travel boom, why the economy is finally softening, how to predict a recession, how many households actually live paycheck to paycheck, the coming refi/HELOC boom, stock pick loss aversion, movie theaters aren’t dead yet and more.