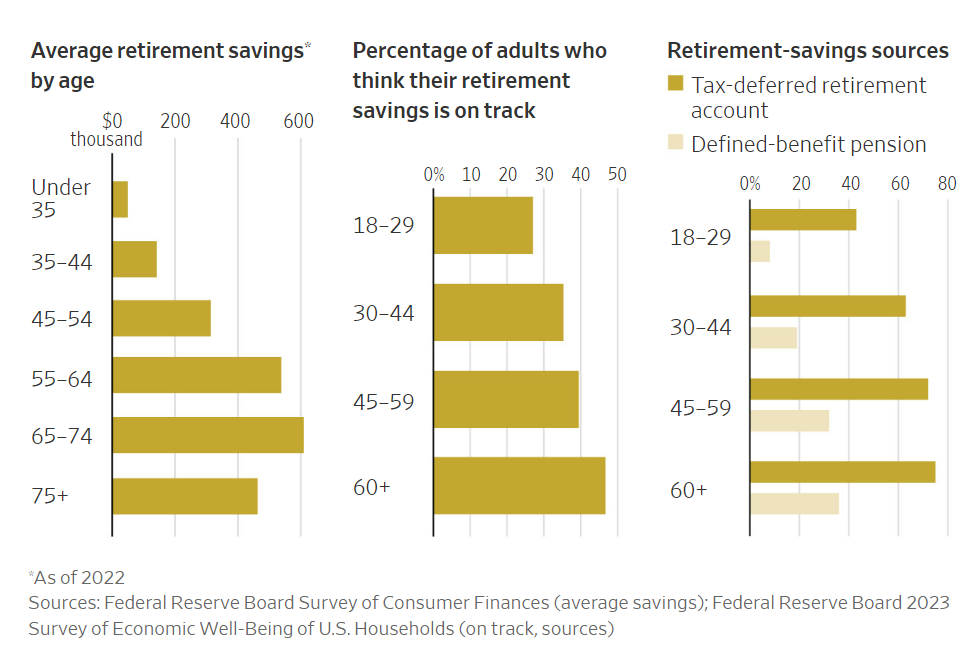

Some legitimate reasons many people don’t save enough for retirement.

Some legitimate reasons many people don’t save enough for retirement.

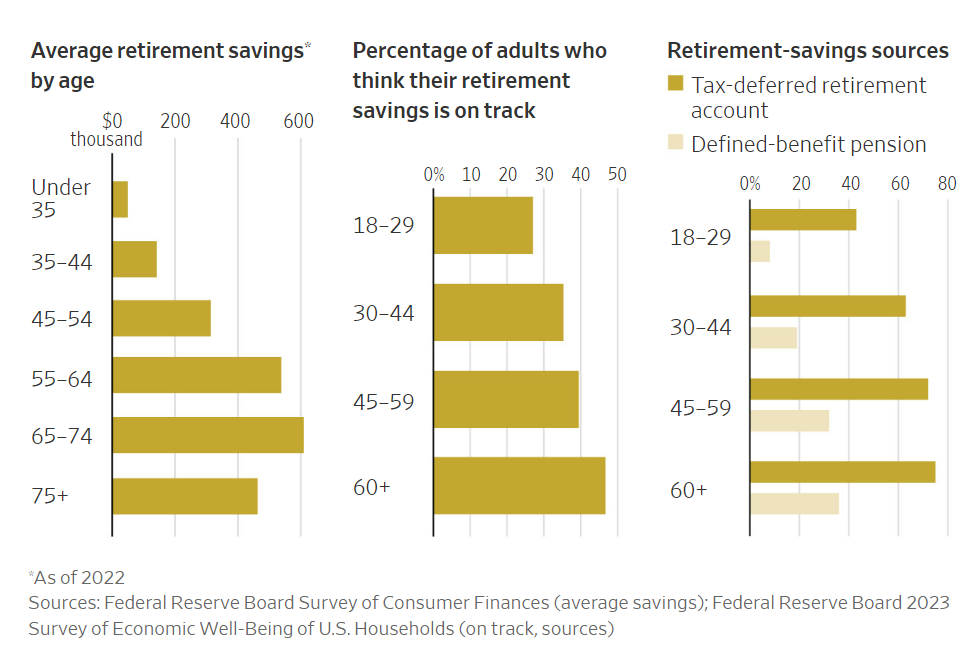

On today’s show, we are joined by Michael Sidgmore of Broadhaven Ventures to discuss all things Alternatives.

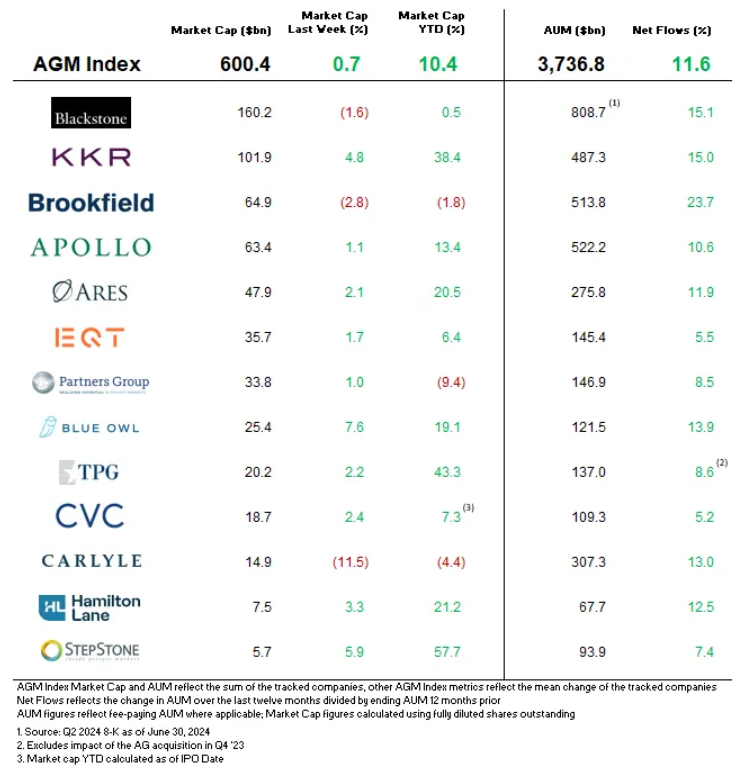

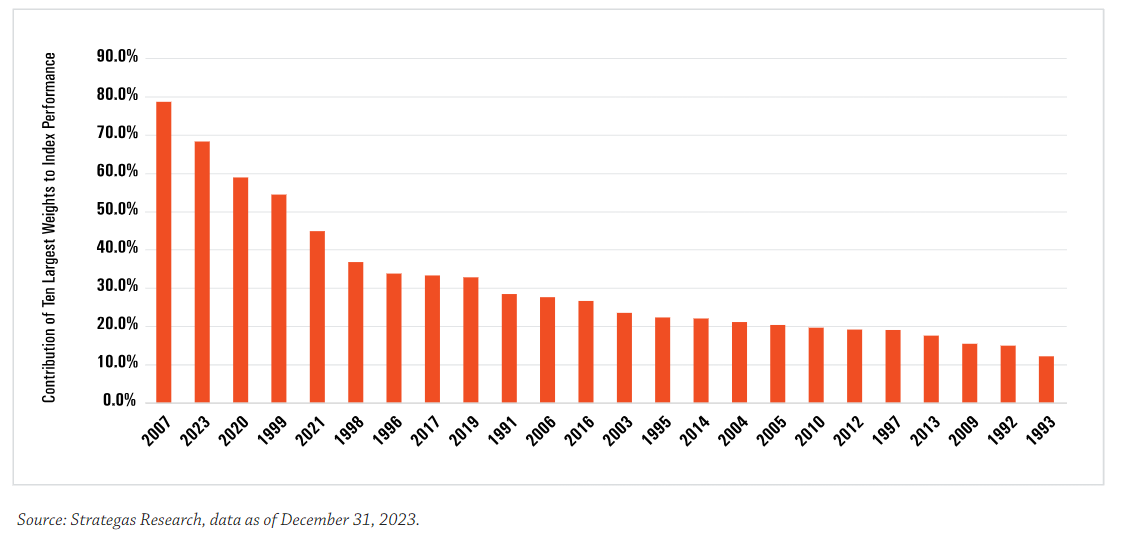

How investors lost $7.5 billion in Cathie Wood’s ARKK fund.

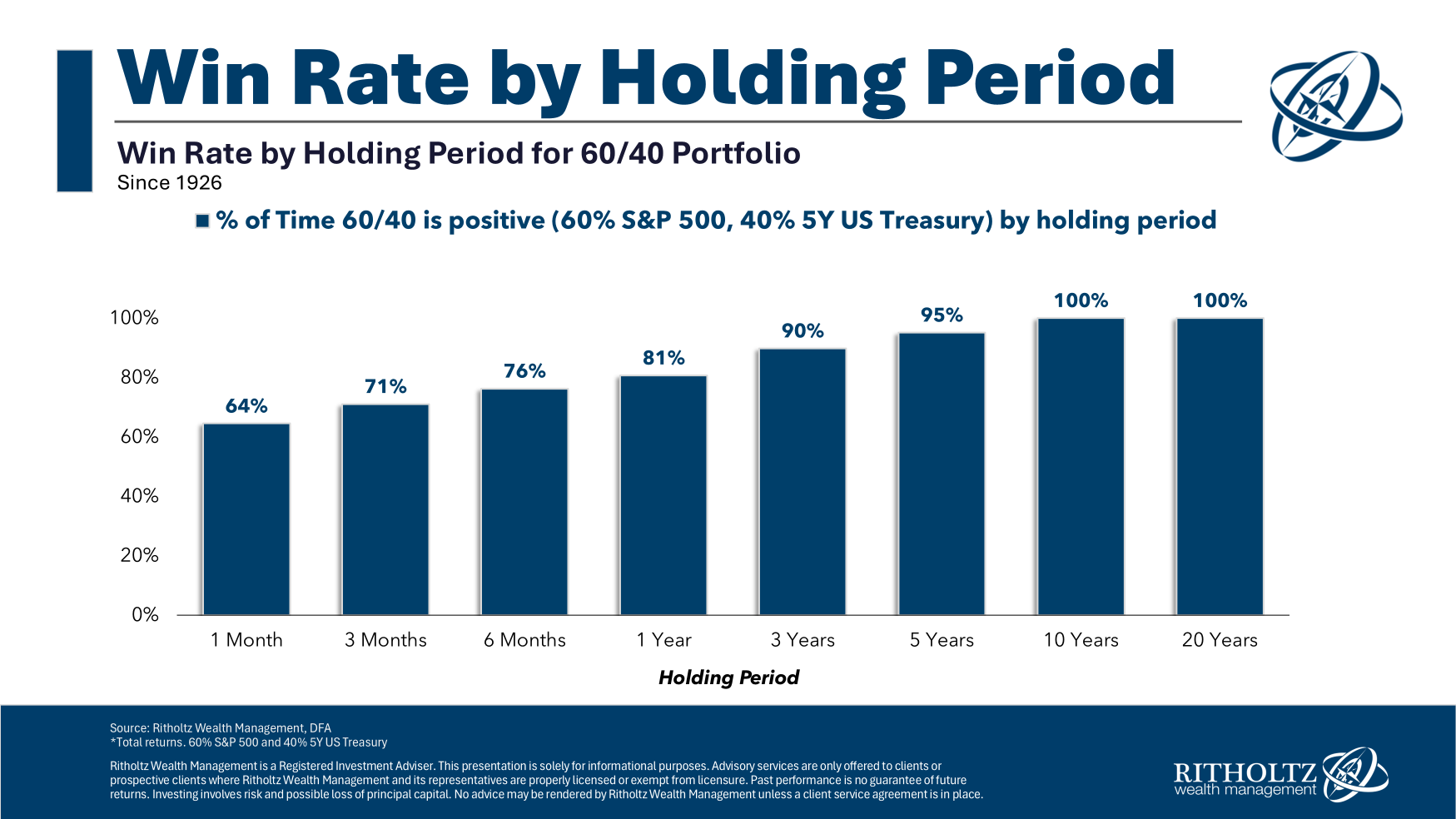

A historical look at the win rate for the 60/40 portfolio over various time frames.

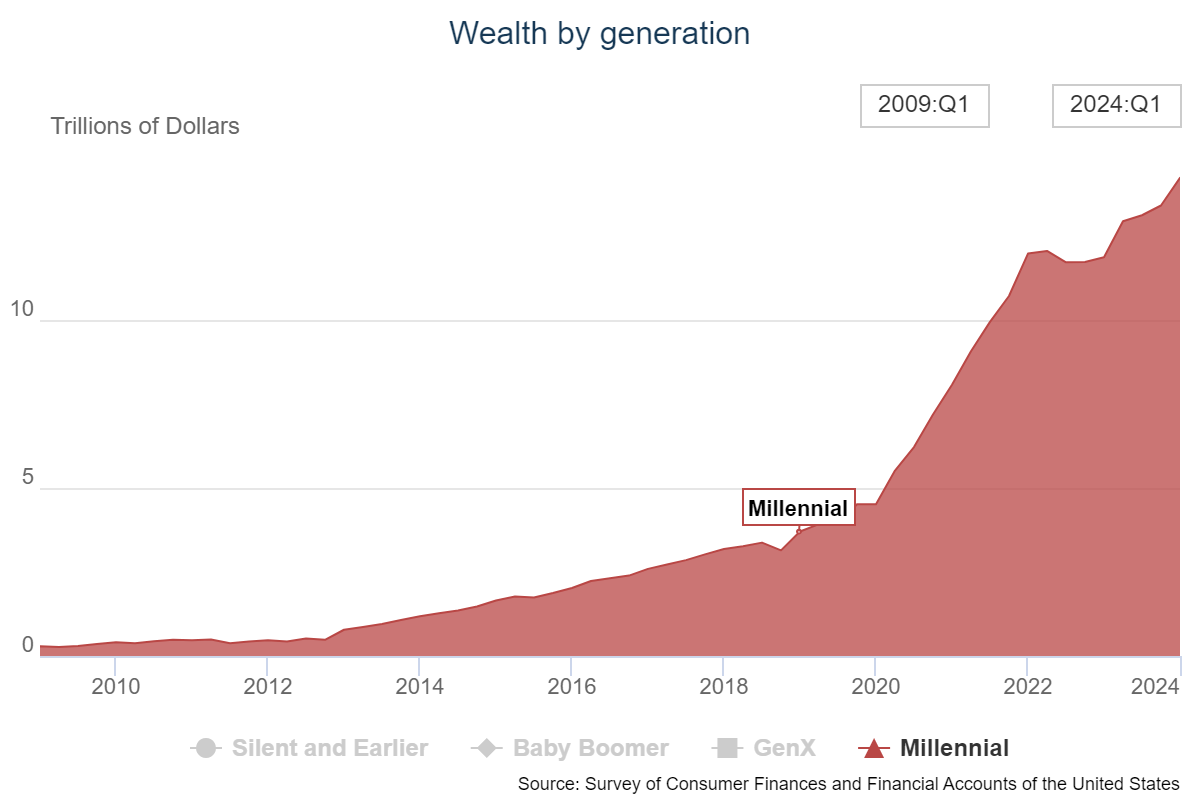

On today’s show we discuss what an average year in the stock market looks like, Seinfeld on consumers, why inflation is such a tricky concept, millennials are richer than you think, grocery stores are not the enemy, star fund managers, how demographics will help the housing market, sending your kids away to summer camp and much more.

How to make poor investment decisions.

On today’s show, we are joined by Kevin Walkush, Portfolio Manager at Jensen Investment Management to discuss what quality means to Jensen, why META was removed from the portfolio, thoughts on AI and tech bubbles, the most exciting sectors for the long term, how interest rates affect valuation models, hallmarks for great quality businesses, and much more!

Millennials gained more wealth than any generation in the 2020s.

Why flash crashes are becoming more common.

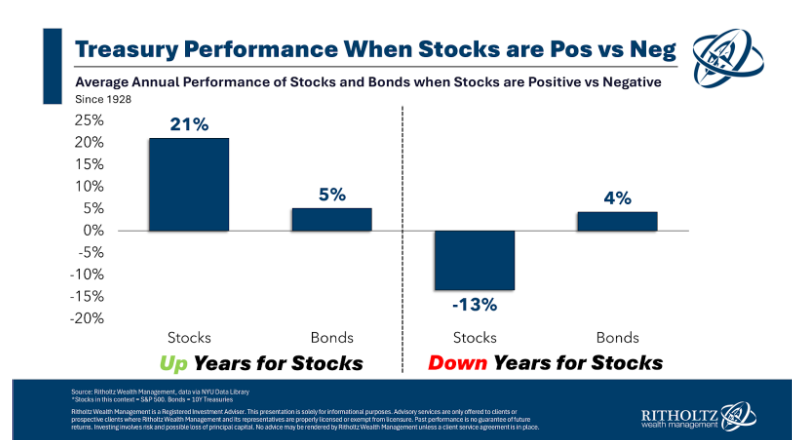

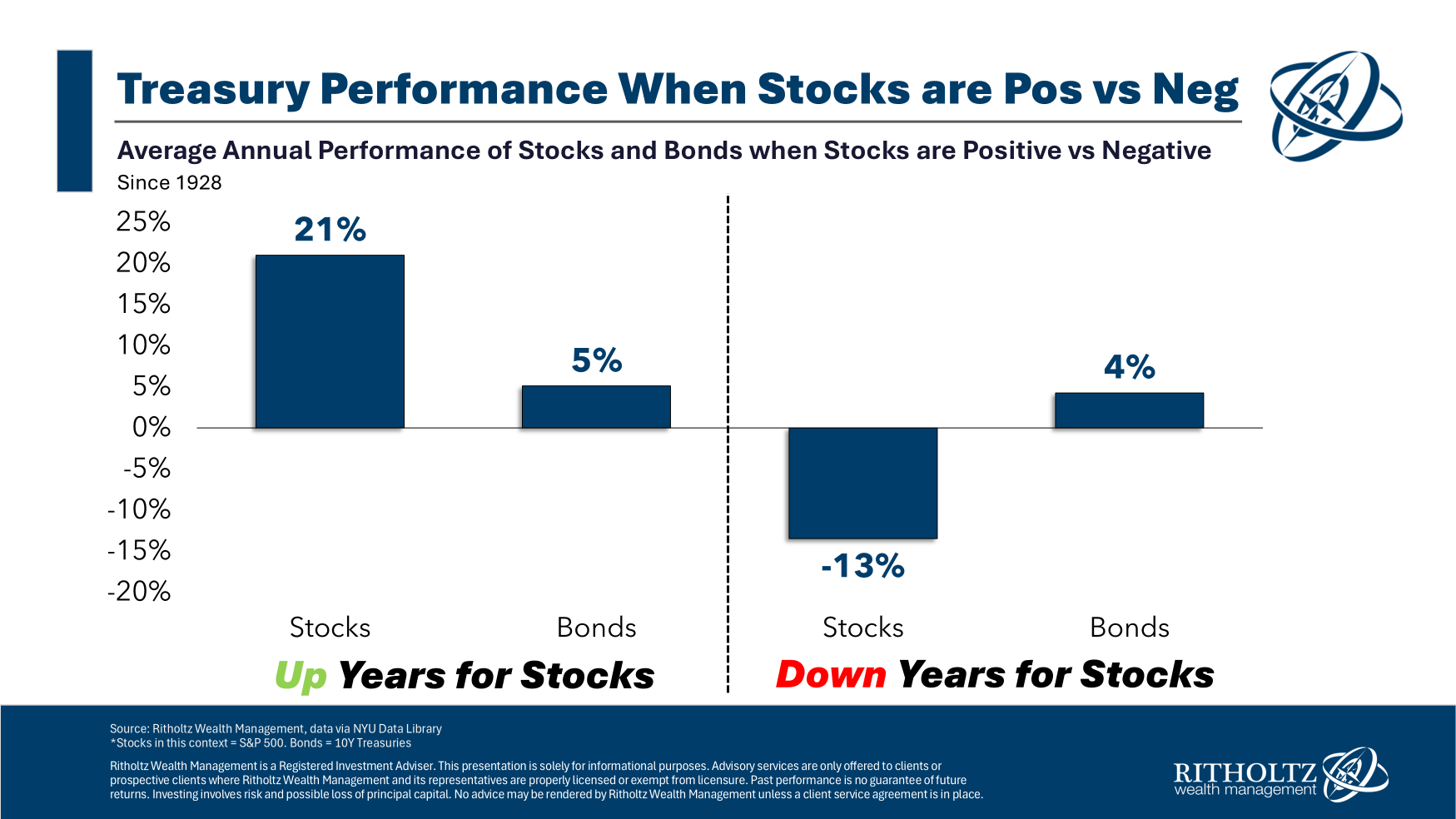

Diversification works most of the time but not all of the time.