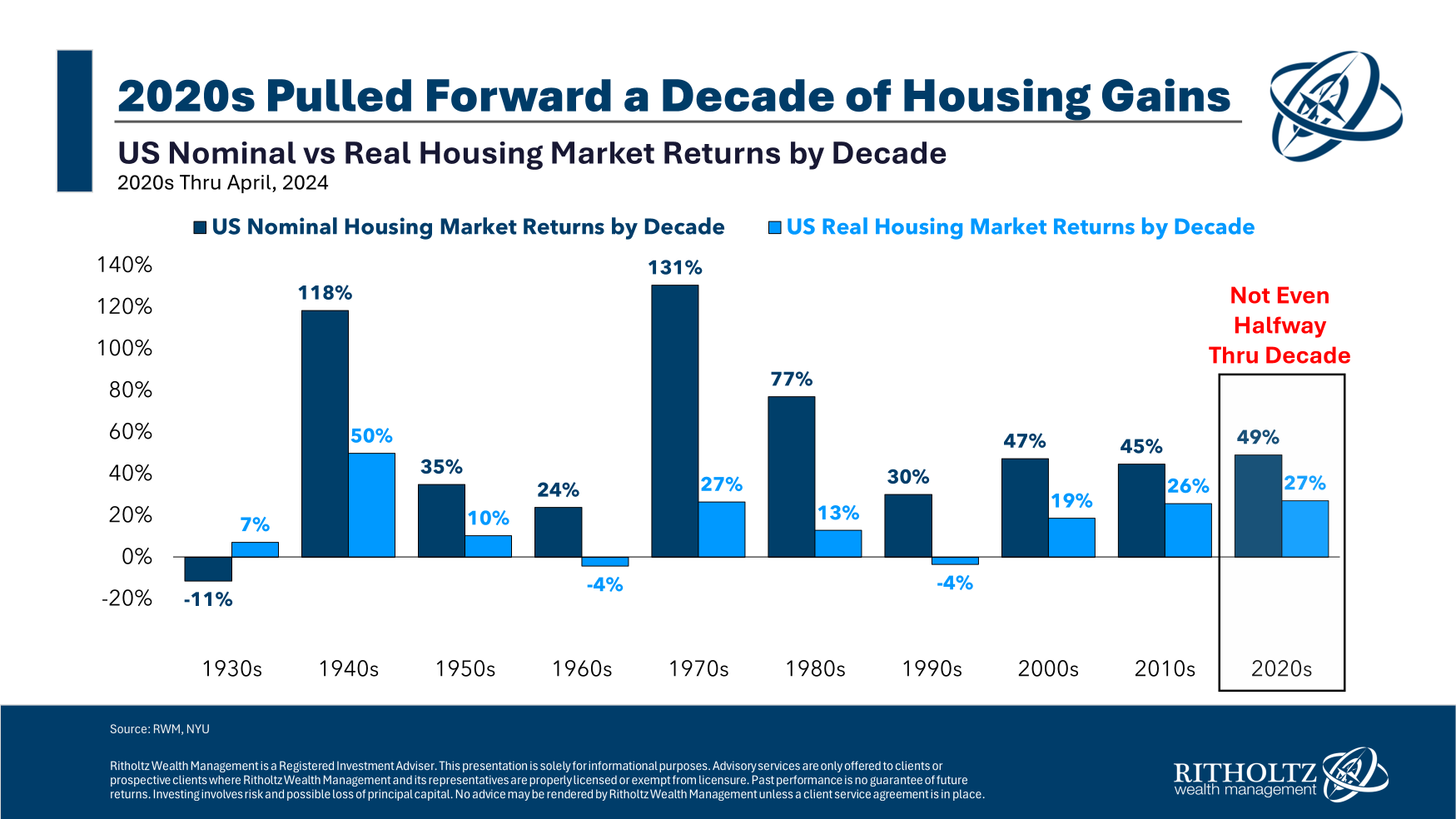

What if this is a top in housing prices?

What if this is a top in housing prices?

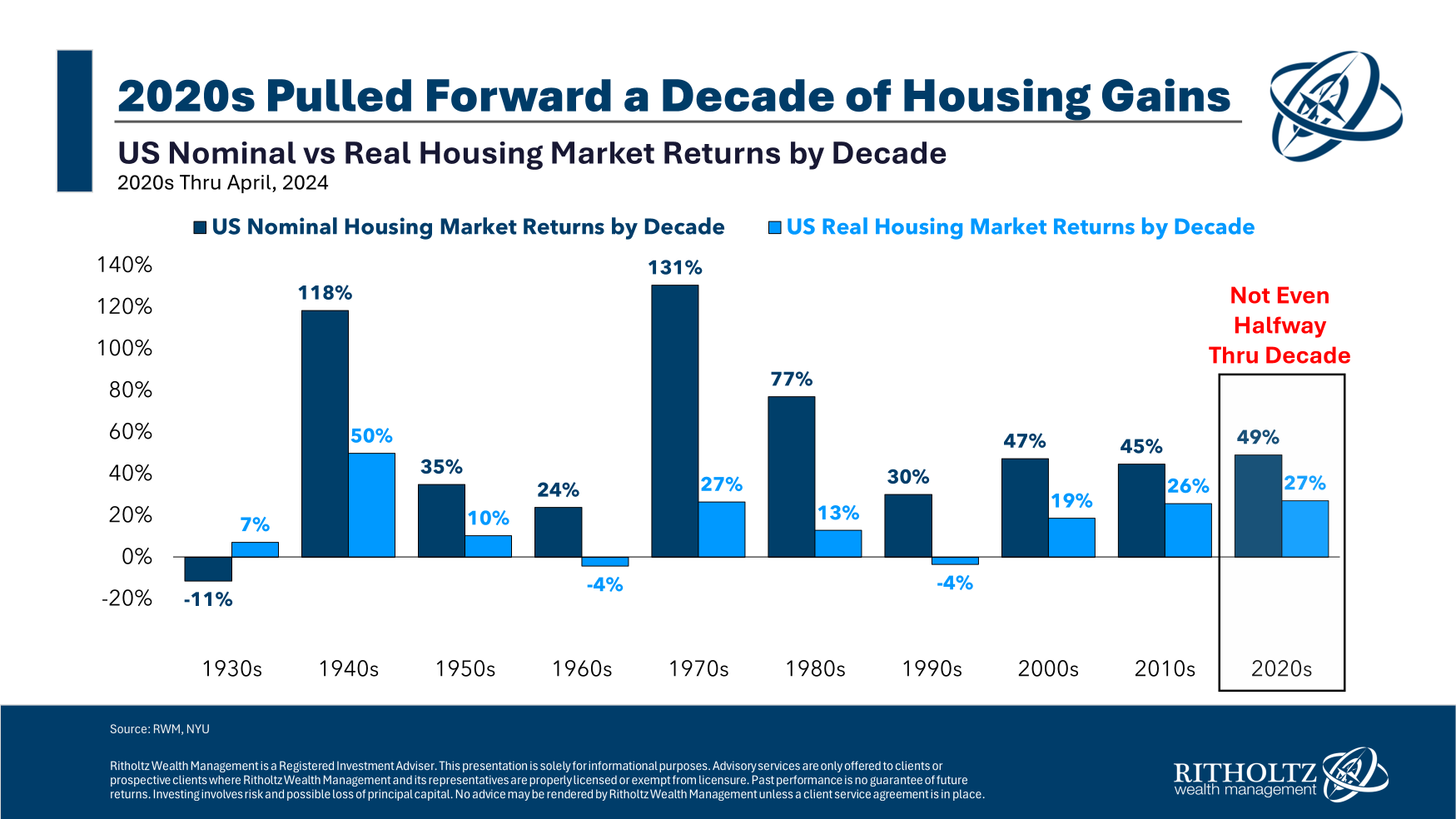

On today’s show, we are joined by Ben Santonelli, Lead Portfolio Manager of Polen Capital’s Credit Opportunities Strategy to discuss how interval funds work, navigating interest rate increases within your bond allocation, how Polen Capital is actively managing bonds, the biggest risk to high yield bonds, how Polen Capital values businesses, thoughts on why spreads have remained tight, and much more!

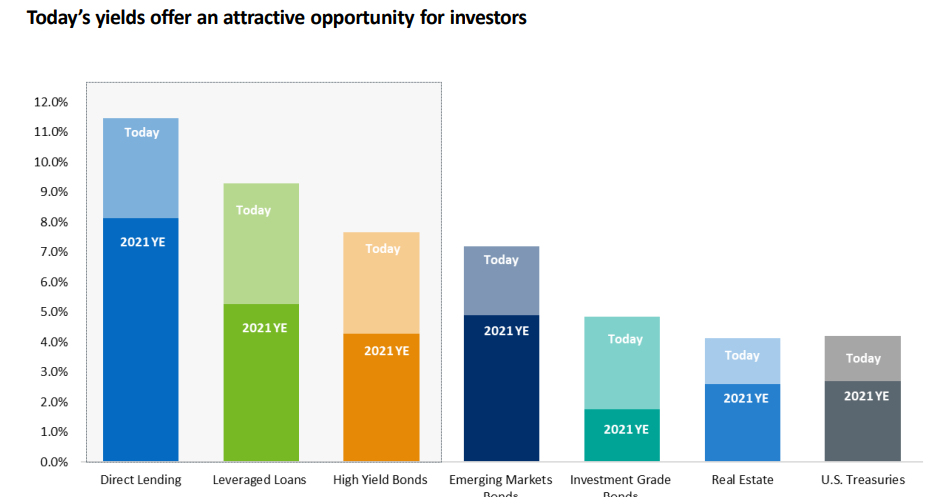

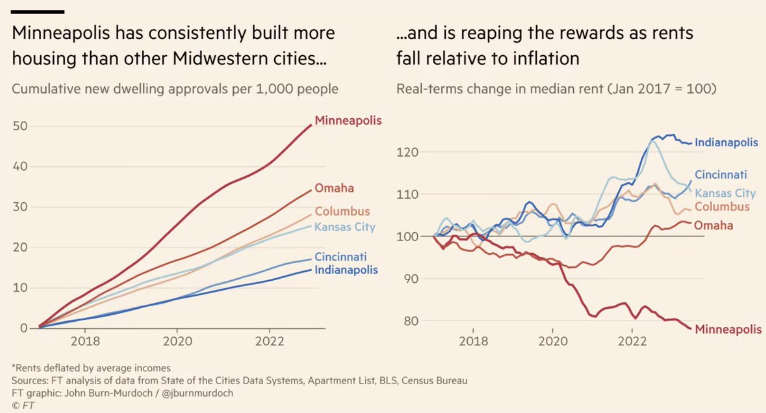

Minneapolis and Austin are the models of making housing more affordable.

On today’s show, we are joined by Coby Lefkowitz, Partner at Backyard to discuss why homebuilding has slowed, why building houses has become such a complex process, thoughts on start-up cities, Private Equity is not buying up all single family units, solutions to the housing crisis, and much more!

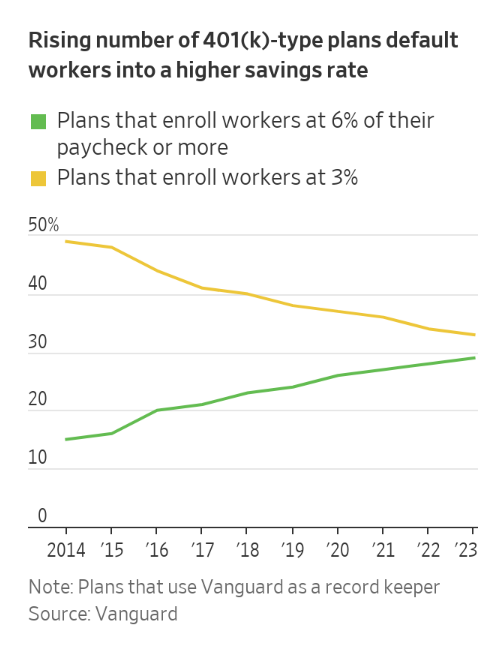

How the 401k plan is impacting the stock market and beyond.

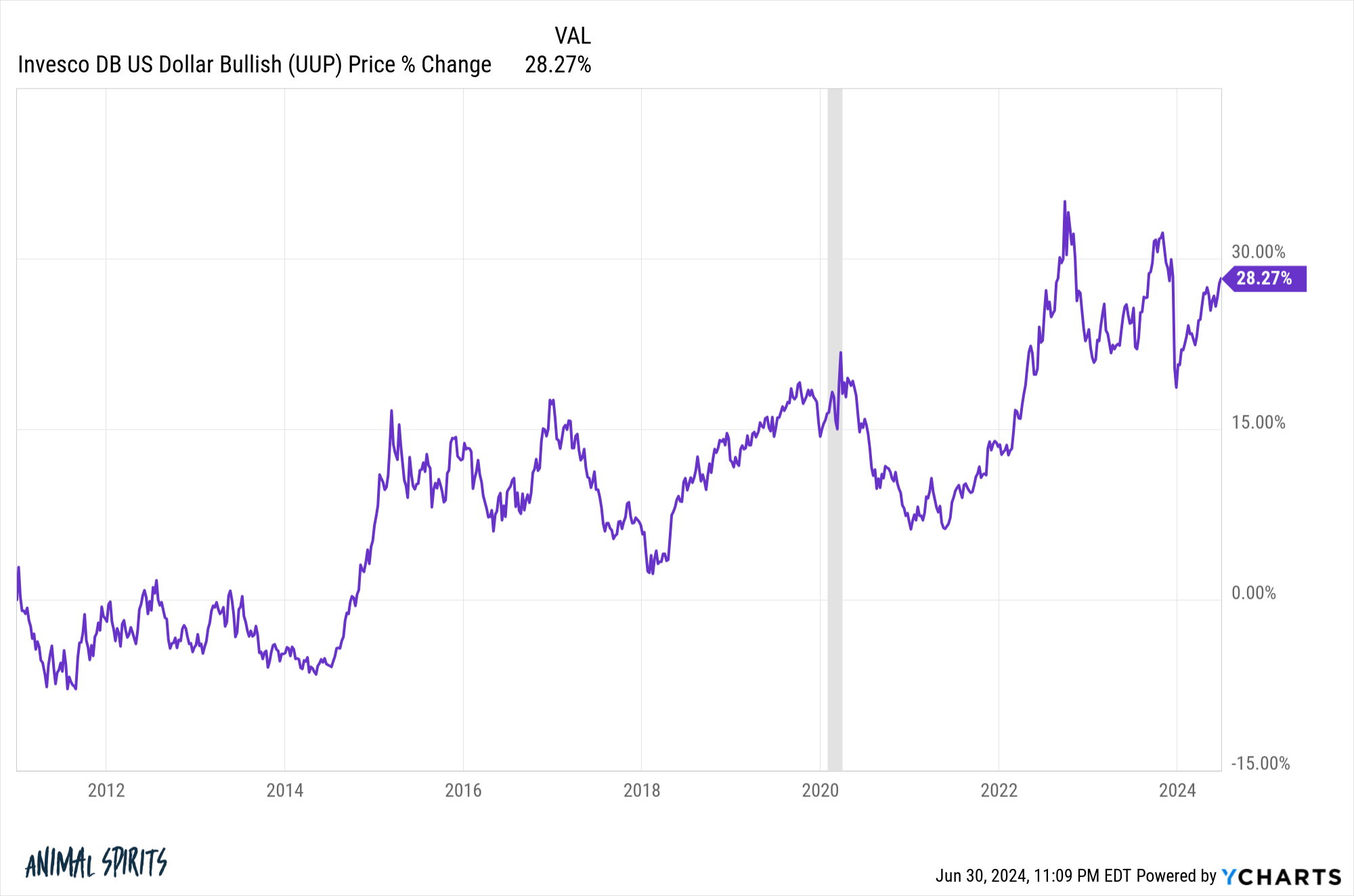

USA! USA! USA!

On today’s show we discuss U.S. domination of the world stock market, how credit spreads work, how the 401k revolution changed the stock market, Americans are rich, an economic slowdown is here, the U.S. labor force is huge, everyone wants to travel, the $5 meal deal inflation indicator and much more.

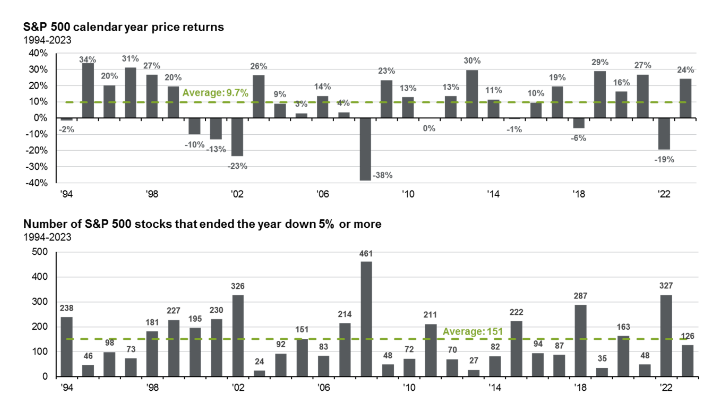

How volatility works in bull and bear markets.

On today’s show, we are joined by Hamilton Reiner, Managing Director, Portfolio Manager, and Head of US Equity Derivatives at JPM Asset Management to discuss active strategies combined with option overlays, why limiting outcomes improves investor experience, how J.P. Morgan constructs option strategies, how volatility affects yield for income strategies, and much more!

An update on housing data.