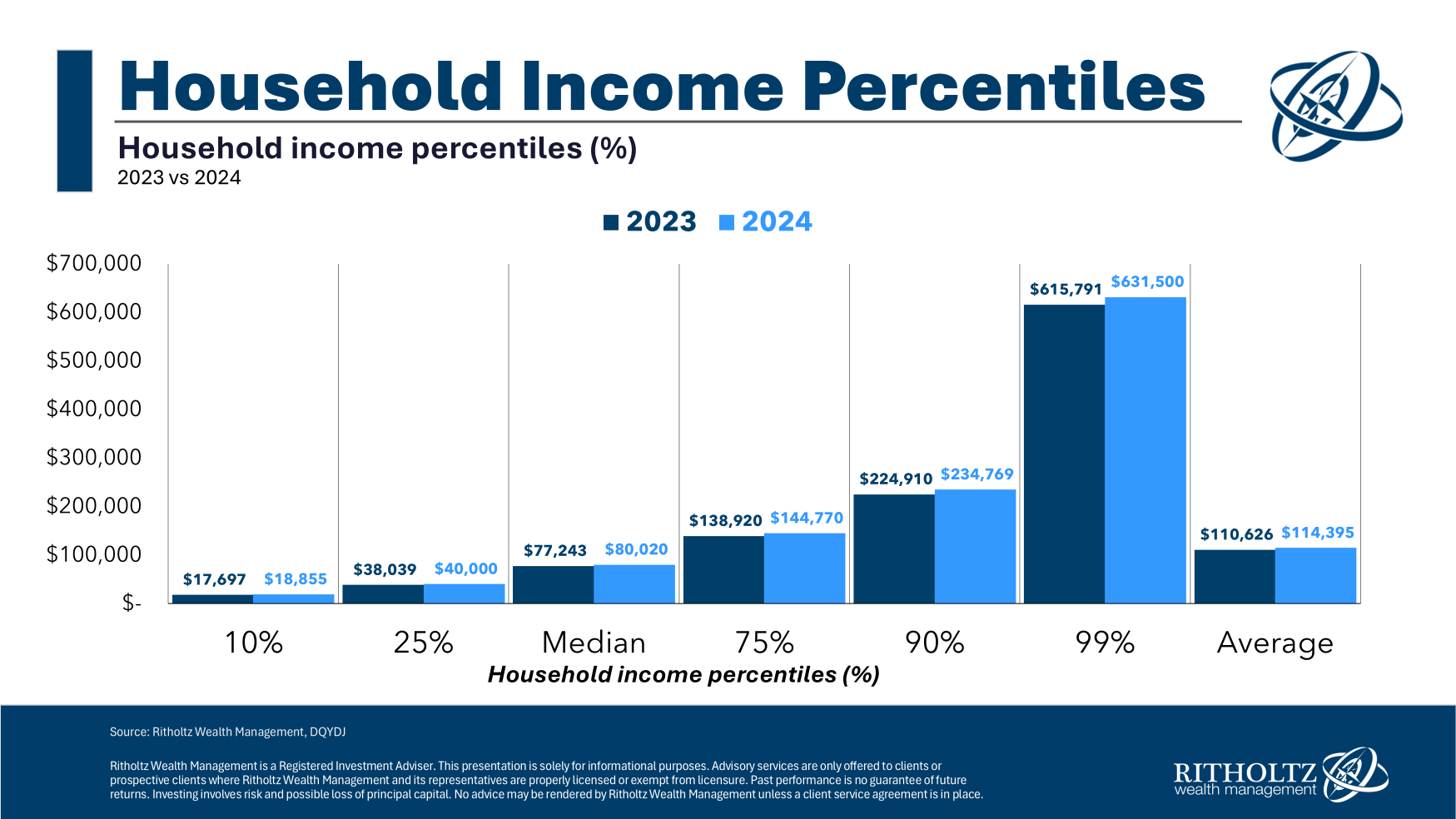

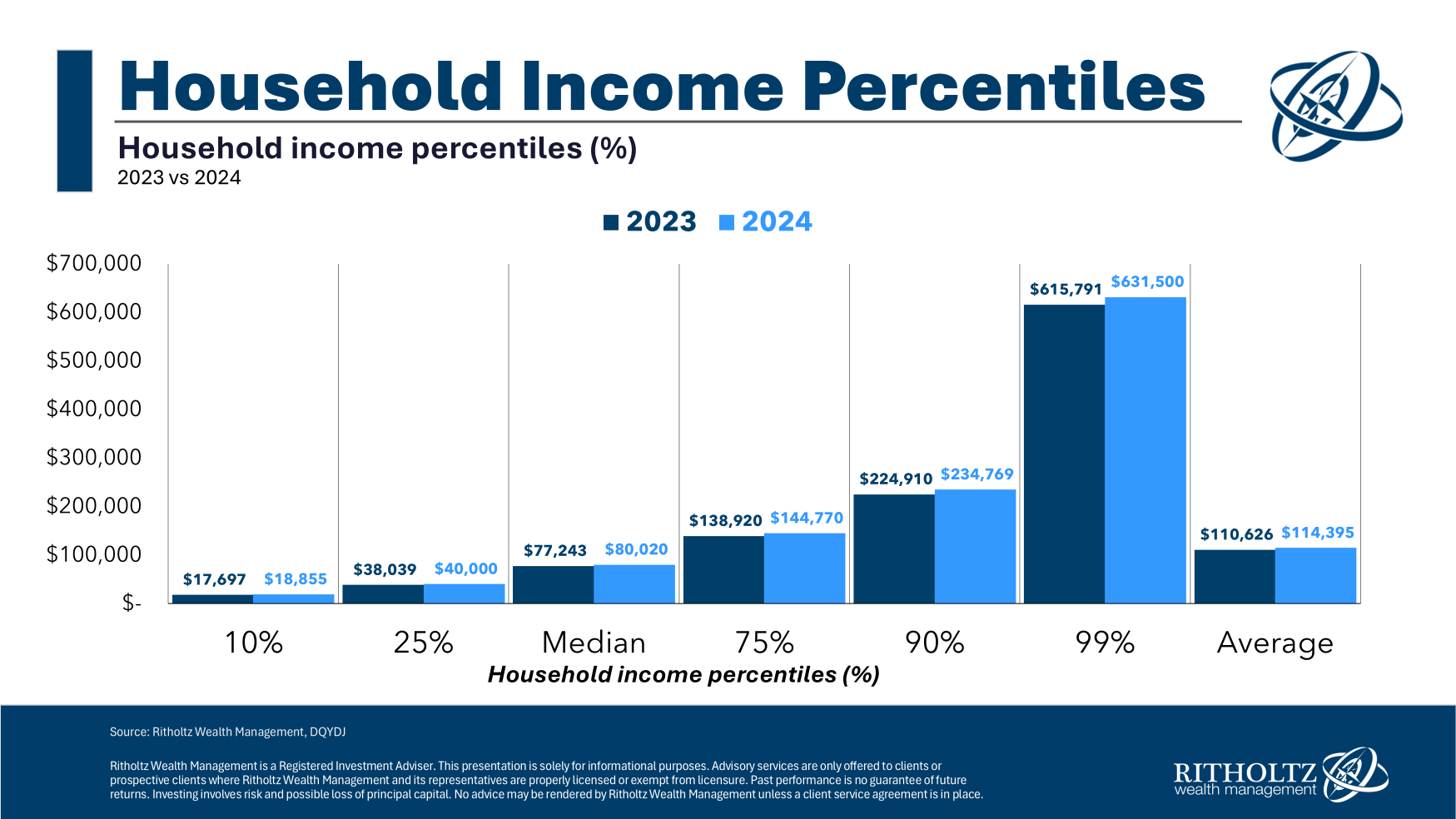

Rich people who don’t feel rich.

Rich people who don’t feel rich.

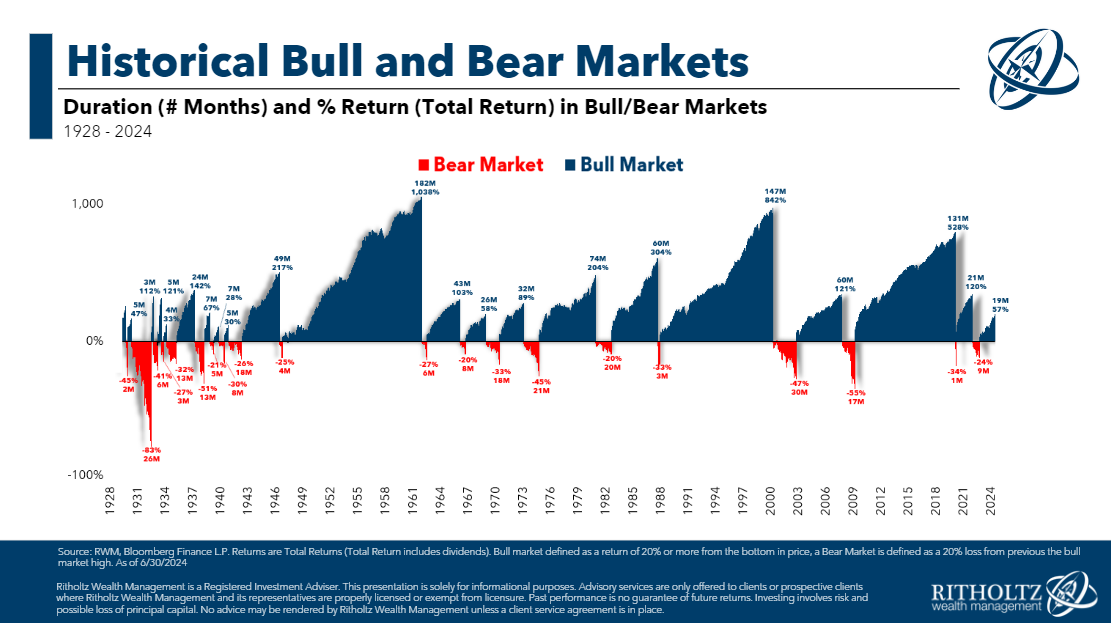

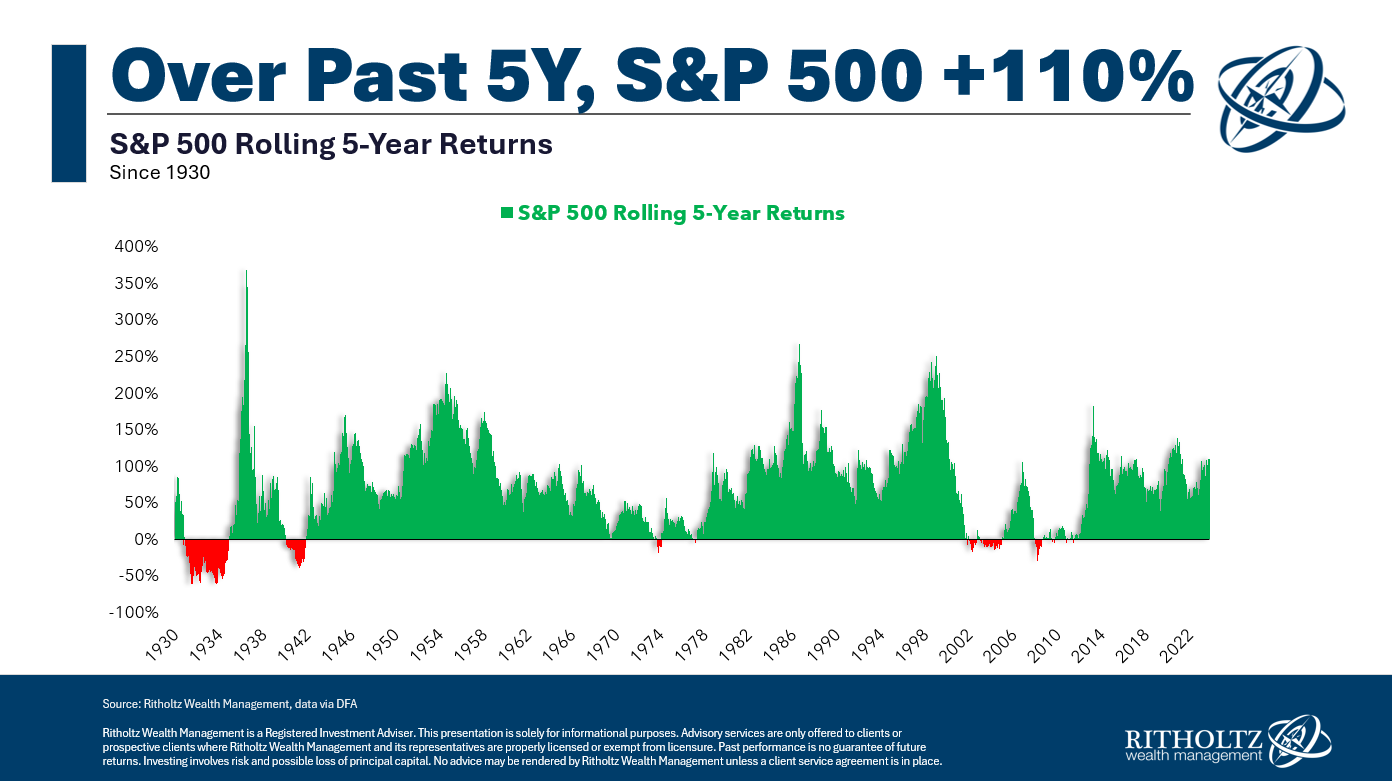

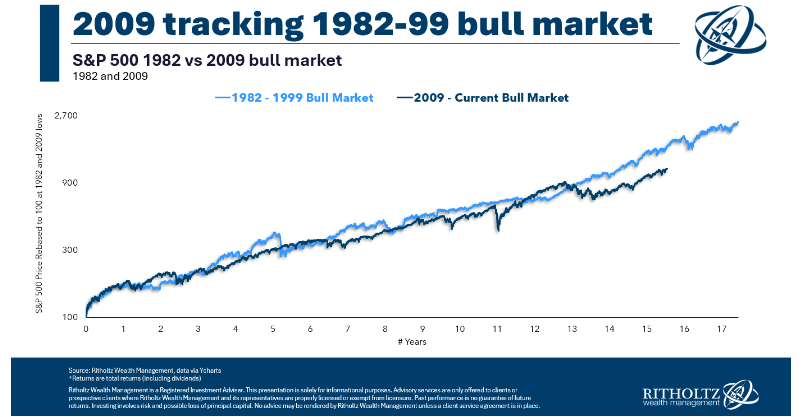

Cyclical and secular bull and bear markets.

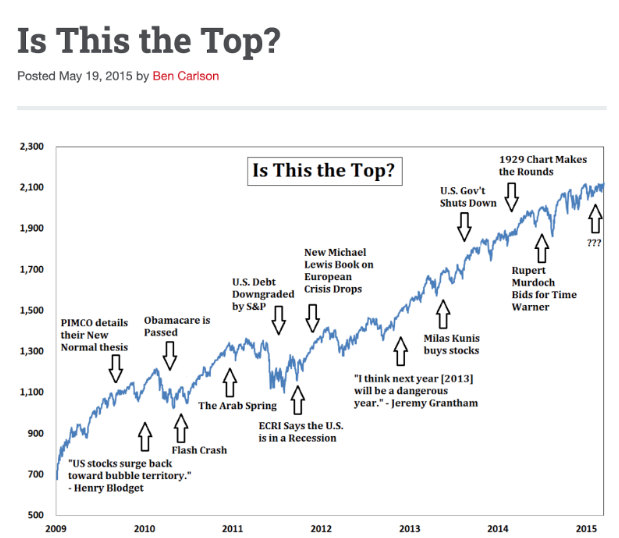

On today’s show we discuss calling a top in the stock market, why people don’t trust data, the economy is still fine, why yields are rising in a rate cutting environment, a bigger innovation than AI, the impact of climate change on the housing market, we are a nation of trucks, money actually does buy happiness and more.

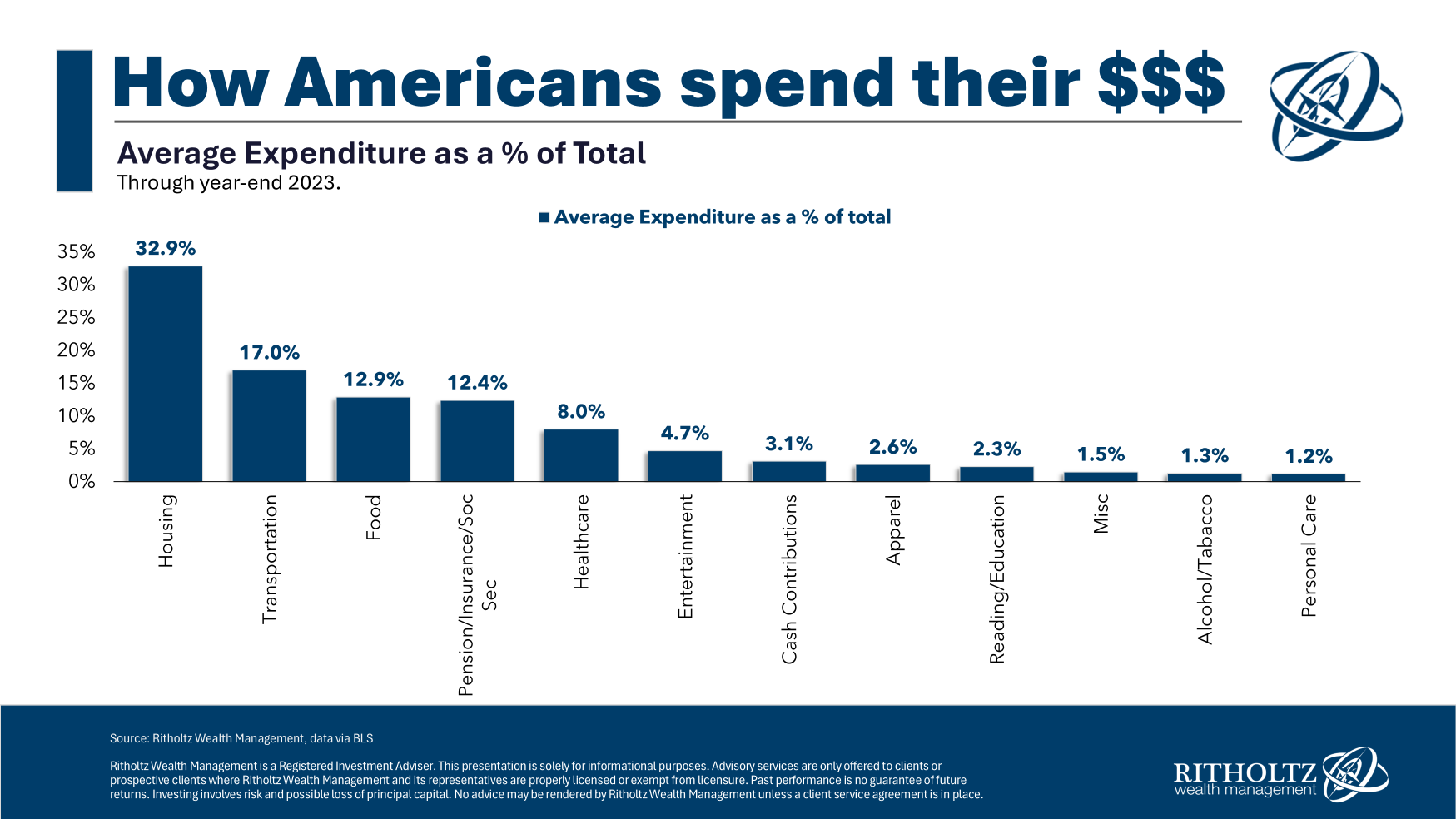

Where to cut back if your budget is stretched.

On today’s show, we are joined by Ted Seides, founder of Capital Allocators to discuss his new new book Private Equity Deals: Lessons in investing, dealmaking, and operations from private equity professionals.

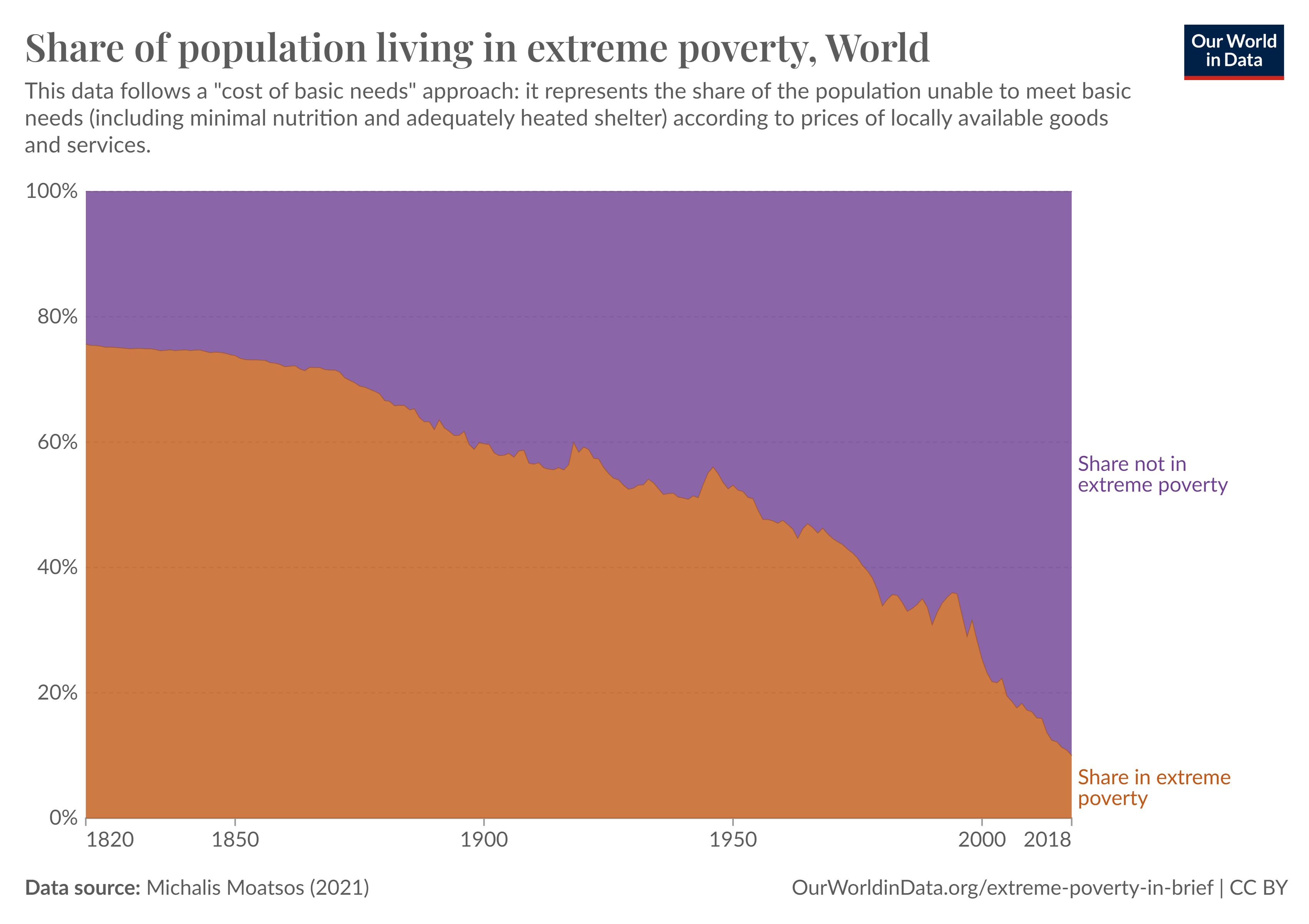

Rich countries are happier than poor countries.

Some thoughts on a potential home renovation boom.

Planning for cash reserves in retirement.

On today’s show we discuss the biggest risk to the real estate market, why bull markets are different today, gold & stocks both hitting ATHs, the US economy is sitting pretty, wearable AI glasses, bullish housing demographics, Michael’s favorite horror movies and much more.

How climate change will impact the housing market for years to come.