On today’s show, we discuss a wild month of stock market performance, bear market rallies, a shift in tariffs, Amazon fighting back, an update on earnings, thoughts on conferences, a new Netflix recommendation, and much more.

On today’s show, we discuss a wild month of stock market performance, bear market rallies, a shift in tariffs, Amazon fighting back, an update on earnings, thoughts on conferences, a new Netflix recommendation, and much more.

The historical probability of achieving returns of 10% or more in the stock market.

On today’s show, we are joined by Nick Kalivas, Head of Factor & Core Equity Product Strategy at Invesco to discuss the research behind equal weighting, concentration within the S&P 500, looking at flows during the selloff in 2025, factor performance, and much more!

My plan to get more people saving for retirement and investing in the stock market.

Investors love buying the dip.

Why risk and reward is more important than bullish or bearish.

On today’s show we discuss some 1929 and 1932 comparisons, the impact of tariffs on small businesses, supply chain problems are coming, putting the dollar’s move into perspective, jumping into a recession, why a recession might feel worse than it actually is, the correction is still relatively mild, retail keeps buying the dip, Bitcoin is decoupling, $145,000 mud rooms and much more.

Buffett’s 4th law of motion.

On today’s show, we speak with Jason Greenblath of American Century Investments about short duration fixed income, remaining active during recessions, inflationary spikes and fixed income and then we speak to Christian Hoffmann of Thornburg Investment Management to discuss opportunities in global credit markets, recession risk, heightened volatility, the Fed and inflation, and much more!

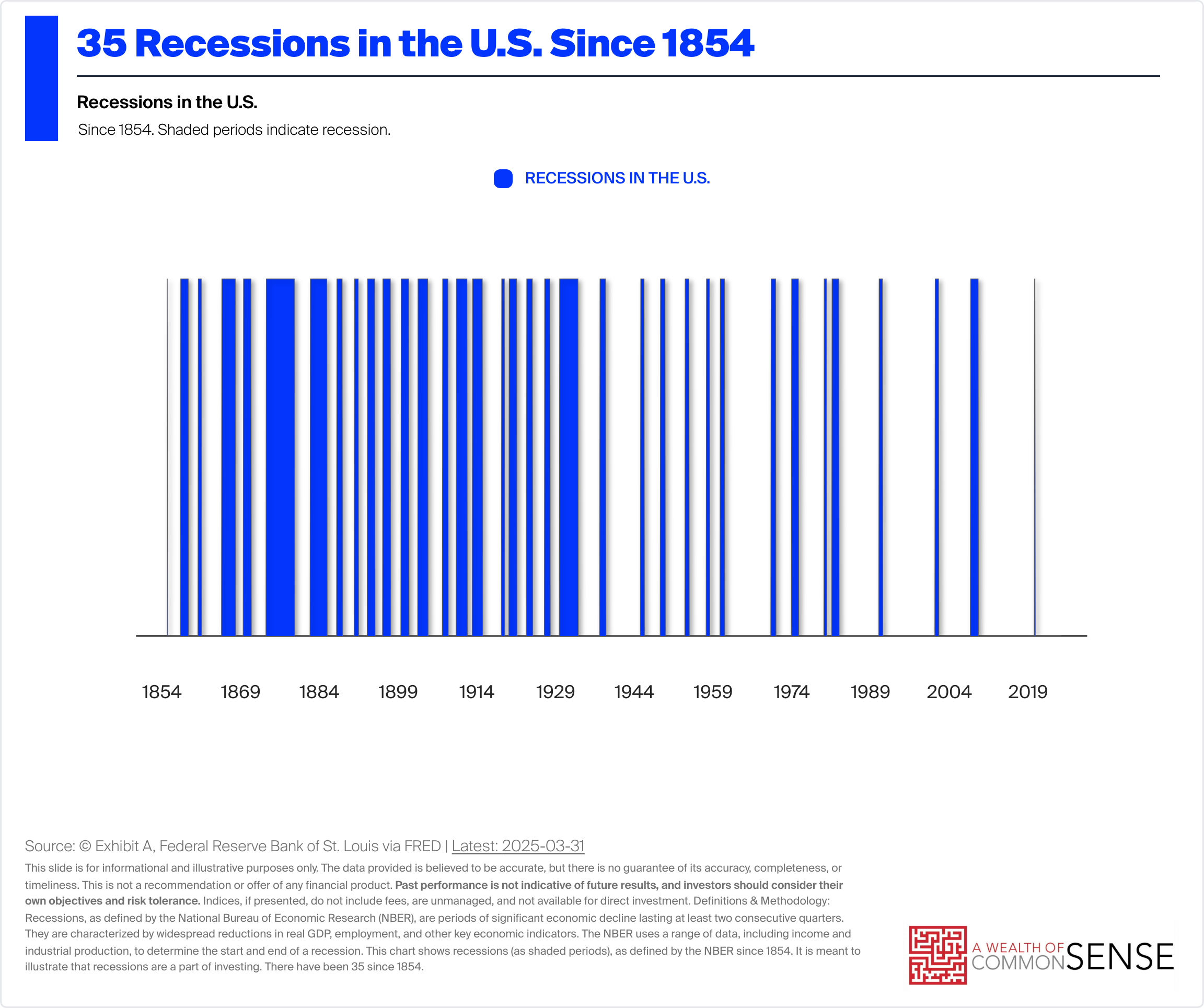

Some thoughts on the timing of the next recession.