Some stories about Lee Child, Mick Herron, Michelin star restaurants and inflation.

Some stories about Lee Child, Mick Herron, Michelin star restaurants and inflation.

A closer look at the defined contribution retirement plan opportunity for financial advisors.

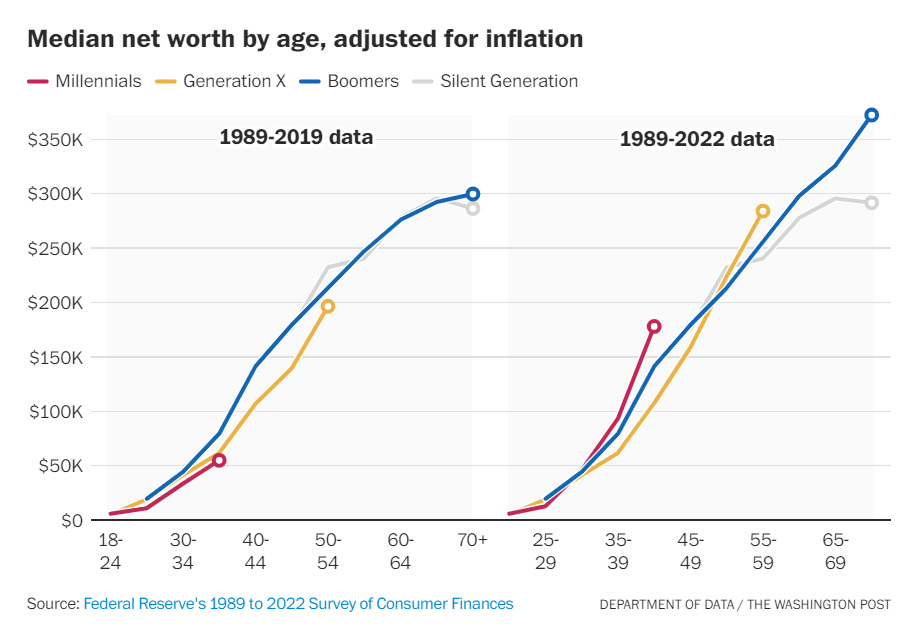

On today’s show, we are joined by Jared Dillian, Founder of Jared Dillian Money to discuss Jared’s bearishness on private equity, understanding the demand side of private equity, a private equity sentiment bubble, an explosion of HVAC private equity deals, and much more!

My conversation with Seth Godin about his new book.

The two forces that drive economic growth over time.

Some thoughts on my general outlook on life.

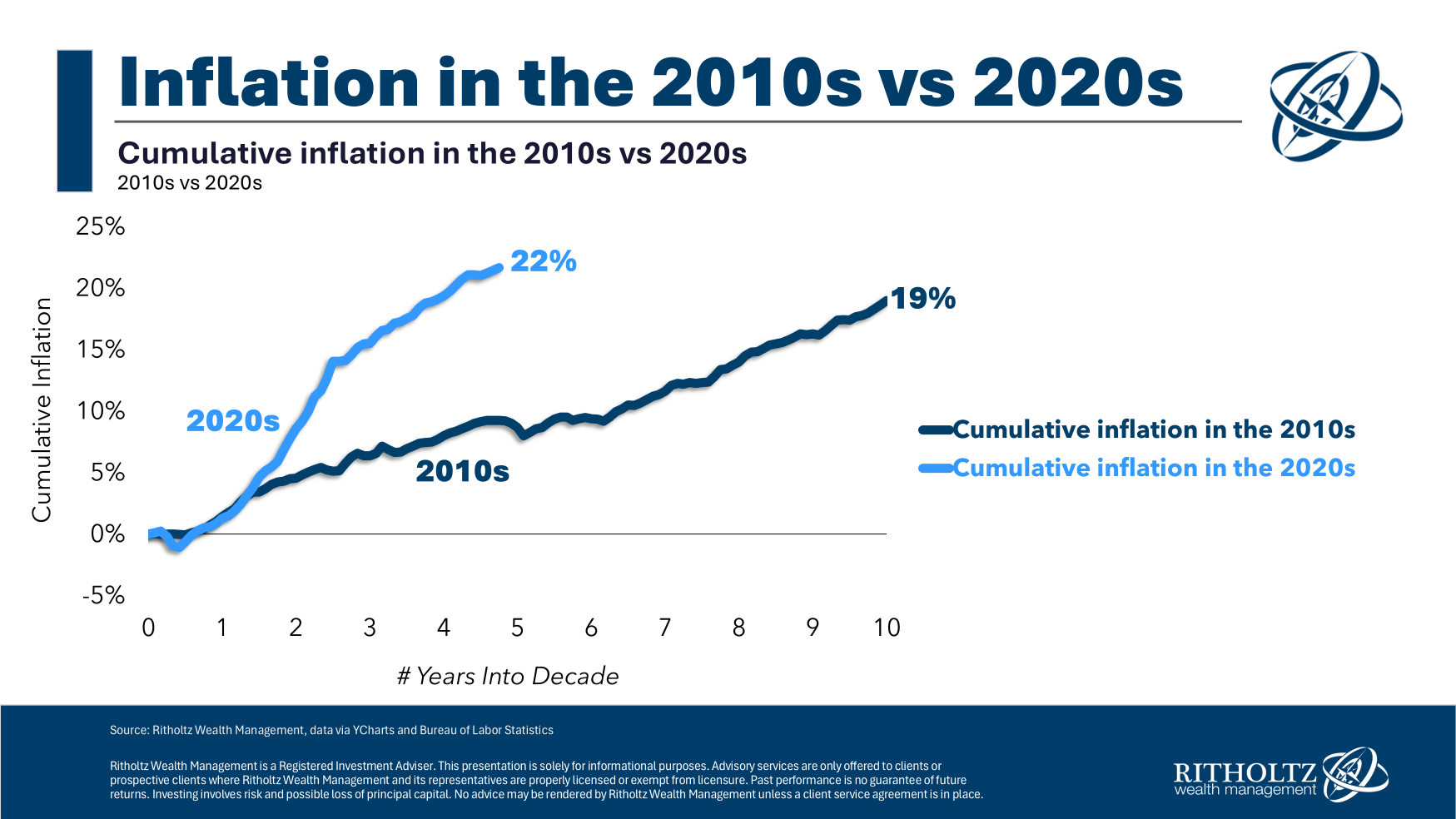

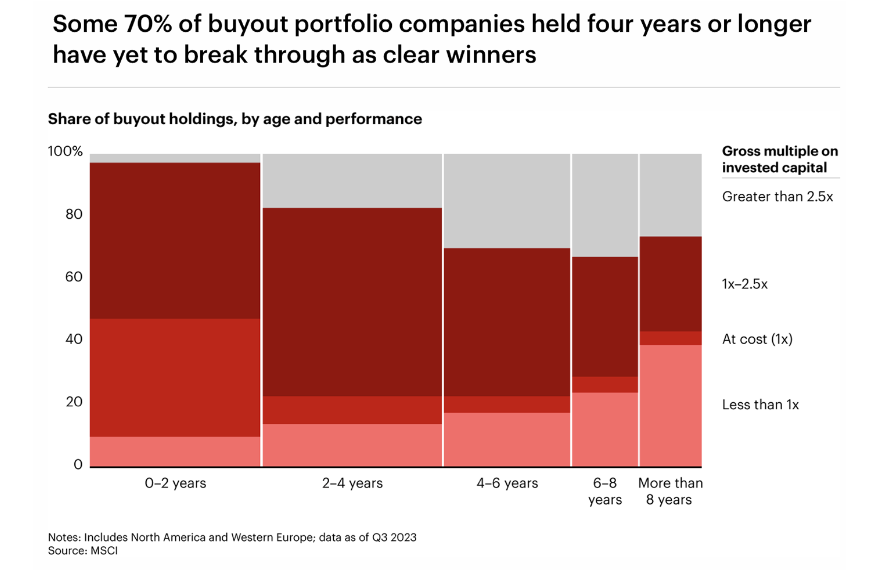

On today’s show we discuss stock market return expectations for the next decade, why there’s no euphoria, Nvidia is a unicorn, the American economy is unstoppable, millennials are richer than expected, sports gambling is coming for ETFs, how to buy a house right now, Netflix won, coaching youth sports and much more.

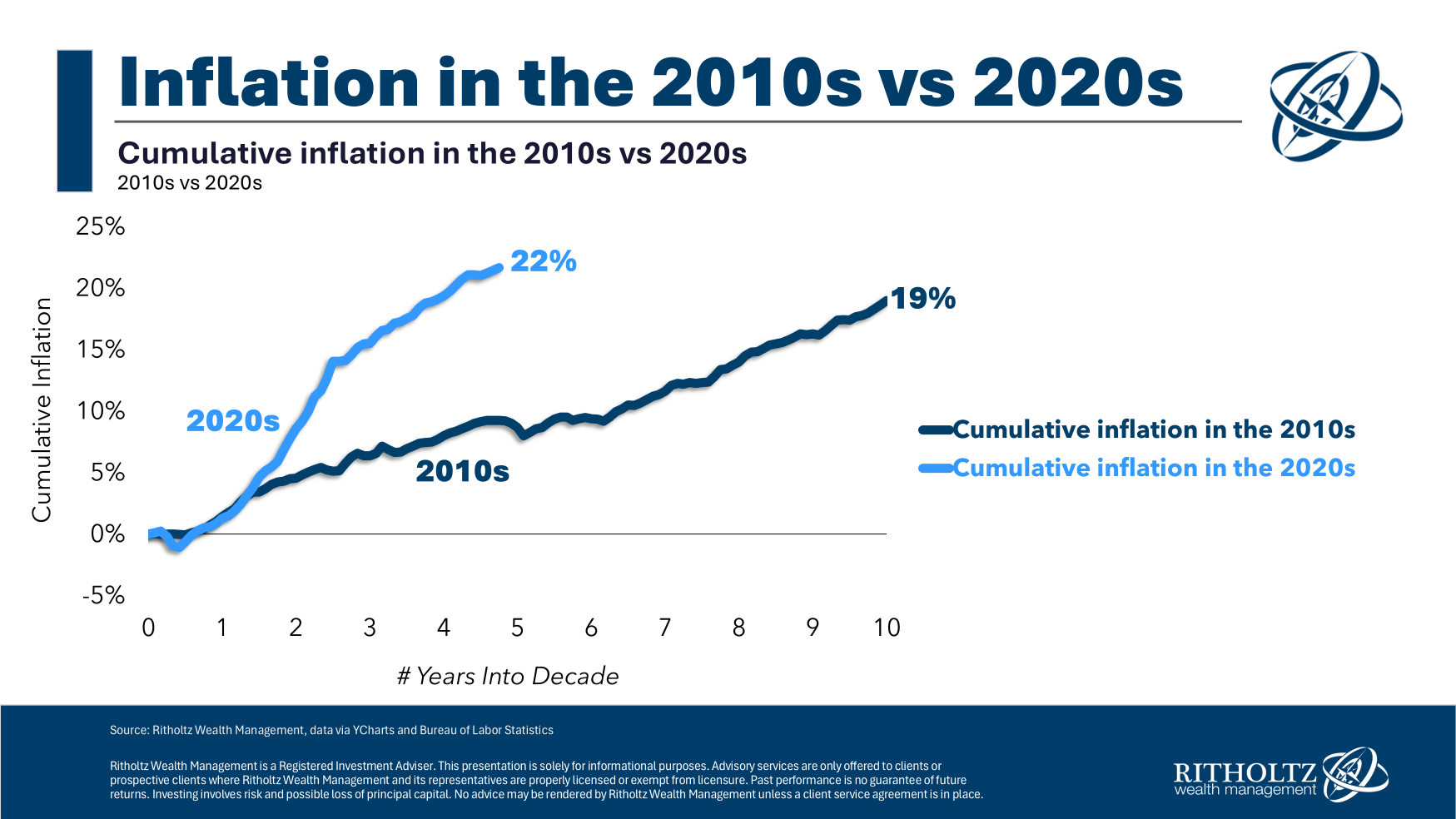

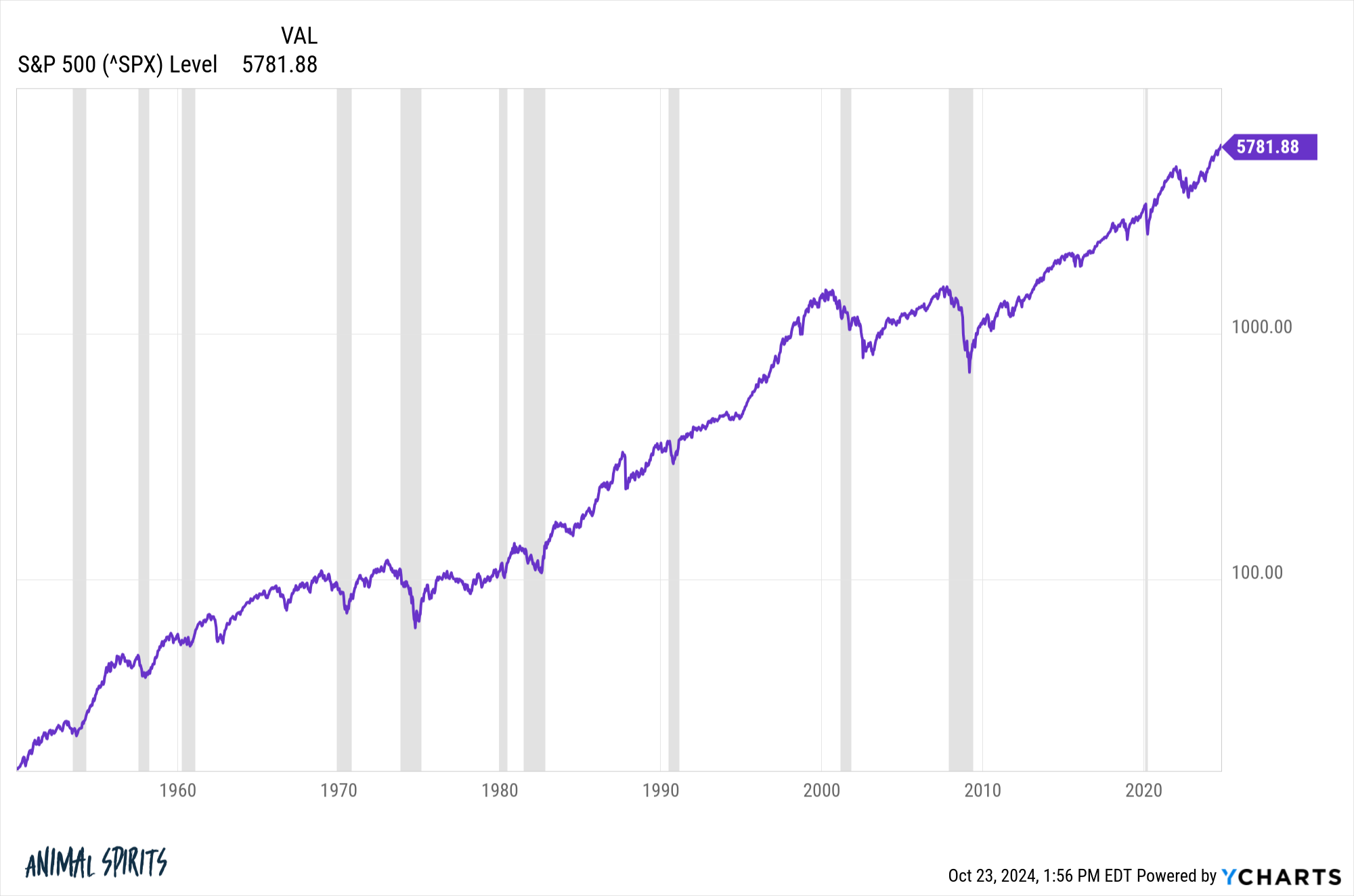

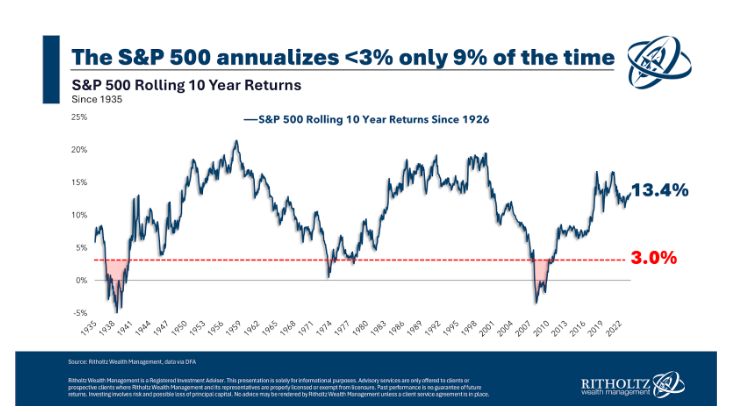

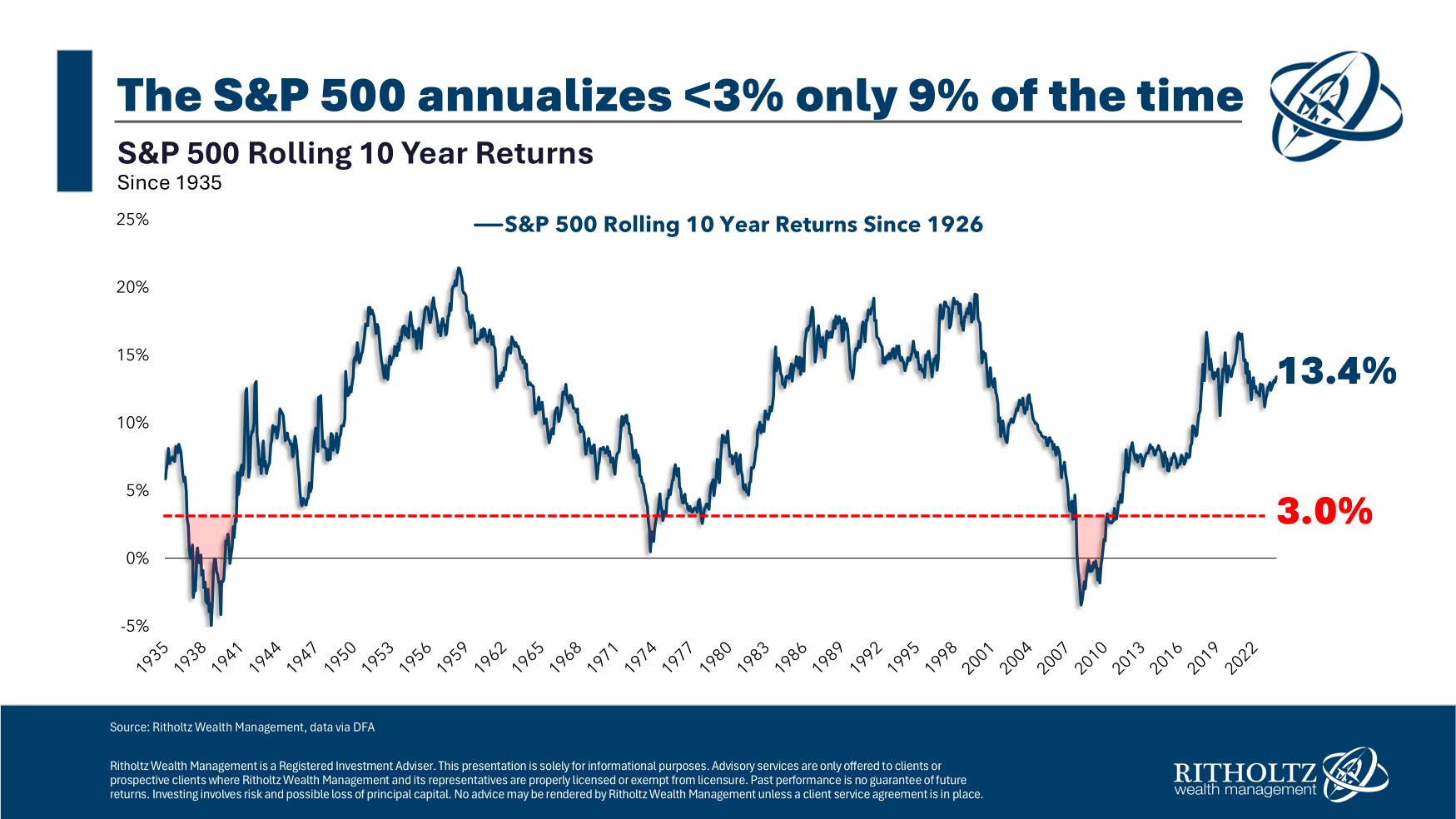

The U.S. stock market has been on fire of late. But it doesn’t feel like we’ve entered the euphoric phase of investor psychology just yet. In fact, many prognosticators have been lowering expectations. Goldman Sachs put out a research piece that posits the S&P 500 could return just 3% annualized over the next 10 years…

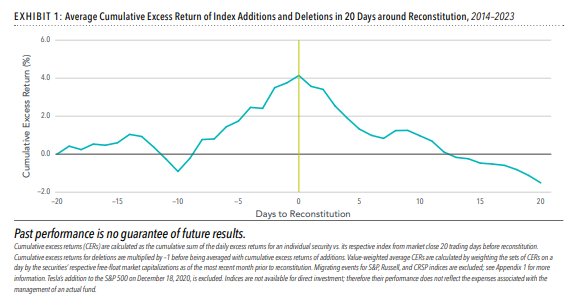

On today’s show, we are joined by Rob Harvey, Co-Head of Product Specialists at Dimensional Fund Advisors to discuss how DFA separates itself as an asset manager, details around converting a mutual fund to an ETF, how DFA handled the meme stock craze, value vs growth, and much more!

The U.S. economy is leaving the rest of the world in the dust.