“It [precious metals stocks] has bone-crushing volatility.” – William Bernstein

If there’s been a worse place to be as an investor over the past few years than precious metals stocks then I haven’t found it. This year a diversified basket of these metals and mining companies is down around 16% but over the past three years the losses are closer to 65%. In that same time the S&P 500 is up nearly 75%, an enormous difference in performance.

In an interview with Morningstar this past week, author and investor William Bernstein said that precious metals stocks are starting to pique his interest and that now wouldn’t be a bad time to add them to your portfolio. Bernstein said he’s been following precious metals stocks for 25-30 years, so he understands the risks and how they generally work in a portfolio. Here are a few points he made on these stocks as an investable asset class:

- They typically have much lower returns than the overall stock market.

- They are extremely volatile, much more so than the market.

- They tend to zig when the market zags, providing a diversification benefit.

- They perform very well during periods of high inflation (one of the biggest reasons they’ve gotten killed lately).

- Even though they’re so volatile, they can actually add to a portfolio’s return, assuming a regular rebalance, and decrease overall portfolio volatility.

Bernstein was skeptical a few years ago when everyone was so sure that commodities were the place to be, so it’s interesting to see that he’s intrigued by the space now. He’s mentioned a smallish 5-10% allocation to precious metals stocks in most of the books he’s written so I thought it would make sense to take a look at the historical numbers to get a better sense of how they tend to act.

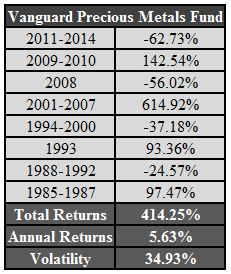

He wasn’t kidding about the bone-crushing volatility in these stocks. Take a look at how cyclical precious metals stocks are based on the Vanguard Precious Metals Fund since 1985:

Volatility is roughly double that of the S&P 500 over this same time frame while the S&P 500 gained almost exactly double the annual returns, 11.20% per year to be exact. So precious metals stocks gave you half the return at double the volatility.

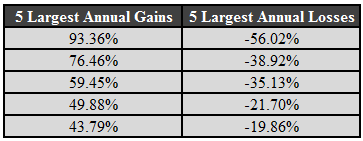

You can get a sense of this volatility by looking at the 5 largest annual gains and losses in the fund:

It’s basically feast or famine.

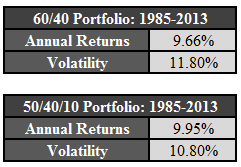

I also looked at two portfolios to see how precious metals stocks would have worked in the past to verify Bernstein’s claims that they decrease volatility and increase returns. This actually has been true in the past, but the differences are minimal.

The first portfolio I looked at was a simple 60/40 portfolio of the total U.S. stock market and the total U.S. bond market. The second portfolio was made up of 50% in stocks, 40% in bonds and 10% in precious metals stocks (so the same 60/40 overall stock/bond ratio). Here are the results from 1985-2013:

Adding a 10% allocation to precious metals stocks did slightly increase the performance and lead to a decrease in volatility. This is most likely a rebalancing and diversification bonus (I assumed an annual rebalance). The correlation between the S&P 500 and the Vanguard Precious Metals Fund was only 0.14, signalling a weak relationship between the two asset classes.

The question investors have to ask themselves is this: Is the ridiculous volatility worth it for the chance to potentially outperform by a slim margin and barely reduce the volatility characteristics of a portfolio? Most investors have a hard enough time dealing with the swings in the stock market. For many investors, the higher the volatility, the higher the chance for making dumb mistakes.

Plus there’s the possibility that these stocks could continue to drop. To go from a 65% loss to a 75% loss would mean another 25% fall from here. Things can always get cheaper before they finally turn around. And there’s nothing that says these stocks have to follow the same path they’ve taken in the past. The 2001-2007 period made up the majority of the gains in these stocks. Who knows if we’ll ever see that kind of outperformance in the commodities space again.

You have to be a very brave investor to add precious metals stocks as a long-term allocation to a portfolio because you could be waiting a long time for them to prove their worth. They are sure to test your patience. Yet I’m sure they also look extremely tempting to many investors after such a huge fall.

Decisions, decisions.

Watch the William Bernstein interview with Christine Benz from Morningstar for more:

Bernstein: Retirement Allocations for 3 Age Bands (Morningstar)

Further Reading:

Are commodities for trading or investing?

[…] Opportunity in Precious Metals Stocks […]

I believe Dr. Bernstein argues that precious metals & mining is a form of insurance against unexpected inflation. You don’t hold it simply to beat the market during times of “reasonable” inflation. You hold it to survive the deep risk of a period of unreasonably high inflation – such as the 70s. The time frame you specified started in 1985, so I am not sure if that time period had unexpectedly high inflation for a time that would constitute a “deep risk”.

Bernstein gives a couple of reasons in his book. One is like you say that a spike in inflation hits. But he also talks about the diversification benefits from rebalancing and the fact that thy’re so volatile as being a good thing. In The Investor’s Manifesto he discusses the huge rebalancing bonus you can get from precious metals stocks as one of the reasons to invest in them over time based on his research.

What happens with your analysis if you include the 1970s?

Good question. I don’t have the data (the VG fund only goes back to 1985) but i would imagine they performed very well in the 70s, which is exactly what Bernstein says.

Came across a stat today – gold stocks were up 28% in the 1973-74 bear mkt. Not bad. All depends on how much pain you can take in the meantime waiting for that type of mkt to hit. Not always going to love everything in your portfolio when diversified.

Would you just buy the ETF like GLD or do something different? WIth high inflation I am not sure how closely the ETF would track the asset prices.

I did have Natural Gas for a long time through UNG but the contago effect meant I could not benefit from the gains in Natural gas

hard to say which commodities will outperform, but looking back historically, the commodities stocks (mentioned here) actually do much better than the commodities themselves. See here:

https://awealthofcommonsense.com/need-commodities-portfolio/

[…] Romer and Romer vs. Reinhart and Rogoff (MoneyBeat) • An Opportunity in Precious Metals Stocks? (A Wealth of Common Sense) see also A quick note on portfolio construction and gold (cc: Professor Mankiw) (The Reformed […]

[…] portfolios, and there is some data to support the idea that they can improve long-term returns, notes Ben Carlson on his blog, A Wealth of Common Sense. But, because of their extreme volatility, “you have to be a very brave investor to add precious […]

[…] The problem with precious metals stocks: feast or famine. (A Wealth of Common Sense) […]

[…] A breakdown of how the market performs after midterm elections (MarketWatch) Stocks Just Stormed Back Into the Lead Against Bonds (Quartz) Inarguable End To Decoupling (Alhambra) Positively Surprising: The Economic Story You’re Not Hearing (Fox Business) When Stock Buybacks Are Not a Waste of Money (H B R) Mapping The Changing Face Of The Lone Star State (FiveThirtyEight) Apple borrowing billions to pay shareholders is everything wrong with capitalism today (Washington Post) How Wall Street’s Favorite Politicians Are Taking Apart Dodd-Frank, One Piece at a Time (Slate) Despite Rally in Stocks, Yields Still Low and Speculators Still Short Treasuries (GaveKal) States That Make Voting Super Simple–or Stupidly Hard (Bloomberg) Is the U.S. economy in a permanent slump? These economists fear it is (LA Times) The Takeaway From Six Years of Economic Troubles? Keynes Was Right. (Anatole Kaletsky) Uber, Lyft, and Liability (New Yorker) Romer and Romer vs. Reinhart and Rogoff (MoneyBeat) An Opportunity in Precious Metals Stocks? (A Wealth of Common Sense) […]

[…] Should you own precious metals? – A Wealth of Common Sense […]

https://bft.usu.edu/s8qbm

https://bft.usu.edu/s8qbm

[…] Further Reading: Are Commodities for Trading or Investing? An Opportunity in Precious Metals Stocks? […]

[…] The majority of the usual suspects have been covered here and elsewhere — TIPS, commodities, precious metals equities and real estate to name a few. All of these different investments could protect investors from an […]

[…] will almost certainly get to the point where they have an enormous snap-back rally. It’s a boom-bust type of investment. The point here is not to necessarily disparage commodities as an asset class. Some people still […]