“Housing takes maintenance, it depreciates, it goes out of style. So why was it considered an investment? That was a fad. That was an idea that took hold in the early 2000s. And I don’t expect it to come back. Not with the same force.” – Robert Shiller

Purchasing a home is the biggest investment that you can make. How many of you have heard this one before? It’s the standard slogan for the American dream. Buy a house, sit on it for a few years, trade up, rinse and repeat. In the 1990s and early 2000s this actually worked out for many people. It seemed that housing prices only went in one direction and that was up.

We all learned the hard way that prices can’t defy logic forever in the aftermath of the housing bubble that burst in 2006. This scenario should really make you think before you assume that housing is a great investment. After looking at the data, housing doesn’t look like a promising long-term investment at all.

Of course, there are pockets where investing in real estate will work out because of the law of supply and demand. Places like New York City, San Francisco, and Seattle are in high demand because they are large cities and many people would like to live there. And every city will have higher demand areas where people want to live because of good school systems, location (like beachfront property), safety or just nicer houses.

Robert Shiller is an economist, author, and professor at Yale University. The forecasting track record of the majority of economists leaves much to be desired, but Shiller is the exception to that rule. He successfully called the technology bubble in the year 2000 and the housing bubble just a few years later in 2006.

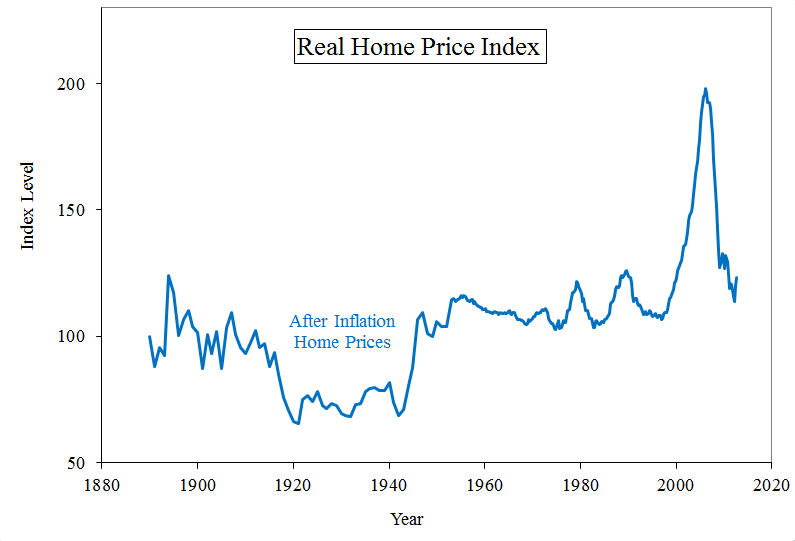

You may not have heard of him if you are not in the finance world but every time you see a statistic on the news about nationwide housing prices that data likely comes from his Case-Shiller home price index. He has collected extensive housing data going back to the year 1880. And his findings are quite surprising to the normal mindset on housing being our biggest investment.

Shiller’s theory is that housing prices cannot outstrip inflation in the long run because, except for land in the high demand areas, house prices will equal out to building costs plus normal economic profit. And he has the data to back him up on this.

From the year 1880 to 2012 the after-inflation return for the average price of a home in the U.S. was a total of 23.25%. So in 132 years, again after accounting for inflation, the average price of a home went up only 0.16% per year! From 1880 to 2006 (the high point of the housing bubble) it was up a total of 96.18% or 0.54% per year.

In fact, most of the housing performance came in the 1996 to 2006 time frame when the total real return was 83.80% or 6.28% per year. And when the bubble burst there were huge losses. From the 2006 peak to the low in early 2012, after inflation prices were down -42.49%. Here is the graph that shows the nationwide real (after inflation) return of home prices based on the Case-Shiller home price index:

You should notice the huge spike in the 2000’s housing bubble. Many people will look at those numbers and say they don’t tell the whole story. Real estate is a leveraged investment. You don’t typically buy a home in all cash. You borrow money from the bank with a small down payment. And it’s true that leverage does amplify returns in a rising market. But it also amplifies losses in a down market.

Let’s look at an example of how leverage affects your returns. If you buy a house worth $250,000 with a 10% down payment ($25,000) and the house appreciates by 10% you have doubled your equity investment. Not bad, right? But guess what happens if the house depreciates by 10%. You guessed it. Your entire down payment gets wiped out. It goes to zero.

That’s why leverage can be so dangerous. It’s a double-edged sword. It doesn’t take a huge loss in the market value of the asset to completely wipe out your equity investment. Remember the simple accounting equation is Assets = Equity + Liabilities. The smaller your equity stake in an asset the larger your liabilities or debt.

If your house is considered your biggest investment then it has some very difficult terms for you as an investor. First of all, it’s not a liquid asset. Liquidity is your ability to turn an asset into cash quickly. If you have a pile of cash you are completely liquid. If you own stocks you can sell them during stock market hours so that would make you relatively less liquid than cash.

But a house is definitely not liquid. Can you sell a house over the weekend? Sure. But that doesn’t mean you get the cash in your hand right when you sell it. That can take time. And this is not the norm considering that the average time it takes to sell a home in this country is 10 months.

All investments should also be looked at after all fees have been paid. Mutual funds charge an expense ratio. You pay transactions fees when you buy a stock. These costs all affect your performance. The same is true with real estate. All costs need to be netted out. When you sell your home you will pay an average of 6% in commissions to real estate agents.

You also pay property taxes and have to maintain your home over the years. You pay closing costs when you buy a house and have to pay insurance premiums. There are moving costs as well as furnishing and decorating. These costs all add up. Of course, there are also tax breaks involved with owning a home which helps offset some of these expenses so remember to look at this on a net basis. But overall the costs are higher than most people assume.

Now I am not trying to say that you shouldn’t buy a home because it is not a great investment. There are many benefits to being a homeowner. You get to build up equity by paying down your mortgage over the years. And assuming you can pay it off before you retire you will have a great deal of flexibility with your lower cost of living. In fact, I recommend this as a goal for any homeowner.

Being able to pay off a mortgage over 15 to 30 years also gives you the opportunity to purchase an asset that is worth more than you could afford to pay with cash. And if you use a fixed rate mortgage, the minimum payment never changes over the years.

Instead of looking at your home as your biggest investment you should assume it is a very long-term asset that barely keeps up with inflation just as Shiller’s data showed us. Just remember that inflation works both ways so with today’s super low-interest rates, your after-inflation payments will actually go down over the years as inflation picks up.

That is because inflation lifts your wages (hopefully) and the prices of goods but the cost of your mortgage stays exactly the same. This is another benefit to thinking long-term with your housing decision.

The longer you stay in your home the greater the benefits you will see. By making your house a long-term choice you take away the costs involved with selling. Plus you build up your home equity. The easiest way to burn through your home equity is to constantly trade up to bigger and better homes and incurring the costs along the way.

I’m not anti-real estate. I just think we have a problem in this country with the perception that we have with real estate. Again, there will obviously be homeowners that do very well in real estate because of where they live. Or they might just get lucky and sell at the perfect time. Just don’t plan on putting all of your eggs in one basket and making your home the largest part of your investment portfolio. You need to have more liquidity with assets that will appreciate with lower costs.

The goal for your home should be to make it a cost that gets lower over the years. It should not be to make a ton of money. As we have seen timing can play a huge role in determining if that happens. And over time houses have barely kept up with inflation. Think about this the next time someone tells you why your home is your biggest investment. It’s a myth.

[…] If you have to pick one place to park your cash I would suggest retirement contributions as opposed to completely paying off your mortgage early (I consider early to be in less than 10 years). Housing doesn’t always work out as a long-term investment. It can be illiquid if you need to sell quickly and pull out your cash. Plus you are making the age old mistake of putting all of your eggs in one basket. By choosing to forgo retirement contributions in favor of accelerating your mortgage payments you are making the decision that your home is your biggest investment. […]

[…] Shiller had a great piece in the New York Times this week about real estate as an investment. He lays out some great points about real estate from a historical perspective that I thought were […]

[…] of having a concentrated bet on your home (or any investment for that matter). On average, an investment in real estate barely keeps pace with inflation over the […]

[…] estate is not a great investment on average but it can be a great asset for you to build equity through a fixed rate mortgage. As […]

Don’t you need to include the rent one could receive from being a landlord (and thereby not having to pay for as owner) minus maintenance? This would be a significant amount, and ignoring this and only focusing on price appreciation would be like ignoring dividends from equity investments.