“I remember the $0.05 hamburger and a $0.40-per-hour minimum wage, so I’ve seen a tremendous amount of inflation in my lifetime. Did it ruin the investment climate? I think not.” – Charlie Munger

You can’t see it, but it’s there. Over time it can be a huge unseen risk to your investment portfolio and other areas of your finances.

Inflation.

Going back all the way to 1871, according to data from Robert Shiller, inflation has averaged 2.1% per year. Since 1945, it’s been higher than that coming in at around 3.9% a year.

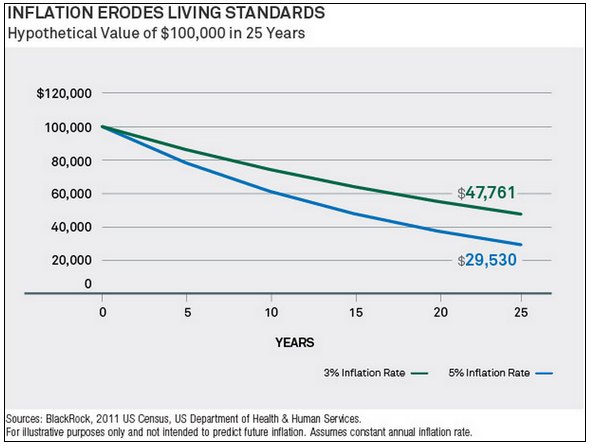

Inflation is simply a general rise in prices. It means that over time your current money will buy less goods and services in the future. Here’s a chart from Blackrock that sums this up nicely:

Inflation is one of the main reasons you need to save and invest for the future. If you just put all the money you earned under your mattress it would slowly lose value over time. It’s also the reason that cash should be looked at as an asset but not an investment.

INFLATION EFFECTS ON YOUR INVESTMENTS

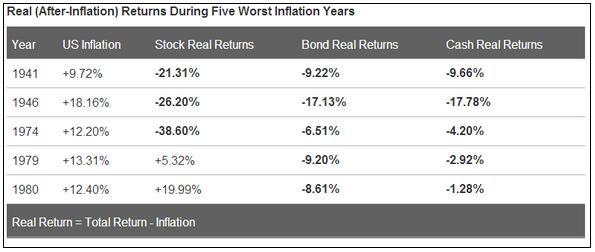

Rising inflation can hurt your investments in certain environments as well. Here are the real (after-inflation) returns for stocks, bonds and cash during some of the worst inflation years in the US:

Stocks were somewhat of a mixed bag, while bonds and cash were hurt each time there was a large spike in inflation. This makes sense since the interest payments you receive from bonds and cash are worth less and less as inflation slowly eats into them. Inflation typically comes in times of rising interest rates (or causes them) which can also hurt fixed income assets.

Stocks and inflation are another story. Some companies can pass on their higher input costs to their customers while many businesses cannot. Extremely high inflation is usually a bad thing for stocks, but luckily it doesn’t last long. Over longer time frames, stocks are still your best bet at beating inflation.

It also makes sense to invest in assets that can raise their payouts that to keep up with or even beat the rate of inflation. This includes REITs, TIPs, and dividend paying stocks.

YOUR PERSONAL INFLATION RATE

Inflation does normally means rising wages as well as rising prices so it’s not all bad. But prices don’t always rise in a uniform manner. Here’s another Blackrock chart showing inflation in some of our main expenditure since 2000:

Rising energy, healthcare and education costs have been well-documented over the years, but hopefully they will come back to reality eventually.

You can’t control the changes in the prices of goods and services, but you can pay attention to your personal inflation rate. Some areas you have no choice but to spend more as prices rise (gas, groceries, healthcare) but other areas you can make a concerted effort to negotiate your rates (car & home insurance, phone, cable, internet) or reign in your spending (entertainment, eating out, clothes, technology, cars).

You also have the ability to negotiate your salary with your employer even though most workers do not like to do this.

Another way to help make up for the inflation shortfall is to aim to increase the amount you save by at least 3% a year. An easy way to do this is to have the increase in your savings rate coincide with your raise at work. That way your lifestyle or spending won’t take a hit and you won’t notice the difference in your take home pay.

There is one area of your finances where inflation actually helps you and that is with a long-term fixed rate mortgage. Think of this as the opposite of what will happen to bonds in a rising interest and inflation rate environment. Since your payment and interest rate stays constant, over time your after-inflation debt payments will continue to drop.

Sources:

Planning for Inflation: The “Real” Deal (Blackrock)

Robert Shiller