A couple weeks I looked at the history of corrections in long-term U.S. treasury bonds. I received a few follow-up questions from people asking for the same information on intermediate bonds for a comparison between the different bond maturities from a risk perspective.

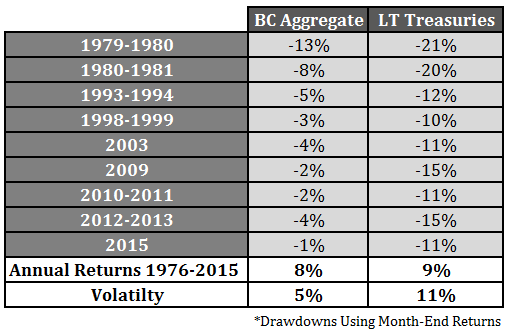

The Barclays Aggregate Index, the industry standard for an intermediate bond benchmark, only has a data going back to 1976 so you don’t get the full history all the way back to the 1920s. But you still get a good sense of the risk differential between bond duration and maturities when looking at this losses:*

The average double digit loss since 1976 in long-term treasuries was -14% while the average loss in the BC Aggregate during these drawdowns was just -4%. So the losses in the BC Aggregate were roughly 70% lower, on average, with around half the volatility. But the returns were nearly 90% of the long-term treasury performance numbers. So to earn slightly better performance numbers, an investor would have had to deal with much higher volatility and much larger losses in long bonds.

It’s also worth noting that there’s a huge caveat on these return figures. Fixed income returns in the 8-9% range on high quality bonds over four decades are a historical aberration based on the huge yields seen in the late 70s and early 80s along with a fall in rates ever since.

The starting yields for both intermediate and long bonds in 1976 were close to 8% and peaked at over 15% by 1981. The current yields are in the 2-3% range, which means there is a much smaller buffer from the income payments when interest rates do rise and prices fall. Bond investors always have to remember that the long-term returns will track their starting interest rate fairly closely.

If you’re a trader, it’s possible long maturity bonds make sense if you can ride the trend and get out before a large loss. If you’re a long-term investor, I think you really have to consider the risk-reward relationship in long-term bonds. When rates were much higher it’s possible that long maturity bonds were worth the risk. For many investors, it may not make sense to invest in long-term bonds at today’s yield levels and maybe any yield levels if you cannot handle large losses in fixed income.

Further Reading:

A History of Bond Market Corrections

What Returns Can Investors Expect in Long-Term Treasuries?

*These drawdowns are calculated using month-end data so they don’t count the continued decline in long-term treasuries in May which has seen them fall an additional 5% or so. The BC Aggregate is down roughly 1% this month.

Yes, I agree. That extra bit of return beyond about a 10 year term isn’t worth the volatility, especially in the part of your portfolio that is there to dampen overall volatilty. The classic 10 year bond ladder, or equivalent duration bond fund is my preference.

Yup, really depends on what you want to get out of your fixed income allocation, but I’m sure most investors aren’t in bonds expecting to see huge drawdowns (nominally at least).

Is this the right comparison? Barclays Aggregate is a corporate bond fund I think if Wikipedia is right. LT treasuries should have lower risk than corporate bonds – much lower default risk. Is there a comparison for intermediate Treasuries and if so what does that look like for these periods. I do like analysis and it has started me thinking differently about bonds.

You have some of the best insights are are no a go to site for me. Keep up the good work.

BC Agg is not a long term index. It is a mix of corp bonds that has a much shorter maturity and lower duration than do LT treasuries. BC Agg duration is around 6 to 8 if not mistaken. So much less interest rate risk and still get 90% of the return of LT treasuries.

Mark I appreciate that. My comment was really meant to say should you compare Corporate bonds versus US government bonds. I appreciate the difference in duration which is the primary point of this post. However, corporate

bonds have an additional risk that Treasuries do not – bankruptcy risk. Would not a better comparison have been intermediate duration Treasuries?

The Agg is a good mix of a total bond fund. So there’s around 43% in gov’t bonds, 30% in mortgage-backed bonds and 27% in corporates. Any total bond mkt fund will basically be tracking the BC Agg. Check out the IEF ETF for the 7-10 years treasury comparison you’re looking for.

Good question and thanks for the kinds words.

Ben, thanks for this very interesting article. While your main points will likely be similar, I agree with Clark that the Barclays US Aggregate Bond Index versus long Treasuries is something of an apple to oranges comparison, since the Barclays US Aggregate Bond Index not only includes includes Treasuries, but also government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency). Therefore, this index will have higher interest rates and greater volatility than 5-year treasury bonds.

Also, did you use the top-line index, since the top-line index includes long bonds (rendering it an even poorer comparator for your purpose), while sub-indices split the index into an Intermediate maturity band that includes bonds with maturities of 1 to 9.999 years, while the Long maturity bands include maturities of 10 years or greater.

I think an apples to apples comparator for intermediate versus long term treasuries is the Barclays US Treasury Bond 3-7 Year Term Index. While this only goes back to 1999, it would still be insightful to compare these two indexes on a year by year and aggregate basis for total return and volatility to get a true sense of the difference that treasury bond duration makes.

This is the 20 to 30 year treasury bond. I think the data has more to say about duration and maturity risk than anything.

[…] Are long term bonds worth the risk. (awealthofcommonsense) […]

[…] Are long-term bonds still worth the risk? – AWOCS […]

Ben,

I still include LT treasuries in my portfolio because they provide an asset class with long-term positive returns that are negatively correlated with stock returns. That said, I think the better choice is with TIPS. The bond portion of my investments have LT Treasuries & TIPS at 50/50. I’m thinking when I rebalance in December, I will move to increase the TIP portion to 75/25. The key assumption here is that a rise in LT interest rates will occur due to LT inflation expectations. Thanks for the article, this is one of those topics I spend a considerable amount of time thinking about.

I have no problem with owning LT treasuries as long as people understand the risks and weigh their options. There really are no easy answers in the bond market these days. It’s something of a pick your poison kind of market. The fact that you are thinking about this a lot shows you’re far ahead of most investors.

[…] Five year treasuries earned almost 95% of the returns for a little more than half as much volatility. Also, over the past forty years or so, intermediate-term bonds have seen drawdowns that are roughly 70% lower than long-term bonds, on aver… […]