Politicians don’t control the stock market.

When stocks go up presidents get too much credit and when they go down they get too much blame. It’s mostly circumstantial depending on the timing of cycles and such.

But the markets move faster than ever these days. Investors are constantly pricing in the future, sometimes right, sometimes wrong, yet never in doubt.

The stock market was already up big heading into the election but things took off in the days following the outcome.1

Many investors are positioning for a boom under a Trump presidency. The biggest pushback I’ve seen is that valuations have been stretched after the big run-up since the 2022 bear market.

We’ve been in a bull market for some time now. The stock market should be expensive! Let’s look at the numbers to see where things stand.

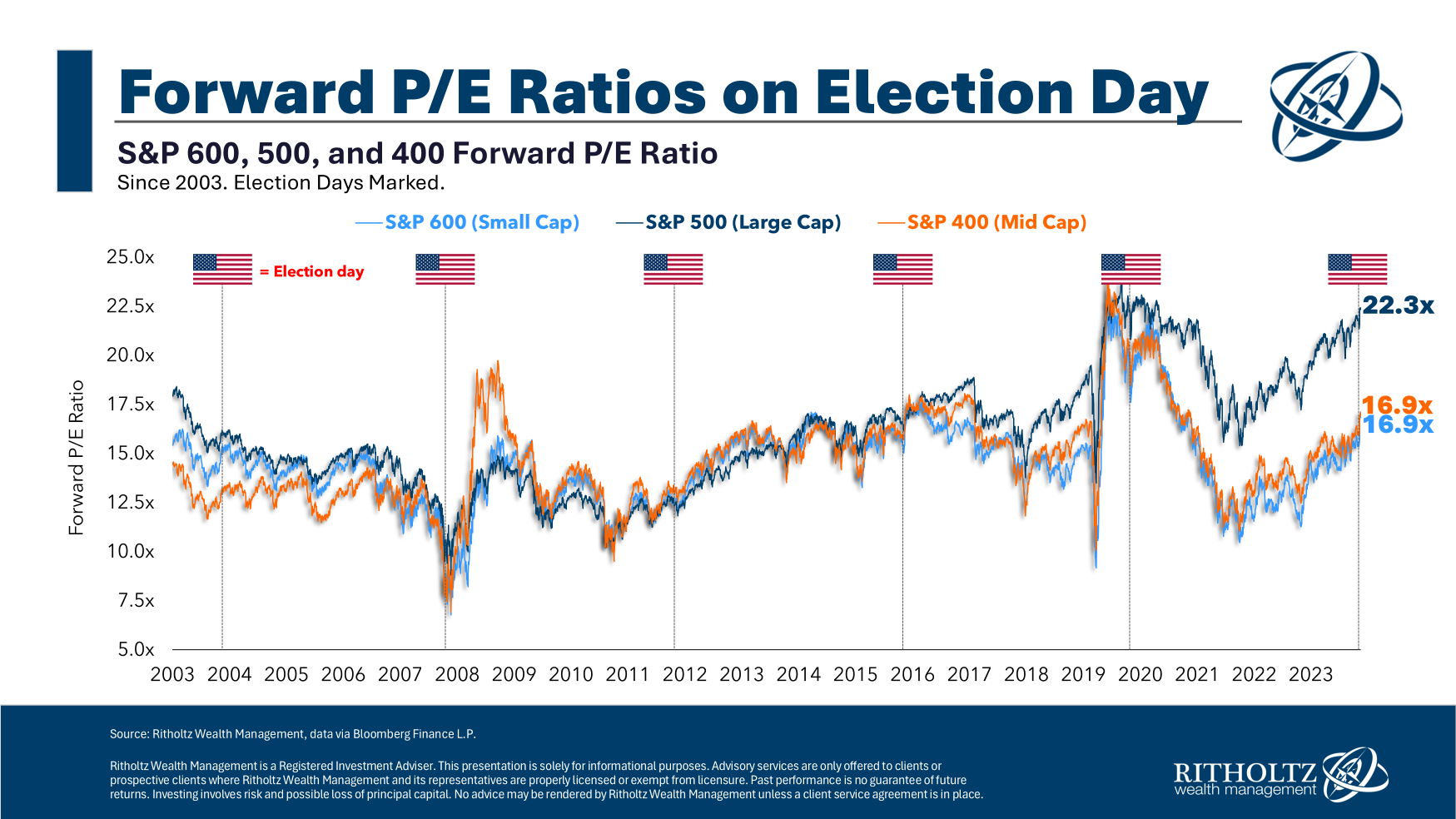

Our crack research team looked back at forward price-to-earnings ratios on election day for each of the past six presidential elections:

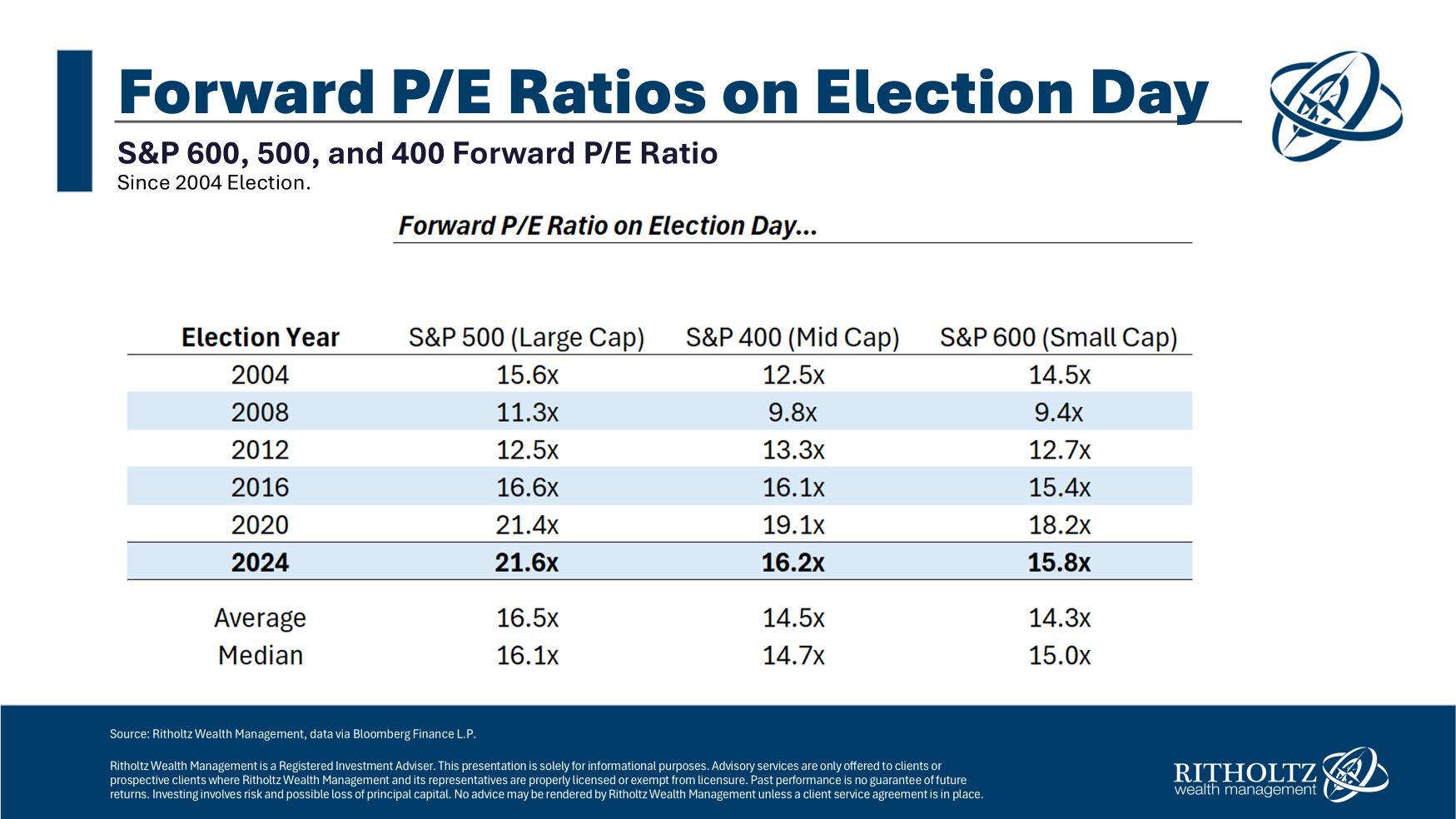

Here are the actual values:

Stocks were obviously much cheaper in 2004, 2008 and 2012 because the market was in or coming out of a crash in each of those instances.

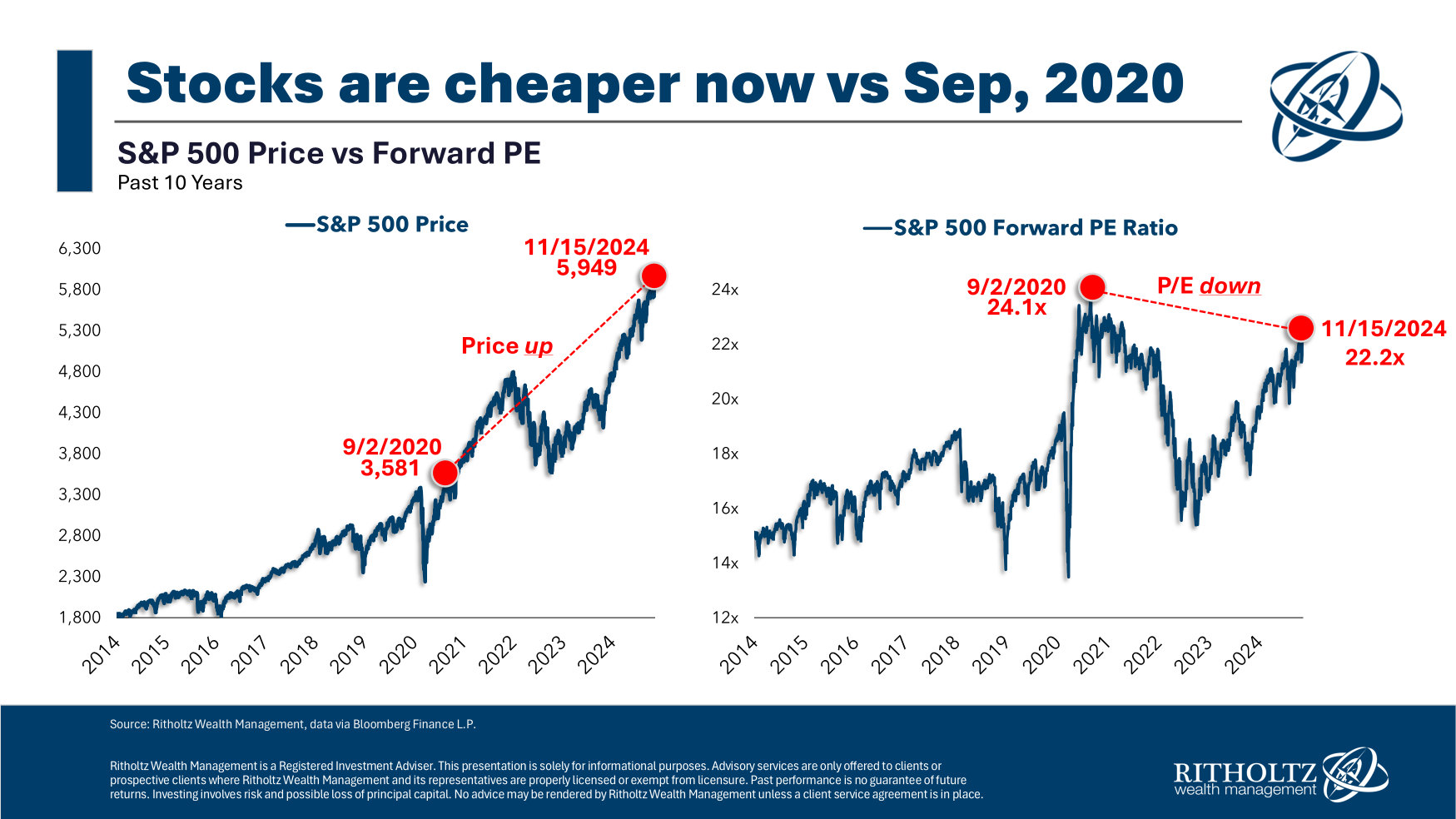

Now look at the 2020 and 2024 valuations. The S&P 500 is up nearly 90% since election day 2020 yet valuations are essentially identical.

How can that be?

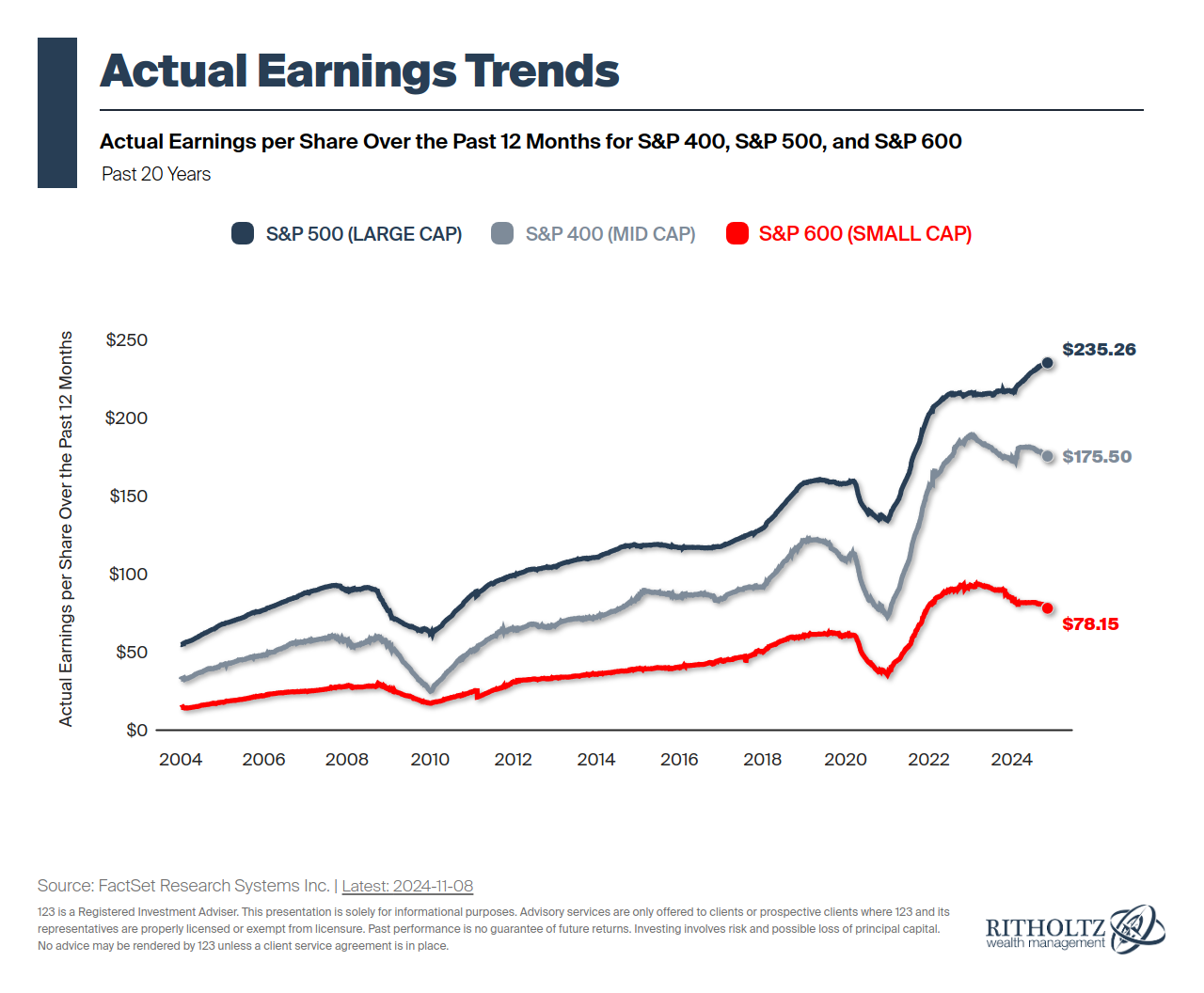

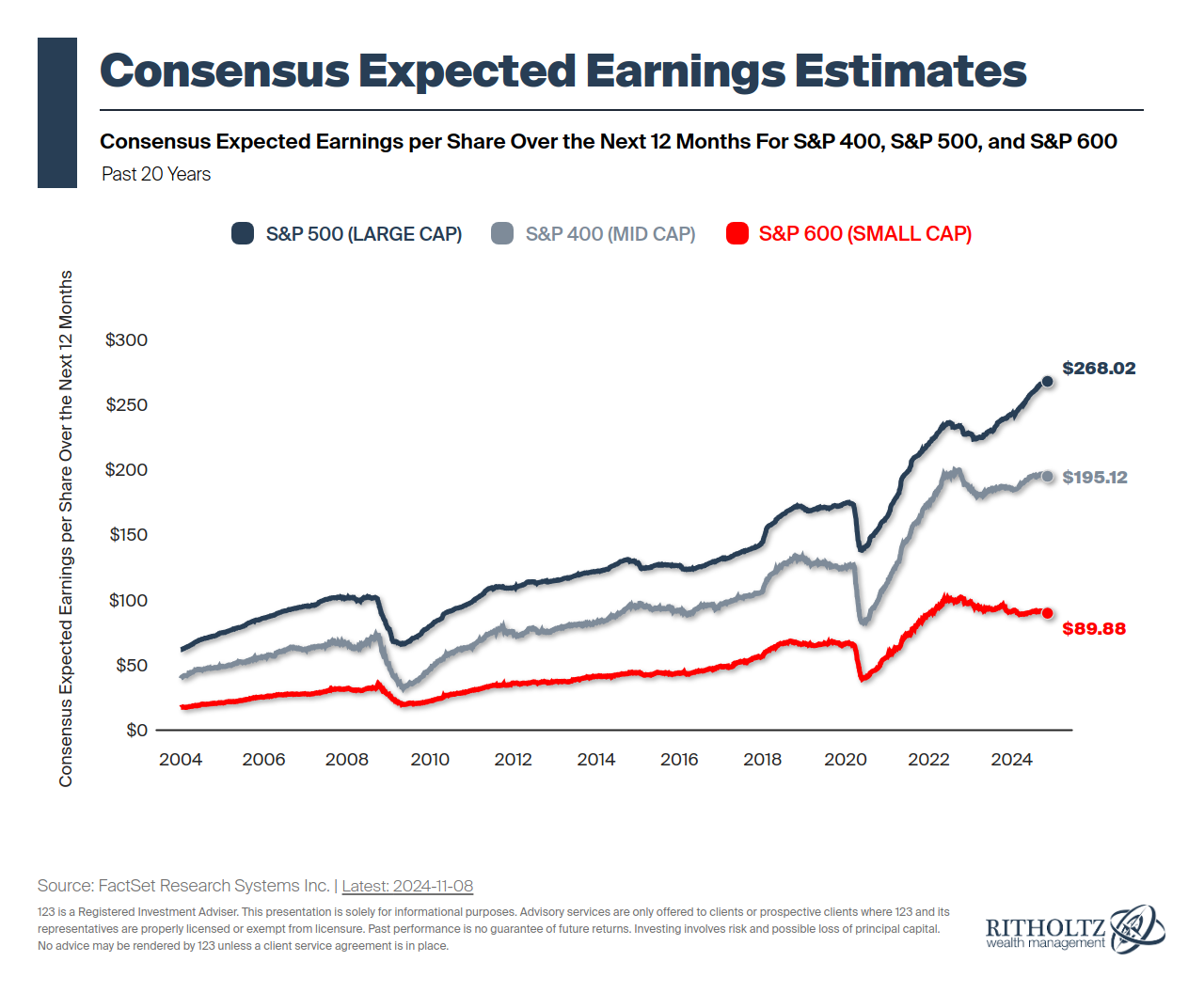

Take a look at earnings:

Stock prices are up a lot but fundamentals2 have kept pace. In fact, the stock market has actually gotten less expensive over the past couple of years because of earnings growth:

Earnings are expected to keep growing too:

Of course, analysts can’t predict the future. They could be wrong but it’s not as bad as some people would have you believe.

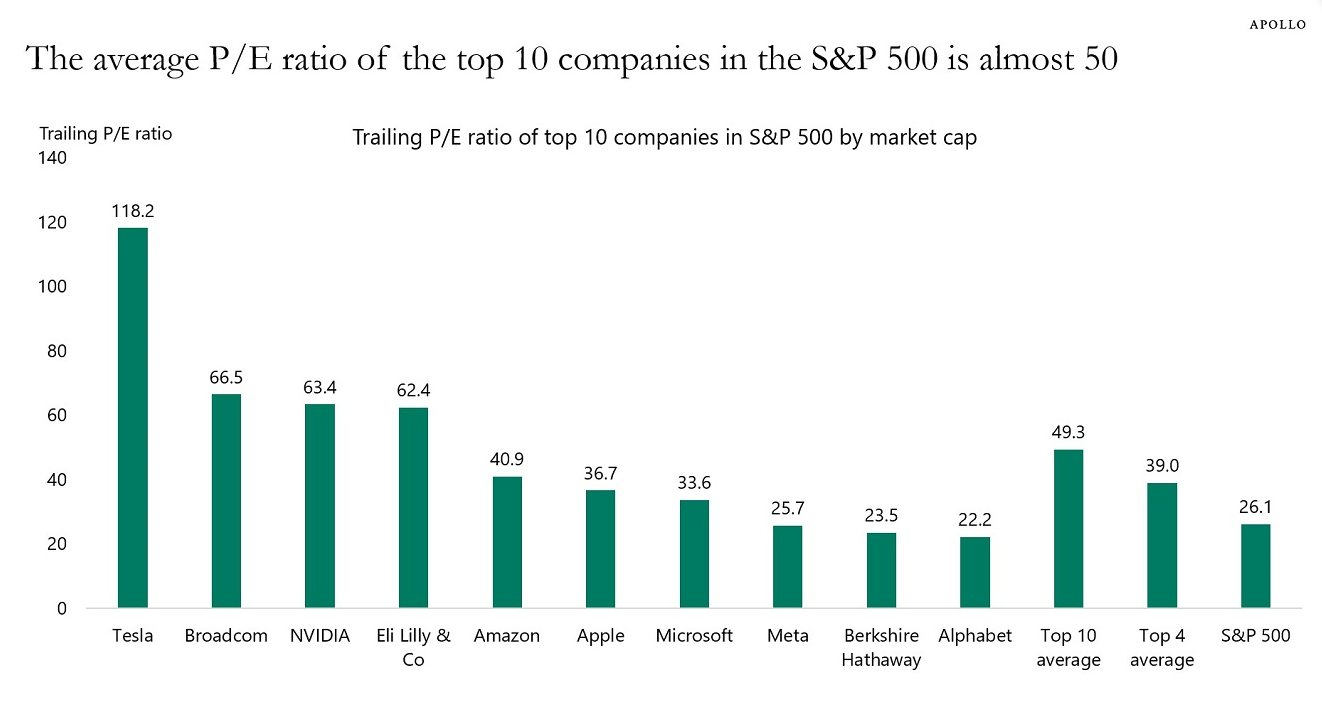

It’s also important to point out that much of the valuation premium on the S&P 500 comes from the largest stocks (via Torsten Slok):

These stocks have high valuations for good reason — they’re some of the best-run corporations in the world.

When I speak to investors these days there are two extremes when it comes to thinking about large cap U.S. stocks:

- The S&P 500 is overvalued. I’m nervous.

- The S&P 500 is the only game in town. Why would I invest in anything else?

The good news for valuation-conscious investors is there is plenty of value outside of the mega-cap stocks. Valuations for small and mid cap stocks are still pretty cheap. They are far less expensive now than they were before the pandemic. Maybe there’s a reason for that but stocks don’t get cheap for no reason.

Valuations haven’t mattered that much during this extended bull market because the biggest, fastest-growing companies have been so dominant. It’s possible that could continue. As long as earnings continue to grow it seems foolish to bet against the best companies in the world.

However, there are cheaper areas of the market if you’re concerned about valuations.

Diversification is going to prove its worth again at some point. I just don’t know when.

Michael and I talked about stock market valuations and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Timing the Stock Market Using Valuations

Now here’s what I’ve been reading lately:

- Time isn’t an asset class (A Teachable Moment)

- Data, trust, media and the vibecession (Kyla’s Newsletter)

- A tribute to the miracle of equities (Morningstar)

- Employment rates by age over the decades (Flowing Data)

- Welcome to Taxsylvania (Downtown Josh Brown)

Books:

1Many investors assume the reason stocks took off because the election result came so quickly. I can see that.

2Some of the numbers in these charts are trailing 12 month PE ratios and some are forward PE ratios. That’s why the numbers don’t always match up perfectly. Close enough is good enough for valuations.