Housing can be a good investment.

Anyone who bought a home before the pandemic can attest to that. The gains this cycle have been spectacular.

But housing is also a form of consumption.

You not only have property taxes and homeowners insurance but ongoing maintenance, lawn care, wear & tear, renovations, decorations, furniture, etc.

I was reminded of this when we had a minor roof leak issue this week. It was nothing major, just a little leak in our screened-in porch.

The roof repair company sent a guy who gave me two options:

Option 1. Really get in there and tear some stuff up at a cost of thousands of dollars.

Option 2. A minor fix to some joint/bracket that I don’t understand, seal a few things and call it good for a much lower cost.

He recommended option 2, which I was obviously on board with considering the cost difference.

This was his sales pitch: “It’s $500. Pretty cheap. $500 is basically free these days.”

I guess that’s inflation for you but this got me thinking about the potential renovation boom we could have in the coming years. If it costs $500 just to get someone in the door, how expensive will it be when people do real work to their homes?

My entire thesis of a renovation boom in the coming year rests on two facts:

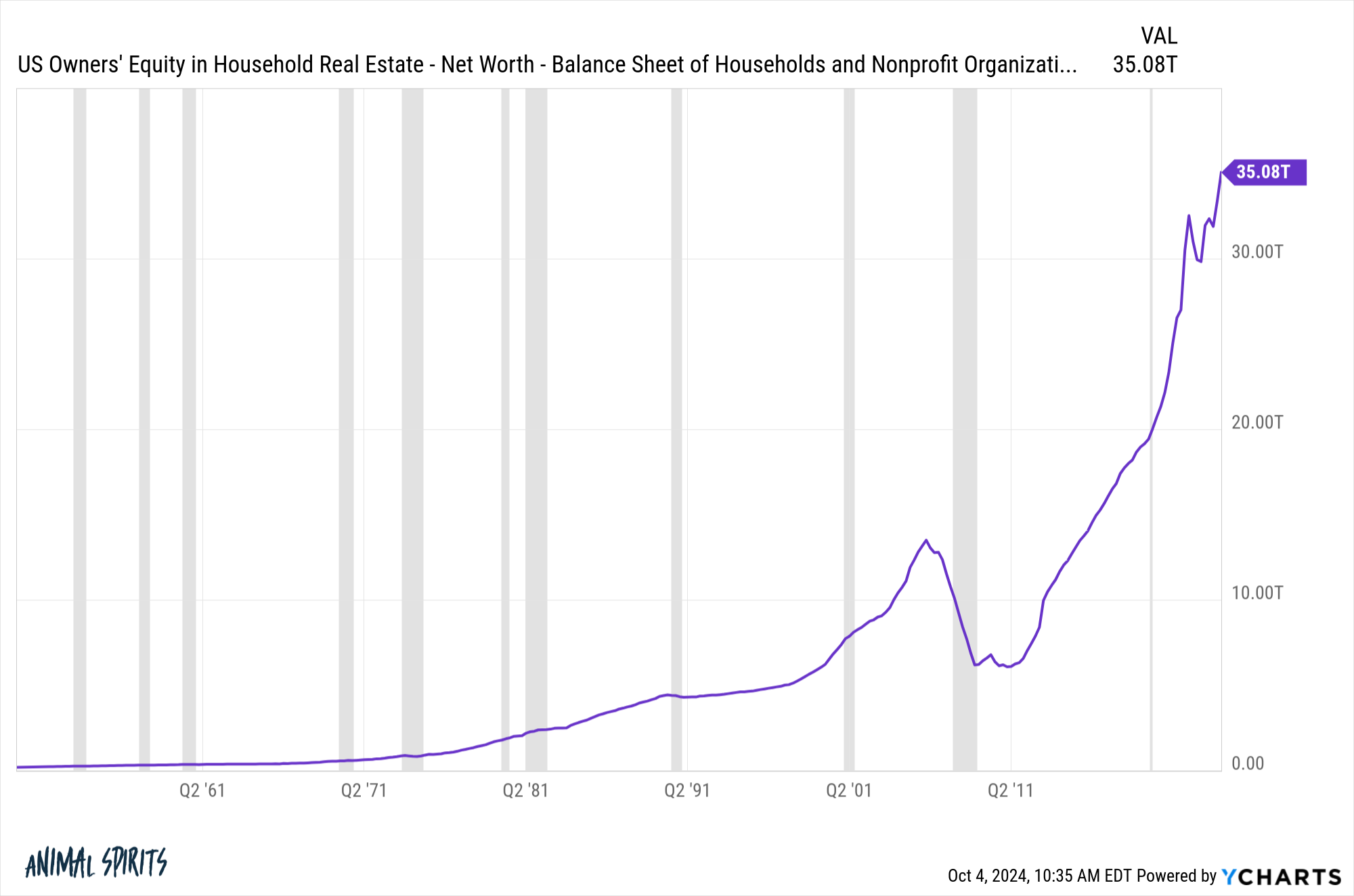

Homeowners have a boatload of equity. In the past 10 years alone, U.S. homeowners have added more than $22 trillion in home equity:

Homeowners with 3% mortgages will have a hard time giving up a low rate. If you can’t move because other houses are too expensive or you don’t want to move because you’re locked into a 3% mortgage, there are going to be tons of people looking to renovate their current dwellings.

What’s the point of having all that equity if you don’t do something with it right? We’re Americans. Spending money on open floor plans, quartz countertops, tiled bathrooms, gas fire pits and entertaining spaces is what we do.

However, I think there will be some sticker shock when homeowners get bids on these projects.

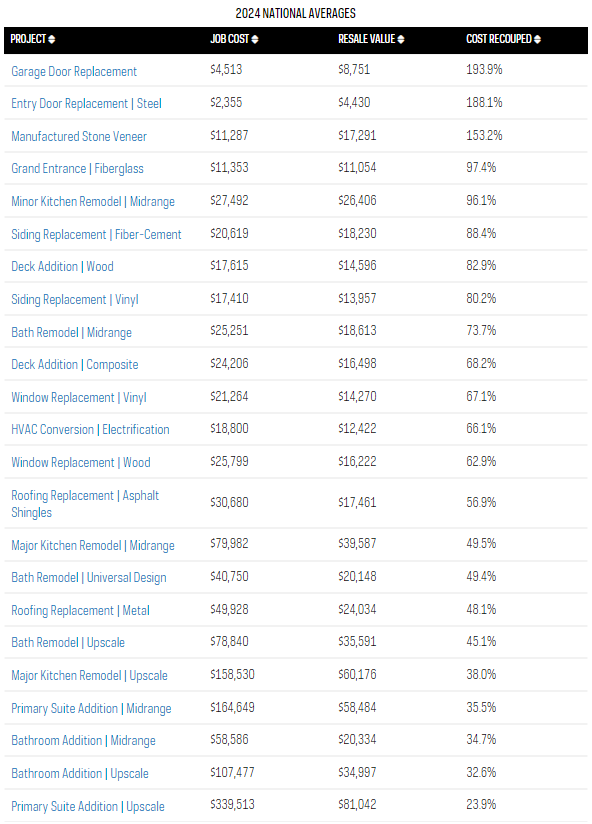

Zonda, a housing research firm, provides an annual list of the average cost for home remodeling projects:

An upscale kitchen remodel could cost up to $160,000. Adding a new bathroom? You’re looking at anywhere from $60k to $100k+. A new composite deck will run you something like $25k.

These numbers obviously vary by region, the scale of the project and taste level. You can also see that some projects have a better ROI than others.1

But the combination of inflation, higher housing prices, higher wages and higher material prices means your remodeling projects in the coming years will probably be more expensive than you think.

We’ve done a handful of renovations in the past, both big and small. Based on that experience, I’ve come up with some general rules of thumb for home renovation projects:

- It will probably cost more than you think.

- It will probably take longer than you think.

- You will probably be overwhelmed by the number of choices you’re forced to make.

- You will probably be happy you did it when all is said and done.

Daniel Kahneman wrote about the planning fallacy in Thinking Fast and Slow. Here’s how he describes it in the book:

Amos and I coined the term planning fallacy to describe plans and forecasts that:

-

- are unrealistically close to best-case scenarios

- could be improved by consulting the statistics of similar cases

Kahneman cites a 2002 study that shows American homeowners expected a remodeled kitchen to cost roughly $19k on average. The actual cost they ended up paying was closer to $40k. I’m sure both of those numbers sound good today because of inflation but most people probably lowball their estimates on this stuff.

I’m still bullish on the prospects for a home renovation boom in the years ahead.

I just think many homeowners will be shocked once they get their estimates.

Michael and I discussed home improvements, the housing market and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Investing in Home Renovations vs. Investing in Stocks

Now here’s what I’ve been reading lately:

- It’s OK to splurge a little bit (The Root of All)

- The longshoreman strike and the democracy of automation (Kyla’s Newsletter)

- The Barry Sanders of investing (Jake’s Newsletter)

- The best recipes in the world have only a few ingredients (Freedom Day)

- You have to enjoy the money to actually be rich (Noah Kagan)

- An oral history of Swingers (Grantland)

Books:

1I’m not sure how to think about these cost recoup numbers. Do people really care that much about a new garage door?