Imagine laying out the following scenario a few years ago:

Inflation will hit its highest level in four decades. That will force the Fed to raise rates from 0% to 5%+ in a hurry. Inflation will eventually fall back to target but a recession isn’t the reason why. By the time the Fed is ready to start cutting rates the stock market will be back to all-time highs. Gold too. And housing prices.

It sounds incredibly implausible when you think about it.

Yet that’s what happened!

How about this one for you:

Mortgage rates fall to generationally low levels during a pandemic after the Fed lowers rates to zero and begins buying mortgage-backed bonds. Remote work and pandemic-related unintended consequences pull forward a decade’s worth of housing price gains as people frantically search for a new home. After the Fed raises rates, 30 year mortgage loans go from sub-3% to 8%. Housing prices don’t crash. In fact, they rise to new all-time highs following a brief dip.

It’s funny because it’s true.

The hope is now that the Fed is cutting rates that mortgages will become more affordable to open up some activity in a housing market that’s slowed to a crawl.

All the homebuyers who have been on the sidelines these past couple of years would welcome this development.

But what if the following happens:

Cutting rates slows the weakness in the labor market. The soft landing is cemented and the economy keeps chugging along. Short-term rates fall but intermediate-term and long-term yields stabilize or potentially go up a little bit. Mortgage rates don’t fall nearly as much as homebuyers would like. Housing prices don’t become all that much more affordable.

Bloomberg’s Conor Sen made the case this week that we either get 4% mortgages from a recession or a stable economy but not both:

Markets and the Fed now agree that in a “softish” economic landing, the fed funds rate is likely to eventually fall to around 3%, well above pandemic-era levels. That limits how much mortgage rates can decline — particularly by next spring’s housing season — after dropping to 6.15% from 8% over 11 months. Those hoping for much lower should be careful what they wish for: A world of substantially lower mortgage rates is one of substantial job losses.

Just look at bond yields since the Fed announced its rate cut — they’re not going down.

On the one hand, a strong economy is preferable to a job-loss recession.

On the other hand, if mortgage rates don’t drop much further from their current 6.2% level, there are going to be plenty of unhappy homebuyers.

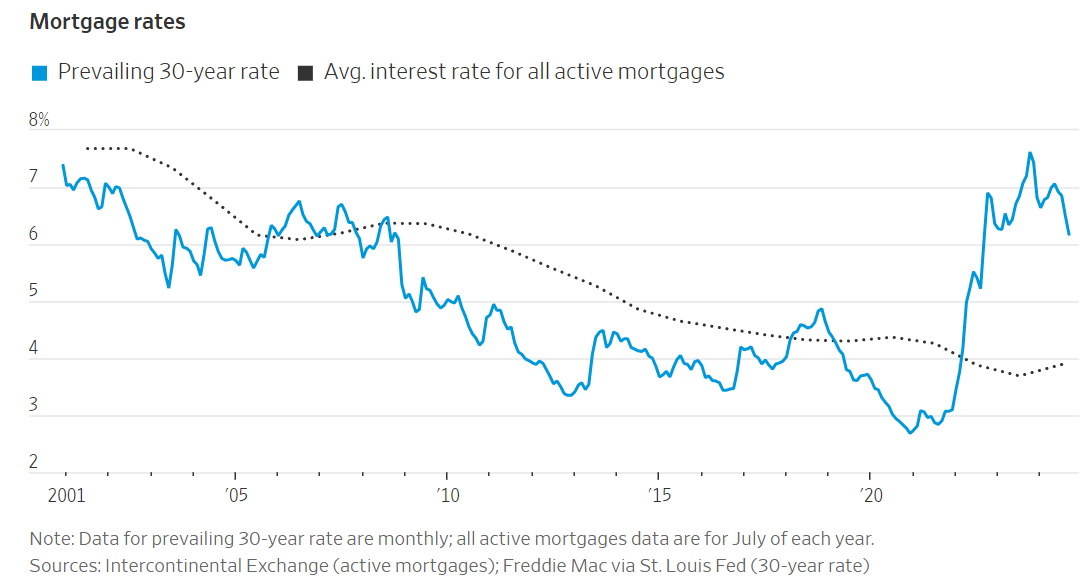

You can see the average mortgage rate is still well below current levels (via the WSJ):

It would likely take a recession to get anywhere close to the 3.9% average rate current homeowners are sitting on.

Is there any way we can avoid a recession and get much lower mortgage rates?

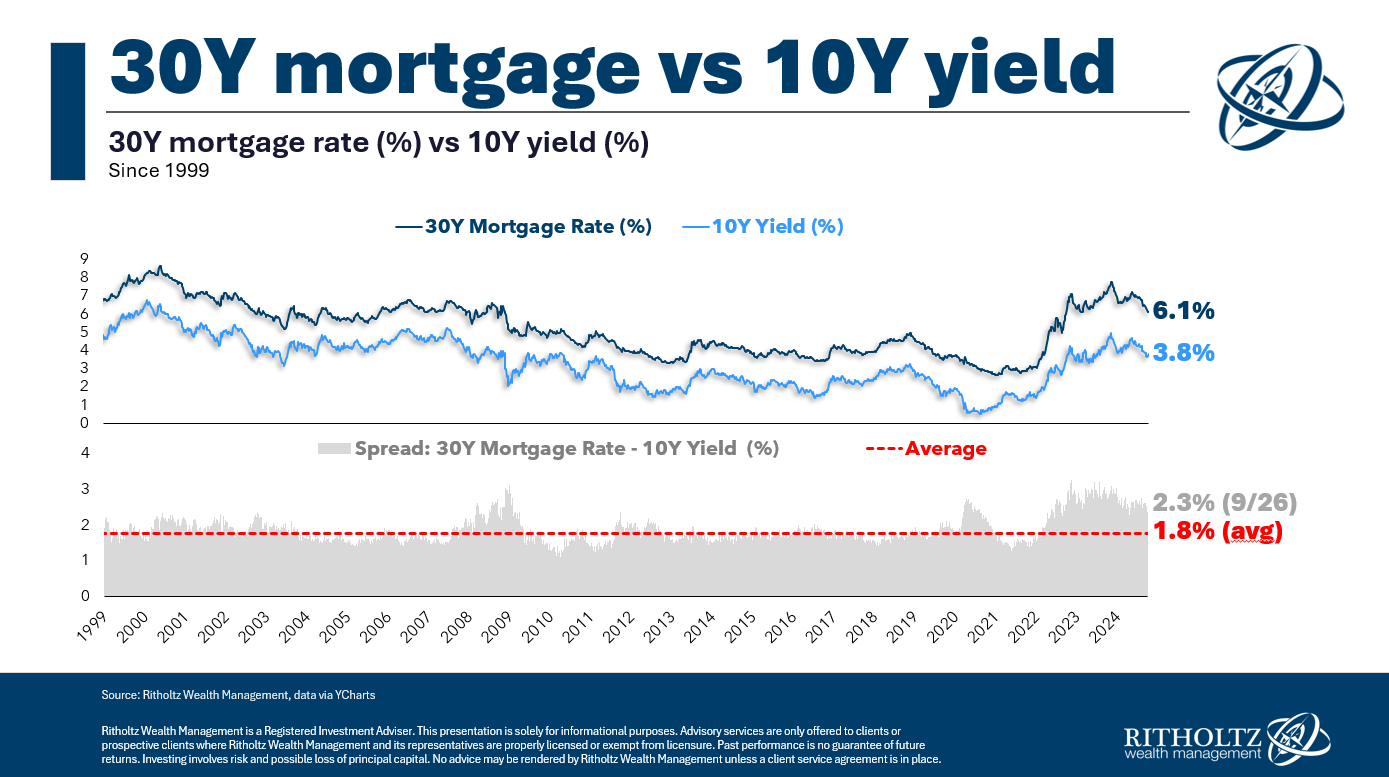

It would be nice if we could see the spread between the 10 year Treasury yield and mortgage rates compress:

It’s about as high as it’s been this century.

The hope would be that we see this spread come back to pre-pandemic norms. Maybe Jerome Powell could threaten the Fed will buy more mortgage-backed bonds just to be on the safe side.1

Short of that, it does seem like a soft landing won’t help homebuyers all that much.

I could be wrong, of course. Things could play out differently. Maybe buyers will step in to buy mortgage bonds and rates will fall. Maybe inflation will continue to come down but the economy keeps growing and yields come in.

Or we finally have that ever-elusive recession, and we get 4% mortgage rates again. That’s not great for those who lose their jobs but the potential homebuyers who keep theirs would welcome lower borrowing costs.

It feels like we’re in a damned-if-you-do, damned-if-you-don’t housing market.

The Fed can’t magically create more houses to fill the shortage we have. Lower borrowing rates would help but there is no elixir that’s going to fix things overnight.

If we’ve learned anything this decade, economic and market relationships don’t always make sense.

Housing prices could fall. So could mortgage rates.

But from where I’m sitting, if we continue in a soft landing zone, it’s hard to see housing getting all that much cheaper from current nosebleed levels.

If the recent past is any indication, I’ll probably be wrong.

Further Reading:

Who’s to Blame For the Broken Housing Market?

1I actually think the Fed should do this to help the housing market thaw out.