“Credit cards are the crack cocaine of the financial world. They start out as a no-fee way to get instant gratification, but the next thing you know you’re freebasing shoes at Nordstrom.” – Scott Adams

One of the first rules of personal finance is to stay out of credit card debt. The average interest rate on credit cards is currently around 14-16% so holding a credit card balance is a sure way to decrease your net worth. This is a no-brainer.

While I am in agreement with those personal finance gurus that preach staying out of debt I don’t go so far as to say that you should cut up all of your credit cards and just use cash. You actually need credit to succeed financially; it’s just the debt part you have to avoid.

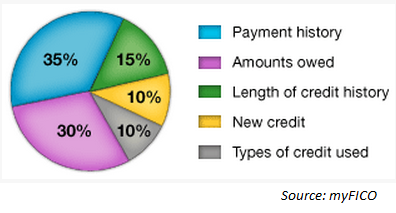

Here is the breakdown of the various influences on your FICO credit score:

Payment history and length of credit history account for 50% of your credit score. That means you need to actually have and use credit cards to improve your FICO score.

From myFICO, here are a few ways to ensure a good credit score:

- Pay your cards off on time (obviously).

- Keep a low percentage of the amount owed in relation to how much credit you have (0% after your payment date is a good number in my book).

- Keep your cards open for a long period of time and continue to use them occasionally even if it’s not your main credit card for spending purposes.

- People with no credit cards are viewed as a higher risk than those who have managed them responsibly.

- Having too many cards depends on your overall credit picture (closed accounts still show up as part of your history). If everything else is good having a lot of cards shouldn’t hurt you.

- Opening several new accounts in a short period of time looks risky for your credit report.

Here are some more potential benefits of keeping your credit in good standing:

- 60% of U.S. employers check credit scores before a hire.

- Your loans get approved faster.

- You get lower rates on your loans.

- Financial institutions will offer you higher lines of credit.

- Any future mistakes count for less against your score if you have a solid history.

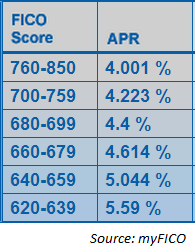

As an example of the amount of money you could potentially save from having a high credit score, here are the different average mortgage rates offered by credit score (looks like these numbers are a couple months old but you get the picture):

That’s a huge gap between the high and low credit scores. On a 30 year fixed mortgage, the difference in monthly payments is over $240 a month or $2,880 a year ($1,433 vs. $1,193). Over the life of the 30 year loan you would end up paying roughly $179,000 in interest on the 760-850 rate, but over $266,000 on the 620-639 rate, a difference of $87,000.

Of course, it’s much easier to misbehave and spend more with the swipe of a credit card than using actual cash. In one study researchers asked people to estimate their expenses before opening their credit card bill and every single person underestimated their bill by an average of 30%.

But there’s no such thing as statement shock anymore. You can check your card balance up-to-the-minute with online banking on your computer or smartphone. There’s no reason people should become unaware of their spending habits when they can check any time they want.

Because credit cards have enormous interest rates the card providers are in constant competition with one another to get new card members to sign up. That means you can get pretty decent cash and travel rewards programs these days as well.

I prefer cash back rewards because they seem to change the travel programs so often, but many cards will offer really nice sign-up bonuses when you get approved for miles rewards card (it usually works out to be a free flight).

I just received an updated list of additional benefits on one of my credit cards in the mail and decided to look it over for the first time. Here’s what was included:

- Purchase replacement: repair or replace purchases which are stolen, damaged or lost within 90 days of the purchase.

- Extended warranties on certain purchases.

- Car rental insurance coverage.

- Lost luggage reimbursement.

- Concierge services (entertainment, gift, personal & getaway arrangements)

Add these benefits to the cash or travel reward possibilities along with the money saved by having a solid credit score and utilizing credit cards in a responsible way can really pay off.

Most personal finance advice encourages people to focus on the little things like cutting back on eating out and coffee purchases. These can make a minor difference, but getting the big things right can have a much larger impact on your finances.

True. I realized it for myself that having no credit history equals to nonexistence and I couldn’t grasp it.

Now I fight the debt of over extending my credit in early years. The banking system has us on the hook as early as they can.

Definitely something that needs to be taught at an early age, but usually depends on personal experience or possibly how you were raised as far as money goes. Probably should be a course on PF for high school seniors covering the basics.

Most American financial blogs that I read put a high emphasis on having a good credit score. I’m not sure if it’s genuine, or because there’s money to be made in credit score affiliate relationships. But if 60% of employers are checking credit scores before a hire, that’s a pretty good reason to try to keep it clean.

I’ve never heard of that in Canada, short of a position that requires financial fiduciary duties. This article suggest less than 20% of Canadian employers do credit checks as part of the screening process – http://www.theglobeandmail.com/report-on-business/careers/career-advice/shaky-credit-history-wont-cost-you-the-job/article4217642/

I’m a big believer in responsible credit use and, like you, I prefer a cash back rewards card to earn a little bit back on my spending. I don’t want to live my life taking cash out of envelopes and jars.

That one was new to me as well.

The jars and envelopes were the ones I was thinking about as well. Only for the worst cases. Everyone else should use credit cards responsibly.

[…] Why you need a credit card. (A Wealth of Common Sense) […]