There was a recent poll about my home state of Michigan where they asked people for their thoughts on the state of the nation’s economy today.

Just 35% of people described the economy as excellent (6%) or good (29%) while 65% described it as either not so good (28%) or poor (37%).

But when asked how they would describe their own personal financial situation these days, a majority of people (61%) described their circumstances as excellent (9%) or good (52%) while 38% described it as either not so good (25%) or poor (13%).

So the prevailing sentiment of this group is: I’m doing just fine thank you very much but the economy stinks.

Kind of a headscratcher, right?

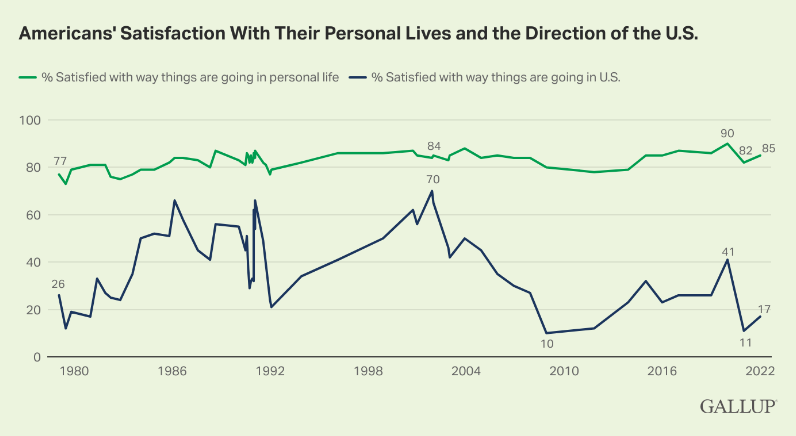

Michigan is not unique in these conflicted feelings. Gallup has a poll that shows people in America are five times as satisfied with their own life than they are with the direction of the country as a whole:

The country is going to hell but everything for me is coming up roses.

It’s a bizarre stance to take.

There are further examples when it comes to this line of thinking:

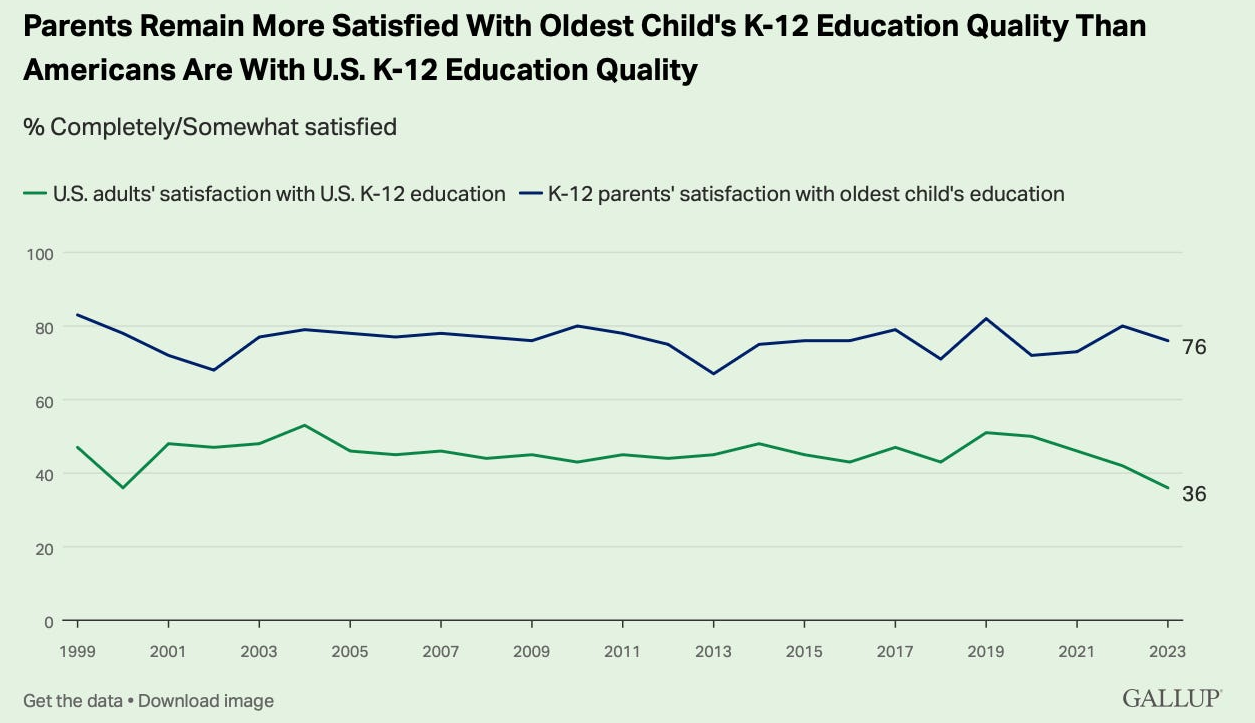

The education system in this country is failing our children! But my child’s education is pretty good.

This isn’t a new phenomenon but it appears to be getting worse in many cases.

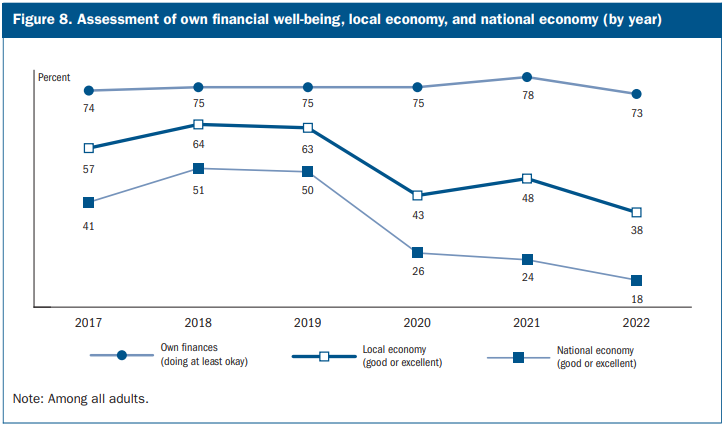

Households have felt strongly about their own financial well-being throughout the challenging pandemic environment but their views on the local and national economies have diverged considerably:

So what’s going on here?

Some of these sentiments are political. Republicans are more positive about the economy when a republican president is running the show and more negative when a democrat is in charge. The same is true for democrats, in reverse order.

Surely, the pandemic and ensuing inflation drove down sentiment.

Then there is the human nature element. People are predisposed to view the rest of the world in a negative light even when they think more positively about themselves.

But I think the biggest reason is the news is making people miserable.

Read a history book or ten. The world has always been a mess. There have always been awful people. There have always been problems.

The difference is now we are constantly reminded of them.

We now get more news in a single day than most people ever saw in their lifetimes just a few short centuries ago.

It started with newspapers, then the radio, and then television. We’ve accelerated the process in recent decades through the Internet, social media, and smartphones.

Our brains aren’t hardwired to have this much information thrown at them. And it’s not simply a case of information overload. It’s the fact that so much of the information we see is negative.

Bad stuff happened in the past at an alarming rate. The difference is our ancestors weren’t inundated with alerts, 24/7 news and social media posts about that bad stuff. They were blissfully ignorant.

It’s impossible to remain blissfully ignorant anymore.

I want to blame the news organizations and social media posters for spreading all of the negativity, but they’re basically just giving us what we want based on our actions.

A recent study looked at more than 370 million stories on the Internet to determine how negative language can impact news consumption. Lo and behold, the more negative the headline, the more likely people are to click on the story, regardless of what the story is about.

You don’t even have to sit through an entire story to be mad now. You can just read a headline or see a screengrab.

Negativity drives eyeballs.

In his book Amusing Ourselves to Death, Neil Postman wrote about what sells when it comes to the consumption of information:

For those who think I am here guilty of hyperbole, I offer the following description of television news by Robert MacNeil, executive editor and co-anchor of the “MacNeil-Lehrer Newshour.” The idea, he writes, “is to keep everything brief, not to strain the attention of anyone but instead to provide constant stimulation through variety, novelty, action, and movement. You are required … to pay attention to no concept, no character, and no problem for more than a few seconds at a time.” He goes on to say that the assumptions controlling a news show are “that bite-sized is best, that complexity must be avoided, that nuances are dispensable, that qualifications impede the simple message, that visual stimulation is a substitute for thought, and that verbal precision is an anachronism.”

It’s worth pointing out this book was published in 1985. Things have only gotten worse.

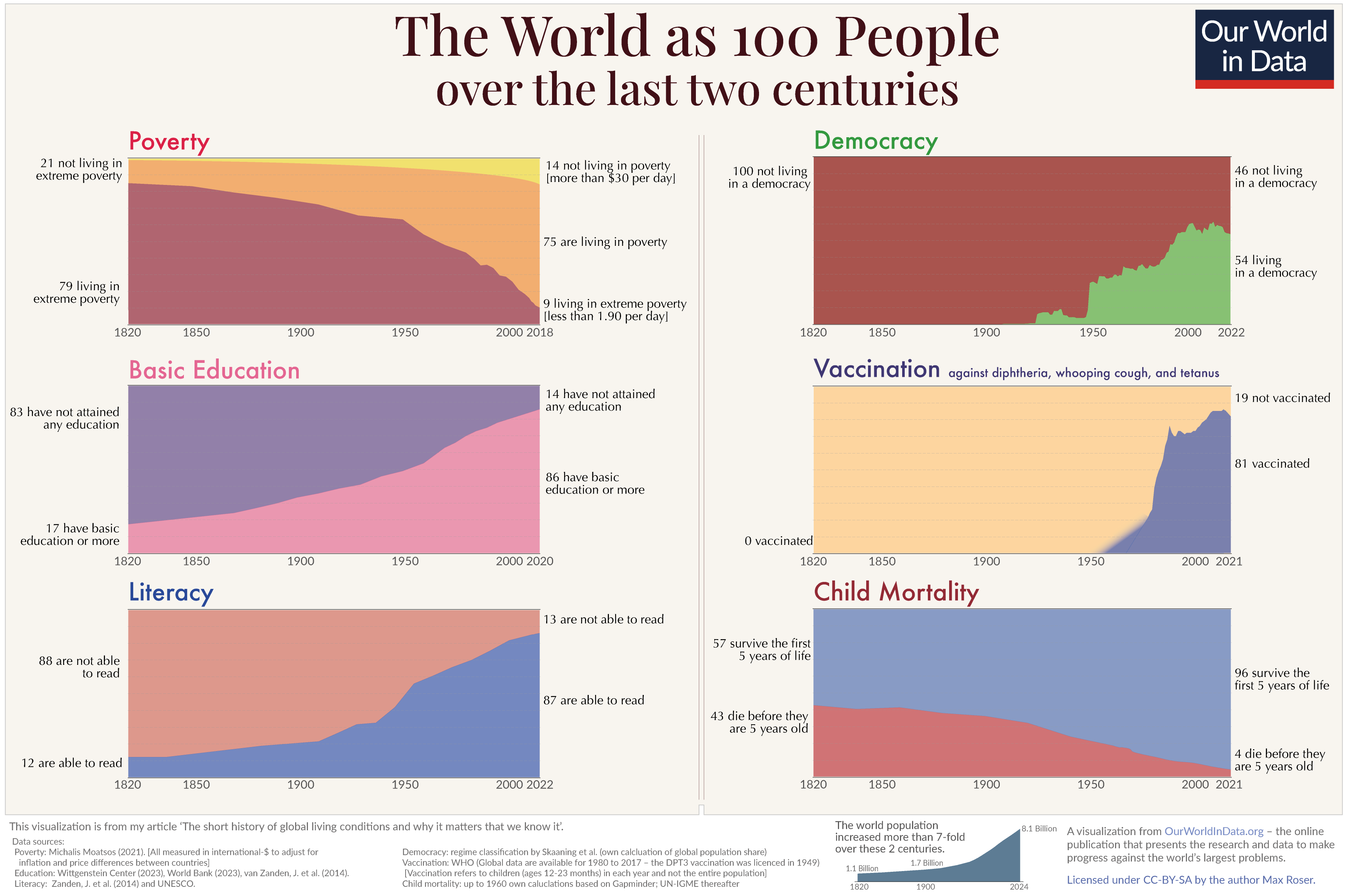

The sad part about all of the negativity in the world is things are generally getting better over time:

We’ve made a lot of progress as a species. Unfortunately, long-term progress doesn’t make for a clickable headline. People would rather read about the car crash than the family that makes it home safely every night.

Tim Wu wrote about the race to the bottom when it comes to drawing attention to negativity in his book The Attention Merchants:

The only communications truly without influence are those that one learns to ignore or never hears at all; this is why Jacques Ellul argued that it is only the disconnected–rural dwellers or the urban poor–who are truly immune to propaganda, while intellectuals, who read everything, insist on having opinions, and think themselves immune to propaganda are, in fact, easy to manipulate.

Ironically, the people who try to stay informed about everything are the easiest ones to manipulate because they get caught up in a never-ending loop of doom-scrolling.

I’m not suggesting we should ignore all of humanity’s problems. The Internet makes it easier to see all of the bad stuff, but it also makes it more convenient to help needy causes.

But constantly watching the news doesn’t fix anything. It just makes you more negative and depressed about the state of the world.

Go outside. Exercise. Play a sport. Spend time with your family. Watch a movie. Read a book.

Any of these activities are better for you than consuming the news.

Further Reading:

50 Ways the World is Getting Better