The majority of my portfolio is rules-based because I prefer convenience, automation and taking my emotions out of my investment process.

There are still decisions that need to be made up-front with this type of investment strategy, but utilizing rules and quantitative measures allow me to think and act for the long-term without stressing so much about my portfolio.

But there is a portion of my money that is run almost exclusively based on qualitative measures.

I went through a stock-picking phase early on in my career and tried to use quantitative measures to pick individual names. But with the advent of ETFs and other rules-based funds that can do it with more diversification at a lower cost, it seemed silly to do it myself.

So I took a break from individual stocks for a number of years.

It’s only in the past two or three years that I’ve gotten back into picking stocks in my fun portfolio. The reason for doing this is because I enjoy following a handful of individual companies and it scratches an itch for me in terms of taking some risks I wouldn’t elsewhere in my portfolio.

It’s not exactly a scientific approach but I mainly bet on people and products when it comes to individual names. No quant screens. No discounted cash-flow analysis. No channel checks.

Just investing in stuff I like and am interested in. I’m sure some people will shake their head at this but it works for me.

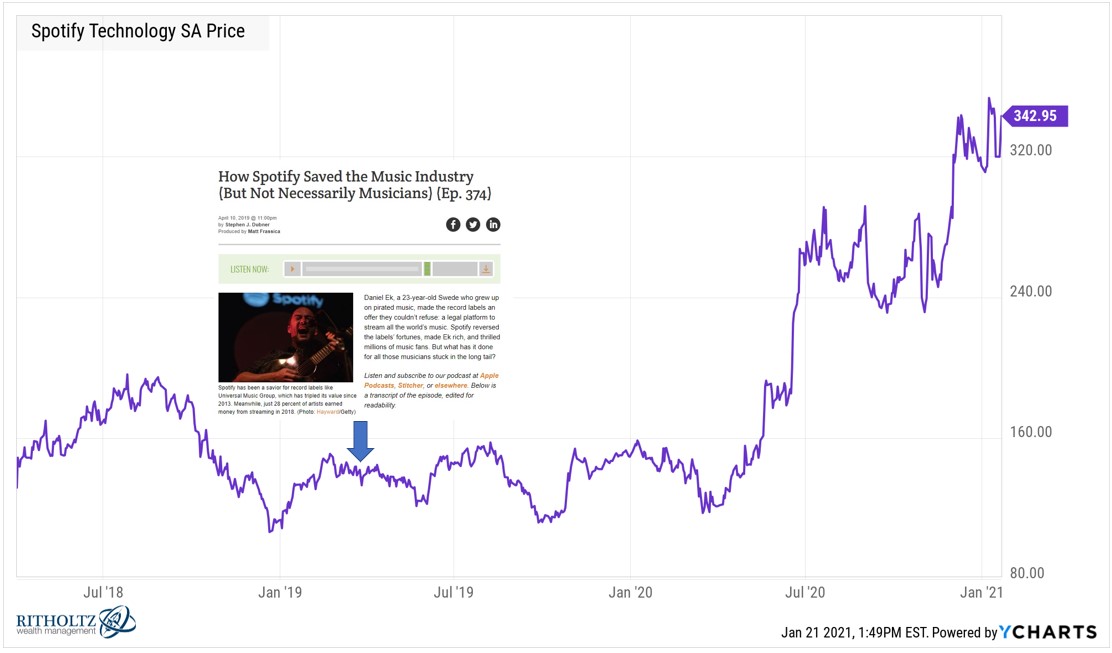

For instance, I listened to a Freakonomics podcast episode with Stephen Dubner interviewing Spotify CEO Daniel Ek in the spring of 2019. I was so impressed with Ek after listening I immediately bought shares in the company:

I didn’t perform any due diligence on Spotify’s business or look through the financial statements or anything approaching the work of an actual analyst. I simply bought it because I was impressed with Ek’s vision for the future of the company and his humility as a leader.

I made a similar purchase of Stitch Fix shares after listening to CEO and founder Katrina Lake talk with Patrick O’Shaughnessy on Invest Like the Best this past summer:

This is a company and idea that immediately made sense to me after hearing her story. Stitch Fix is an online retailer that pairs you up with a personal stylist who sends you apparel based on your tastes (which you share through a questionnaire and ongoing feedback).

This is the part that did it for me:

At this point, we have billions upon billions of data points that help us to understand, not just who’s going to like what, but we also understand what are the attributes and clothes that matter. You could take every measurement of every garment, but if you don’t actually know which ones are the ones that are meaningful and the ones that drive decisions from customers around what they’re going to buy and what they’re not, it’s pretty meaningless. This data that matters is really what I talk about, when people are trying clothes on, they’re letting us know this is too big, this is too small. It’s not like online reviews. It’s not just the people who hate it and the people who love it. We get this very high completion rate of people who are sharing with us what’s working. That’s not necessarily big data, but it’s small, real meaningful data.

Just hearing her talk about where this company could go next made me want to buy the stock. I performed no other research other than listening to this one podcast before buying.

Every Warren Buffett book in history talks about the trip be made to the GEICO office on a Saturday to speak with the CEO, a trip that convinced Buffett to buy the stock. He would go on to make a kajillion percent or so on this investment which is why this story is in all 10,000 books written about the Oracle of Omaha.

People also used to have to request, by mail, the quarterly financial statements for publicly-traded companies.

Now it’s almost too easy to get information and access that people almost take it for granted.

The point here is not to brag about my stock prowess1 (seriously, not to brag) but as a show of appreciation for this format.

It’s amazing we all now have access to CEOs, founders, investors, authors, actors, athletes, comedians and other intelligent people through long-form podcasts.

I actually tried Stitch Fix the product and got my first shipment this past week. I gave my review on this week’s recommendations segment for Animal Spirits. After sharing my story about buying shares because of the podcast, a handful of listeners wrote in saying they did the same.

Here’s this week’s Animal Spirits video on how we’re seeing micro bubbles all over the place:

Subscribe to The Compound so you don’t miss these videos each week.

Further Reading:

How I Invest My Own Money

*******

Now here’s what I’ve been reading lately:

- Demystifying the art market for investing (Not Boring)

- Investing in a bubble (Verdad Capital)

- 10 investing lessons from 2020 (Dollars and Data)

- Spending more than 4% in retirement can be safe (Oblivious Investor)

- Can growth investing go out of style? (Irrelevant Investor)

- Carlson’s way (Humble Dollar)

1I’ve also been a Twitter shareholder in recent years which basically went nowhere. I sold those shares in recent weeks. Can’t win ’em all.