“All my life I made mistakes, but in losing money I have gained experience and accumulated a lot of valuable don’ts.” – Jesse Livermore

The majority of my portfolio is invested in simple, low-cost index funds and ETFs. I like to practice what I preach. But I do keep about 10% of my portfolio in a brokerage account to buy individual stocks and other non-core ETFs.

This account allows me to have some fun, follow individual companies and take some more risk with a small piece of my portfolio. As long as you scale it correctly and have a game plan, I see no problem with other investors taking this route.

Those that can put in the time and research could use more than 10%, but that’s what I’m comfortable with.

The way I look at it, I know that 90% of my portfolio that is extremely diversified so I feel fine taking on some individual company risk with the remaining 10%. (I’ll go into some of my strategies in more depth in the future, but I just wanted to get that out of the way now since I have been singing the praises of index funds since I started this website).

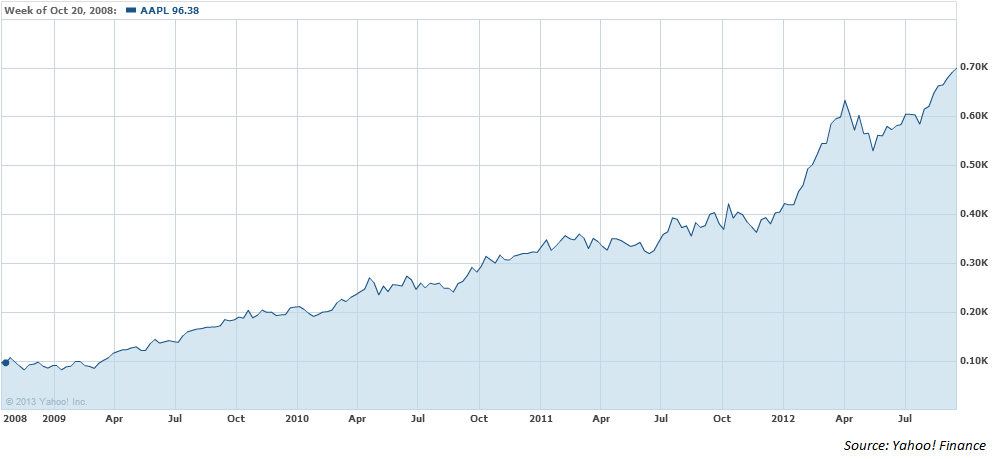

Anyways, one of the stocks I have held now for a number of years is everyone’s favorite smartphone and tablet maker, Apple (AAPL). I was lucky enough to buy AAPL throughout the financial crisis in late 2008 and early 2009 at some bargain basement prices in the $80-90 range.

Holding this position for a few years paid off nicely as you can see here:

The stock rose all the way from the mid-$80s to just over $700 a share by September of 2012. At that point I was riding pretty high, feeling good about this buy and patting myself on my back to anyone that would listen.

Here’s what I didn’t ask myself:

At this point, who else is there to buy the stock that hasn’t bought in already? All the analysts say it’s a buy. It’s all anyone in the financial media can talk about. Where does the marginal buyer come from? Paying attention to the sentiment around a particular investment is more of an art than a science, but it’s a great way to gauge whether a stock is overheating.

What’s my selling strategy? It’s very easy to buy stocks. The majority of the time stocks go up in price. It’s not very easy to sell stocks. It could be a price target. A valuation target (i.e., a P/E over 20 and I sell). Or even a rebalancing target (any position over 3% of my portfolio and I trim it back). Some also use technicals to sell when a chart is broken (breaks through a long-term uptrend).

The difficult part in owning stocks is coming up with a risk management plan once you actually hold the shares. What happens if the stock goes up by X% or down by X%? When should you take gains or buy more shares? This is where investors get into trouble.

I didn’t have a plan of attack of when to take some profits from this Apple purchase. I got overconfident.

As AAPL was hitting $700, the company had a huge pile of cash (they still do) that matched the annual GDP of many smaller countries form around the world and they had just announced their first dividend.

I thought these things meant the stock at least had a floor under it and that it couldn’t go down in price.

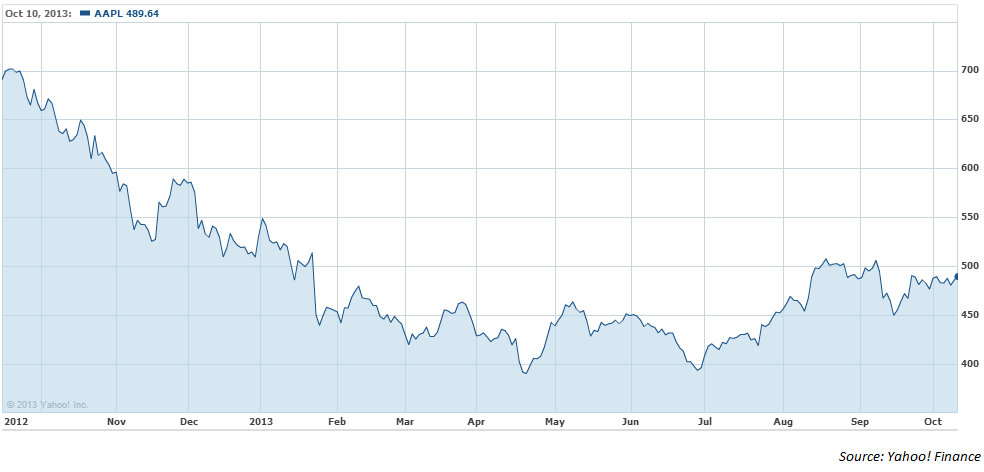

Of course I was wrong. Here’s what happened next:

This loss hurt even more on a relative basis because the rest of the market continued to power higher.

All is not lost from this experience as I stepped back to look at the lessons learned.

Here are my takeaways from this mistake:

Don’t get overconfident with any investments. I talk all the time about how dangerous the overconfidence bias can be and it still sucked me in. Luck plays a larger role in your investments than you realize.

Have a rules-based selling strategy before you buy a stock. I need to have a better strategy to take profits and rebalance from winners to losers. More on this in the future.

Investments don’t grow forever. Mean reversion is an ever present part of life in the markets. Even the very best performers have to slow down eventually. The last shall be first and the first shall be last.

Great companies don’t always make for great investments. Apple was at the top of its game when the stock peaked. It could do no wrong as a company. Or so I thought. Price and valuation have a much larger impact on future stock returns than the quality of the company. Great companies can make for crappy investments and crappy companies can make for great investments depending on the price.

Expectations matter. Over the short to intermediate time frame, expectations drive the markets. If things are bad but not as bad as yesterday, that’s seen as a positive. Same goes when things are terrible but getting slightly worse.

Apple’s expectations were so sky high that any indication of coming up short of those expectations was bound to make a difference. Compared to the rest of the market, Apple still showed unbelievable growth, but not against their lofty expectations.

Learning from your past mistakes is a key to becoming a better investor. Sometimes you are better off avoiding decisions that hurt your portfolio more than you are making decisions that help your portfolio.

You should expect to make mistakes when investing in complex financial markets. There’s no shame in that. Just make sure you use those mistakes as lessons going forward and don’t continue to make the same mistakes over and over again.

It’s also nice to be able to find lessons in the mistakes of others.

What were your biggest investment mistakes this year?

[widgets_on_pages]

Fortunately I made no big mistakes this year. I think I already made all my mistakes in previous years and made many of them in advance, so hopefully I won’t make anything stupid next year 🙂

As you said, it is all about a plan. And finally I have a plan and know what stocks I want to be buying and what options I want to be selling 🙂 so I do not expect any horrible mistakes, unless I deviate from my plan/strategy.

Nice, you can use my mistakes as lessons. Staying with your process and learning from the mistakes of others (and your own) should lead to solid outcomes.

SO … are you out now? Whilst a 800% return might have been really great, hard to call a 500% return a mistake.

I actually held on and bought some more on the way down. Some of those purchases are starting to look OK now, but when Apple was down around -30% at one point this year and the markets are up 20-30% that’s a huge swing on a relative basis. That’s just how individual stocks work though.

I guess my mistake was in anchoring to my original price and thesis and not weighing the new information that sentiment on AAPL was way out of whack. It’s impossible to time these things perfectly, but looking back on it I think taking some profits at $600, $650 & $700 would have made sense.

I do have some price targets now to keep myself honest. We’ll see…

[…] Further Reading: Common Sense Investment Rules My Biggest Mistake of 2013 […]