Sometimes the biggest reason the stock market or certain stocks experience a severe decline in price is because they first experienced a massive rise in price.

Trees don’t grow to the sky and all that.

The pandemic has changed the way we view the many previously held ways of doing things which has led to some insane gains in certain stocks that have been able to capitalize.

Many of those pandemic winners finally took a breather in recent days.

Overstock has crashed more than 44% after rising more than 2,000% since the bottom in March.

Wayfair is down more than 23% after rising 1,000% since March 23rd.

Zoom fell more than 19%.

DocuSign is down nearly 20%.

Peloton is down 12% from its pandemic-induced high.

It’s possible these stocks have gotten ahead of themselves. Maybe people have overreacted about how things will look in a post-pandemic world.

But let’s assume these companies were not only in the right place at the right time, but end up becoming some of the biggest stocks from here on out.

Even if these companies live up to their now lofty expectations and their stocks end up being grand slam investments, it’s not going to be a straight line up and to the right.

These companies could become some of the most successful stocks of the next few decades and they will still crash spectacularly at some point.

This is the way it has to be for even the best of stocks because it’s impossible for expectations to stay in line with reality when you have uber-successful companies.

Let’s take a little stroll down drawdown memory lane to see how some of the most successful companies, brands and stocks in history have done over their life as a public company.

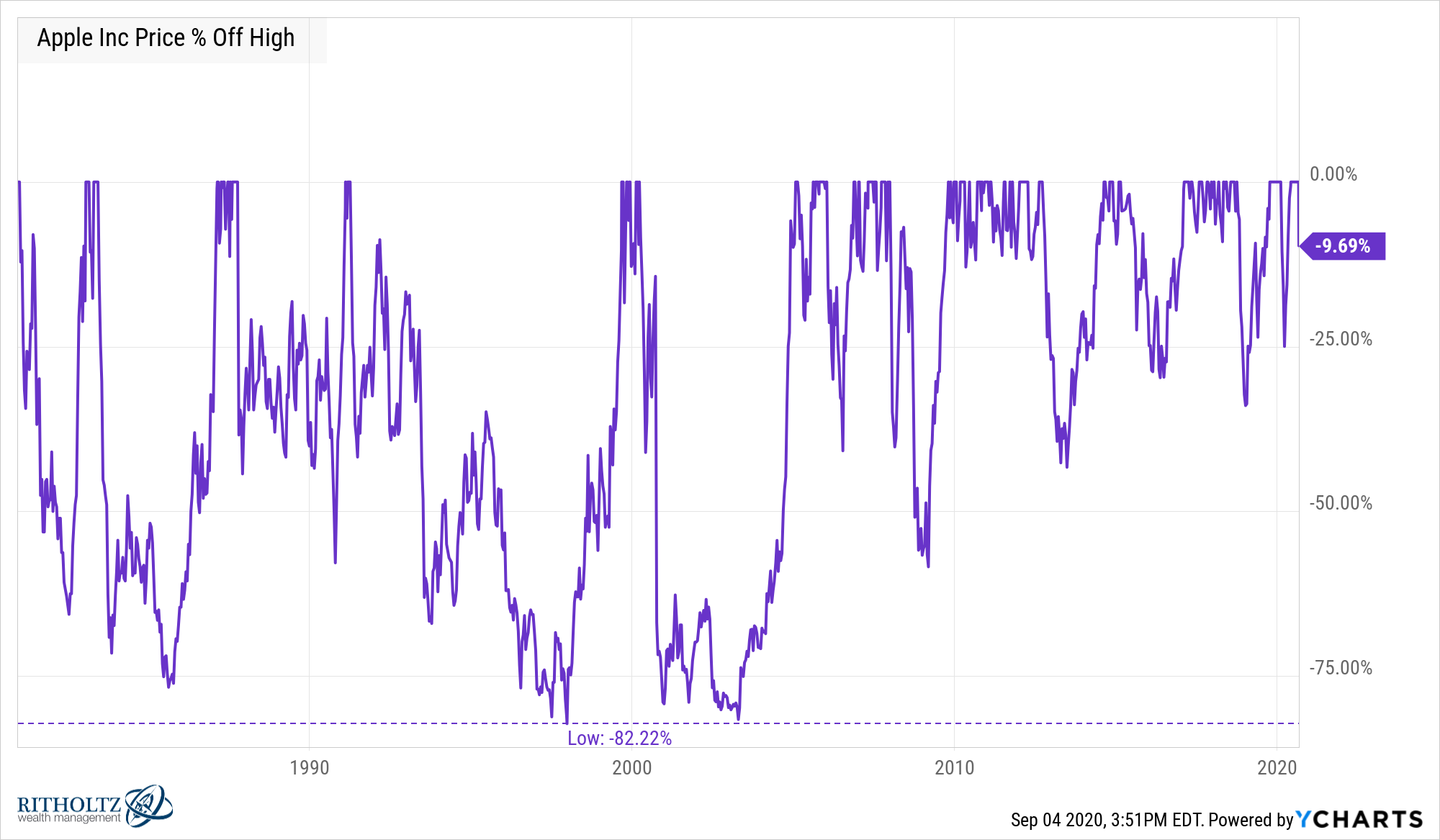

Apple is up almost 120,000% (19.5% annualized) since the early 1980s. Yet the stock has fallen more than 75% on three different occasions and has been cut in half more times than you could count on one hand:

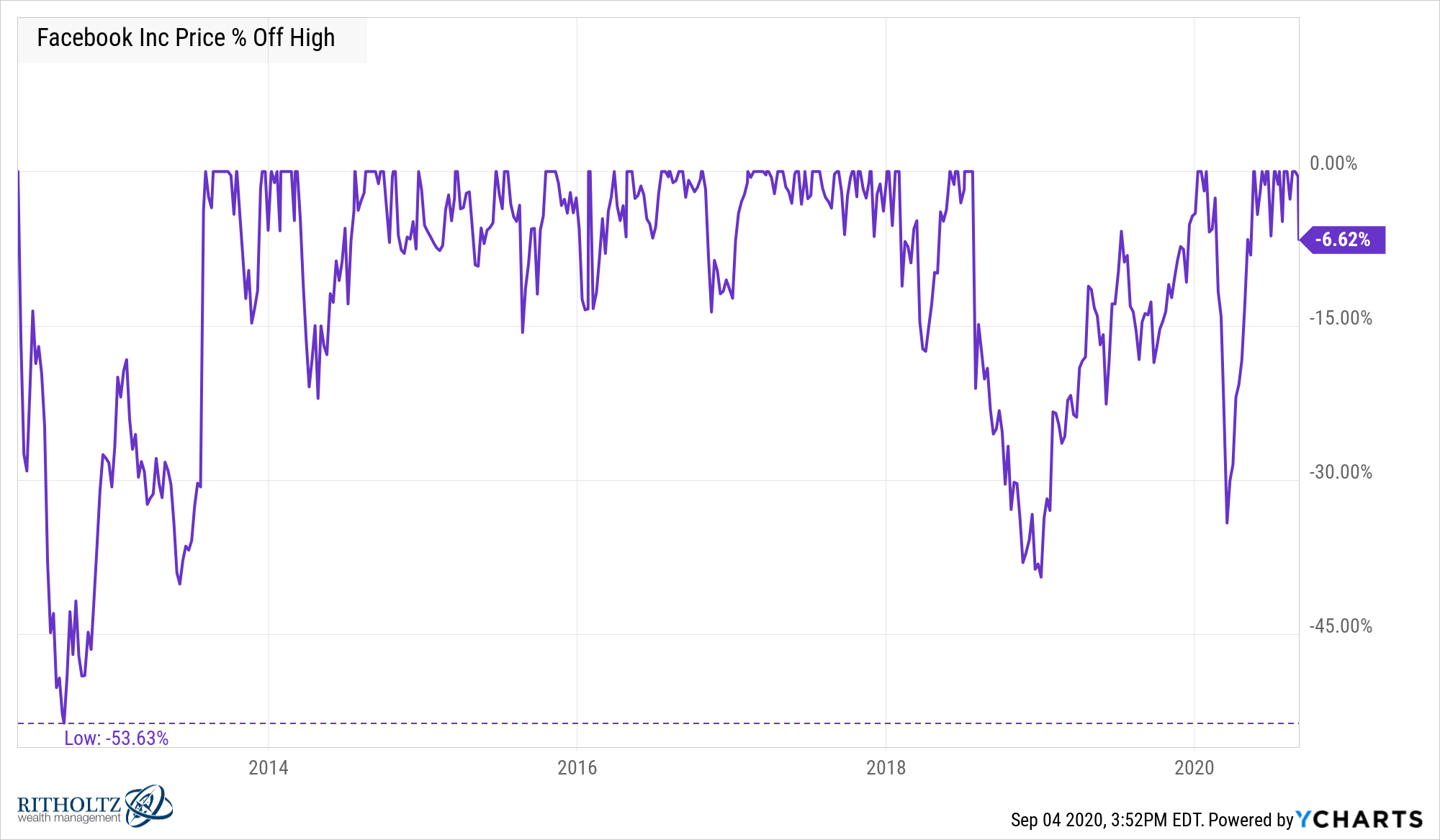

Facebook is up more than 600% (27% annualized) since its IPO in 2012. The stock has endured three separate declines of 30% or more since then including a 53% crash immediately after going public:

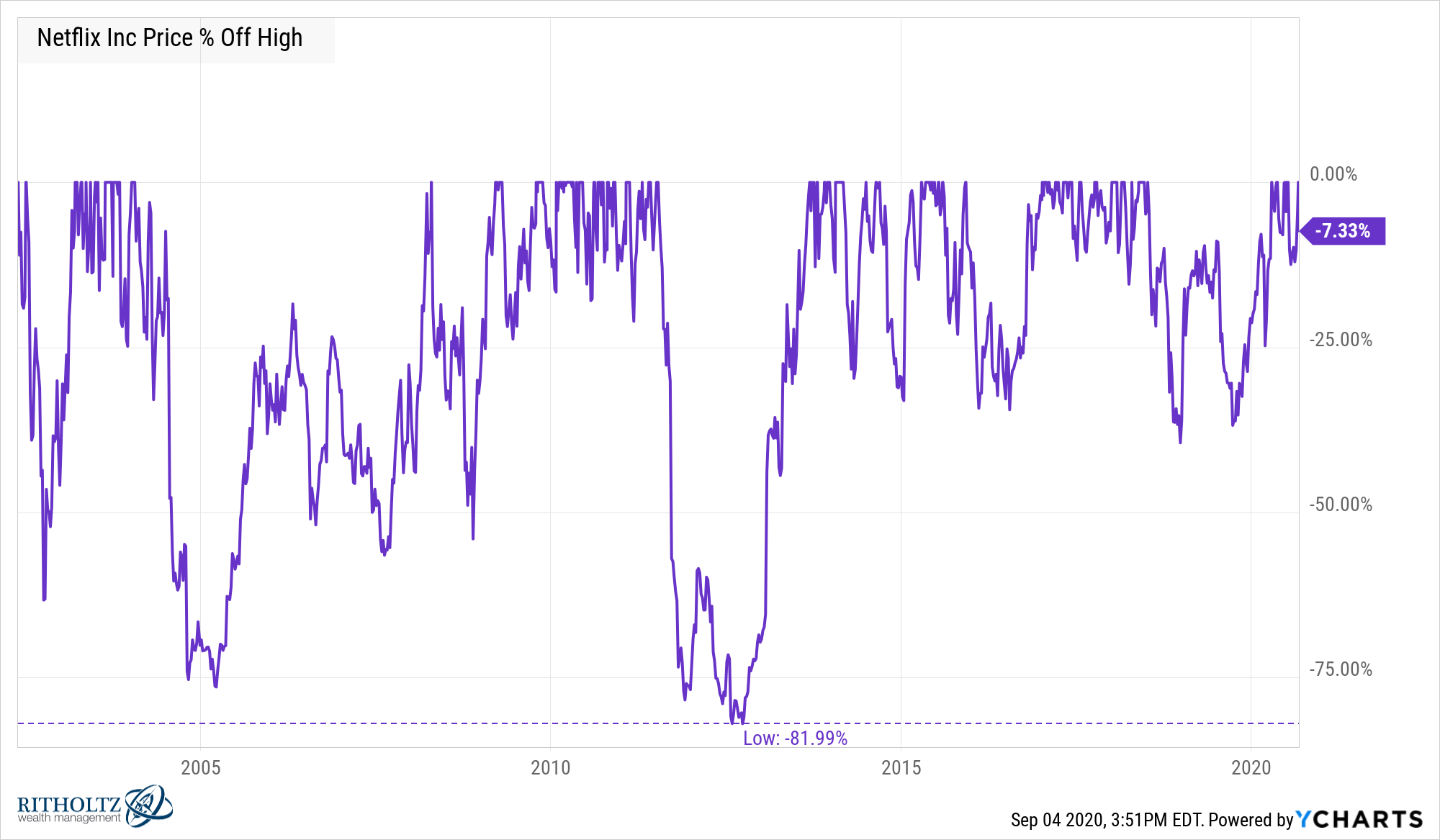

Netflix is up more than 43,000% (39% annualized) since 2002. The stock of the streaming giant has fallen 50% or worse four times including two 75% or worse crashes:

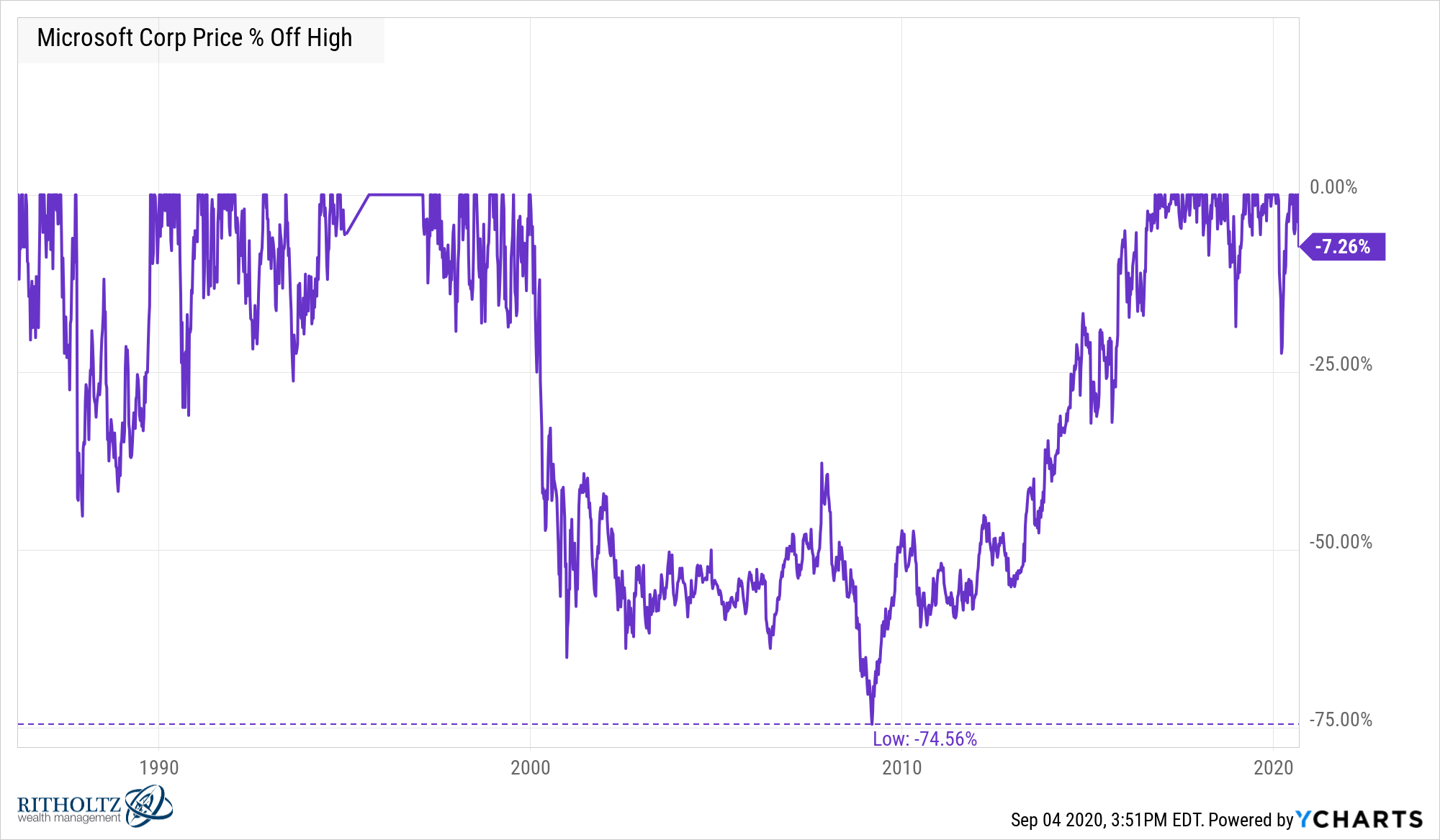

Microsoft is up nearly 350,000% (27% annualized) since the mid-1980s. It was, however, in a drawdown for nearly 15 years following the bursting of the dot-com bubble, which saw a price decline of 75% from peak-to-trough:

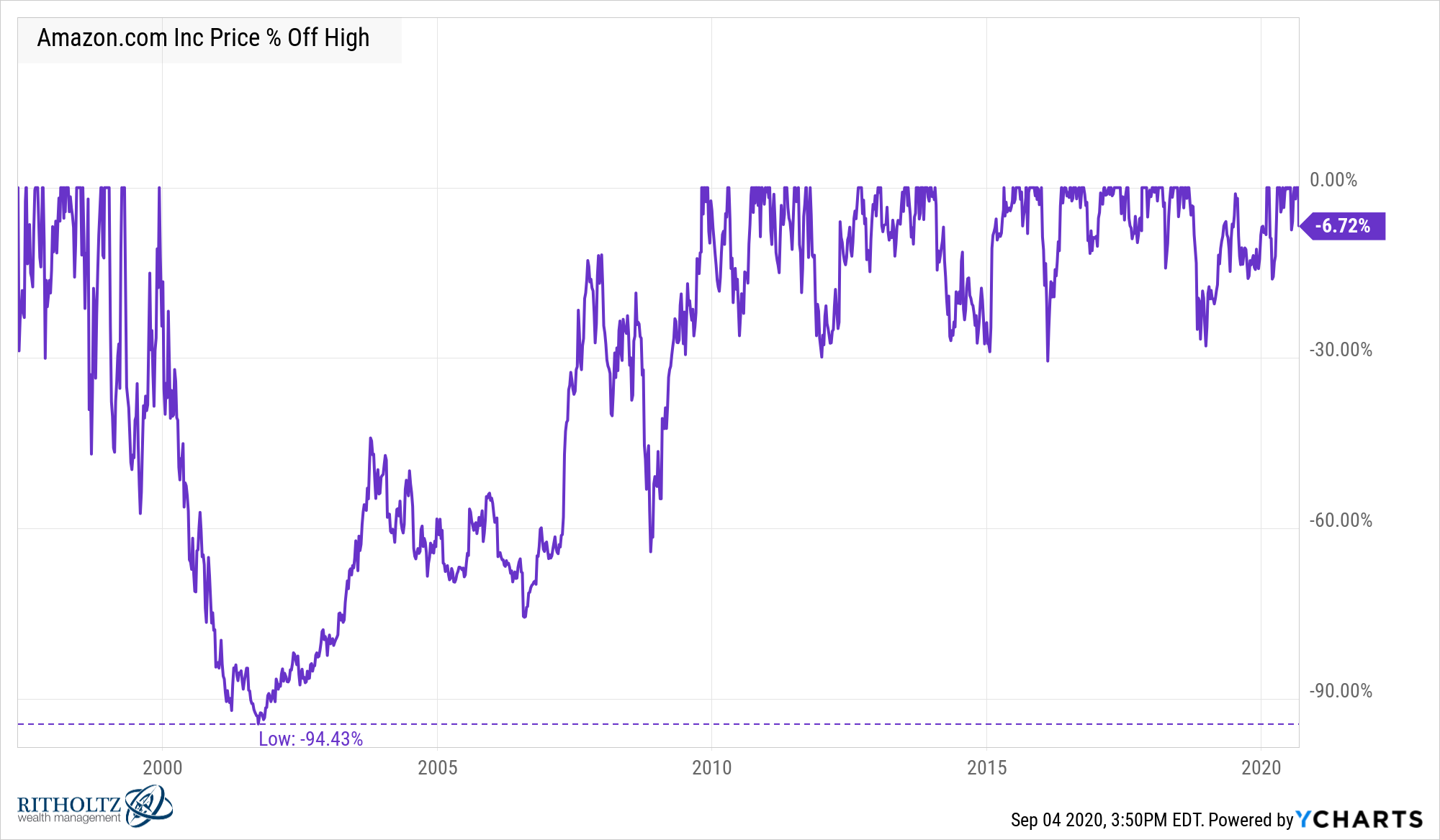

Amazon is everyone’s favorite “If you would have put $10k in at the IPO…” stock for good reason.1 It’s up almost 170,000% (38% annualized) since 1997. The worst crash in the company’s stock was a plunge of almost 95%. There have been multiple 30% slides since then:

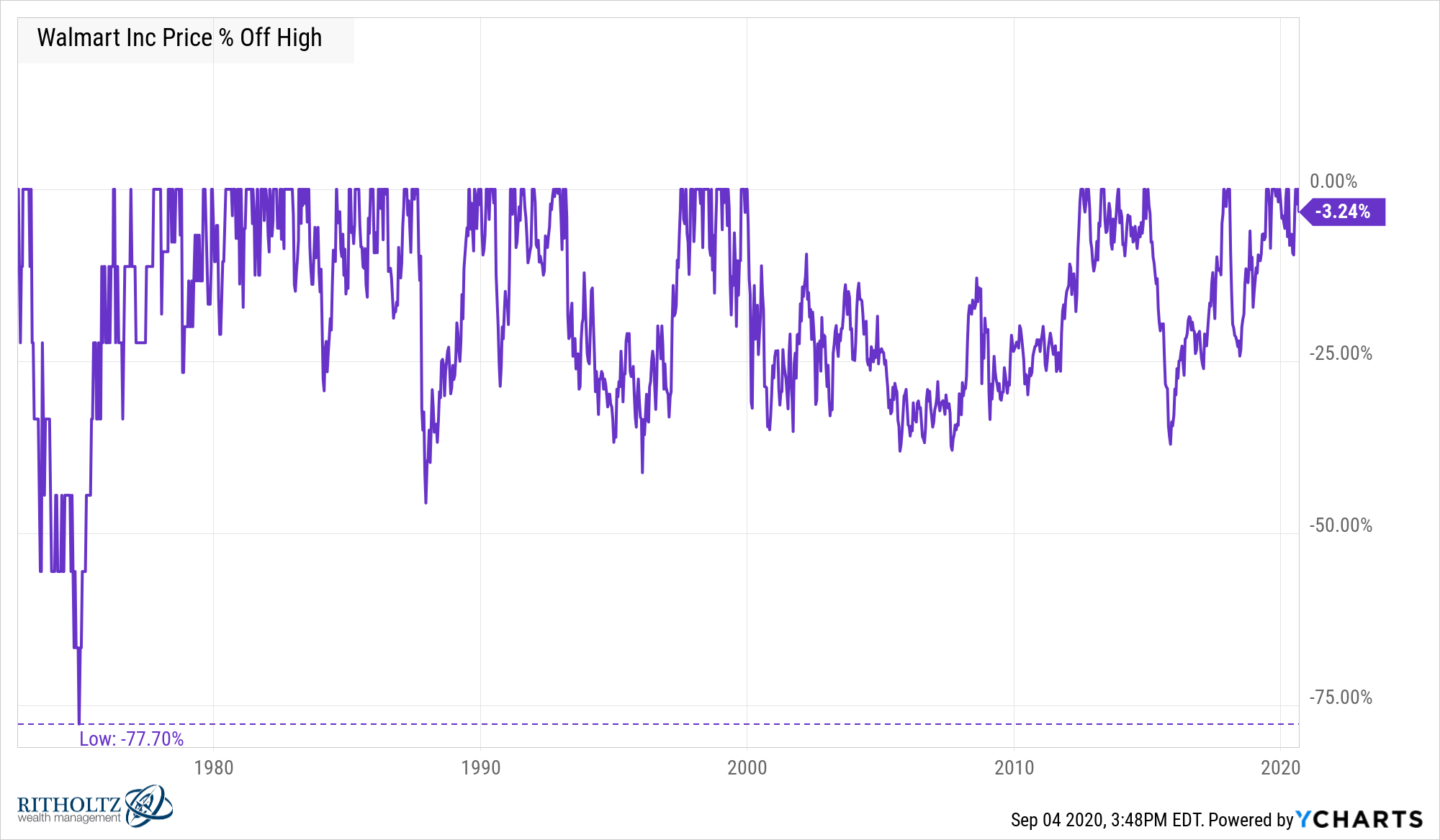

Walmart went public in the early-1970s. In close to five decades its stock is up more than 321,000% (19% annualized). It has eight corrections of 30% or worse in that time along with an underwater run in price from 2000 to 2012:

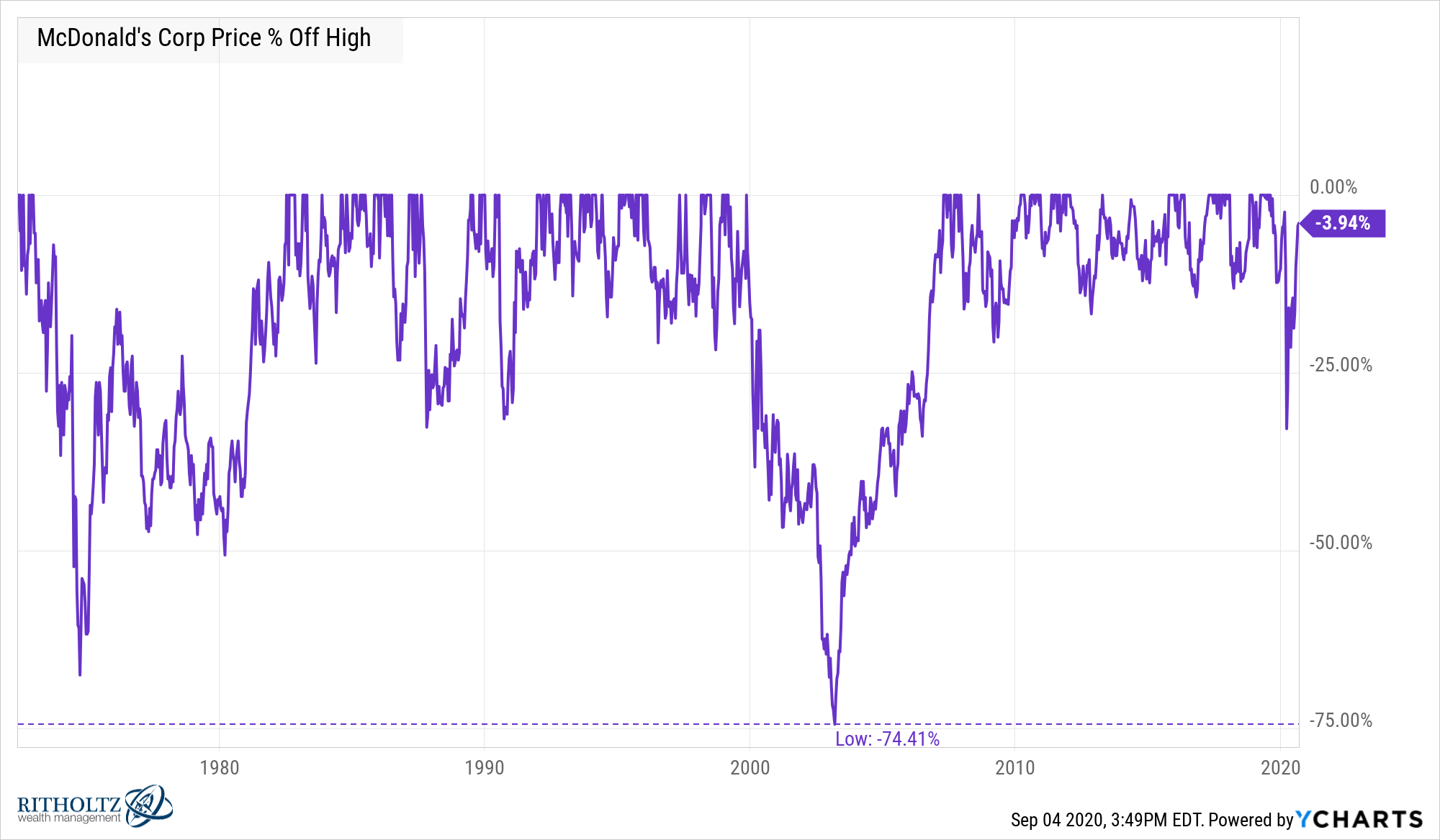

McDonald’s is up 31,000% (13% annualized) since the early-1970s. There have been two crashes in excess of 65% for the golden arches in that time:

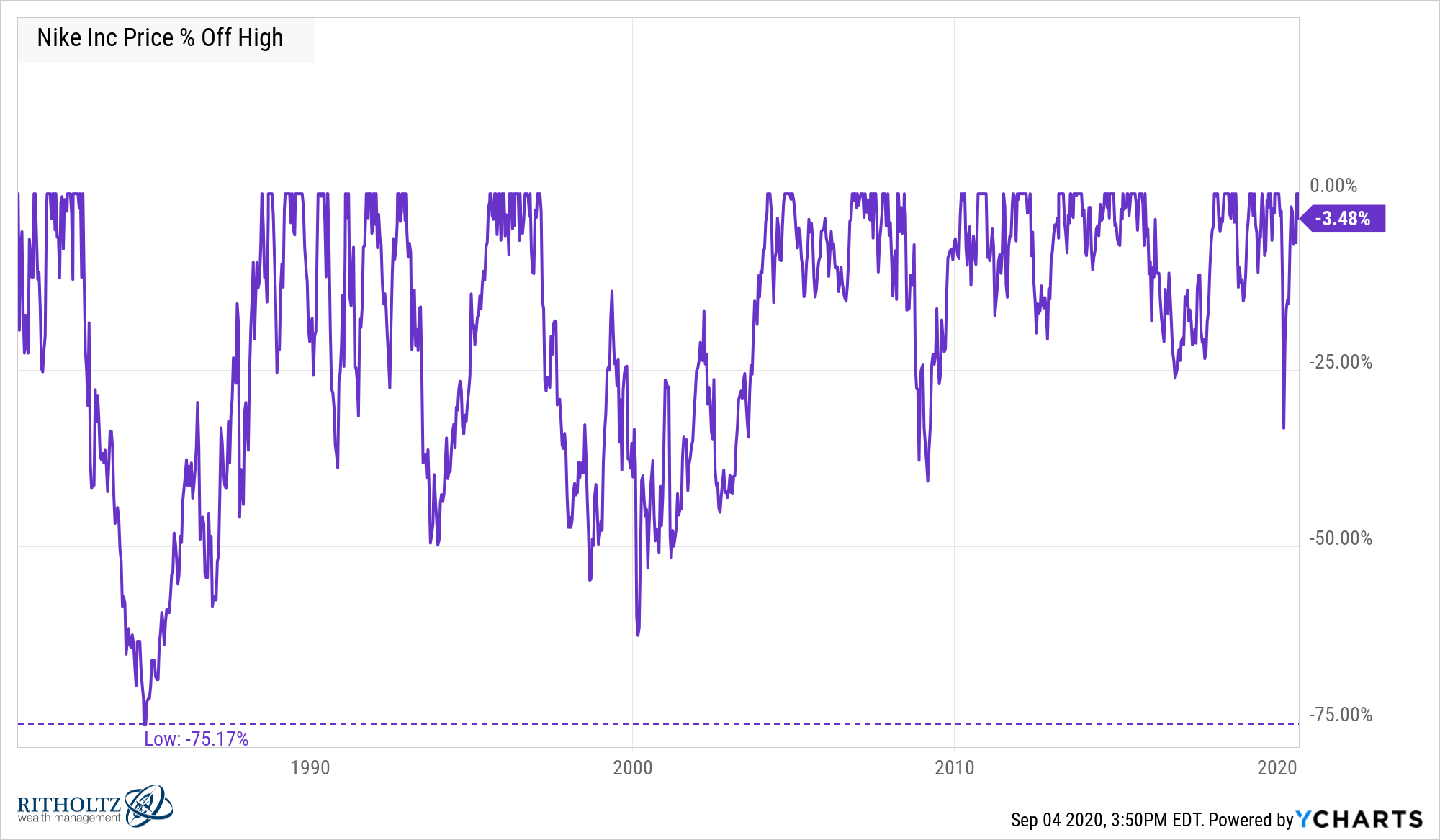

Nike is up almost 100,000% (19% annualized) since the early-1980s. Phil Knight’s brainchild has seen drops of 75%, 62% and 48%:

You get the point.

I don’t know if these work from home or workout from home stocks will end up being as successful as these companies. Probably not, but I suppose anything is possible.

Yet even if these up and coming corporations do become some of the more successful stocks in the world from here on out, they will almost certainly experience one or more enormous crashes to get there.

This is what happens to successful companies and successful stocks.

They have to crash because expectations get out of whack, company leadership has a misstep or an unforeseen event causes a severe disruption to the business.

If you want to earn big returns in the stock market, expect to live with big losses to get there.

Further Reading:

To Win You Have to Be Willing to Lose

1That initial $10k investment would now be worth a cool $17 million.