We discuss:

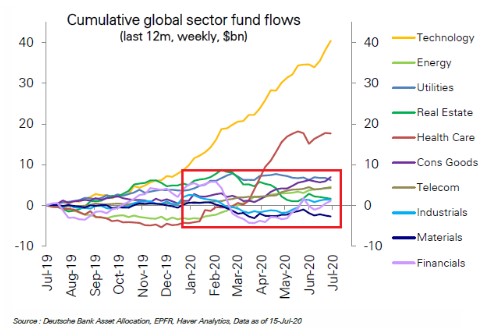

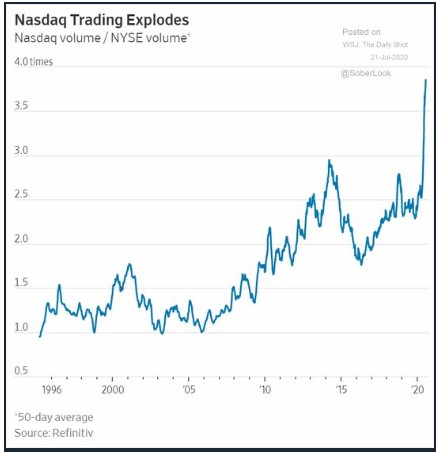

- How is it possible to have a situation that so closely looks like the late-1990s again?

- Is technology speeding up market cycles?

- Everyone has day-trading anecdotes now

- Why the risk of fraud is so high right now

- Why predicting the outcome of all this market gambling is so difficult

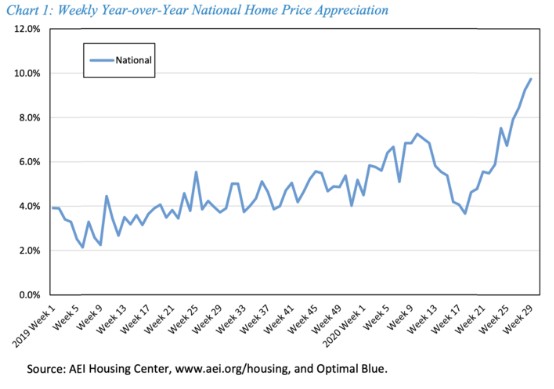

- Residential real estate is red hot; commercial real estate is not

- Millions of Americans have moved during this crisis

- Will WFH kill commercial real estate in big cities?

- How reliant is the economy on fiscal stimulus right now?

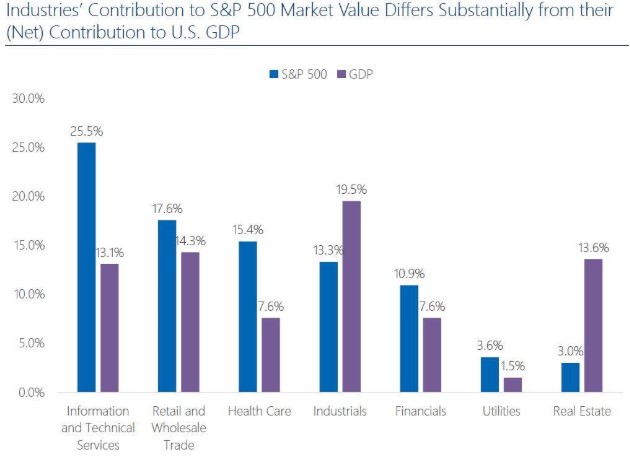

- The stock market vs. the economy

- Are airlines in worse shape than we think?

- Why didn’t free ETFs take off more than they did?

- Are active mutual funds toast?

- Why is gold hitting new highs?

- Tom Hanks talking history and much more

Listen here:

Stories mentioned:

- Why everyone’s trading

- Everyone’s a daytrader now

- U.S. existing home sales rose 21.7% in June

- Millions of Americans have moved during the coronavirus crisis

- The virus turns Manhattan into a ghost town

- 32 million people will lose their unemployment benefits if Congress doesn’t act

- Airlines face the end of business travel as they knew it

- Flowmageddon

- A golden rule from a golden fool

- GLD’s fall from grace

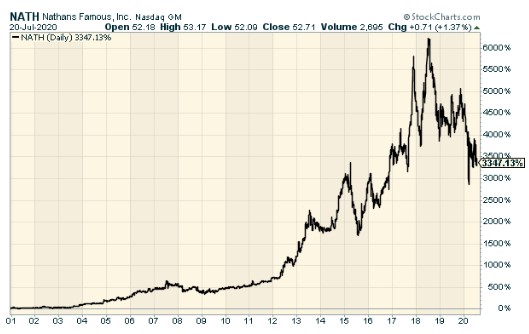

- The home run stocks Wall Street doesn’t know about

- Jim Chanos: “We are in the golden age of fraud”

- Google to keep employees home until Summer 2021

- Warner Brothers postpones Tenet release indefinitely

Books mentioned:

- Against the Gods by Peter Bernstein

- The Four Pillars of Investing by William Bernstein

- How We Got to Now by Steven Johnson

- Go Like Hell by A.J. Baime

Podcasts mentioned:

Charts mentioned:

Facebook group mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on Shuffle.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: