The world of investing can be overwhelming for everyone but especially for young people just starting out.

What accounts should I open?

What kinds of investments should I choose?

Do I pick stocks or mutual funds? And what about ETFs?

What should my asset allocation be?

What should I be reading or listening to for advice?

Where do I even begin?

Michael, Josh, and I filmed a short video to address some of these questions:

As a follow-up to supply some more detail for young investors here are some further thoughts:

Saving habits are more important than portfolio management when you’re young. Everyone wants to be the world’s greatest stockpicker when they first start out but how much you save will have a much larger impact on the size of your portfolio, especially at a young age. Living on less than you earn is one of the few sources of alpha that will never dry up.

You’re going to make mistakes. Even the most seasoned of investors make mistakes with their investments. There’s no shame in making mistakes. In fact, it’s best to get some of your biggest mistakes out of the way when you’re young. That way you can slowly learn what doesn’t work in the market and what doesn’t work for your personality. Developing negative knowledge by figuring out what to avoid pays dividends for years to come.

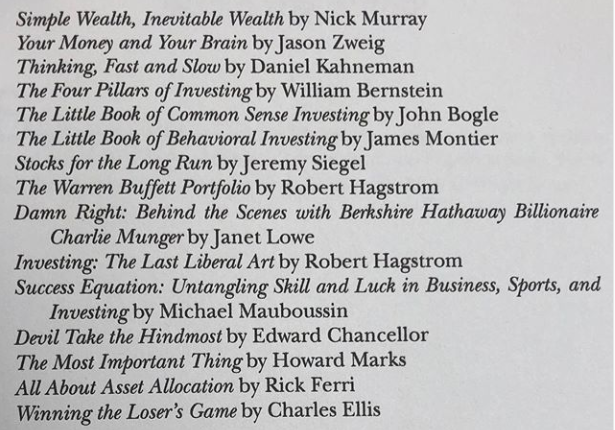

Read, read, read. In the video, I talked about the importance of self-learning when you’re just starting out to find yourself as an investor but didn’t provide specific titles. I get asked this question a lot so here’s the list of books I provided in my own book that helped me learn and grow as an investor:

I will also add one more to this list since it’s free to download on Kindle — If You Can by William Bernstein. This is a great introduction to the world of investing.

Reading books on investing will get you much further than going to your brother-in-law or co-worker for hot stock tips.

The hierarchy of investing accounts. As mentioned in the video, if you’re saving for retirement, always get that 401k match before all else. Even if you have terrible fund choices, that’s still an ROI of 100% for simply making contributions. Plus that money comes out of your paycheck automatically, with deferred tax benefits, so you never even see it hit your checking account.

A Roth IRA comes next because it offers lots of flexibility in terms of where you open it, what you can do with your contributions in an emergency (take them out penalty free), and the tax deferral benefits. Any low-cost fund company will do (and make those contributions automatic so you don’t even have to think about it).

If you still have money left over to save after funding your 401k and Roth IRA, good for you. You’re a better saver than most. Now you move on to a taxable account. I like Robinhood for young people because it’s free, it’s easy, and it allows you to have some fun with your money for those who need to scratch that itch. It’s also a good place to save for some more intermediate-term goals so you’re not tempted to touch your retirement funds.

Just get started. The biggest thing when starting out as an investor is simply getting started. So many young people put it off because “I’ll start saving when I’m ready” or “How could I possibly even think about saving in this economy?!”

Don’t worry if you don’t have it all figured out when you’re getting started. No one does.