Credit cards are the torn Larry David GIF of personal finance:

They offer an interest-free loan if you pay them off every month but they’re one of the biggest destroyers of wealth if you don’t.

They offer some fantastic sign-up bonuses and rewards points when you know which cards to use but they can also hit you with loads of fees if you’re not careful with your usage and payments.

They offer a simple way to track your spending in one place but they also make it easier than ever to buy stuff with the swipe of a card or click of a button.

Credit cards can be your best friend or your worst enemy depending on how they’re used. So it really depends on the user.

Not everyone needs a credit card but they can improve your finances when used responsibly. FICO determines your credit score based on:

- Payment history

- Amount owed

- Length of credit history

- New lines of credit

- Types of credit used

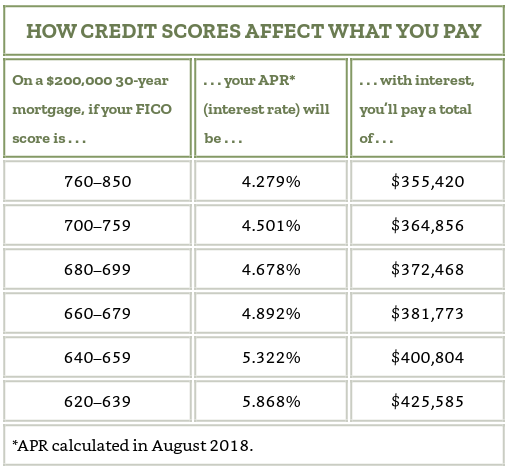

Frequent, responsible use of a credit card from an early age can improve your credit score, which in turn, can lower your borrowing costs. In the updated version of his book I Will Teach You To Be Rich, Ramit Sethi walks through a simple example to show how your credit score could impact your mortgage rate and subsequent payments:

This is why using credit like an adult can be such an important part of your personal finances. It can actually save you money on the big-ticket items that truly matter to your finances. You can cut back on all the lattes you want but it’s never going to come close to the amount of money you could save by lowering the borrowing costs on your home or car loan.

And when you do act like an adult with your credit card usage there are other benefits as well. Ramit talks in his book about the simple act of asking for stuff for being a loyal customer:

Just like with car insurance, you can get great deals on your credit when you’re a responsible customer. In fact, there are lots of tips for people who have very good credit. If you fall in this category, you should call your credit cards and lenders once a year to ask them what advantages you’re eligible for. Often, they can waive fees, extend credit, and give you private promotions that others don’t have access to. Call them up and use this line:

“Hi there. I checked my credit and noticed that I have a 750 credit score, which is pretty good. I’ve been a customer of yours for the last four years, so I’m wondering what special promotions and offers you have for me . . . I’m thinking of fee waivers and special offers that you use for customer retention.”

Last year I was able to get late fees with my credit card and overdraft fees with my bank waived on the spot simply by asking. It was an honest mistake on my part and I’ve been with the same bank/card company for years so when I called up and explained what happened they were more than happy to oblige a loyal customer by refunding the fees that hit my account.

There are also benefits to your credit card that most people don’t even know exist.

When I got a new card a couple months ago I actually flipped through the little book they sent me instead of immediately ripping it up and dumping it in the trash like usual. Beyond the rewards points and such, here’s what I discovered my credit card offers from actually reading the fine print:

Car rental collision damage waiver: Meaning you don’t have to pay car rental agency for this when they hassle you for it at the desk.

Purchase protection: This covers personal property you buy using your credit card in the event of theft, damage or lost goods. The coverage works for the first 120 days after buying something up to $50,000. So there’s no reason to pay for extra protection when buying something at the store or online.

Extended warranty protection: Credit cards will extend the original manufacturer’s warranty by one year for warranties that are three years or less for up to $50,000 per account. So you don’t have to worry about buying an extended warranty on your electronics and such.

Lost luggage: They reimburse you for costs incurred to repair or replace luggage and personal property due to loss or damage on a flight.

Trip delay reimbursement: This covers up to $500 if your trip is delayed for more than 12 hours or requires an unexpected overnight stay. The card company also picks up baggage delay to you and your immediate family to purchase essential items for your trip.

Roadside dispatch: This is a flat fee wherever you travel for towing, getting pulled out of a ditch, tire change, jump start, getting locked out somewhere, or running out of gas.

These perks aren’t the same for every card so do your homework to see what benefits come with your credit card company.

Further Reading:

The First Rule of Personal Finance