“Here is part of the tradeoff with diversification. You must be diversified enough to survive bad times or bad luck so that skill and good process can have the chance to pay off over the long term.” – Joel Greenblatt

For investors that would like to keep things extremely simple, investing in a low cost total stock market index fund is a good option. Assuming you use a total world fund or a combination of a total US and total international fund, you cover all of the bases on the diversification front for your stock investments.

Total market funds typically hold about 75% of their holdings in large cap stocks. As long as you were disciplined and didn’t abandon your investment plan, you could probably do just fine investing in any of these funds.

For those investors that would like to go one step further, by diversifying in small cap, mid cap, large cap, REITs and foreign stocks you can not only increase your returns, but also lower your risk.

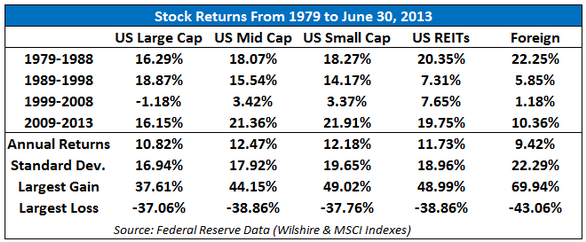

Take a look at the stock returns below that are broken down by different markets to see the historical differences in performance:

Many professional investors define risk as standard deviation or the amount of variation you get around your average returns. A higher standard deviation means there is a wider variation around the average. When professional investors refer to volatility, standard deviation is the chosen measure.

Following the general rule that higher returns come from higher risk, you can see that this mostly holds for these asset classes. Small cap stocks have the highest returns along with the second highest volatility (foreign stocks had some huge returns in the 1980s that seem to skew the standard deviation higher than the other markets).

I don’t subscribe to the fact that volatility is the biggest risk factor for investors. Volatility can actually be extremely beneficial over the long-term for those investors that have the correct perspective on risk.

The biggest risks most investors face are (1) the risk of not achieving your long-term goals and (2) the risk of permanent loss of capital.

Investors that hold an investment for a number of years should be able to ignore volatility in the short-term to gain a long-term edge.

Utilizing diversification along with a systematic rebalancing approach can allow you to use volatility to your advantage over time by consistently buying low and selling high. In turn, this can actually decrease your overall portfolio volatility.

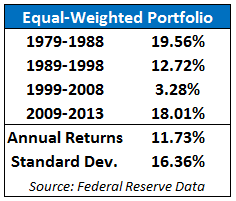

To see this in action, take a look at the results of a portfolio of stocks equally-weighted in each of the five markets from above with an annual rebalancing policy:

By combining markets that perform differently in different years, you can see that you can actually create a portfolio with less volatility than any of the individual markets. For comparison purposes, the returns for the Wilshire 5000 total stock market index over this time frame was 10.86% with a standard deviation of 17.01%. A more balanced approach increased returns and decreased volatility over the total stock index.

How is this possible?

Over the 34.5 year period, out of the five different markets listed in the table above, almost 55% of the time at least one of these markets had a negative year performance-wise. So over half of the years included in this period had at least one market that lost money.

You would think would be bad news for your investments. It’s actually a good thing because it allows you to redeploy capital into those lagging markets. Periods of underperformance eventually lead to periods of outperformance so you can consistently use volatility in your favor by rebalancing to the down markets.

Just for fun, I decided to see how much money an investor would have accumulated by saving $5,500 a year (the current maximum IRA contribution limit) in 1979 and increasing that amount by 3% a year for inflation. The result? Assuming expenses of 0.50% per year, an investor would have ended up with over $2.2 million. Not a bad haul.

Obviously, a portfolio that is invested 100% in stocks is nearly impossible to pull off for most investors because of the difficulty of experiencing periodic large losses, but you can see the positive results of a disciplined long-term plan nonetheless.

I obviously can’t say that returns will look like this going forward, but if you choose to invest in these other markets, make sure you are in it for the long haul and stick to your process. Diversification only works over long time frames. Who knows how things will look over shorter periods.

If you don’t want to invest in multiple funds, a total market index fund is a nice fallback plan for those that would like to keep things simple.

Source:

Federal Reserve Data

[widgets_on_pages]

[…] Wealth of Common Sense told us why diversification works. This is the biggest reason, for me: you can move capital into lagging markets (or stocks) […]

[…] But over very long time frames, the riskier small and mid cap stocks have historically added to performance (see Why Diversification Works). […]

[…] Further Reading: How to beat the market over 20 years Why diversification works […]