A reader asks:

Do you think the S&P 500 top 10 will change in the next 10 years?

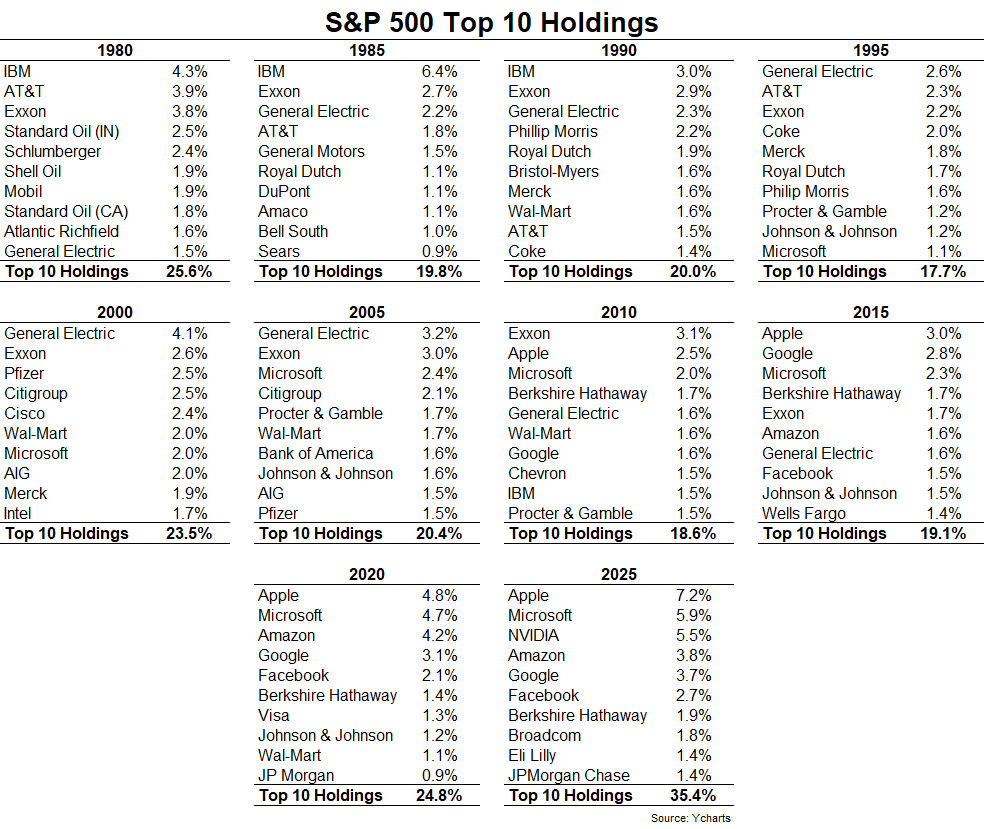

I love this topic. I’ve been been keeping track of the top 10 names for years. Here’s the latest update with the current top 10 in the S&P 500:

A few things stand out from this data.

There are companies that can stay in the top 10 for a very long time.

IBM was in there until 1990. They were at the top of the heap all the way back in the 1960s. Exxon was in the top 10 from 1980 to 2015 before finally dropping out.1

GE was the biggest stock in the world for many years before faltering during the 2008 financial crisis.

Microsoft first made an appearance in 1995 and has more or less been in and around the top 10 every since despite dropping out for a few years after the dot-com bubble burst. Apple has been on a nice run during the most recent cycle.

The other pattern is there is plenty of turnover at the top.

This table covers the top 10 every 5 years going back to 1980 so that’s 100 slots. I count 42 different companies in total. So on average there are roughly four new companies that enter the top 10 every 5 years.

Plus, there are lots of companies that jump in and out in-between these periods. Tesla is not in the top 10 right now but they were just a few months ago before the stock crashed.

In short, yes I think the top 10 will change over the next 10 years. What I don’t know is which stocks will drop off and which stocks will take their place.

Nvidia wasn’t in the top 10 as recently as 2020. It’s now one of the biggest companies in the world. Apple and Microsoft were the only big tech companies in the top 10 back in 2010. Now tech stocks dominate the top slots.

In Stripe’s latest annual letter, the Collison brothers described how innovation is speeding up turnover in the S&P 500:

The US corporate sector is both a cradle of invention and a densely populated graveyard of companies that had fabulous futures in their pasts. Of the 500 companies in the S&P 500 at its inception in 1957, only 53 remain in the index today. (More than half of that remaining 53 use Stripe.)

Back in 1957, companies could expect to remain in the index for 61 years. In 1980, the average tenure was 36 years. Today, it’s just under 20 years. Enduring businesses are increasingly rare.

There is likely an artificial intelligence or robotics company that no one is talking about right now that will find its way into the top 10 names over the next decade. There will also be a surprising company that seems indestructible right now that will underperform and drop off the list.

This is the nature of capitalism and the stock market.

This dynamic is also why studying market history is both helpful but also not always actionable.

You know corrections and bear markets will happen but no one can predict when they will occur. And you know a handful of the current crop of top 10 names will not be there in 5-10 years but no one has any idea which ones it will be.

There will be investors who pick the up-and-coming names but most people will swing and miss.

The simple solution is to own index funds and let the market pick the winners for you.

It’s boring but it works.

I covered this question on the latest edition of Ask the Compound:

Kevin Young joined me on the show to answer a question for a young financial advisor who is dealing with his first correction with nervous clients. We also touched on questions about when to sell Palantir, when to sell a rental house and how to deal with a regional recession in Washington DC.

Further Reading:

Mega Cap World Domination

1Exxon is back in the top 15 now so they might make a return visit.