I like Jesse Livermore quotes because they’re often multi-faceted.

This is one of my favorites:

Another lesson I learned early is that there is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.

I agree with this sentiment. Human nature is the one constant across all market cycles. Even AI won’t change that.

I also know the stock market structure is constantly changing and never the same.

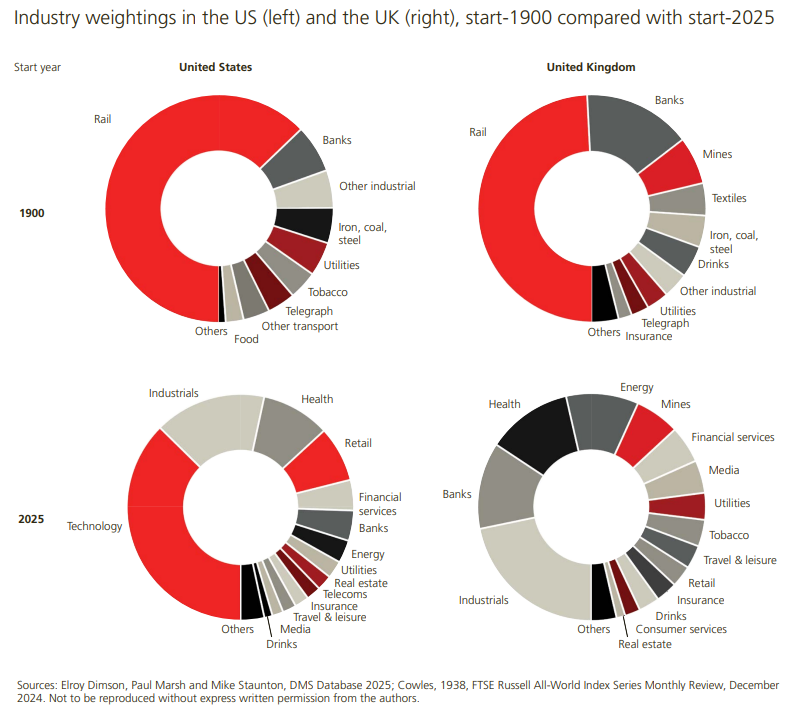

Here’s one of my favorite annual charts from the UBS Global Investment Return Yearbook:

I still remember reading The Intelligent Investor for the first time and wondering why Benjamin Graham kept writing about railroad stocks. Well, it was written in the 1940s and Graham grew up when railroad stocks ruled the day.

That’s not the case anymore. Tech stocks rule the day in America. In the UK, it’s more spread out.

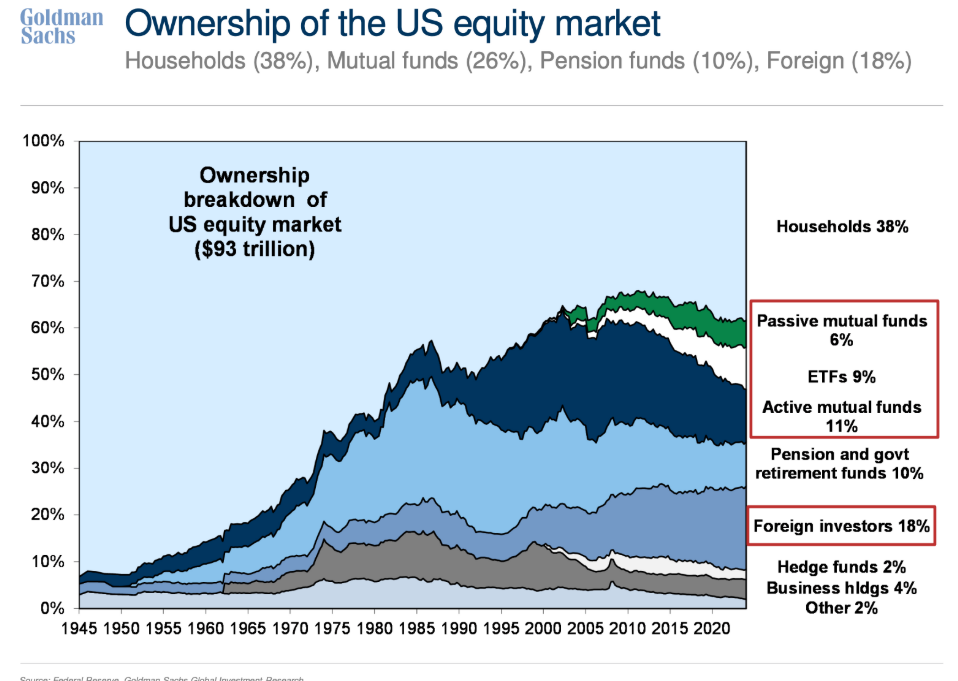

Ownership of the stock market is always changing too. This Goldman Sachs chart is another personal favorite:

Stock market ownership used to be heavily concentrated in the hands of households. That’s not the case anymore.

Households still have the highest ownership percentage but it’s dropped from more than 90% in 1945 to 38% now. The fund industry controls more than one-quarter of the stock market. Foreign investors make up neatly one-fifth of the total.

Obviously, households still own most of the stocks through these other vehicles but there is far more diversification in the ownership structure. I think this is a good thing for the health of the market.

Eggs are in lots of baskets now.

Leadership in the stock market is always changing as well.

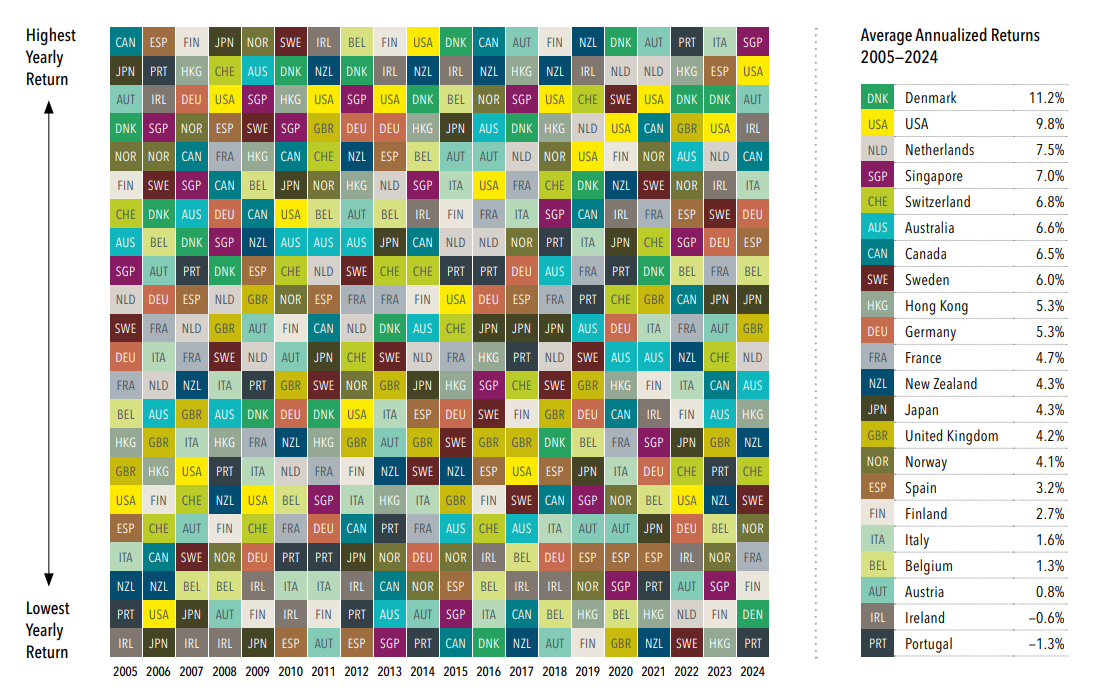

Regular readers of A Wealth of Common Sense know I’m a huge fan of performance quilts. Here’s a great one from DFA that ranks country stock markets over the past 20 years:

Who would have thought Denmark outperformed American stocks over the past 20 years?

But the real takeaway here is how the performance rankings are constantly changing. Can you imagine if you had to guess who the best or worst performer was in a given year?

The global stock market is schizophrenic and I mean that as a compliment.

It wouldn’t make sense if the rankings were the same year in and year out. It wouldn’t be much fun either.

The stock market has to change all the time.

Otherwise it wouldn’t offer investors a risk premium.

Further Reading:

Timeless Wisdom From Jesse Livermore