Today’s Animal Spirits is brought to you by KraneShares and Fabric:

See here for more on KraneShares AI and Tech ETF

Go to meetfabric.com/spirits for more information on life insurance from Fabric by Gerber Life

Get a random Animal Spirits chart here

See here for more information on Exhibit A

On today’s show, we discuss:

- Get How Not to Invest Here

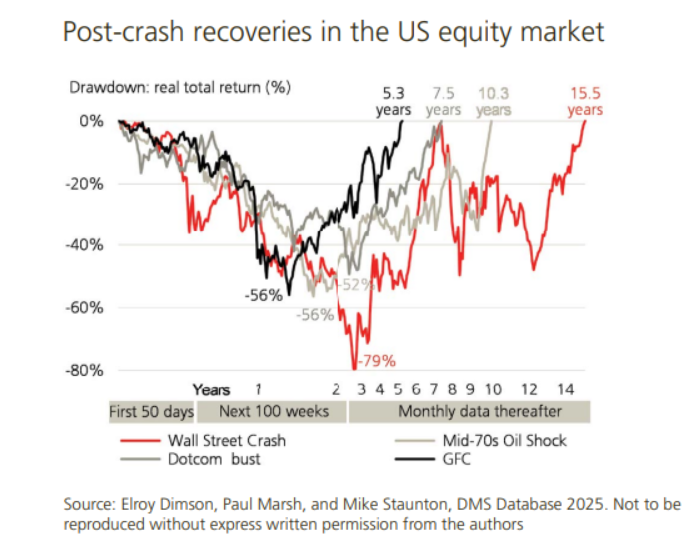

- UBS Global Investment Returns Yearbook 2025

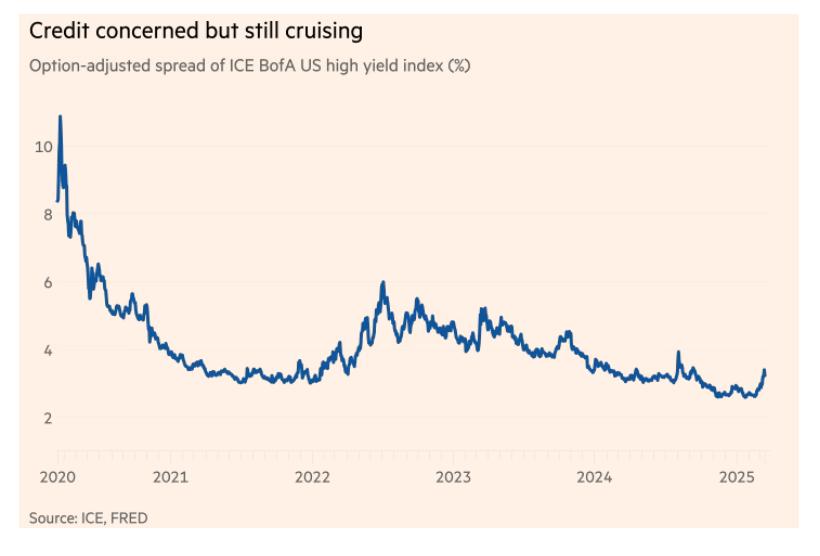

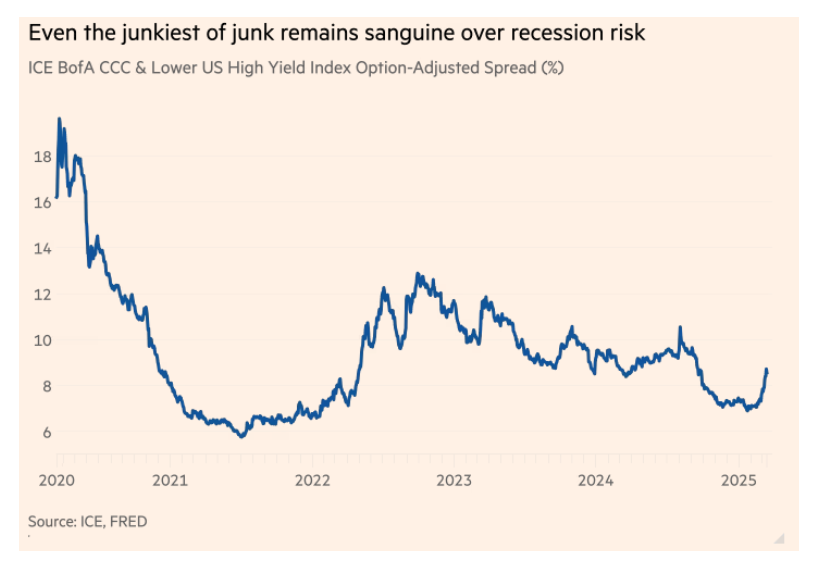

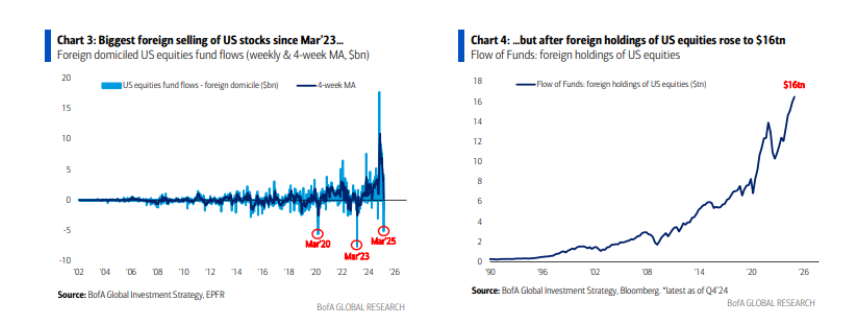

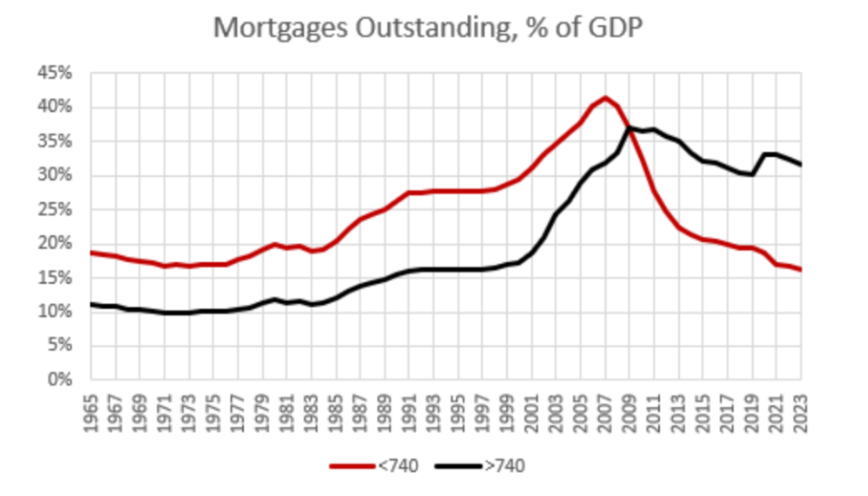

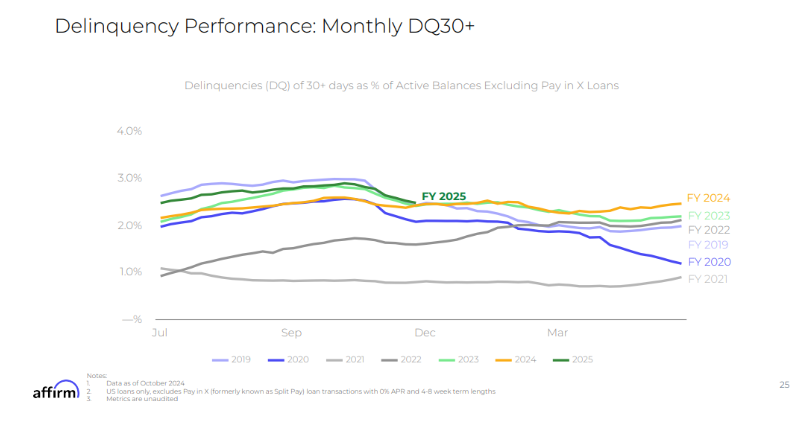

- Is credit cruising for a bruising?

- Private Credit Firms Are Pushing Boundaries to Win Large Deals

- Can the dollar remain king of currencies?

- eToro Announces Public Filing of Registration Statement for Proposed Initial Public Offering

- Ticket reseller StubHub files for an IPO

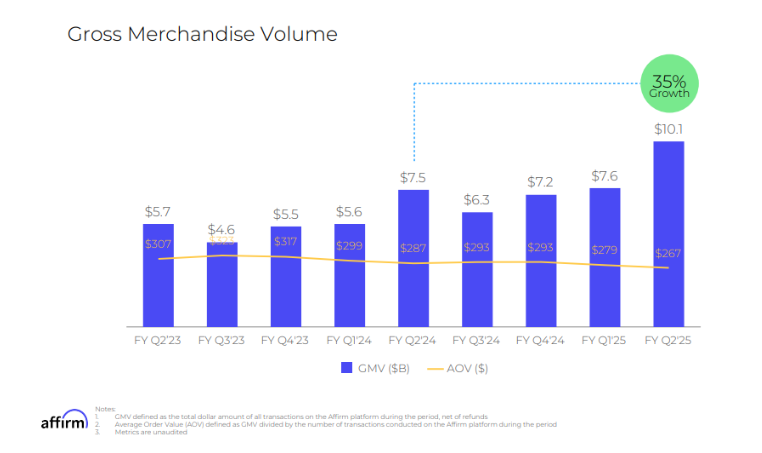

- Klarna lands buy now, pay later deal with DoorDash, notching another win ahead of IPO

- Klarna Chameleon

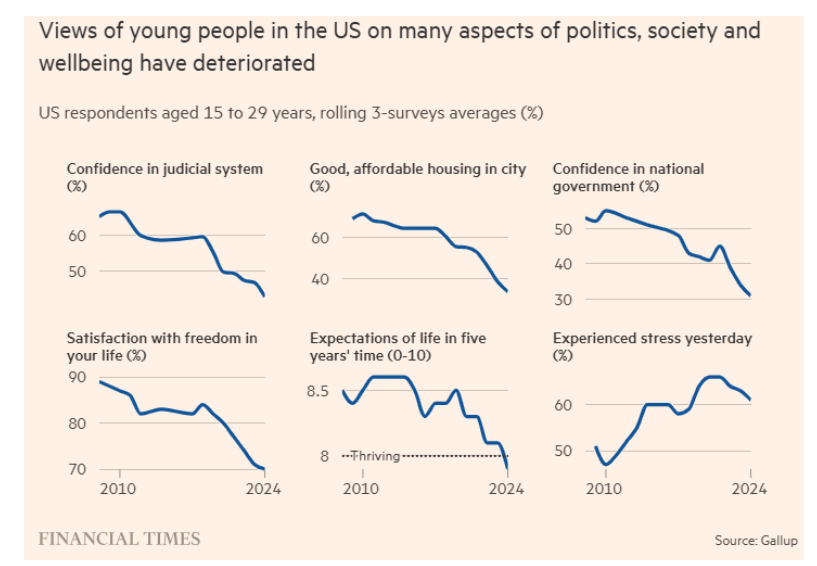

- Young Americans lose trust in the state

- Box Office: ‘Alto Knights’ Bombs as ‘Magazine Dreams’ Nabs Just $700K

Listen here

Recommendations:

Charts:

Tweets/Bluesky:

A cold email one year ago changed my life.

Without it, Exhibit A wouldn’t exist. Here’s our story:Around this time last year, @michaelbatnick, @Downtown, @Ritholtz, @awealthofcs, and @krisvenne gave me the opportunity to enhance @TheCompoundNews and @RitholtzWealth's chart…

— Matt Cerminaro (@mattcerminaro) March 20, 2025

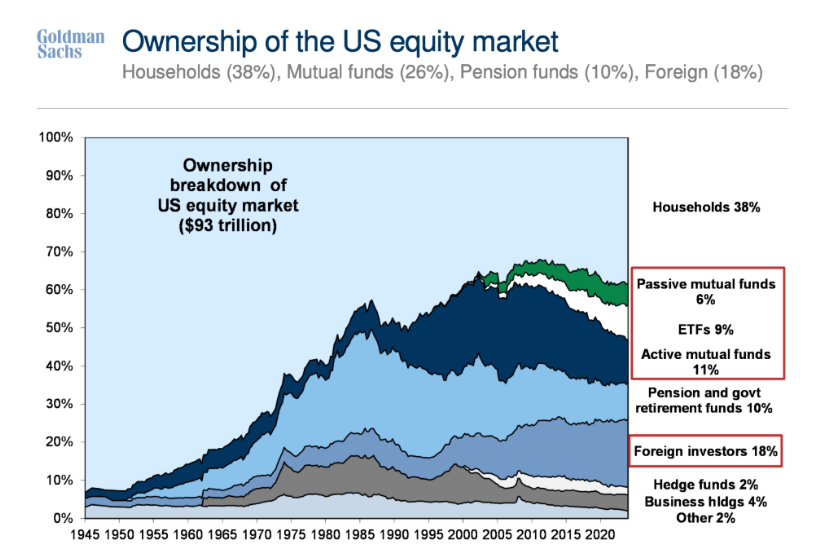

American households have never been more exposed to the risk of a stock market selloff. At the end of last year, they held $38 trillion in listed equities. Stock wealth now runs to 170% of disposable income, more than double the long-term average pic.twitter.com/ueNhsWpplD

— Mike Bird (@Birdyword) March 19, 2025

US households own stocks.

UK, Euro Area not so much. pic.twitter.com/4jwmE0hlm7— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) March 19, 2025

19 stocks in the Russell 1,000 have been "100-baggers" over the last 25 years (since the 3/24/00 Dot Com peak).

Monster Beverage $MNST is the only 1,000-bagger.

It's far from all Tech. Apple $AAPL sits between a farm supply retailer $TSCO and an auto parts retailer $ORLY. pic.twitter.com/hbJd1dwQhu

— Bespoke (@bespokeinvest) March 24, 2025

New hot sauce flavor just dropped: VistaShares with a filing for a Animal Spirits ETF (ANIM) and a 2x Animal Spirits ETF (WILD) which will hold the five fastest-growing 2x single stock ETFs. pic.twitter.com/CeRuq1YDgS

— Eric Balchunas (@EricBalchunas) March 18, 2025

Here's the average intraday path of the S&P on Fed Days by Fed Chair. If the trading day ended at 2:45 PM ET, Powell would be the 2nd best in history. But it doesn't… pic.twitter.com/TnP9XjeEmr

— Bespoke (@bespokeinvest) March 19, 2025

Homebuilder incentives are one of the tougher historical data sets to track consistently. Here’s what Lennar $LEN (the second biggest builder in America) has publicly reported on this metric since 2009.

For the most recent quarter through February, incentives hit 13%. pic.twitter.com/RIMFx8oQ55

— Rick Palacios Jr. (@RickPalaciosJr) March 23, 2025

what do you mean you have $11k in "doordash debt" pic.twitter.com/pu1h8GqdZg

— adam 🇺🇸 (@personofswag) March 20, 2025

We are selling pad thai in installments to willing buyers at the current fair market price https://t.co/9cA6hQDbYg pic.twitter.com/p2fZU419G7

— Axial Wanderer (@EricWollberg) March 20, 2025

"They're called Chimichanga Default Swaps" pic.twitter.com/uXNu85dSJw

— 𝐄𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐇𝐲𝐩𝐞 (@EffMktHype) March 21, 2025

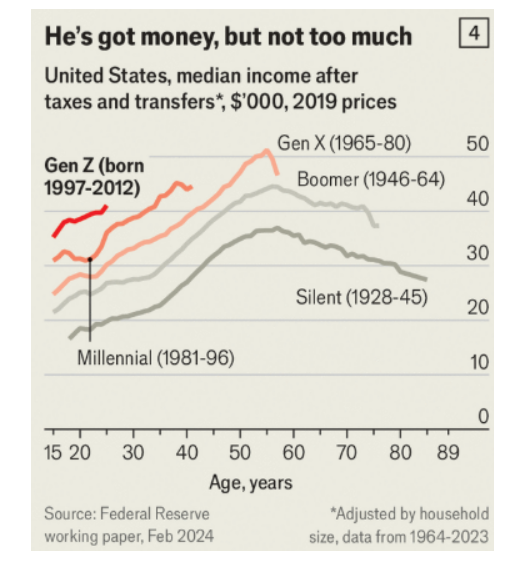

The middle class is shrinking because many people are getting too rich to remain middle class pic.twitter.com/dEK9ArL2nv

— Chris Freiman (@cafreiman) March 23, 2025

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product