It’s estimated baby boomers will pass down more than $80 trillion to their millennial and Gen X heirs over the next 20 years.

This is going to be the greatest wealth transfer the world has ever seen.

The timing of these transfers will be a hotly debated topic for many families.

Baby boomers were born between 1946 and 1964, making them in the range of 60-78 years old. Let’s assume that puts the ages of their children somewhere in the range of 30-50.

The average life expectancy for someone in the 60-78 age range is somewhere in the neighborhood of 83 to 90.1

That would mean most children receiving an inheritance will do so sometime in their 60s. Obviously, not everyone will be in the fortunate position of receiving an inheritance. If you are in that position, count yourself lucky.

However, some young people will prefer to get the money sooner rather than later, when they have more responsibilities.

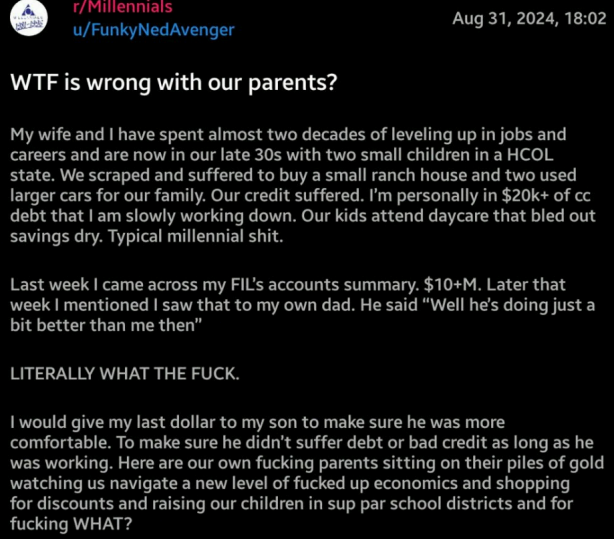

Here’s one such example from a Reddit post:

This guy is NOT happy. His parents and in-laws have millions of dollars. He’s struggling financially and would like to tap into that inheritance early.

Look, I don’t know all the details here. Maybe the parents are blind. Or maybe this guy is bad with his finances and they’re trying to teach him a lesson.

Whoever you side with on this kind of thing, this story makes it clear there are some generational differences in how baby boomers and millennials view family money.

I would like to share some thoughts on these generational differences.

These are overgeneralizations that don’t include everyone from these groups but this is what I’ve observed through my experiences with family, friends, peers, clients and readers when it comes to money differences between baby boomers and millennials:

Baby boomers. The parents of baby boomers didn’t have nearly as much money. Retirement was still a relatively new concept for the Greatest Generation. Many of them died in their 60s or 70s because they smoked and didn’t have the same healthcare resources we have today.

The Greatest Generation lived through the Great Depression. There were no handouts. They taught hard work and the value of a dollar. Although baby boomers eventually became consumers, scarcity was the mindset drilled into them by their parents.

No one really talked about money in family circles, and most baby boomers probably didn’t get much help from their parents.

To be fair to today’s young people, the cost of housing, childcare, and education was much lower back then, so people didn’t need as much help from their parents.

If there was any family money, the inheritance came when the parents passed away. I think older generations view inheritance as something that occurs after you die because that’s how it’s always been.

Millennials. Young people face higher costs than prior generations in many ways, but we also lead more extravagant lifestyles.

Millennials spend way more money than baby boomers at the same age. We drive nicer vehicles and desire bigger, more opulent houses (I blame HGTV). We travel more than our parents did. How many people did you know growing up who took family vacations to Europe? Now, it seems like everyone does it. We also shell out more money for better technology that makes our lives easier. We pay up for convenience.

Millennials spend way more on their kids.

Daycare is the big one, of course. But there’s also travel sports which is not cheap. Kids wear much higher-quality clothing. I never had a pair of Jordans growing up. Now it seems like every kid has multiple pairs. Parents don’t drive a station wagon or minivan anymore. Now it’s an $80,000 SUV even though we have fewer kids than previous generations.2

Both generations have a point.

It is more expensive for young people these days but some of those higher costs come from the fact that we’ve turned luxuries into necessities.

Baby boomers might have had it easier in some ways, but they had their own problems to deal with and didn’t have the same lifestyle we’re accustomed to today.

My only solution here is for families to talk about money more often. If you need help with your finances, you should ask for help. Your parents aren’t mindreaders.

If there is an inheritance somewhere down the line, baby boomers should talk with their children about it. Tell them your plans. Be transparent.

Better communication is the best way to avoid an angry Reddit post by a family member.

Michael and I talked about the generational push and pull between millennials and baby boomers and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Millennials Are Becoming Boomers

Now here’s what I’ve been reading lately:

- Why taxes usually don’t cause people to go broke (Oblivious Investor)

- House-hunting right now is painful (Money with Katie)

- Higher incomes with lower stability (Of Dollars & Data)

- Modest millionaires (The Best Interest)

- Money secrets (Sherwood News)

Books:

1The life expectancy for a 78 year old woman is roughly 90. For a 78 year old man it’s 88. For a 60 year old its 85 and 83, respectively.

2I’m always shocked to see the vehicles teens drive in our area these days. None of my friends had nice cars when we were in high school. Today these kids drive luxury SUVs. It’s insane. Get off my lawn please.