Today’s Animal Spirits is brought to you by Global X and KraneShares:

See here to learn more about Global X’s suite of ETFs

See here and here for more info on KWEB and China Last Night

Subscribe to the Unlock here and here

On today’s show, we discuss:

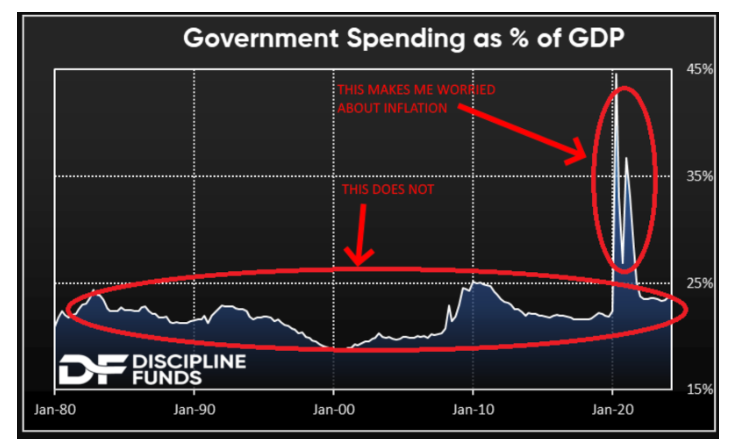

- We Need to Have a Talk About “Bond Vigilantes”

- Paul Tudor Jones says market reckoning on spending is coming after election: ‘We are going to be broke’

- Here are the highlights from the Paul Tudor Jones interview with Goldman Sachs

- Generational Theft Needs to Be Arrested

- Giverny Capital Asset Management Q3 Update

- ‘Americans just work harder’ than Europeans, says CEO of Norway’s $1.6 trillion oil fund, because they have a higher ‘general level of ambition’

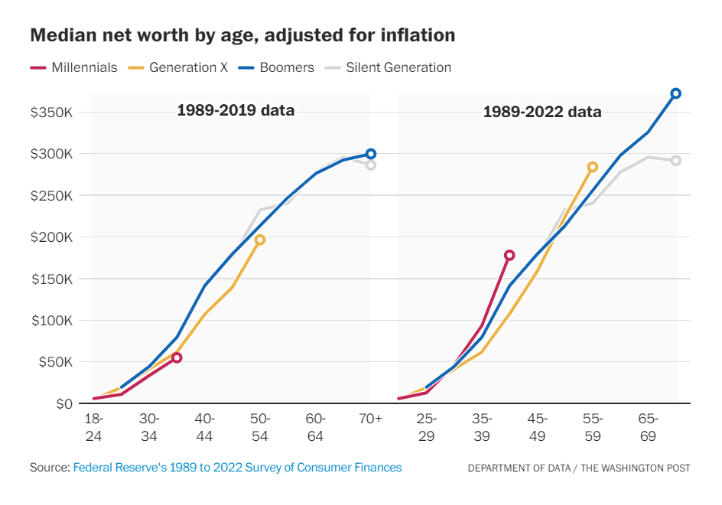

- The Bottom 50%

- A $12 Trillion Opportunity for Financial Advisors

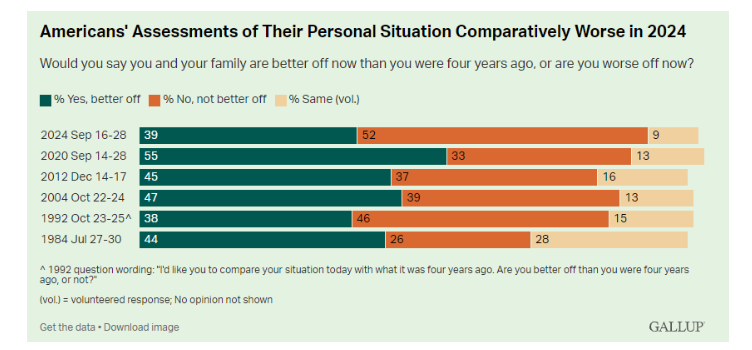

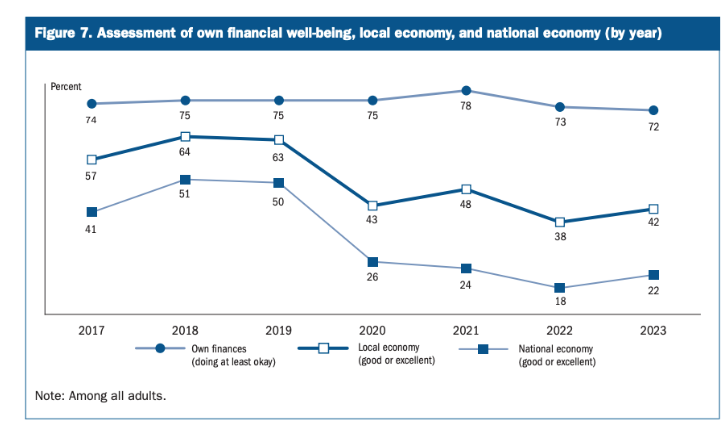

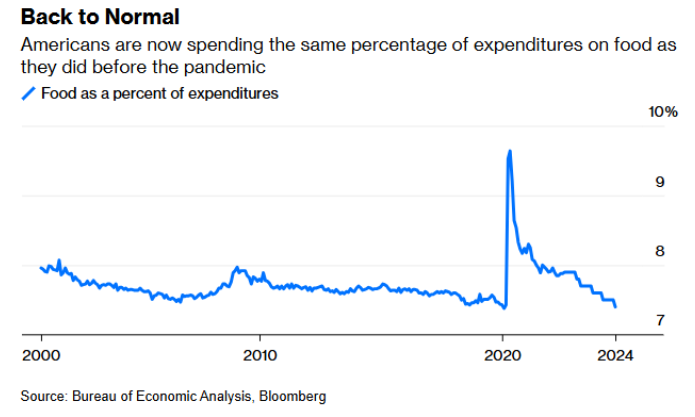

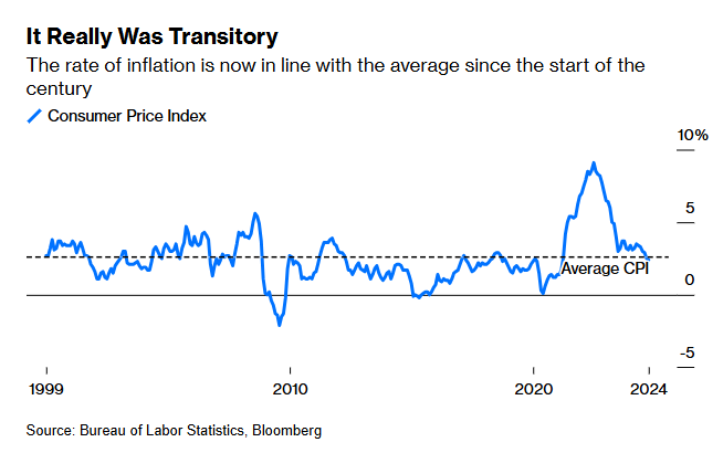

- Data shows disconnect between Americans’ perceived financial strain and reality

- Majority of Americans Feel Worse Off Than Four Years Ago

- Economic Well-Being of U.S. Households in 2023

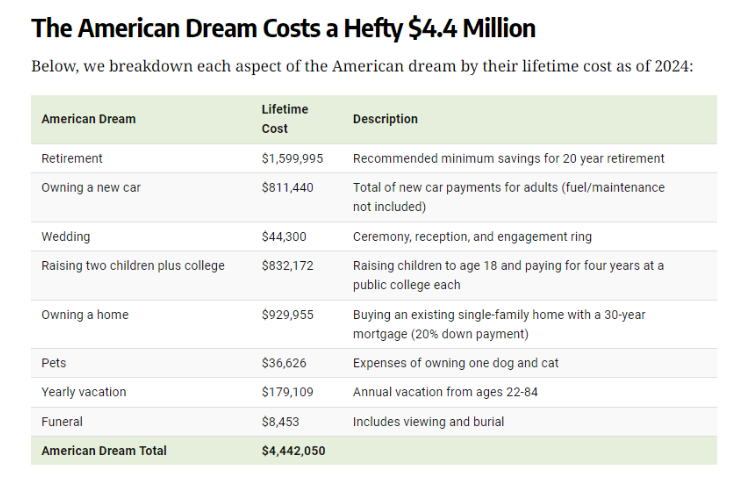

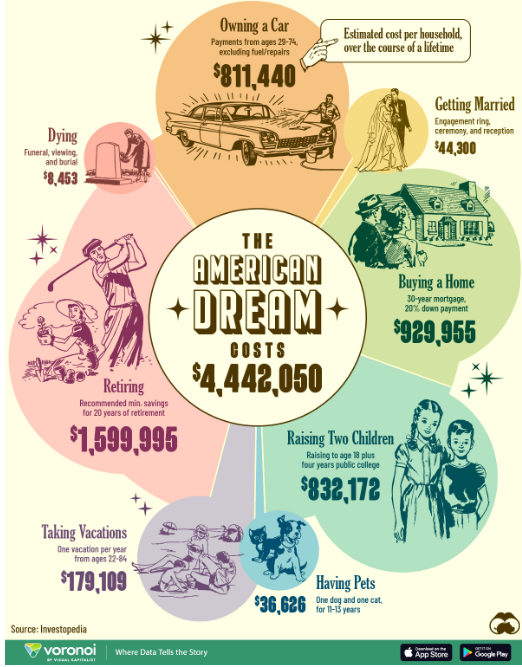

- Visualizing the Cost of the American Dream in 2024

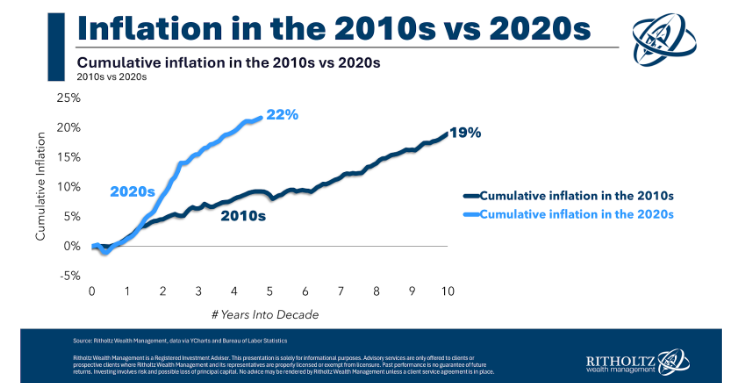

- Inflation Has Cooled, but Americans Are Still Seething Over Prices

- The Porterhouse at Weis Points to Inflation’s Demise

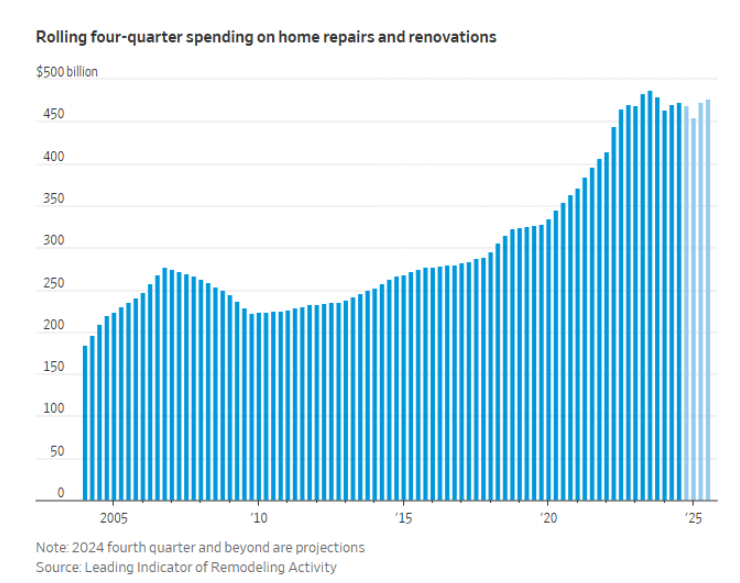

- America Is Primed for a Home-Renovation Resurgence

Listen here:

Recommendations:

Charts:

Tweets:

https://t.co/ftlPiSdrb4 pic.twitter.com/pmOehGfPcX

— Bill (@wabuffo) October 22, 2024

BONDS

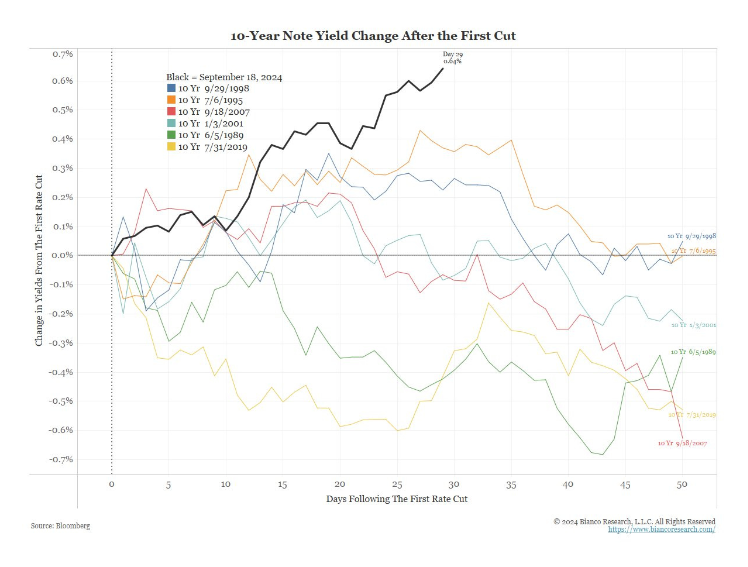

Many are misinterpreting recent price action. The move (from 3.6 to 4.25) in the 10-yr (post-Fed cut) does not signal a policy mistake.

Instead, it is the unwind of "recession insurance" buyers.

Conclusions from the 9/19 @3F_Research report below: pic.twitter.com/24O6aGTg9v

— Warren Pies (@WarrenPies) October 23, 2024

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.