When Ted Benna discovered a change in the tax code that would allow employees and employers to make tax-deferred retirement contributions in the late-1970s, it would change the retirement industry in immeasurable ways.

The automatic investing revolution has surely impacted the stock market with the advent of regular automatic contributions, rebalancing and a one-stop shop for broad diversification (targetdate funds).

Defined contribution retirement plans have also provided ample ammunition for financial advisors. In a defined benefit world of pension plans, there’s not as much need for financial advice on retirement planning.

But when everyone is on their own when it comes to retirement, it’s a whole new world.

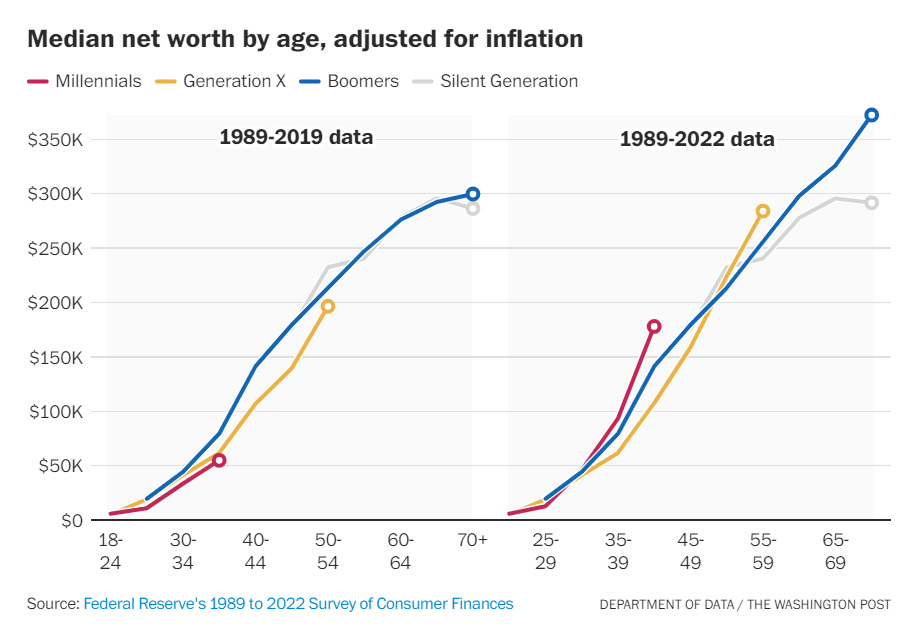

The Washington Post recently looked at wealth by generation at the same age over time:

A few things stand out from these charts:

- There was a huge surge in wealth between 2019 and 2022.

- Millennials and Gen X are now ahead of Baby Boomers and the Silent Generation at the same age.

- Whereas the Silent generation saw their wealth stagnate in their 60s, Baby Boomer wealth is accelerating as they age.

There are extenuating circumstances in any comparison like this, but Baby Boomers are worth nearly $80 trillion. Ten thousand members of this generation will retire every day between now and the end of this decade.

Retirement is a scary proposition for many because of all the uncertainties involved in the process.

In a 2022 earnings call, former Morgan Stanley CEO James Gorman stated, “In a decade, we’ll look back at this firm and say that our workplace business was the most significant strategy change. I truly believe that the retirement space is the next frontier.”

Morgan Stanley manages something like $1.5 trillion of assets in their wealth management division. And their big focus is on boring old retirement plans. Why?

There is now $12 trillion1 tied up in defined contribution retirement plans (401k, 403b, 457, etc.).

A good chunk of this money will be moving and in need of financial advice in the years ahead. In 2023 alone, there was $765 billion in IRA rollovers from these plans.

That money needs financial planning, investment management, tax planning, estate planning, retirement withdrawal strategies and more.

Defined contribution retirement plans are an enormous opportunity for financial advisors and it’s not just those in or approaching retirement age.

If you’re an advisor, you can’t just expect to find these clients when it’s time to get that gold watch.2 By the time the rollovers begin, most of that money is already spoken for.

You have to plant the seed early if you hope to advise on defined contribution retirement assets from the HENRYs of the world who are slowly but surely building wealth over the long haul.

I talked to Shawn O’Brien, Director of Retirement at Cerulli Associates, about the massive opportunities defined contribution retirement plans provide for financial advisors on The Unlock:

We’re ramping up content for financial advisors at The Unlock. If you’re a financial advisor, subscribe to The Unlock here. We’re doing deep dives into best practices, industry research, wealth tech, and growth insights that we’ve never shared anywhere else.

We’ve got a lot of great stuff coming so you don’t want to miss out.

Further Reading:

The Automatic Investing Revolution

1There is another $13 trillion in IRA assets.

2Is that still a thing when people retire?