Today’s Animal Spirits is brought to you by Eaton Vance:

See here for more information on Eaton Vance’s suite of ETFs

On today’s show, we discuss:

- Tropical Bros Animal Spirits collection

- Seinfeld: “Breaking up is like knocking over a Coke machine”

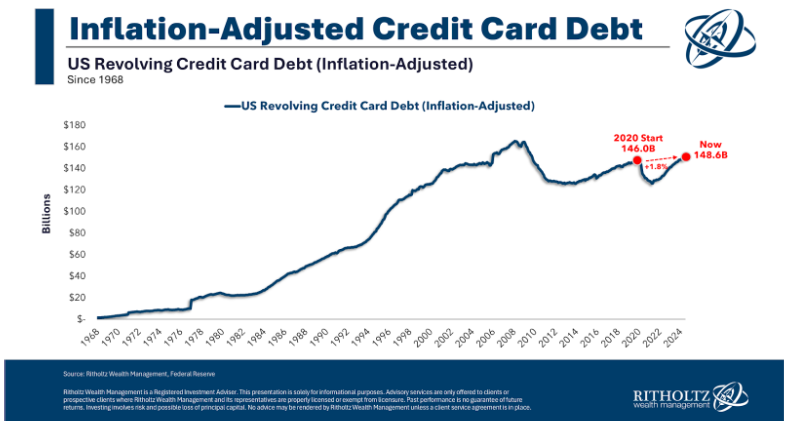

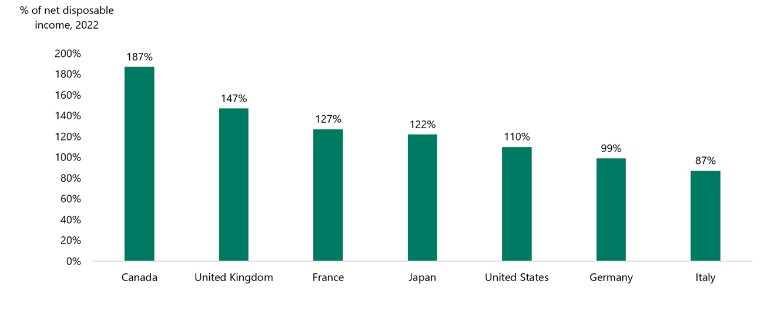

- Household Debt to Income

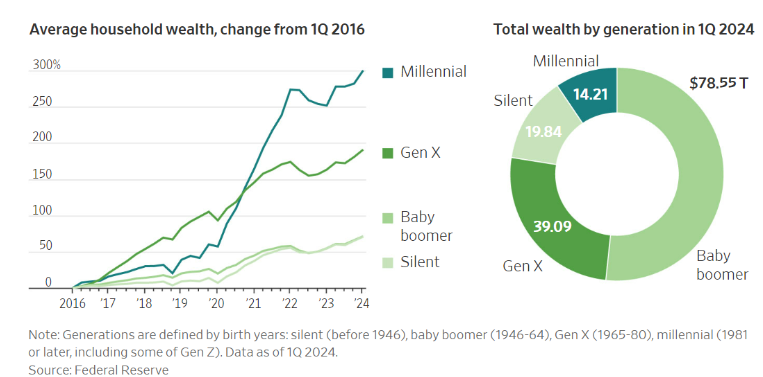

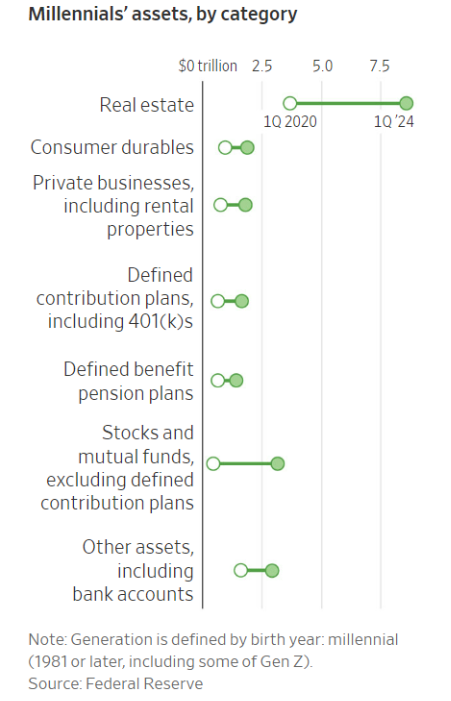

- The Dramatic Turnaround in Millennials’ Finances

- Florida hit by ‘worst real estate crisis in decades’ as desperate condo owners slash prices by up to 40%: ‘It’s paradise lost’

- Why your parents should buy you a house

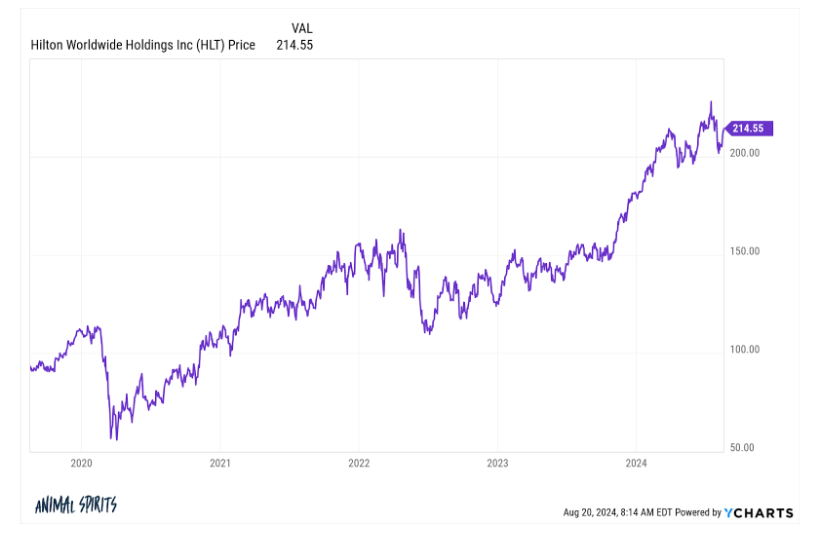

- HLT earnings

- WMT earnings

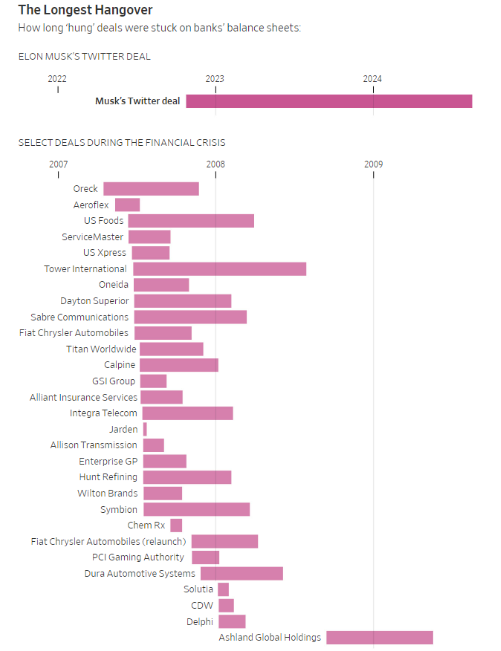

- Elon Musk’s Twitter Takeover Is Now the Worst Buyout for Banks Since the Financial Crisis

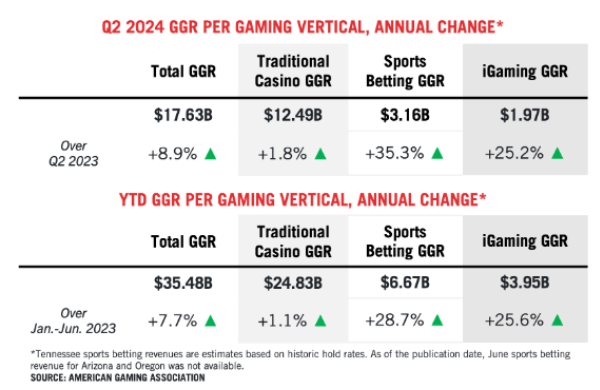

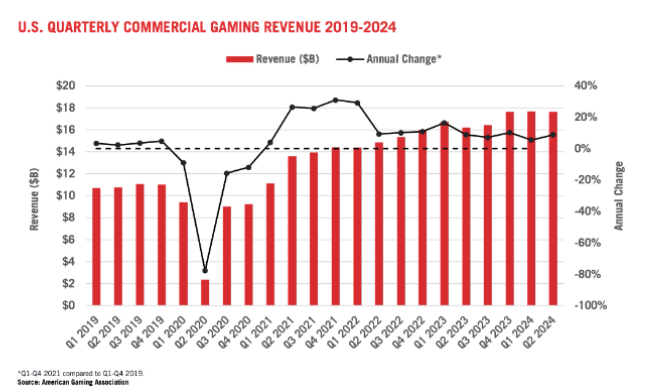

- AGA Commercial Gaming Revenue Tracker

Listen here

Recommendations:

- The Bikeriders

- Bad Monkey

- Paramount Plus

- James Carville

- Trap

- The Union

- Industry Season 3

- It Ends With Us

- Furiosa

- Alien: Romulus

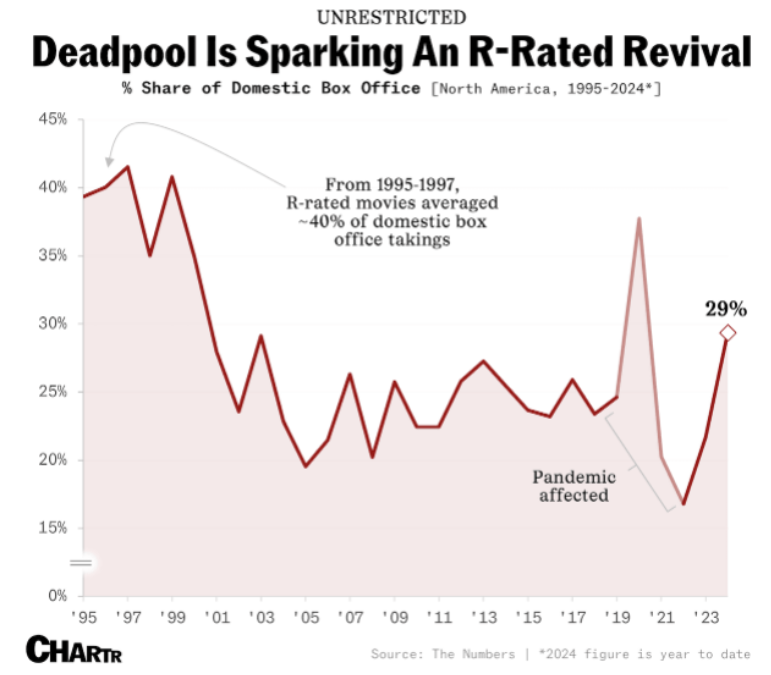

Charts:

Tweets:

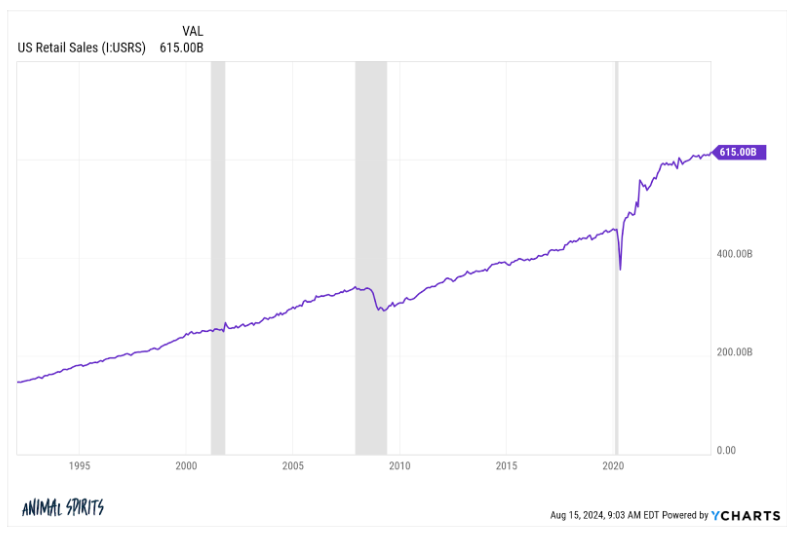

Retail sales above expectations at 0.4% gain overall, with control group up 0.3% and jobless claims below expectations at 227K. Continuing claims a bit lower.

— Kathy Jones (@KathyJones) August 15, 2024

Layoffs rate is extremely low pic.twitter.com/mVIeV15LZB

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) August 19, 2024

APOLLO: “.. retail sales are strong, jobless claims are falling, restaurant bookings are strong, air travel is strong, hotel occupancy rates are high, bank credit growth is accelerating, bankruptcy filings are trending lower, credit card spending is solid, and Broadway show… pic.twitter.com/WXes9Hi1Uh

— Carl Quintanilla (@carlquintanilla) August 17, 2024

Moreover, the relatively little core inflation we've had in the last three months was more than entirely shelter. If you take shelter out then the annual rates are:

1 month: -0.2%

3 months: -0.3%

6 months: 1.5%

12 months: 1.8% pic.twitter.com/barpFTghtY— Jason Furman (@jasonfurman) August 14, 2024

The last 12 inflation readings:

2.89%

2.97%

3.27%

3.36%

3.48%

3.15%

3.09%

3.35%

3.14%

3.24%

3.70%

3.67%At the very least the volatility of price levels has subsided

— Ben Carlson (@awealthofcs) August 14, 2024

https://t.co/BzxByqZkH8 pic.twitter.com/iCIzMHuw24

— Nick Timiraos (@NickTimiraos) August 15, 2024

Food company profit increases since inflation peaked:

Cheesecake Factory +471%

Cal-Maine +268%

Jack In The Box +213%

Chipotle +110%

Starbucks +47%

Sysco +43%How much did they collectively spend on stock buybacks? Over $10 billion.

They used inflation as cover to get rich.

— Robert Reich (@RBReich) August 16, 2024

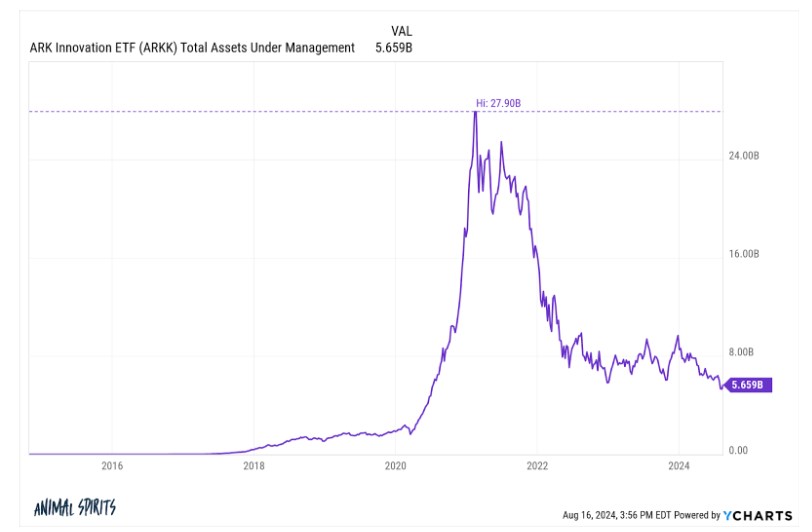

From ARKK's 10/31/14 incept through 1/31/24 (date of its most recent semi-annual report), the fund had collected ~$362.7MM in fees, cumulative. Over this period, the fund had lost ~$7.5B cumulative. pic.twitter.com/NFurkXoKon

— Jeffrey Ptak (@syouth1) August 15, 2024

Some people are very disturbed over how we sent our daughter to sleepaway camp for 7 weeks. Let’s hit the basics:

– Camp is the ultimate playground for kids, where they make lifelong friends and grow as humans.

– It is a privilege, not a punishment.

– We missed her way more… https://t.co/cacYFmBHCu

— Heather Joelle Boneparth (@averagejoelle) August 17, 2024

Saved by the Bell premiered this day in 1989.

It was the first time many people had seen a cell phone.

Roughly 1% of Americans had one at the time.

It cost thousands of dollars.

It took 10 hours to charge.

And the battery lasted for 30 minutes. pic.twitter.com/kChiaql2YE

— Jon Erlichman (@JonErlichman) August 20, 2024

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.