Charley Ellis wrote a great book about the index fund revolution back in 2016.

One of my favorite parts of the book is where Ellis looks at how Wall Street has changed in the past 50 years:

- MBAs were uncommon. PhDs were never seen. Commissions still averaged 40 cents a share. All trading was paper based. Messengers with huge black boxes on wheels, filled with stock and bond certificates, scurried from broker to broker trying to complete “good deliveries” of stock and bond certificates.

- Brokers’ research departments–then usually fewer than 10 people–were expected to search out “small-cap” stocks for the firm’s partners’ personal accounts. One major firm put out a weekly four-page report covering several stocks, but most of the time provided no research for customers.

- Trading volume of New York Stock Exchange listed stocks increased from 3 million a day to 5 billion, a change in volume of over 1,500 times.

- The dollar value of trading in derivatives rose from zero to more than the value of the “cash market.”

- The investors executing this surging volume of trading have changed profoundly. Individual amateur investors did over 90 percent of all New York Stock Exchange (NYSE) trading 50 years ago. They may have read an article in Forbes, Barron’s, Business Week, or a newspaper or taken advice from their busy broker, but they were market outsiders. They were not regular traders. They averaged less than one trade in a year, and almost half their purchases were AT& T common stock, then the most widely owned U.S. stock.

- Fifty years later, the share of trading by individuals has been overwhelmed by institutional and high-speed machine trading to over 98 percent. Today, the 50 most active (and ruthless) professionals– half of them hedge funds– do 50 percent of all NYSE listed stock trading, and the smallest of these 50 giants spends $100 million annually in fees and commissions buying information services from the global securities industry. These institutions are all market insiders who get the “first call”– and they know what to do with new information.

- Bloomberg machines, unheard of 50 years ago, now number over 320,000 and spew unlimited market and economic data virtually 24 hours a day.

- The population of CFAs (Chartered Financial Analysts) has gone from zero 50 years ago to 135,000, with over 200,000 more in the queue studying for the tough annual exams where pass rates are less than 60 percent.

- Algorithmic trading, computer models, and corps of inventive “quants” (quantitative analysts) were unheard of years ago. Today, they are major market participants.

- The Internet, e-mail, and blast faxes have created a revolution in global communications: instantaneous, worldwide, and accessible 24/ 7. We really are all in this together.

- National securities markets, once isolated, are increasingly integrated into one nearly seamless global megamarket operating around the clock and around the world. And this megamarket is increasingly integrating with and transforming bond markets and currency markets as well as the major markets for such commodities as oil, gold, and wheat.

- Regulations have changed to ensure simultaneous disclosure to all investors of all potentially important investment information. Since 2000 in the United States, the Securities and Exchange Commission’s Regulation FD (Fair Disclosure) has required that any significant corporate information be made simultaneously available to all investors. (Years ago, such information– when proprietary– was central to successful active investing.) Regulation FD is a game “changer” that has effectively commoditized investment information from corporations.

- Hedge funds, acquisitive corporations, activist investors, and private equity funds have all– with different perspectives and different objectives– become major participants in price discovery in today’s securities markets, now the world’s largest and most active prediction market.

The way markets used to function would be unrecognizable for today’s participants.

In the past 50 years we’ve witnessed the development of index funds, ETFs, 401ks, IRAs, online trading, zero commission trading, targetdate funds, automated investing, direct indexing, high-frequency traders, message boards and more. Plus, we have much more knowledge about the market than people did in the past.

The stock market is very different in so many ways.

In other ways, the stock market never really changes.

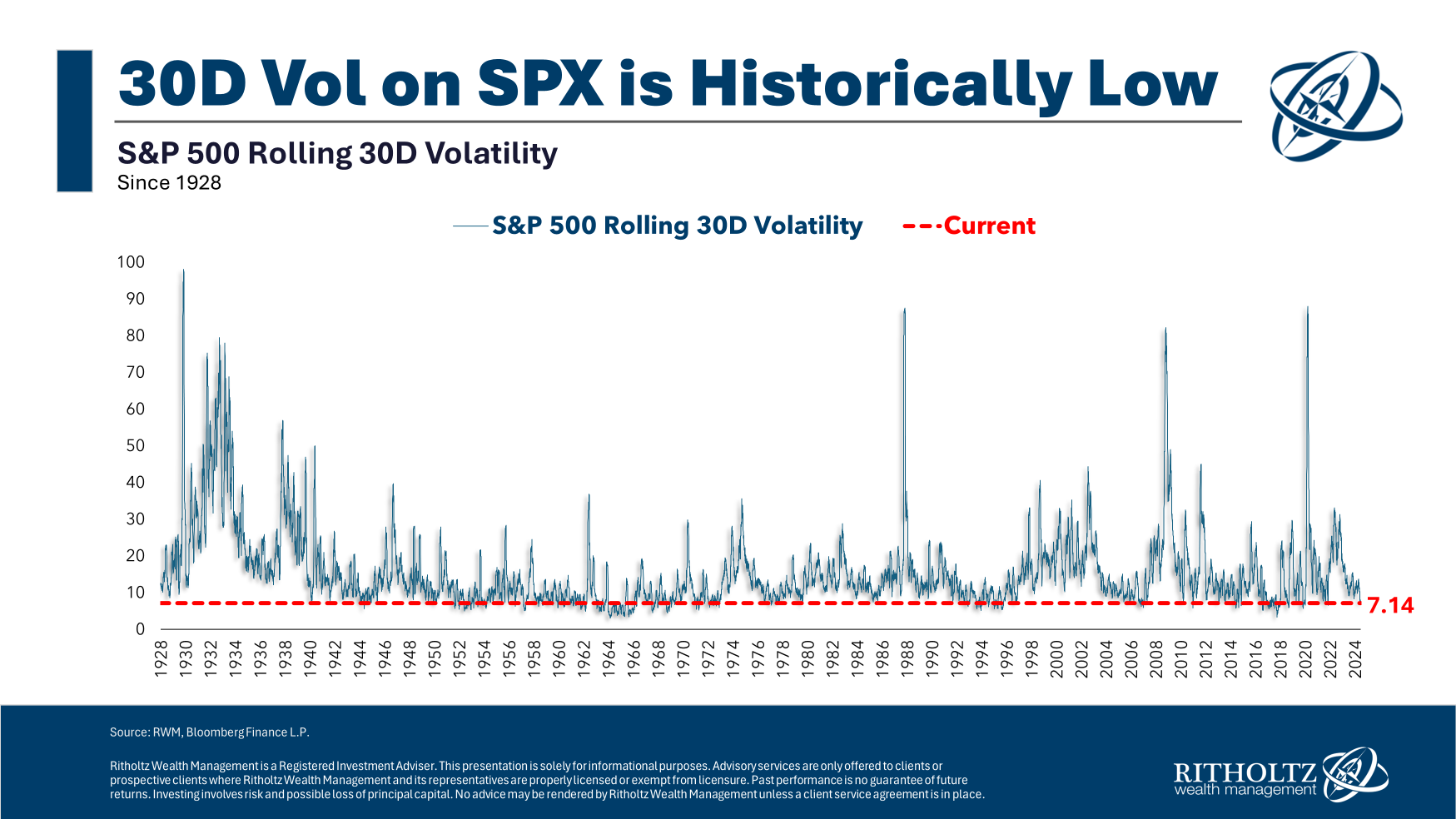

Here’s a look at the rolling standard deviation of 30-day returns on the S&P 500 since 1928:

This is a good proxy for the VIX, which is essentially a measure of volatility in the stock market.

Market structure, liquidity and costs may have changed but volatility is the constant. You can see the huge spikes during a crisis — the Great Depression, the 1987 crash, the Great Financial Crisis, the Covid crash — all look fairly similar.

There have also been periods of relative calm (like now) throughout the market’s history, with the occasional volatility spike during a correction.

Volatility looks the same across history because human nature is the one constant in the stock market that will never change.

You can’t get rid of fear, greed, panic, euphoria, anxiety or FOMO.

Jesse Livermore said it best roughly 100 years ago: “Another lesson I learned early is that there is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.”

Everything around the stock market can change, but the stock market itself can never change because human emotions don’t change.

Michael and I talked about what hasn’t changed in the stock market and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Timeless Advice From Jesse Livermore

Now here’s what I’ve been reading lately:

- When life happens (Humble Dollar)

- What to do with stocks at all-time highs (Belle Curve)

- Mean reversion or extreme aversion (Albert Bridge Capital)

- Happy but not satisfied (Irrelevant Investor)

- Life moves pretty fast (The Sandbox)

- Why international investing makes sense for long-term investors (Morningstar)

- The purpose of things isn’t to stop doing things (Young Money)

- James Caan didn’t think Will Ferrell was funny (Variety)

Books: