A reader asks:

Do you guys really think foreign investsments and private equity really aren’t driving up housing prices? It really seems like it is.

I understand the sentiment here.

The housing market is broken right now for a lot of people. The blame is simply misplaced here. It’s not Blackrock or Blackstone or any other institutional investor who is causing the lack of supply in the housing market.

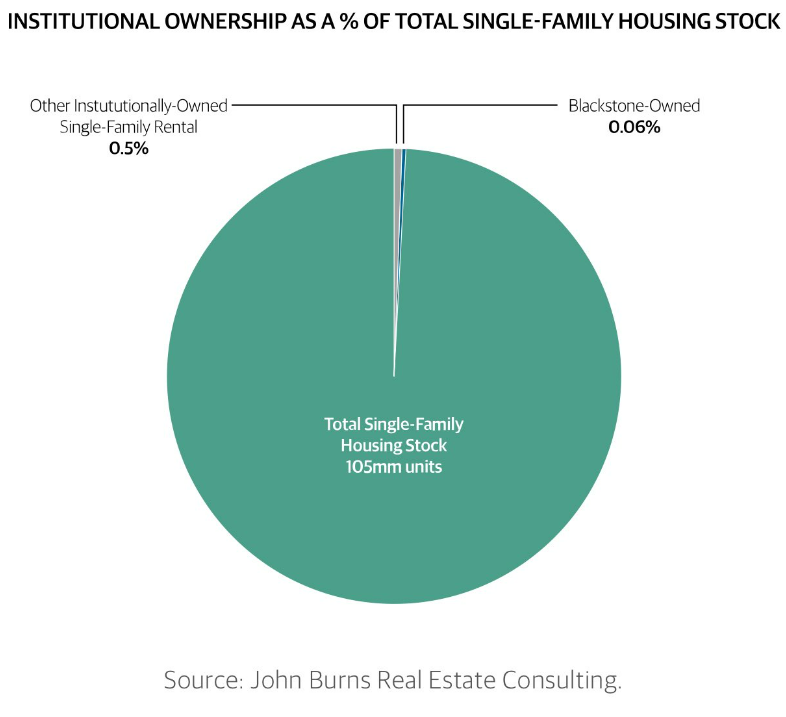

John Burns has some good data on institutional ownership and buying patterns.

Institutions own less than 1% of the more than 100+ million single-family homes in the United States:

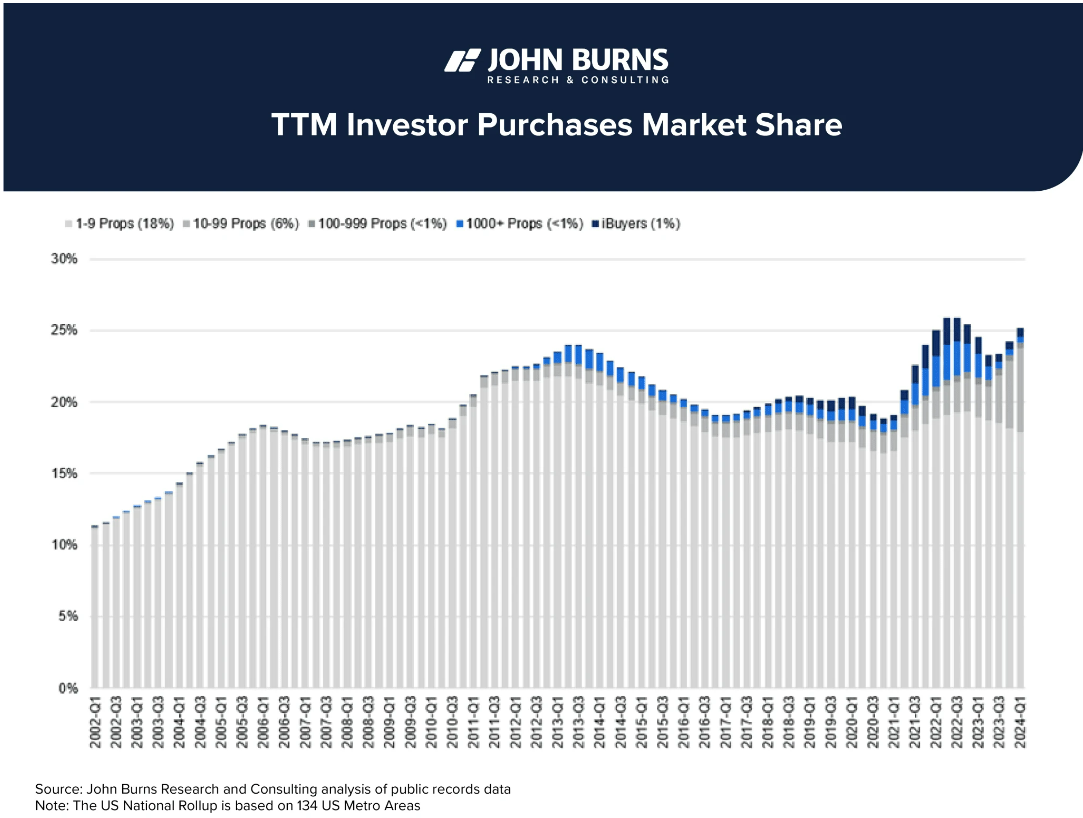

It’s a tiny number. Granted, investors have been more active in recent years than they were in the past. Here’s a look at the purchase share by year for investors since 2002:

The number is certainly higher for large investors.

All real estate investors were buying 12% of homes in 2002. That number is now more like 25%. But it’s not behemoth financial firms. It’s mainly small mom and pop investors buying a rental home or two as an investment property.

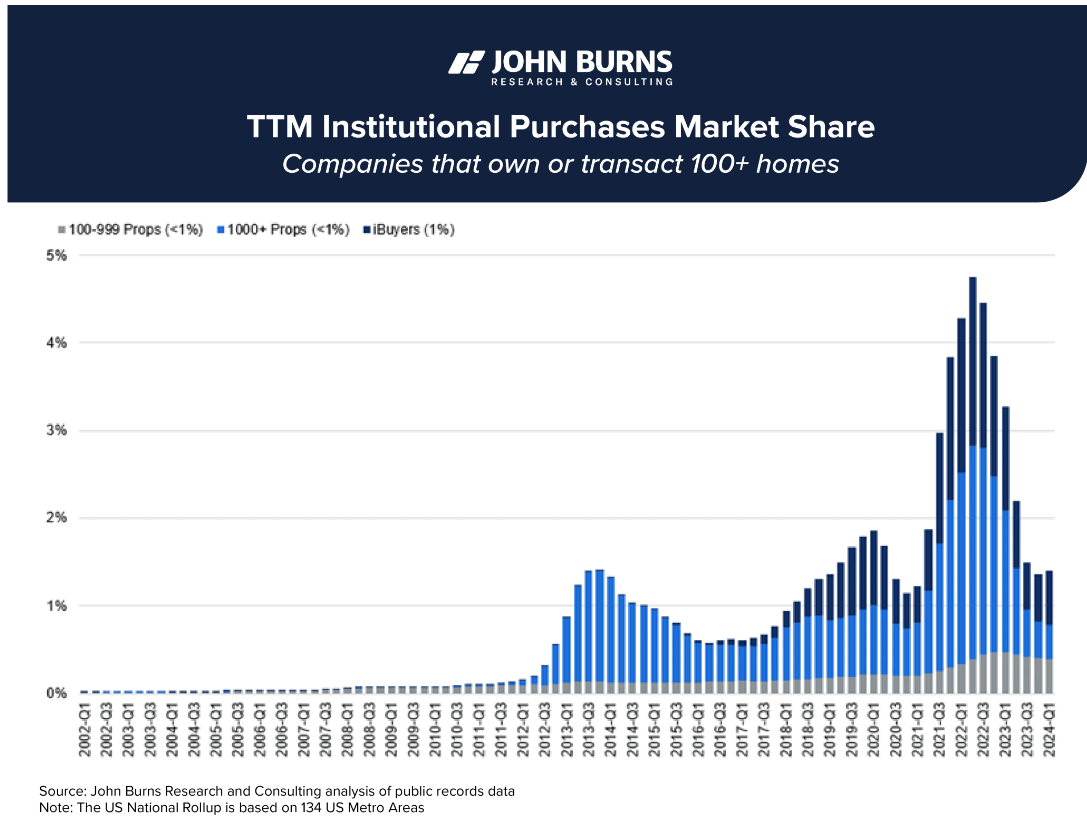

The big institutions now make up less than 2% of purchases down from a high of nearly 5% in 2022:

If anything, it’s shocking how small of a share big financial firms have in the housing market.

A lot of this activity involves small-time investors or people who took advantage of ultra-low mortgage rates to invest in residential real estate. There are plenty of people who didn’t want to let go of their 3% mortgage so they turned into rental investors by renting out their old home once they purchased a new one.

John Burns estimates rental home investors make up 9.9% of all homes in America, only slightly higher than the 9% share in 2005.

These things are also highly cyclical. Investors have pulled in recent years as rates shot higher.

Here are some numbers from The Wall Street Journal:

Investor purchases of single-family homes tumbled 29% last year, as higher interest rates and record home prices compelled even deep-pocketed investment firms to pull back.

Businesses large and small acquired some 570,000 homes in 2023, down from 802,000 in 2022, according to national research from Parcl Labs, a real-estate data and analytics firm. Fourth-quarter investor purchases of 123,000 represented the lowest quarterly total in the eight quarters tracked by Parcl.

In a separate analysis of sales for the first nine months of last year, Realtor.com said 2023 was on track for the largest annual drop in investor buying activity in at least 20 years.

This makes sense. Cap rates fell so many investors pulled back.

If private equity firms aren’t to blame for the unhealthy housing market, then who is?

Here’s the short version of what happened:

There was a housing bubble in the early to mid 2000s based on rising home prices and loose lending standards. We actually overbuilt homes for a number of years.

The housing bubble popped, home prices crashed, and homebuilders big and small got annihilated.1

Coming out of the 2008 financial crisis, lending standards got much tighter. After getting left holding the bag, homebuilders got more conservative and pulled back on the number of homes they were building.

The result is that in the 2010s, we severely underbuilt the number of new homes needed for the coming millennial wave of homebuyers.

There was an uptick in housing activity during the 3% mortgage days of the pandemic but 7% mortgage rates will likely slow things down again.

Add to all of this the fact that more onerous rules and regulations now make it more difficult to build in most states and we have a shortage of housing in America.

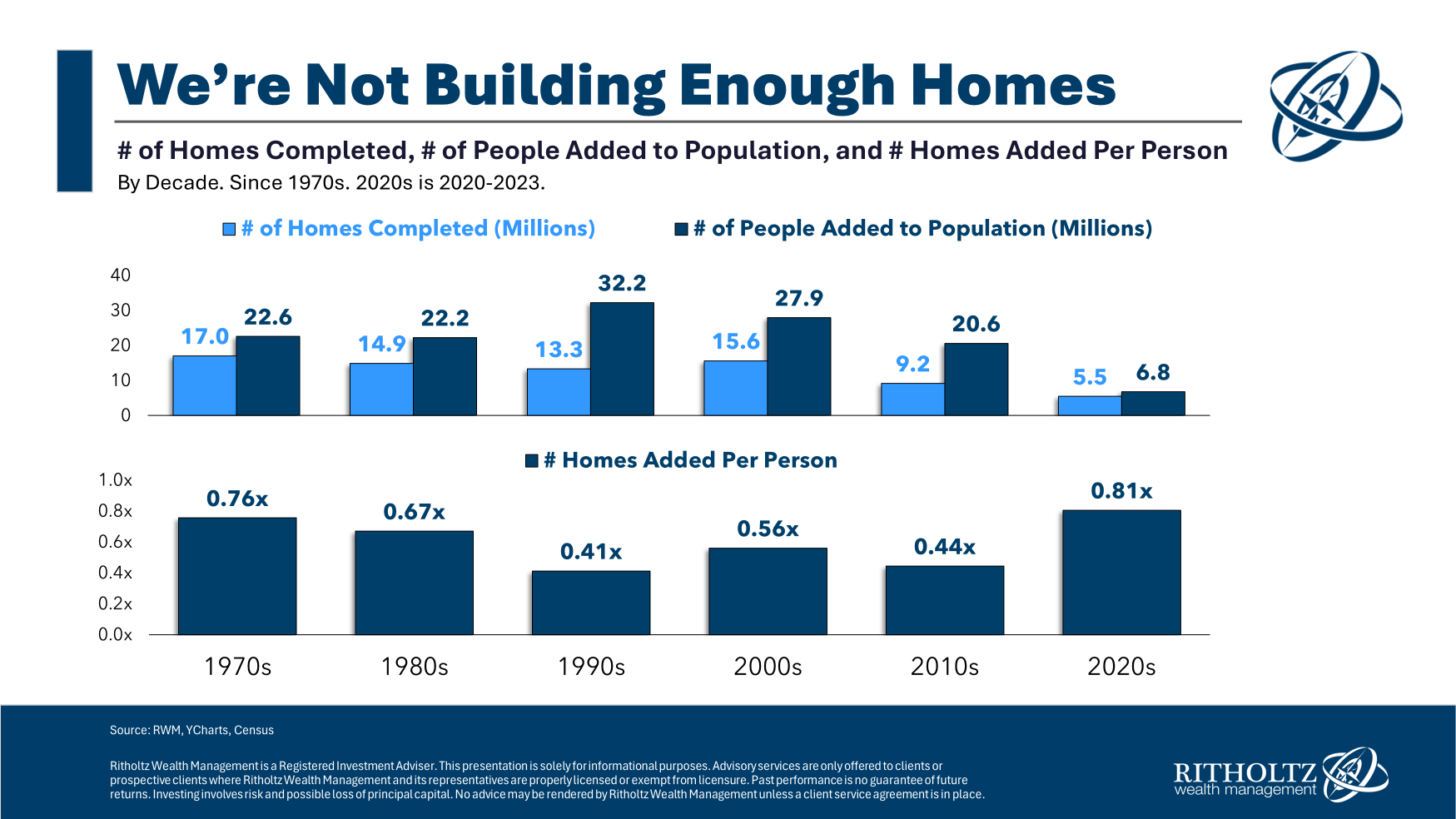

You can see from the number of homes built by decade compared to the population increases we’ve experienced the only way to fix the housing market is by building more houses:

Zillow estimates the United States has a shortage of 4.3 million homes.

Some people want to blame the Fed but there’s nothing they can do to fix the situation. Keeping mortgage rates high has only driven down the supply of existing homes for sale.

If the Fed lowers rates, it could spur demand from buyers who have been sitting on the sidelines.

Jerome Powell and company can’t make new homes or apartment buildings appear out of thin air through monetary policy.

There is no magic wand we can wave over the U.S. housing market to provide a short-term fix. Even if the government incentivizes homebuilders to increase inventory, I’m not sure we would have enough construction workers to make it happen.

It’s going to take time.

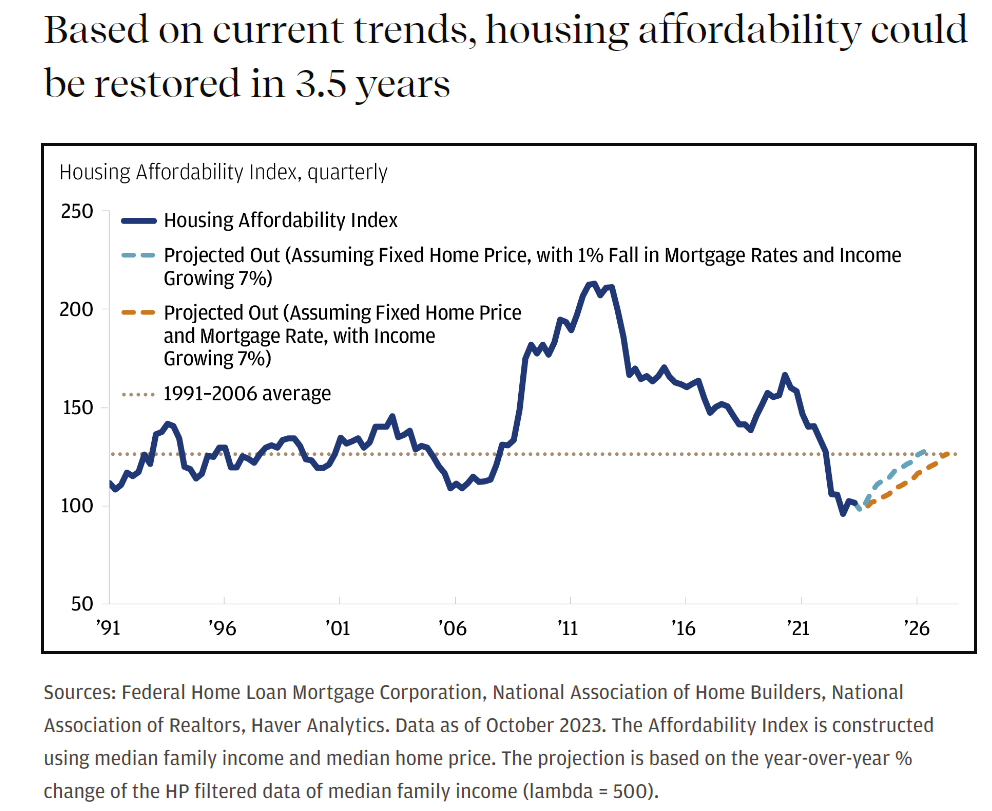

JP Morgan economists estimate it would take a little less than four years to restore housing affordability, given current trends in income growth, mortgage rates and price appreciation:

There are a lot of assumptions baked into these numbers and outcomes will obviously be impacted by location and personal circumstances.

No one knows what the future holds so it’s possible an exogenous event will come out of nowhere to alter the current trajectory of housing affordability.

No one could have imagined a pandemic would cause the greatest home price gains in history in such a short period of time.

Short of an anti-pandemic response by the housing market, it’s hard to envision a scenario where things improve on a meaningful basis in the near-term.

We covered this question on the latest edition of Ask the Compound:

Nick Sapienza joined me on the show again this week to discuss questions related to how much you should put down on a new house purchase, how to reduce taxes on RSU grants, compatibility with your financial advisor and optimizing your financial plan for a life-altering disease.

Further Reading:

Who is Buying a House in this Market?

1The homebuilders ETF (XHB) was down nearly 85% from the start of 2006 through the bottom in early-2009. That’s a Great Depression-level shellacking.